With over 300 million subscribers across 190+ countries, Netflix stands as the benchmark for digital content delivery. Its annual revenue, hovering around $41.7 billion, surpasses that of many traditional media conglomerates.

It spends around $18 billion annually on content, funding a constant stream of original movies, series, and documentaries available in over 60 languages. From “The Crown” to “Squid Game,” Netflix Originals have become household names, driving nearly 45% of total viewing hours on the platform. [1]

Yet, the story of Netflix’s dominance is no longer one of uncontested reign. It’s a story of fierce competition and industry transformation. The global streaming video-on-demand market has become a battleground of giants.

Every year, the competition grows tougher as entertainment titans invest heavily to capture global audiences. This competition is not merely about content — it’s a race for viewer attention, global localization, and technological personalization.

This article explores the top Netflix competitors and alternatives, breaking down their business models, subscriber growth, content strategies, and key strengths.

Did you know?The global video-on-demand market (valued at $133.4 billion in 2025) is expected to exceed $381.16 billion by 2032, growing at a CAGR of 16.2%. [2]

Table of Contents

14. iQIYI

Launched in 2010Content: 15,000+ titles

Users: 128 million+

Competitive Edge: Micro-drama format & high engagement

iQIYI, often dubbed the “Netflix of China,” focuses on high-quality dramas, films, variety shows, anime, and documentaries.

Over the past decade, it has evolved into a key player in both subscription-based and ad-supported streaming. It now reaches over 520 million monthly active users and has about 128 million paying subscribers.

The platform relies on Baidu’s technology, utilizing AI recommendations, efficient video compression, and user data to create personalized viewing experiences. Its interface and recommendation system are similar to Netflix’s, but it stands out for its strong focus on local content, offering exclusive Chinese dramas and historical series.

iQIYI has produced numerous blockbuster titles, including The Bad Kids, The Longest Day in Chang’an, and Story of Yanxi Palace, which have drawn billions of cumulative views.

Beyond streaming, iQIYI has built a comprehensive entertainment ecosystem that spans film production, live concerts, short videos, virtual reality (VR), and even online literature. Its subsidiaries and content studios enable in-house production at scale, reducing dependence on third-party licensing.

The company has already produced more than 250 original titles, and is increasingly focusing on international co-productions and cross-border licensing deals.

13. Pluto TV

Content: Content: 400+ TV channels, 1500+ movies and TV shows

Users: 80 million+

Competitive Edge: Deep partnerships with top content producers

Pluto TV is a free, ad-supported streaming television platform that offers a unique blend of live TV and on-demand content. It was acquired by Paramount Global (formerly ViacomCBS) in 2019 for around $340 million,

The platform’s appeal lies in its linear viewing model, which replicates traditional television experiences but through streaming technology. Users can “channel surf” across thematic stations like “Pluto Movies,” “Comedy Central,” “Pluto Sports,” and “Nick Jr.,” without needing a paid subscription or registration.

It features a broad range of content (from movies, classic TV shows, and kids’ programming to news and sports) by partnering with leading media companies like CBS, Paramount Pictures, Nickelodeon, and CNN.

In fact, many legacy TV brands within Paramount’s portfolio use Pluto TV as a secondary monetization channel for their libraries, helping maximize content lifecycle value.

12. Tencent Video

Launched in 2011Content: 100,000+ hours

Subscribers: 120 million+

Competitive Edge: Tencent ecosystem integration, Exclusive Chinese dramas

Tencent Video is one of China’s biggest and most influential streaming platforms, and it’s known as WeTV in international markets.

The platform offers an expansive content library of over 100,000 hours of movies, dramas, anime, and variety shows, backed by advanced streaming technology. In 2022, Tencent also signed a $280 million deal to secure streaming rights for 6,000 films. [3]

Its mix of originals and licensed exclusives has produced major hits in China and abroad, such as The Untamed, Joy of Life, and Nothing But Thirty. Tencent adds around 100 new drama titles to its domestic catalog every year.

Unlike Western streaming platforms that operate independently, Tencent Video thrives within Tencent’s vast digital network. Its integration with WeChat (with over 1.4 billion users) allows seamless video sharing, cross-promotion, and personalized content discovery.

11. Rakuten Viki

Content: 3,500+ movies and TV shows

Registered Users: 95 million+

Competitive Edge: Exclusive Asian content, Community subtitles

Viki specializes in Asian entertainment, including K-dramas, C-dramas, J-dramas, and other regional content. It hosts more than 3,500 movies and TV shows from South Korea, China, Japan, Taiwan, and Thailand, by partnering directly with major broadcasters such as SBS, KBS, tvN, MBC, and CJ ENM.

In fact, it has become one of the leading destinations for international audiences seeking subtitled Asian content. Viki differentiates itself through its community-driven subtitling system, where volunteers translate shows into more than 160 languages, creating one of the most linguistically diverse streaming libraries in the world. [4]

The platform operates under a freemium model. This means users can watch most content for free with ads or upgrade to Viki Pass Standard or Plus, which offers HD streaming, ad-free viewing, and early access to exclusive titles.

As a subsidiary of Rakuten Group, a Japanese digital services giant, Viki benefits from robust infrastructure, marketing reach, and financial backing. Rakuten has integrated Viki with its other services, including Rakuten Advertising and Rakuten Rewards, to strengthen monetization and user engagement.

10. Tubi

Content: 275,000+ movies and TV episodes

Monthly Active Users: 100 million+

Competitive Edge: Zero cost to consumers, Massive content library

Tubi is a free, ad-supported streaming platform owned by Fox Corporation. This model makes it more accessible than many paid OTT services, particularly for viewers unwilling to pay recurring subscription fees.

The platform has grown steadily since launch. In 2025, it surpassed 100 million monthly active users. By the end of 2024, Tubi had nearly 97 million MAUs, streamed over 10 billion hours of content, and generated more than $1 billion in annual ad revenue, reflecting both its massive reach and advertiser demand. [5]

Unlike Netflix, which invests heavily in original content (over $18 billion annually), Tubi relies on licensing agreements and Fox’s vast library to maintain breadth and variety.

Tubi’s content library is one of its biggest strengths. It offers over 275,000 movies and TV episodes across a wide range of genres and eras, along with more than 300 exclusive originals. Because of this breadth, some observers believe Tubi now has the largest library of any streaming service. [6]

9. Crunchyroll

Content: 1,300+ anime titles and 50,000+ episodes

Subscribers: 17 million+

Competitive Edge: Dominant player in pure anime streaming

Crunchyroll has evolved from a niche anime-sharing community into a mainstream digital entertainment brand serving more than 200 countries and territories. It is owned by Sony Group Corporation.

The platform has over 17 million paying subscribers and a massive 120 million registered users, making it the largest dedicated anime streaming service globally.

Its growth is driven by the global surge in anime demand, which has evolved from a niche category into a major force in the streaming economy. With the anime market expected to surpass $60 billion by 2030, Crunchyroll acts as a bridge between Japanese studios and international audiences. [7]

Plus, its early partnerships with Japanese studios such as Toei Animation, MAPPA, Aniplex, and Kyoto Animation provide it with exclusive streaming rights and first access to new productions — an advantage that even Netflix’s production budget can’t always overcome.

Beyond streaming, Crunchyroll has expanded into manga publishing, gaming, theatrical distribution, and merchandise, creating a vertically integrated anime ecosystem.

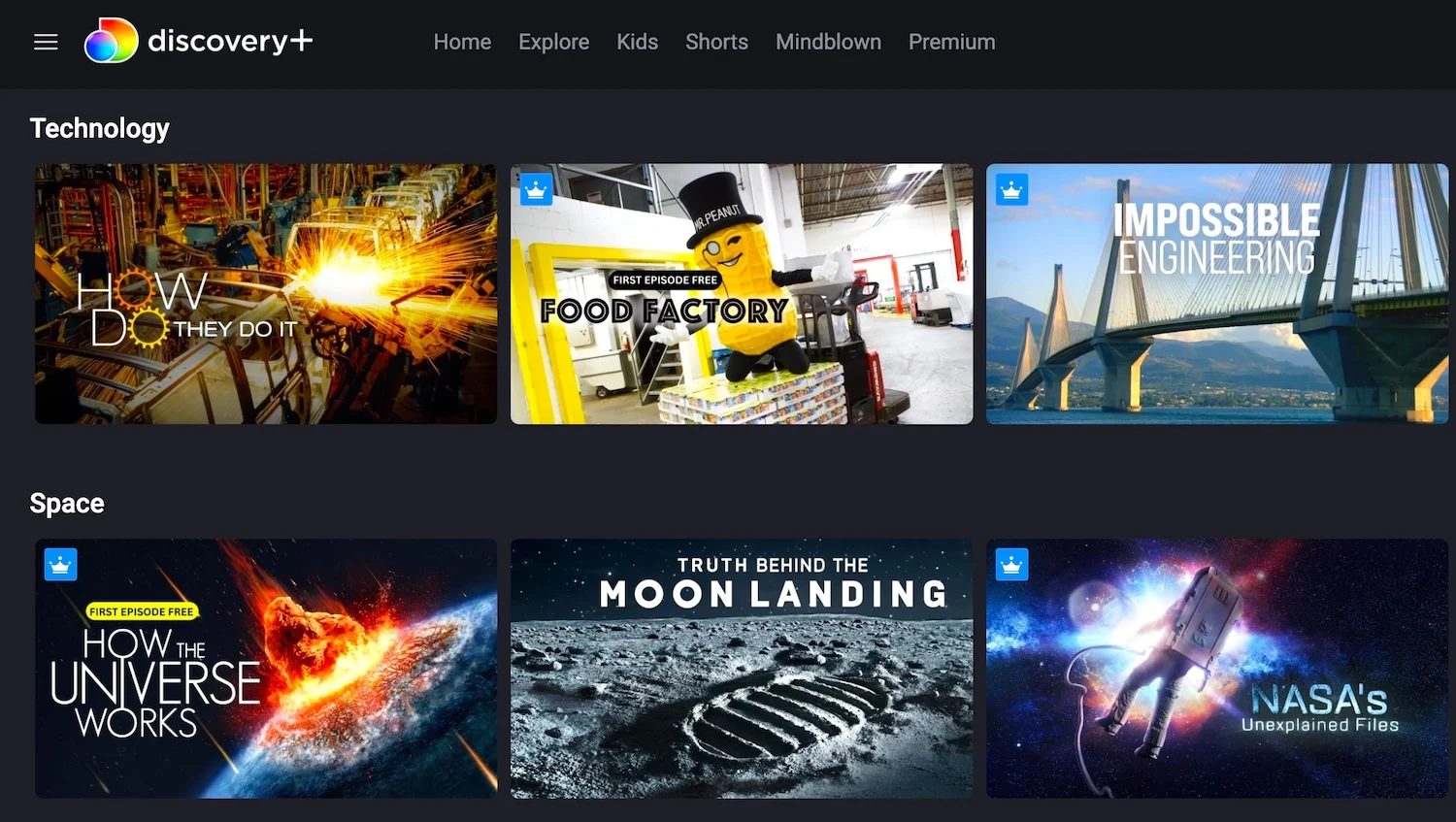

8. Discovery+

Content: 2,500+ shows

Subscribers: 20 million+

Competitive Edge: Strong non-fiction library, Affordable pricing

Owned by Warner Bros. Discovery (WBD), Discovery+ is the global streaming service created to deliver factual, entertainment, documentaries, and reality-based programming.

The platform unites top Discovery-owned networks, including Animal Planet, HGTV, TLC, ID, and Food Network, under one brand.

Its library features over 55,000 episodes from more than 2,500 shows, making it one of the largest collections of factual content. The programming spans 40+ genres and subgenres, including Science, History, Wildlife, Food, and Lifestyle.

Discovery+ offers a more affordable subscription model, with plans that cost nearly half as much as Netflix in many regions. This pricing flexibility, combined with a strong library of family-friendly and bingeable real-world shows, allows Discovery+ to capture audiences who prefer light, continuous-viewing experiences rather than dramatic narratives. [8]

7. YouTube Premium

Content Library Size: 10,000 hours+

Subscribers: 125 million+

Competitive Edge: Massive user base, Geographic reach, Localisation

YouTube Premium is one of the largest paid digital media services globally, with over 125 million subscribers (including YouTube Music Premium) across 100+ countries. [9]

This immense scale stems from YouTube’s dual role as a video-sharing platform and a social entertainment hub, with over 2.7 billion monthly active users on its free, ad-supported service.

As a competitor to Netflix, YouTube Premium represents a different kind of threat. It is not a traditional content-streaming rival, but a time-share rival. Both platforms compete for users’ attention, screen time, and subscription budgets.

YouTube Premium merges user-generated content, professional entertainment, music streaming, and exclusive original shows into one platform. Subscribers gain access to ad-free video viewing, background playback, offline downloads, and bundled access to YouTube Music Premium.

Over the years, its library of original content, once branded as “YouTube Originals,” has evolved from scripted dramas to creator-led productions and event-style content. While the focus on big-budget originals has reduced, YouTube continues to invest in creator partnerships, live events, and music content that leverage its massive creator economy.

6. Peacock (NBCUniversal)

Launched in 2020Content Library Size: 80,000 hours+

Subscribers: 41 million+

Competitive Edge: Synergy with NBCUniversal’s film studios

Peacock is the streaming platform owned by NBCUniversal, which itself is a subsidiary of Comcast Corporation. Despite being relatively new compared to Netflix, Peacock has carved out a strong foothold, especially in the US.

Peacock’s programming strategy heavily leans on NBCUniversal’s vast intellectual property. Popular TV shows such as The Office, Parks and Recreation, Brooklyn Nine-Nine, and Saturday Night Live form the backbone of its library. It also features major Universal movies and original content like Poker Face and Bel-Air.

A large share of its subscriber base is on ad-supported plans (roughly 80%), which makes its ad business increasingly important. In 2024, Peacock crossed $2 billion in advertising revenue.

In 2025, Peacock surpassed 41 million paying subscribers and reached over 100 million active accounts (including ad-supported users), showing rapid growth fueled by hybrid monetization and cross-promotion from Comcast’s cable and broadband ecosystem. [10]

That same year, NBCUniversal struck a deal to bring Peacock Premium Plus to Amazon’s Prime Video Channels. This lets users subscribe to the ad-free Peacock tier via Amazon’s ecosystem, expanding reach. [11]

5. Paramount+

Content Library Size: 4,500+ films, 200,000+ TV episodes

Monthly Active Users: 79 million+

Competitive Edge: Diverse content, Live programming, Franchise continuity

Paramount+ offers an expansive mix of on-demand movies, live TV, original programming, and sports content. It combines legacy networks, including CBS, Nickelodeon, MTV, BET, Comedy Central, and Paramount Pictures.

The platform houses more than 200,000 TV shows and movies, along with exclusive original series like Halo, 1923, Star Trek: Strange New Worlds, Mayor of Kingstown, and Tulsa King.

It also benefits from the historic strength of Paramount Pictures, one of Hollywood’s oldest film studios, which brings blockbuster films such as Top Gun: Maverick, Mission Impossible Dead Reckoning, and Transformers directly into the streaming ecosystem after theatrical runs.

Paramount+ competes with Netflix as both a legacy studio challenger and a diversified media ecosystem. While Netflix dominates global reach and data-driven personalization, Paramount+ holds a strong position in family, sports, and entertainment niches.

Plus, its close association with CBS provides unparalleled access to live news and sports, allowing it to capture segments of the audience that still value real-time programming.

4. Apple TV+

Content Library Size: 100+ titiles

Monthly Active Users: 45 million+

Competitive Edge: Quality over quantity, Integration with Apple ecosystem

Unlike rivals that boast tens of thousands of titles, Apple TV+ has a handful of exclusive originals, including series, documentaries, and films. However, it has earned industry respect through award-winning productions, minimalist design, and a tightly curated library that emphasizes storytelling and artistic depth.

It made history in 2022 when its original film CODA won the Academy Award for Best Picture, making Apple the first streaming service to win that category — an achievement that even Netflix hadn’t reached at that time. [12]

The platform’s series, such as Ted Lasso, Severance, The Morning Show, and For All Mankind, have become critical and audience favorites, earning over 350 major awards and 1,500 nominations across the global entertainment landscape.

With Apple spending nearly $4.5 billion annually on original content, the platform’s strategy is clear: quality over quantity, emphasizing craftsmanship, storytelling, and high production value. [13]

In terms of monetization, Apple TV+ and Netflix take very different approaches. Netflix relies entirely on subscription revenue, while Apple uses Apple TV+ to keep users engaged within its wider ecosystem of services like iCloud, Apple Music, and Fitness+. For Apple, streaming isn’t just about direct profit: it’s about long-term customer loyalty across its ecosystem.

3. HBO Max

Content Library Size: 7,800+ titles

Monthly Active Users: 125 million+

Competitive Edge: Prestige & quality legacy, High ARPU

HBO Max merges the renowned legacy of HBO with the vast catalogs of Warner Bros., DC, CNN, Discovery, and Cartoon Network. It offers more than 35,000 hours of content. [14]

At its core, HBO Max is built on a foundation of high-quality, story-driven programming, a legacy stretching back decades through HBO’s award-winning series such as Game of Thrones, Succession, The Last of Us, The Sopranos, and Euphoria.

Plus, Warner Bros.’ massive film library (which includes franchises like Harry Potter, The Dark Knight, The Matrix, and Dune) gives Max content firepower Netflix cannot replicate.

It also extends beyond scripted dramas to include Discovery+’s unscripted and lifestyle content, adding genres like food, travel, home improvement, and nature documentaries to broaden its audience appeal.

While Netflix’s strength lies in global scale and algorithmic personalization, HBO Max competes through content prestige, cinematic depth, and intellectual property strength. HBO historically defined quality television, winning more Emmy Awards than any other network for two decades running. [15]

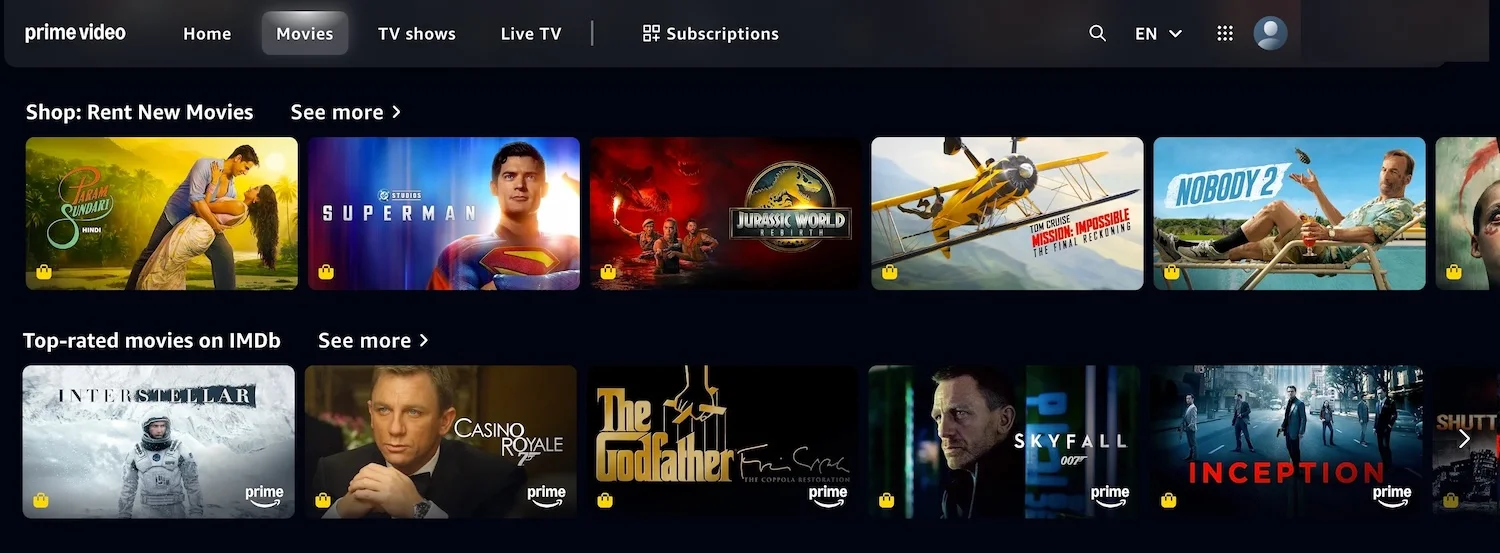

2. Prime Video

Content Library Size: 23,000+ movies and series

Monthly Active Users: 260 million+

Competitive Edge: Ecosystem integration with Amazon Prime

Prime Video has become a cornerstone of Amazon’s Prime ecosystem — a subscription bundle that offers shopping benefits, fast delivery, music, and video under one unified membership.

It gives access to a large catalog of movies, TV shows, and Amazon Originals with the ability to rent or buy premium titles on demand. This approach gives Amazon a revenue advantage that goes beyond subscription income.

Amazon has invested aggressively in premium content. In 2023, their total video and music expenses were $18.9 billion, up 14% compared to the previous year. For 2024, their budget for original and licensed movies, TV shows, and live sports was around $7 billion.

Blockbuster originals like The Boys, The Marvelous Mrs. Maisel, Reacher, and The Lord of the Rings: The Rings of Power have become international hits. The platform has also dominated live sports, acquiring exclusive streaming rights to events such as Thursday Night Football (NFL) and the English Premier League.

Globally, Prime Video rivals Netflix in both reach and influence, particularly in key markets like the US, UK, and India. In the US alone, Prime had approximately 180 million members in early 2024, which constituted roughly 75% of the adult population. Roughly 3 out of 4 American households used Prime. [16]

1. Disney+

Content Library Size: 11,700+ episodes, 700+ movies

Monthly Active Users: 127 million+

Competitive Edge: Strong content IP & franchises

Operated under The Walt Disney Company’s Disney Entertainment division, the platform leverages nearly a century of storytelling heritage from brands such as Disney, Pixar, Marvel, Star Wars, and National Geographic.

Its growth has been driven by both content scale and brand equity. As of 2025, the platform hosts more than 11,700 TV episodes and 700 movies, spanning animated classics, blockbuster franchises, documentaries, and exclusive series.

Disney’s vertical integration model (owning production studios, distribution, theme parks, and merchandise) gives it a unique ability to monetize content far beyond subscription fees, something Netflix lacks.

In 2022, Disney+ introduced an ad-supported plan to address declining profits. Today, this plan is available in all countries alongside the standard ad-free and premium plans.

In 2025, Disney finalized its acquisition of Hulu and took full ownership. Hulu’s content is now integrated into the Disney+ app through a dedicated Hulu hub. [17]

With the Disney Bundle (Disney+ + Hulu + ESPN+), the company now offers an all-in-one package for families and sports fans — a value proposition Netflix currently doesn’t offer.

Read More

Sources Cited and Additional References- Todd Spangler, Netflix Content Spending hits $18 billion in 2025, Variety

- IT Services, Video-on-demand market size and trend analysis, Fortune Business Insights

- Iris Deng, Tencent signs $280 million deal for streaming rights to 6,000 shows, SCMP

- News, Rakuten Viki celebrates K-drama fandom across the world, Rakuten

- Press Releases, Tubi achieves record audience scale and engagement, Tubi

- Jason Parham, Tubi is not the next Netflix. It’s something better, Wired

- Industry Analysis, Japan Anime market size and trend, GrandViewResearch

- Jennifer Maas, Discovery+ hikes price for ad-free and ad-supported plans, Variety

- Todd Spangler, YouTube hits 125 million music and premium subscribers, Variety

- Tony Maglio, Peacock subscribers stuck at 41 million, Hollywood Reporter

- Dawn Chmielewski, NBCUniversal struck a deal to bring Peacock to Prime Video, Reuters

- Newsroom, Apple’s “CODA” wins historic Oscar for Best Picture, Apple,

- Swati Gandhi, Apple loses $1 billion every year on streaming biz, Business Standard

- Lauren Forristal, Max makes its US debut, giving subscribers 35K hours of content, TechCrunch

- Ying Yang, Research on the entertainment marketing challenge of HBO, ResearchGate

- Eugene Kim, A record 3 out of 4 Americans use Amazon Prime, Business Insider

- Dawn Chmielewski, Disney to pay additional $438.7 million for NBCU’s stake in Hulu, Reuters