Peloton has reshaped the fitness landscape by blending connected hardware, subscription content, and wellness apps. The company generates over $2.5 billion in annual revenue and has built a subscriber base of nearly 3 million paid members, supported by a wider community of over 6 million registered accounts. [1]

In a single year, Peloton members completed over 650 million workouts, averaging more than 200 workouts per subscriber. The platform continues to dominate the home fitness market, accounting for an estimated 51% of US connected fitness equipment revenue.

Beyond hardware and streaming classes, the battle for market share now includes wellness integration. Peloton has started expanding into meditation, sleep tracking, nutrition advice, and AI-driven personalization.

Rivals are following suit, integrating recovery tools, meal planning, and even mental health features into their platforms. Peloton’s top competitors have never been more aggressive, or more varied, in their strategies.

The companies that win in the next five years will be those that can keep users not just active, but engaged across multiple aspects of their daily lives.

Did you know?The global home fitness equipment market is projected to exceed $19.7 billion by 2032, growing at a CAGR of 6.3%. Meanwhile, the connected gym equipment market is forecasted to reach $9.9 billion by 2033, with a CAGR of 26.2%. [2][3]

Table of Contents

13. Wahoo Fitness

Founded: 2009Revenue: $60 million+

Rivalry Angle: Competes in connected fitness

Competitive Edge: Hardware innovation and Interoperability

Wahoo Fitness produces high-performance indoor training equipment and wearable technology. Over the years, it has expanded its portfolio beyond bike trainers to include GPS cycling computers, heart rate monitors, smart bikes, and an entire training ecosystem.

Wahoo rose to prominence with the launch of its KICKR Smart Trainer in 2012, a product that revolutionized indoor cycling by offering a realistic road feel. The company followed this with the ELEMNT series of GPS cycling computers and the TICKR heart rate monitor, solidifying its reputation among professional cyclists and triathletes.

While competitors like Peloton target mainstream home fitness users, Wahoo appeals to serious athletes and cycling enthusiasts who value accurate power measurement, realistic riding simulation, and compatibility with professional-grade training platforms.

Its products are known for exceptional reliability and app compatibility, working with Zwift, Rouvy, TrainerRoad, and Strava.

12. Orangetheory Fitness

Founded: 2010Number of Studios: 1,500+

Rivalry Angle: Competes in the premium fitness market

Competitive Edge: Science-driven programming, Franchise scalability

Orangetheory Fitness is one of the fastest-growing boutique fitness franchises globally, known for its science-backed, technology-driven group workout model. It has expanded rapidly to over 1,500 studios across 25+ countries. [4]

The company’s concept revolves around heart rate–based interval training, where users wear connected fitness trackers to maintain optimal zones for calorie burn and cardiovascular health.

The workouts are designed around the “orange zone,” a heart rate range where the body burns more calories even after the session ends, known as Excess Post-Exercise Oxygen Consumption.

Each class is a mix of rowing, treadmill running, and strength training, guided by certified coaches and enhanced with real-time biometric tracking displayed on studio screens. This blend of data-driven personalization and a social, group-oriented environment has helped Orangetheory stand out in a competitive fitness market.

In 2024, Orangetheory Fitness merged with Self Esteem Brands, which now oversees more than 7,000 locations and generates $3.5 billion in sales. This consolidation has expanded the company’s reach and operational scale. [5]

11. Whoop

Number of users: 500,000+

Rivalry Angle: Competes for health and engagement data leadership

Competitive Edge: Deep biometrics and health analytics

Founded in 2012 by Harvard student-athlete Will Ahmed, Whoop began as a tool to help athletes gain insight into recovery and optimize performance via biometric tracking. Today, it produces a screenless fitness tracker that focuses on critical metrics, including strain, recovery, sleep, heart rate variability, and respiratory rate.

Whoop devices are screenless, sleek, and designed to be worn 24/7 for continuous monitoring. The company has nearly 500,000 active members globally, with partnerships spanning the NFL Players Association, PGA Tour, CrossFit, and professional cycling teams.

It follows a subscription-based model, bundling the wearable with a monthly or annual membership starting at $30 per month, which provides access to advanced analytics and features. Currently, Whoop has over 200,000 paying subscribers, from professional athletes to biohacking executives.

Both Peloton and Whoop operate within the broader fitness and wellness industry, but their approaches differ significantly. While Peloton’s primary offering is connected fitness equipment paired with instructor-led workouts, Whoop is equipment-light and analytics-heavy, relying on wearable data to enhance recovery, performance, and overall wellness.

In short, Peloton tells users what workouts to do, while Whoop tells users when to work out and how much strain to take on, based on physiological readiness.

10. Zwift

Founded: 2014Membership Cost: $19/month

Rivalry Angle: Targets cyclists and runners with interactive, gamified training

Competitive Edge: Sport-specific training, Extensive virtual worlds

Zwift blends indoor cycling and running with the immersive excitement of a massively multiplayer online game. Users train, race, and explore virtual worlds together, seamlessly mixing fitness with social gaming.

The company’s rapid growth in the connected fitness space is largely attributed to its gamification approach, where users collect points, unlock gear, and climb leaderboards, fostering long-term engagement.

Zwift’s virtual environments are constantly expanding, with popular maps like Watopia, London, and New York, offering diverse terrains and conditions. This variety keeps workouts fresh and competitive. [6]

It has also expanded into hardware with the launch of the Zwift Ride Smart Frame in 2024, priced at $799.99, signaling its intention to compete directly with Peloton and other connected equipment makers. [7]

9. BODi

Founded: 1998Annual Revenue: $320 million+

Rivalry Angle: Home fitness subscription

Competitive Edge: Structured program library + nutrition Integration

BODi offers a combination of workout programs, nutrition products, and digital platforms. It targets at-home users through program-based fitness journeys that pair structured workouts with nutrition guidance, supplements, and mindset support.

It features popular workouts like P90X, Insanity, and 21 Day Fix, catering to all fitness levels, from beginners to advanced athletes. Users can choose from a wide range of training styles, including yoga, HIIT, strength training, cycling, dance workouts, Pilates, and mixed martial arts, with 1,000+ workouts available for home or gym sessions.

Beyond fitness, BODi offers structured nutrition guidance, including portion control plans, weekly meal prep guides, grocery lists, and recipes tailored to various dietary preferences, such as vegan, vegetarian, and gluten-free.

The platform reports a 96% monthly retention rate and has more than 900,000 subscribers. [8]

While BODi does not have Peloton’s dominance in hardware, it offers stronger dietary integration and long-term coaching content. Peloton focuses on entertainment and brand community, whereas BODi emphasizes depth of content, lifestyle integration, and long-standing brand trust among users seeking lasting transformation.

8. Equinox Group

Founded: 1991Number of Employees: 10,000+

Rivalry Angle: Competes in the premium fitness space

Competitive Edge: Luxury-first positioning, Diverse brand portfolio

Equinox Group is an American luxury fitness and lifestyle company that has redefined the health club experience with a high-end, holistic approach. It offers more than a traditional gym experience, focusing on luxury, personalized training, spa services, and curated lifestyle experiences.

Equinox currently operates more than 300 club facilities across major cities in the US, as well as in London, Toronto, and Vancouver. It captures roughly 2.3–2.4% of US health club revenue.

Their operations go beyond the core Equinox Fitness Clubs to include specialized concepts such as SoulCycle (indoor cycling), Blink Fitness (value segment), Pure Yoga (yoga-focused studios), and Equinox Hotels (integrating wellness and hospitality).

The annual membership fees can range from $200 to over $500 per month, with initiation fees that can exceed $500. Equinox has also made strategic moves into the digital fitness space, offering its Equinox+ app, which provides streaming access to classes from Equinox, SoulCycle, Precision Run, and more.

Compared to Peloton, which is primarily a hardware-plus-subscription company, Equinox is a physical-first lifestyle brand built on luxury fitness clubs, premium amenities, and in-person community engagement, with digital offerings as a complementary service.

7. Keiser

Annual Revenue: $30 million+

Rivalry Angle: High-end indoor cycling market

Competitive Edge: Prioritizes accurate power measurement & biomechanics

Founded by brothers Dennis and Randy Keiser, the brand pioneered the first air-powered pneumatic resistance equipment in 1978. Over the past four decades, Keiser has led the way in functional fitness equipment, serving a diverse range of users from elite athletes to rehabilitation professionals.

Known for its biomechanically precise design, Keiser leverages compressed air resistance across both strength and cardio equipment, ensuring smoother, safer, and velocity-sensitive workouts.

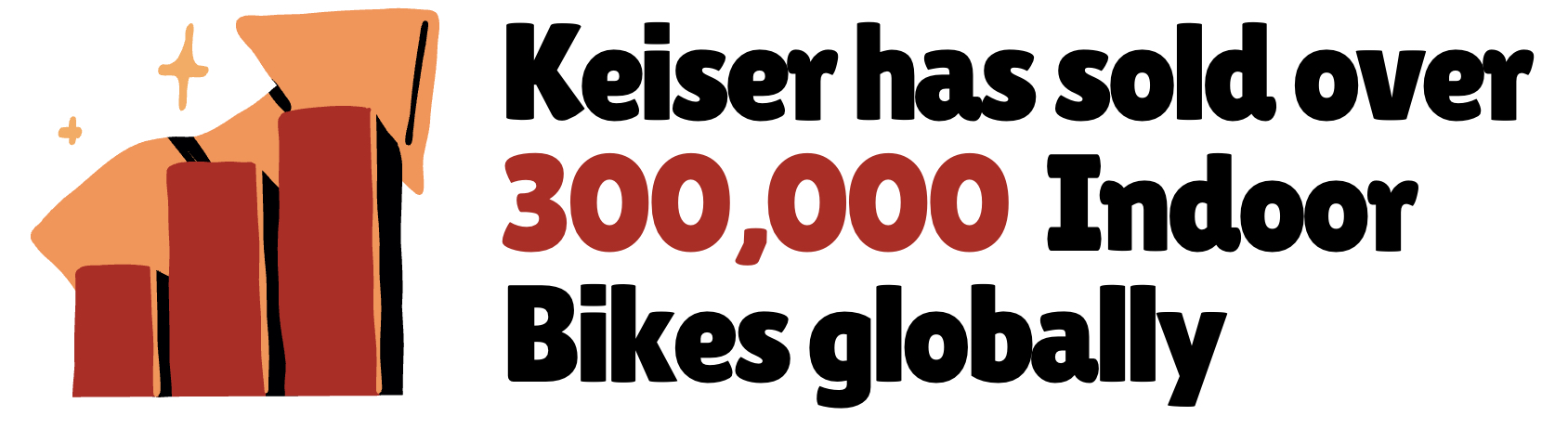

Its M Series indoor bikes, which use magnetic eddy-current resistance, are renowned for their durability, smooth performance, and low maintenance. Over 300,000 units have been sold worldwide.

Keiser’s reach extends to professional sports teams, the US Armed Forces, NASA, and medical and rehabilitation facilities. All Keiser products are designed and manufactured in California, reflecting American craftsmanship and precision engineering. [9]

6. BowFlex

Founded: 1986Membership Cost: $11.99/month

Rivalry Angle: Affordable, diverse equipment beyond cycling

Competitive Edge: Versatility and space efficiency

BowFlex has established a strong foothold in the home workout market by targeting both casual fitness users and serious athletes seeking convenience without compromising quality. It perfectly balances affordability, durability, and functionality.

Its product range caters to various workout preferences, from the BowFlex C6 Bike competing directly with Peloton, to Max Trainer hybrid cardio machines, and the SelectTech dumbbells, which have sold in the millions and are a favorite among space-conscious home gym users.

The connected cardio machines are powered by the JRNY adaptive fitness platform, which offers adaptive, AI-based training. Features include personalized coaching, virtual training content, and streaming entertainment directly from the console, available for about $11.99/month.

In short, Peloton is the “Apple” of connected cycling, offering a premium, software-driven ecosystem, while BowFlex is more like a Swiss Army knife of home fitness, catering to multiple workout needs with durable, space-efficient equipment that stands the test of time.

5. Life Fitness

Founded: 1977Number of employees: 2,200+

Rivalry Angle: Connected workouts with integrated subscription content,

Competitive Edge: Extensive product range & Global distribution network

Life Fitness has an extensive product portfolio that includes treadmills, stationary bikes, elliptical trainers, strength machines, and connected fitness solutions. It has consistently adapted to changing fitness trends, investing heavily in connected training solutions, digital fitness platforms, and biomechanically advanced machines.

Today, Life Fitness operates under KPS Capital Partners and encompasses multiple brands such as Hammer Strength, InMovement, Indoor Cycling Group, and Cybex.

Their equipment is used in both commercial and home settings, totaling billions of usage hours and miles of activity. In 2024 alone, exercisers logged 5.9 billion hours on Life Fitness machines, completing 331 million individual workouts, burning 48.6 billion calories, and covering 484 million miles. [10]

Beyond product sales, Life Fitness offers leasing and financing options, informational resources, design services, and sustainability initiatives, with a goal of achieving carbon-neutral operations by 2050.

4. Technogym

Founded: 1983Revenue: $1 billion+

Rivalry Angle: High-end connected fitness equipment

Competitive Edge: Diversified customer base, Scientific training accuracy

Technogym is one of the most recognized premium fitness equipment manufacturers worldwide, often referred to as the “Ferrari of fitness equipment” due to its luxury positioning, advanced technology integration, and strong brand associations with elite sports teams, Olympic Games, and high-end gyms.

The company supplies professional-grade equipment to over 100,000 wellness centers and 500,000 private homes across 100+ countries. Its clientele includes exclusive hotels, professional sports franchises, rehabilitation centers, and luxury residential developments, making it a dominant name in both commercial and home fitness markets.

Financially, Technogym generates over $1 billion in annual revenue, with nearly 90% of its sales coming from international markets outside Italy. [11]

Unlike Peloton, which excels in creating a consumer social network of fitness enthusiasts, Technogym’s strength lies in engineering precision, luxury design, and global institutional trust. Plus, it operates in far more countries and has deep roots in B2B relationships.

3. Hydrow

Total Funding: $255 million+

Rivalry Angle: Premium, content-rich alternative in rowing

Competitive Edge: Cinematic on-water workout experiences

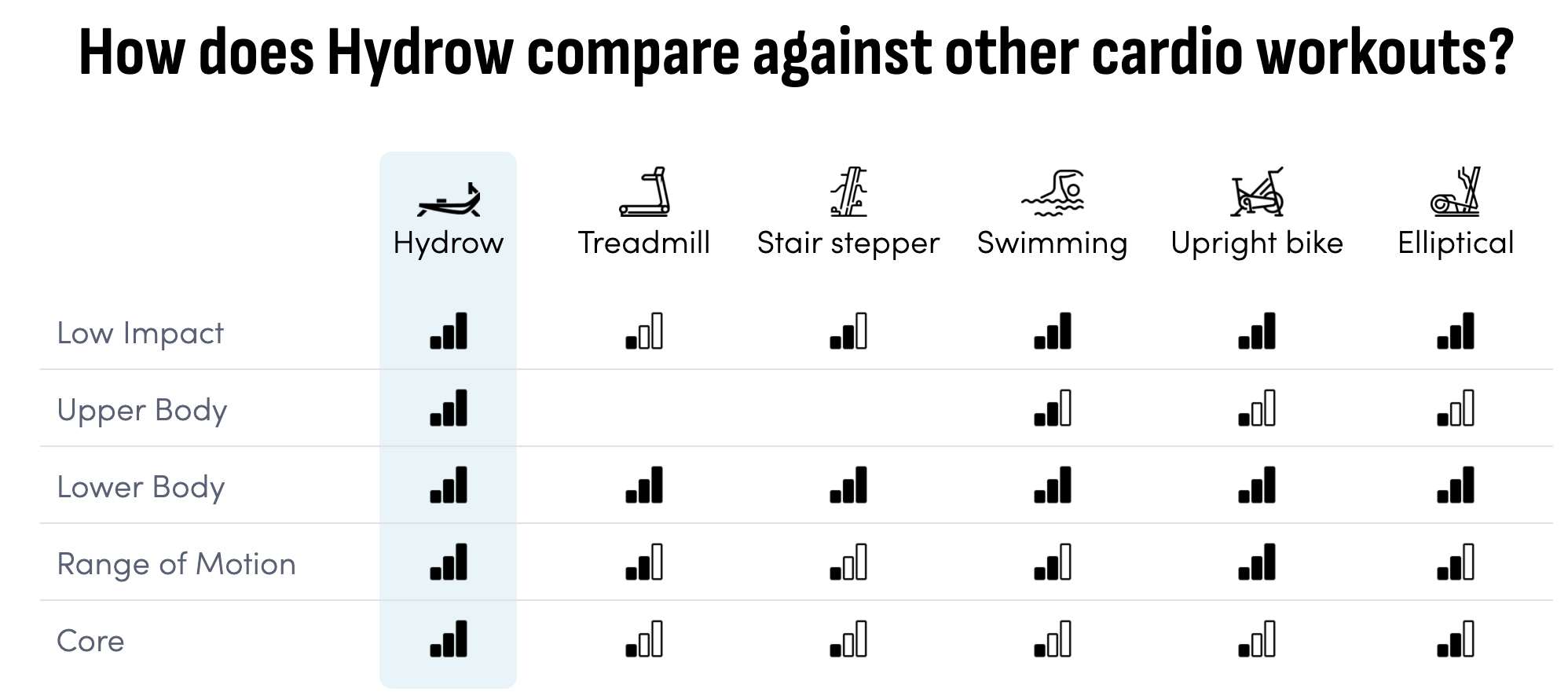

Hydrow specializes in interactive rowing machines that blend immersive on-water experiences with live and on-demand workouts. Instead of focusing on cycling or treadmills like many of its rivals, Hydrow differentiates itself by offering a workout that engages over 86% of the body’s major muscle groups in a single session. [12]

Its flagship Hydrow Rower features a sleek design, patented electromagnetic resistance technology, and a large HD touchscreen that streams workouts filmed on actual waterways around the world.

The company has also expanded its product lineup with the Hydrow Wave, a more affordable, compact rowing machine targeting apartment dwellers and cost-conscious consumers.

Hydrow offers premium connected rowing machines priced between approximately $1,695 and $3,995. Members can access live rowing sessions and on-demand workouts by paying a monthly fee of about $44 for full access or $19.99 for digital-only access.

Over 90% of Hydrow customers had never owned a rowing machine before, highlighting the brand’s success in attracting newcomers to the sport. Its content library features nearly 5,000 workouts filmed in scenic locations around the world, including Miami, London, Boston, and the Alps. [13]

2. Echelon Fitness

Subscription Plan: Starts at $11.99/month

Rivalry Angle: Budget-friendly in the connected cycling segment

Competitive Edge: Accessible pricing & broad retail distribution

Founded with the aim of offering more affordable alternatives to premium interactive fitness systems, Echelon quickly carved out its space in the market through a diverse product lineup that includes smart stationary bikes, treadmills, rowing machines, and a connected fitness mirror.

Echelon combines hardware sales with a strong subscription-based digital content model, positioning it as a direct competitor to Peloton. Its products typically start at prices far lower than Peloton’s (some smart bikes are available for under $500) while offering live and on-demand classes through its Echelon Fit app.

The brand supports its hardware with a robust subscription-based platform (Echelon United and the Echelon Fit App), which offers 40+ daily live classes across modalities such as cycling, rowing, treadmill, and mirror-based workouts.

The company has partnered with major retailers, including Walmart, Costco, and Amazon, to reach a mass-market audience. In 2025, Echelon acquired FORTË, a leading B2B fitness streaming platform with over 457,000 users, 20 million minutes of content viewed, and a presence in 39 countries. [14]

1. iFIT Health & Fitness

Number of users: 6.4 million

Rivalry Angle: Cardio equipment & subscription-based training content

Competitive Edge: Extensive hardware portfolio & immersive scenic workouts

iFIT Health & Fitness is one of the world’s largest and oldest players in the home fitness equipment industry, tracing its roots back to 1977 when it started as ICON Health & Fitness.

Today, it integrates high-quality hardware with immersive, instructor-led content. The iFIT ecosystem spans several major fitness brands, including NordicTrack, ProForm, and Freemotion, each catering to different price points and workout preferences.

NordicTrack, for example, is the flagship brand that offers premium connected treadmills, stationary bikes, rowers, ellipticals, and strength machines. ProForm focuses on mid-tier affordability, while Freemotion is aimed at the commercial gym market.

A key factor in iFIT’s growth is its proprietary interactive training platform, which offers thousands of on-demand and live workouts led by elite trainers. These sessions often feature Google Maps-powered route simulations, outdoor scenic rides or runs, and automatic machine adjustments for incline, resistance, or speed, setting it apart from traditional, static workout programs.

Its community spans over 6.4 million total members with 1.5 million interactive fitness subscribers across 120+ countries, guided by a collective of 180 world-class trainers.

iFIT is strongly rooted in innovation, employing 2,400 people and holding more than 720 active or pending patents. The majority of these patents are filed in the United States, followed by China and Taiwan. [15]

Read More

Sources Cited and Additional References- Sports & Fitness, Number of Peloton subscriptions worldwide, Statista

- Homecare & Decor, Connected gym equipment market size and trend analysis, GrandViewResearch

- Healthcare, Connected gym equipment market and trend analysis, Imarc Group

- External Company, Orangetheory Fitness taps grammy award, American Spa

- PR NewsWire, Orangetheory Fitness and Self Esteem Brands complete merger, Ians

- Zwift Community, What is virtual cycling?, Zwift

- Andrew Williams, Zwift Ride smart bike review, LiveScience

- Meg Flippin, The Beachbody company’s “Sticky” business model, Nasdaq

- Steve Manz, Keiser’s commitment to American innovation in fitness, Keiser

- Sam McGrath, Powering fitness excellence, LifeFitness

- Financial Highlights, Technogym closes a record-breaking 2024 and launches Healthness, Technogym

- Chris Haslam, Hydrow is the silky smooth Peloton of rowing machines, Wired

- Bethany Biron, Indoor-rowing leader maintains its upward trajectory, Business Insider

- News, Echelon Fitness acquires Forte, Echelon

- Key Insights, iFIT Health & Fitness patents, GreyB