China is the leader in the global electric vehicle (EV) market, accounting for more than 70% of global sales in 2024. The number of new EV registrations in the country reached 8.1 million in 2023, a 35% increase from 2022. In 2024, that number grew to 11.25 million. [1][2]

China’s EV charging infrastructure is expanding at a rapid pace, with more than 16.69 million charging piles — by far the largest network in the world. The vehicle-to-charging pile ratio currently stands at 1.1:8. [3]

Chinese automakers are rapidly expanding their presence in international markets. In 2022, about 35% of exported electric cars came from China, compared with 25% in 2021.

In 2023, China exported over 1.54 million EVs, a 64% jump from 2022, with Europe as its biggest market for both EVs and batteries. In 2024, the country exported nearly 1.25 million EVs, representing around 40% of global EV exports.

Below, I highlight the top Chinese electric car brands that are facilitating this growth. The article aims to provide valuable insights into the key players driving the electric revolution in China.

Did you know?

In 2017, China implemented a “Dual Credit Policy” that incentivizes automakers to produce more EVs by rewarding those that meet new energy vehicle and fuel efficiency targets and penalizing those that do not. The country spent $230.8 billion over a decade developing its electric industry. The scale of government support represents 18.8% of total electric car sales between 2009 and 2023. [4]

Table of Contents

17. Zeekr

Founded in 2021Revenue: $12.6 billion+

Annual Sales: 222,123 units (2024)

Zeekr, a subsidiary of Geely—one of China’s largest automakers—focuses on producing premium electric vehicles for both domestic and international markets. With a manufacturing capacity of up to 300,000 vehicles annually, the company is committed to rapidly expanding its global footprint.

Zeekr has been well-received in the market, particularly for its emphasis on luxury and quality. It has witnessed rapid growth in its short history. In 2023, it generated $7.29 billion compared to $4.4 billion in 2022. However, it has not yet turned a profit, reporting a net loss of $1.16 billion in 2023. [6]

In 2025, just a year after its US IPO, Geely Auto took Zeekr private by acquiring all shares at $25.87 each, valuing the company at about $6.83 billion. The move is intended to streamline Geely’s automotive operations amid increasing domestic competition.

16. Avatr Technology

Funding: $3 billion+

Annual Sales: 73,606 units (2024)

Avatr produces luxury electric vehicles that integrate advanced smart technologies. The company leverages its partnership with Chinese automobile and tech giants. For example, Changan provides automotive expertise, Huawei contributes smart vehicle and autonomous driving solutions, and CATL supplies high-performance batteries.

In 2022, the company launched its first model, Avatr 11, a luxury SUV focused on smart features and high performance. So far, they have secured nearly $3 billion across six funding rounds from big investors, including the Chongqing Changan Foundation and the National Green Development Fund. [5]

In 2024, Avatr sold 73,606 vehicles, marking a sharp 132.47% increase from the previous year. The growth is driven by the success of models like the Avatr 07 and 06. Looking ahead, the company plans significant expansion, aiming to reach 400,000 global sales by 2027.

15. Aiways

Revenue: $82.4 million (2024)

Aiways has created its own electric vehicle platform called MAS (More Adaptable Structure). This platform is modular, meaning it can be adjusted and used to build different types of vehicles on the same base, giving the company more flexibility in design and production.

However, the company has faced several challenges in recent years, including financial difficulties and a competitive domestic market. That’s why they have adopted a business model centered on exporting vehicles to international markets, particularly in Europe. [9]

Aiways’ financial performance has been modest, reflecting the broader challenges faced by many EV startups. In 2020, they sold 2,600 units, followed by 3,011 units in 2021. In 2023, they exported over 1,000 vehicles.

In 2024, the company withdrew from China to focus on European markets. They are developing a new budget-friendly EV priced around €25,000 to broaden appeal in Europe.

The company’s future largely hinges on its ability to secure new investments and maintain a competitive edge in international markets.

14. Hozon Auto

Founded in 2014Revenue: $1.91 billion

Annual Sales: 127,400+ units

Hozon Auto has rapidly gained traction in the EV market by adopting a business strategy akin to that of Xiaomi in the smartphone industry. This involves offering high-quality vehicles at highly competitive prices, targeting customers in lower-tier cities and rural areas.

The company produces affordable electric SUVs, such as the Neta V and Neta U, priced around $15,000. This pricing strategy allows Hozon to tap into a less crowded market segment, avoiding direct competition with higher-end brands like Tesla and Nio.

Hozon plans to expand into 50 international markets, including the Middle East, Southeast Asia, and Latin America. In 2024, the Hong Kong government announced a subsidy of up to $25.6 million to help ease Hozon’s financial burden and support its overseas expansion. [11]

In the same year, three Chinese government-founded investment firms collectively invested $691 million to further alleviate Hozon’s financial pressures.

13. Seres

Founded in 2016Revenue: $20 billion+ (2024)

Annual Sales: 426,900+ units

Seres is known for its strategic partnership with Huawei, under which it established the AITO brand. This collaboration has yielded popular models such as the AITO M5, M7, and M9.

In 2023, Seres generated $5.05 billion in revenue, a slight increase from the $4.99 billion recorded in 2022. Despite this growth, the company remains unprofitable, reporting a loss of $540 million in 2023, down from a $680 million loss in 2022. This loss was primarily due to substantial investments in R&D and marketing costs. [10]

In 2024, Seres reported $20 billion in annual revenue, a massive 305% increase compared to the previous year. The company also turned things around financially, moving from a net loss of about $540 million in 2023 to a net profit of $720 million in 2024.

This success made Seres one of the few profitable new energy vehicle (NEV) companies in the world, alongside Tesla, BYD, and Li Auto.

12. Great Wall Motor

Ora Lightning Cat

Ora Lightning Cat

Revenue: $28.3 billion+

Annual Sales: 1,233,292 units (2024)

Great Wall Motor (GWM) is one of the largest automakers in China, with a diverse portfolio of brands, including Haval, Wey, ORA, and GWM Pickup. It has been increasingly focusing on new energy vehicles (NEVs) as part of its strategy to remain competitive in the rapidly evolving automotive industry.

In the first three quarters of 2023, the company invested $771 million in R&D, a 16.8% increase over the previous year. As per their 2021 plan, total R&D spending is projected to reach $14 billion by the end of 2025. [12]

In 2023, GWM sold 261,546 new energy vehicles, with the Haval brand accounting for over 7,000 units, a year-on-year increase of 649%. The same year, the company reported annual overseas sales exceeding 300,000 vehicles for the first time, bringing its cumulative overseas sales to over 1.4 million vehicles. [13]

In 2024, GWM delivered 1,233,292 vehicles, a slight increase of 0.22% YoY. While sales in China dropped, the company saw strong growth overseas, with a 43.39% YoY increase and a record 453,141 units sold. Its new energy vehicle (NEV) sales also hit a record high, climbing 22.82% to 321,795 units.

11. Leapmotor

Revenue: $4.4 billion

Annual Sales: 293,724 units (2024)

Leapmotor produces cost-effective electric vehicles, focusing on self-developed technologies such as powertrains and software systems. This allows the company to control costs effectively and offer vehicles at competitive prices.

They have developed their own operating system, called Leap OS, which powers the infotainment and smart features in their vehicles, including navigation, voice recognition, and connectivity with mobile devices.

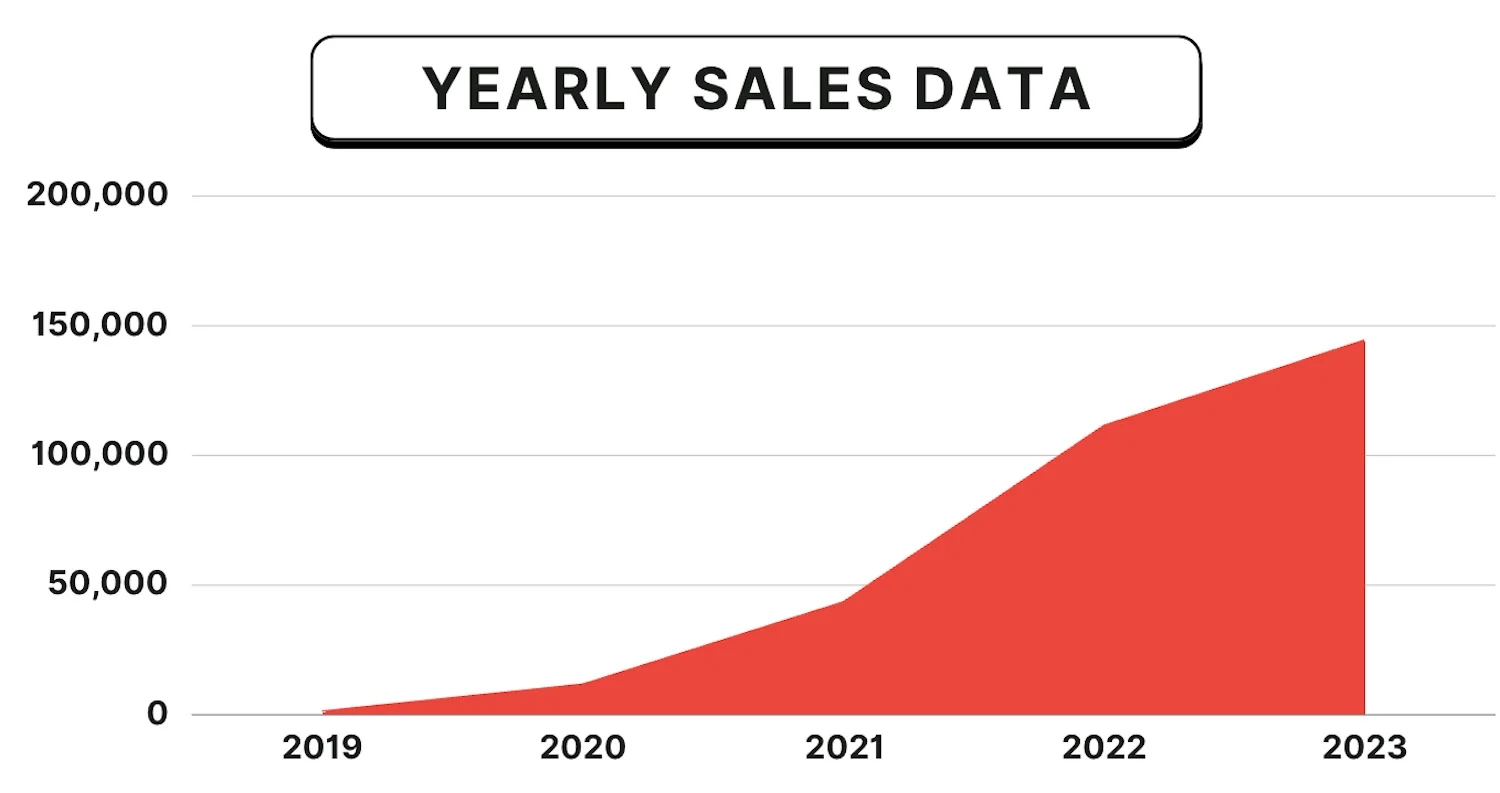

In 2023, Leapmotor sold 144,155 new energy vehicles, marking a 30% increase from the previous year, making it the tenth-largest manufacturer in China that year. Their sales network is also expanding steadily, now encompassing over 560 stores across 182 cities. [14]

The company has garnered significant attention from industry giants like Stellantis, which acquired a 20% stake in Leapmotor in 2023. This partnership is set to accelerate Leapmotor’s global ambitions, with plans to enter the European market soon.

In the first half of 2025, Leapmotor achieved its first-ever interim net profit of $4.2 million, making it the second Chinese EV startup to do so (after Li Auto) on a half-year basis.

10. Hongqi

Hongqi HS7

Hongqi HS7

Revenue: $14 billion

Annual Sales: 411,777 units (2024)

Hongqi produces luxury vehicles under the FAW Group. It blends luxury and Chinese cultural heritage that resonates strongly with domestic consumers. The brand aggressively expanded into the EV market, with plans to fully electrify its lineup by 2030.

Between 2018 and 2021, the brand experienced remarkable growth, with sales rising from 33,000 units in 2018 to over 100,000 in 2019, more than 200,000 in 2020, and surpassing 300,000 in 2021 — an increase of over nine times (about 809%) within just four years.

In 2023, the brand achieved a significant milestone, selling over 370,000 vehicles, a 29.5% increase from 2022. Among these, the sales of new electric vehicles exceeded 85,000 units, reflecting an impressive 135% year-on-year growth. [15]

In 2024, Hongqi delivered 411,777 vehicles, a 17.4% YoY increase and its seventh consecutive year of growth. NEV sales soared to 115,000 units, up 43.7% YoY.

At the Auto Shanghai 2025 Show, Hongqi introduced its “Shared-Value Mobility Union” initiative and unveiled new models, such as the Guoya, EH5, and EHS5. The company also presented concept vehicles, including an off-road model and a “flying car.”

9. Lynk & Co

Lynk & Co Z10

Lynk & Co Z10

Annual Sales: 280,000 units (2024)

Jointly owned by Geely and Volvo, Lynk & Co’s business model revolves around flexibility and connectivity. It offers several options for consumers to access its vehicles, such as purchase, subscription, and car-sharing.

The brand positions its vehicles as “smartphones on wheels,” emphasizing seamless connectivity and integration with digital ecosystems. All Lynk & Co vehicles come with a cloud-connected platform that allows for over-the-air updates and remote diagnostics.

They have been performing well, especially in China and Europe. In 2022, their membership base and workforce more than doubled. By 2023, they sold 220,250 vehicles globally, with new energy vehicles (NEVs) accounting for nearly 55.3% of total sales. [16]

In 2025, the company launched the Lynk & Co 900, a PHEV SUV and the first production vehicle powered by Nvidia’s Drive Thor chip. They also introduced the Lynk & Co 10 (Z10 PHEV), a plug-in hybrid sedan equipped with LiDAR, an advanced hybrid powertrain offering up to 192 km of EV range, and a high-performance infotainment system powered by Snapdragon 8295 and Nvidia Thor-U.

8. Chery

Chery eQ1

Chery eQ1

Revenue: $39 billion

Annual Sales: 2.6 million units (2024)

Being an early adopter of EV technology in China, Chery has developed a range of electric cars under its own brand and through joint ventures with companies like Jaguar and Land Rover. It is among China’s top five automobile brands, and has been the country’s leading car exporter since 2003.

In 2023, Chery delivered 1,881,316 vehicles, including 937,148 units exported to more than 80 countries. In 2024, Chery Group reached 2.6 million global vehicle sales, with EV sales increasing by 232.7% to over 583,000 units. Plus, they exported 1.1 million vehicles during the year.

The company invests nearly 7% of its total revenue in research and development. As of 2023, Chery had applied for over 26,000 patents, solidifying its position as a leader in the industry. [17]

Chery has introduced its Super Hybrid technology, which emphasizes industry-leading safety. The models successfully passed extreme tests, including saltwater battery immersion, seven-car pileups, and full-frontal crashes, with zero failures.

7. XPeng

Revenue: $5.6 billion

Annual Sales: 190,000+ units (2024)

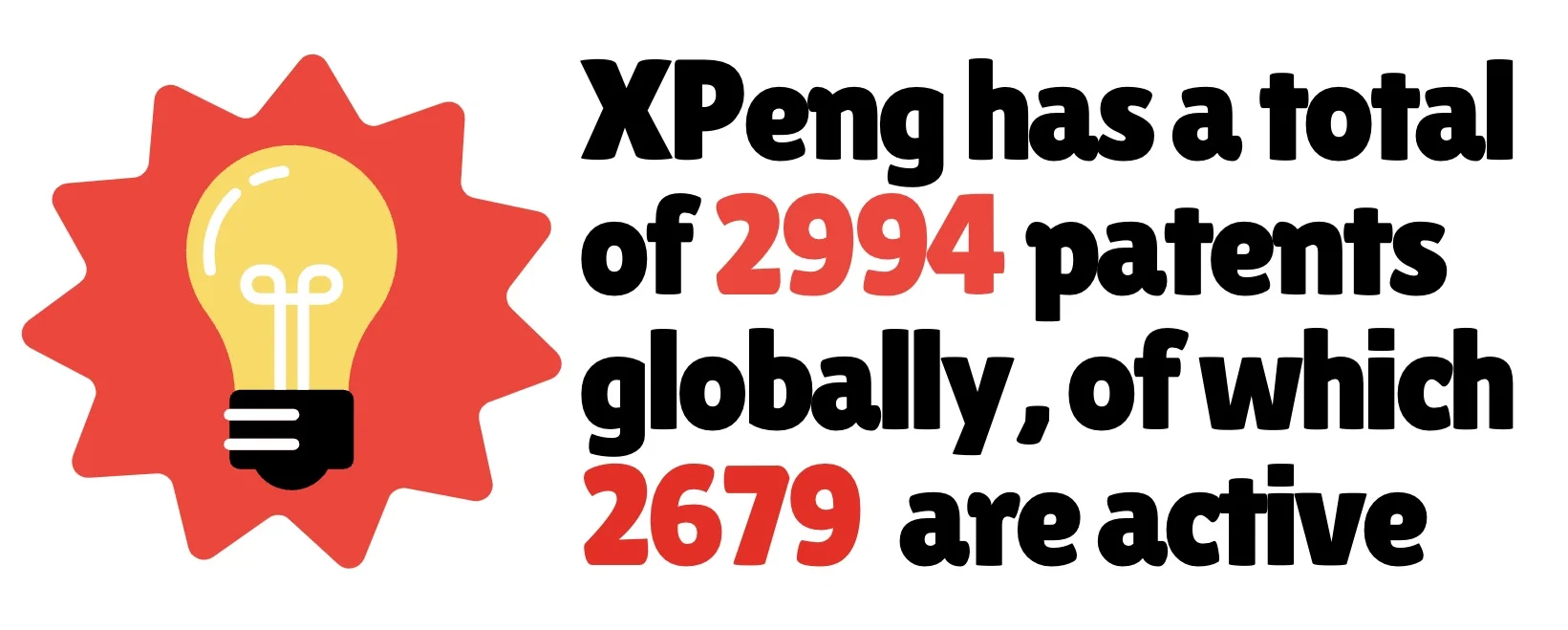

XPeng has quickly risen to prominence in the EV market, competing with major Chinese brands like NIO, Li Auto, and BYD. The brand has sold more than 445,000 vehicles since its inception.

Its proprietary autonomous driving system, XPILOT, is one of the most advanced in the Chinese market. XPILOT features adaptive cruise control, highway navigation, automatic lane changing, and parking assist. It is designed to evolve into Level 4 autonomous driving in the future.

In 2023, XPeng generated $4.32 billion in revenue, up from $3.98 billion in 2022. However, the company remains unprofitable, with a net loss of $1.46 billion in 2023, compared to a net loss of $1.35 billion in 2022. [18]

In the first half of 2025, XPeng delivered 197,189 vehicles, surpassing its total deliveries of 190,068 in 2024. In the same year, the company introduced 5C fast-charging batteries, which allow charging from 10% to 80% in approximately 12 minutes.

The company currently operates over 2,000 charging stations across China, and its customers have access to an additional 200,000 third-party stations in major cities.

6. Nio

Nio ET5

Nio ET5

Revenue: $9 billion+

Annual Sales: 221,970 units (2024)

Nio produces premium high-tech electric vehicles equipped with a smart cockpit that includes a large central touchscreen, voice-activated controls, and an AI-powered digital assistant called NOMI.

Unlike other players in the EV market, Nio implements the “Battery as a Service” (BaaS) model. This approach enables customers to purchase Nio cars without a battery, thereby reducing the upfront cost. Instead, they subscribe to a battery plan, which enables them to swap batteries at Nio’s swap stations. The company has more than 1,300 battery swap stations in China.

This model not only makes Nio’s vehicles more affordable but also helps alleviate range anxiety, a common concern among EV users. The strategy has proven successful: Nio sold 160,038 vehicles in 2023, a 30.7% increase from the previous year. [19]

2024 was even better: Nio delivered 221,970 vehicles, a 38% YoY increase. This figure includes deliveries for the main Nio brand, which sold 201,209 vehicles, and its new sub-brand, Onvo, which delivered 20,761 vehicles.

5. Li Auto

Li Auto Mega

Li Auto Mega

Revenue: $19.79 billion

Annual Sales: 500,508 units (2024)

Li Auto produces extended-range electric vehicles, which combine battery power with a small internal combustion engine that acts as a generator. This hybrid approach offers the benefits of electric driving with the added assurance of a gasoline engine for extended range.

Li Auto has shown impressive growth in recent years. In 2024, the company sold 500,508 vehicles, a significant jump from 376,030 units in the previous year. This surge led to an annual revenue of $19.79 billion, reflecting a 13.45% increase from 2023.

As their revenue grew, the company also increased its investment in R&D. In 2024, Li Auto’s R&D expenses reached $1.5 billion. These expenditures were allocated partly toward advancing EV technology and partly toward enhancing intelligent driving systems. [20]

4. Changan Automobile

Revenue: $47.5 billion+

Annual Sales: 2.68 million+ units

Changan Automobile is a state-owned enterprise with a strong emphasis on R&D, innovation, and strategic partnerships. It is one of China’s oldest and largest automakers, with a market share of 6.4% in China. [7]

In 2023, the company sold over 2.5 million vehicles, an 8.8% increase from the previous year. Among these, 474,045 units were new energy vehicles, which saw a dramatic 74.8% year-on-year growth.

Changan has been actively transitioning towards electrification as part of its broader strategy to align with global trends in sustainable transportation. It aims to cease production of vehicles powered solely by internal combustion engines by the end of 2025.

Plus, the company plans to introduce more than 30 new energy products by 2028, offering a mix of fully electric, plug-in hybrid, and hybrid models. [8]

At Auto Shanghai 2025, Changan unveiled its technology roadmap, which includes a prototype solid-state battery developed in collaboration with CATL. It is expected to go into mass production by 2027. The company also introduced an intelligent battery collision monitoring system and a fast-charging battery technology called Kirin 4C.

3. SAIC Motor

SAIC Motor IM LS7

SAIC Motor IM LS7

Revenue: $87.2 billion

Annual Sales: 4.6 million+ units (2024)

SAIC Motor is a state-owned enterprise that produces both traditional internal combustion engine vehicles and New Energy Vehicles (NEVs). It operates several joint ventures with international automotive giants like Volkswagen (SAIC Volkswagen) and General Motors (SAIC-GM).

In 2023, SAIC Motor sold over 5 million vehicles, maintaining its position as the top domestic automaker for the 18th consecutive year. SAIC also made notable strides in the areas of NEVs and international markets.

Building on its achievement of surpassing 1 million NEV sales in 2022, the company sold 1.12 million NEVs in 2023, ranking second among domestic automakers. The MG4 EV played a crucial role in this success, emerging as the top-selling compact EV in Europe in 2023. [21]

2024 was largely similar to the previous year for SAIC Motor. The company reported annual terminal deliveries of 4.63 million vehicles and cumulative wholesale sales of 4.013 million vehicles. However, it achieved record results, with 1.234 million NEVs sold wholesale and 1.038 million overseas sales.

2. Geely

Founded in 1986Geely Auto Group unveils its new short blade EV battery technology:

-New standards for safety

-1-million kilometer safe driving

-Super-fast charging and stable low temperate performanceClick the link to learn more:https://t.co/TcLgY9HWJ5

— Geely Auto (@GeelyAutoGlobal) June 28, 2024

Revenue: $33.11 billion+

Annual Sales: 2,176,567

Geely is perceived as an innovative and forward-thinking automaker, particularly in the context of NEVs. Its robust supply chain, prominent brands like Lynk & Co and Zeekr, and strategic partnerships (such as with Volvo and Proton) have bolstered its reputation globally.

Geely’s ability to integrate advanced technologies like the short-blade LFP battery and smart cockpit system enhances its product offerings. They are also heavily investing in renewable energy sources, sustainable manufacturing practices, and the development of recyclable materials for use in their vehicles.

In 2023, Geely sold over 1.68 million units, with NEV sales rising by 48.3%. In 2024, it delivered more than 2 million vehicles, and its revenue rose by more than 200% to surpass $33 billion. [22]

At the 2025 Shanghai Auto Show, Geely announced it would share over 1,500 battery-safety patents with the broader automotive industry to advance EV safety standards.

1. BYD

BYD Seal

BYD Seal

Revenue: $107 billion (for BYD Group)

Annual Sales: 4.27 million+ (2024)

BYD initially focused on rechargeable batteries but later expanded into automobiles, rail transit, and electronics. In 2003, it formed an automotive subsidiary, BYD Auto, which later became a key player in the global shift towards EVs.

Beyond being the best-selling car brand in China, BYD Group also leads in research and innovation. In 2023, the group was granted 3,207 new patents in China, bringing its total number of Chinese patents to 26,201. [23]

BYD is gaining traction globally, with a substantial increase in exports – up 334.2% in 2023. The company has established a strong presence in Europe, Latin America, and North America, with its electric buses and trucks being utilized in major cities worldwide, including London, Santiago, and Los Angeles.

As of August 11th, 2024, BYD has reduced carbon emissions by a total of 65,257,613,986 kg, offsetting the equivalent of 1,087,626,900 trees worth of CO₂

Removing the equivalent of 15.53 million ICE vehicles being driven for a year. If lined up around the world, those cars would… pic.twitter.com/mt3JaVYSX6

— BYD (@BYDCompany) August 12, 2024

In 2022, BYD became the world’s largest EV maker by sales, surpassing Tesla. This milestone was driven by the popularity of its plug-in hybrid and electric models, particularly in China.

In 2023, BYD sold over 3.02 million vehicles, including 1.6 million fully electric vehicles. The best-sellers were the Ocean and Dynasty Series, which together reached 2,877,353 units, representing a 55.3% increase from the previous year. [24]

In 2024, the company set a new record with global sales of 4.27 million NEVs, up 41.26% from 2023. Nearly 90% of BYD’s sales came from the Chinese market.

The company has introduced the Super e-Platform, which supports mega-watt (1 MW) charging and can add 400 km of range in just five minutes using blade battery technology. The platform also includes new high-speed motors, with the first models to feature them being the Han L and Tang L.

Read More

Sources Cited and Additional References- Global EV Outlook, Electric car sales break new records, IEA

- Electric car sales, Nearly one in five cars sold in 2023 was electric, IEA

- News, The number of charging piles in China will increase to 16.6 million, EEWorld

- Evelyn Cheng, China has spent at least $230 billion to build its EV industry, CNBC

- Company Overview, Avatr’s funding and financials, Crunchbase

- Forn F-1, Zeekr Intelligent Technology Holding Limited representing 175,000,000 ordinary shares, SEC

- Sales Data by Models, China’s automotive sales data, Marklines

- Newsroom, 2024 Changan Global Partners Conference, Changan

- Nick Carey, Chinese EV maker Aiways talking to investors for export-only approach, Reuters

- Earnings for Seres Group, The latest financial report of the company’s current earnings, CompaniesMarketCap

- Jill Shen, Hong Kong to provide a $25.6 million subsidy to China EV maker Hozon Auto, TechNode

- Market & Tech Reports, GWM: Over 1.23 million units sold in 2023, Marklines

- Dong Yi Chen, GWM sold 261,546 new energy vehicles in 2023, up 98.39%, CarNewsChina

- Annual Results, Leapmotor’s total deliveries were 144,155 units in 2023, HKEXnews

- Gabriella From Gasgoo, Hongqi’s annual retail sales exceed 370,000 vehicles in 2023, AutoNews

- News, 2023 annual sales by Geely holding brands rise 20% to 2.79 million units, Geely

- Chery, Over 26,000 patents showcase Chery’s R&D capability, PRNewswire

- Company Financials, XPeng’s net income chart, Macrotrends

- News Release, NIO delivered 160,038 vehicles in 2023 in total, increasing by 30.7% year-over-year, NIO

- Company Financials, Li Auto’s R&D expenses, Macrotrends

- Annual Report, 2023 was a year of great accomplishment and significant progress for SAIC, SAIC

- Electric & New Energy vehicles, Geely’s profit soars 213% driven by EVs, SCMP

- Vehicles & Road Traffic, Cumulative number of patents granted to BYD Group, Statista

- News, BYD concludes 2023 with a record 3 million annual sales, BYD