Accenture has evolved from a traditional management consulting firm into a $69.6 billion technology-driven services giant. Over the past decade, the company has strategically repositioned itself as a digital-first organization, driven by cloud, data, and artificial intelligence.

It employs more than 779,000 people across 120+ countries. Its client list includes 91 of the Fortune Global 100 and over 75% of the Fortune Global 500, highlighting its dominance across industries such as finance, energy, healthcare, telecommunications, and the public sector. [1]

Yet, Accenture faces stiff competition from major players in consulting, strategy, risk advisory, and digital transformation. These rivals are not just chasing market share; they are redefining the future of professional services through automation, sustainability, and generative AI.

The competition now extends beyond traditional consulting, into cloud migration, data engineering, quantum computing, and intelligent operations.

I’ve featured the top Accenture competitors (covering their business models, financial strength, offerings, and strategic direction) to give you the full picture of how the global professional services race is unfolding.

Did you know?The global professional services market size (valued at $1.2 trillion in 2025) is expected to exceed $3 trillion by 2034, growing at a CAGR of 10.9%. [2]

Table of Contents

13. DXC Technology

Founded in 2017Headquarters: Virginia, United States

Revenue: $12.7 billion+

Number of Employees: 120,000+

Competitive Edge: Industry-specific technology solutions, Cost-conscious

DXC Technology was formed through the merger of Computer Sciences Corporation (CSC) and the Enterprise Services division of Hewlett Packard Enterprise (HPE).

Its mission revolves around enabling clients to “seize the opportunities of change,” which is reflected in its focus on hybrid cloud environments, AI-driven automation, and agile software delivery.

While both Accenture and DXC target the same client base (large multinational corporations seeking digital transformation), DXC differentiates itself by offering cost-efficient technology solutions for complex legacy environments.

DXC provides mission-critical IT services to industries such as insurance, healthcare, manufacturing, and financial services.

In recent years, the company has been focusing on cloud, AI, and other value-added services as it shifts away from legacy infrastructure toward higher-value offerings. This move is aimed at improving margins and strengthening its competitiveness against peers. [3]

12. McKinsey & Company

Founded in 1926Headquarters: New York City, United States

Revenue: $16 billion+

Number of Employees: 40,000+

Competitive Edge: Strategic depth & unparalleled global influence

McKinsey & Company is one of the world’s most prestigious management consulting firms, often considered the gold standard of strategic advisory services.

Its core mission has always been to help companies achieve lasting and measurable performance improvement. The firm operates across a wide range of industries, from financial services and healthcare to manufacturing and energy.

It provides expertise in areas like corporate strategy, organizational transformation, digital innovation, sustainability, and advanced analytics. In recent years, McKinsey has made a decisive push into technology and data-driven consulting, with its McKinsey Digital and QuantumBlack AI by McKinsey divisions leading this charge.

Unlike Accenture, McKinsey is privately held and operates as a global partnership, which gives it greater agility and a long-term strategic outlook.

The firm’s influence in the corporate world is remarkable — more than 400 of its alumni have become CEOs of major corporations or senior government leaders worldwide. This powerful network, often called the “McKinsey Mafia,” highlights the firm’s strong leadership development culture and global impact.

In developing markets, the consulting industry is seeing new growth dynamics. According to reports, the top strategy-consulting firms (including McKinsey) crossed $1 billion each in India in 2024. [4]

11. HCL Technologies

Founded in 1976Headquarters: Noida, India

Revenue: $14.2 billion+

Number of Employees: 226,600+

Competitive Edge: Engineering & R&D services

HCL has evolved from a traditional IT service provider into a full-stack digital transformation partner, emphasizing cutting-edge domains like data analytics, AI, and cloud-native applications.

One of the defining features of HCL’s success is its Mode 1–2–3 strategy, which balances core IT services (Mode 1), next-generation digital offerings (Mode 2), and innovation through ecosystems and products (Mode 3).

As a competitor of Accenture, HCL positions itself as a cost-efficient yet innovation-driven alternative in the global IT consulting and digital transformation market. Its approach is more technology-led, leveraging automation platforms like DRYiCE and proprietary AI frameworks to deliver operational excellence.

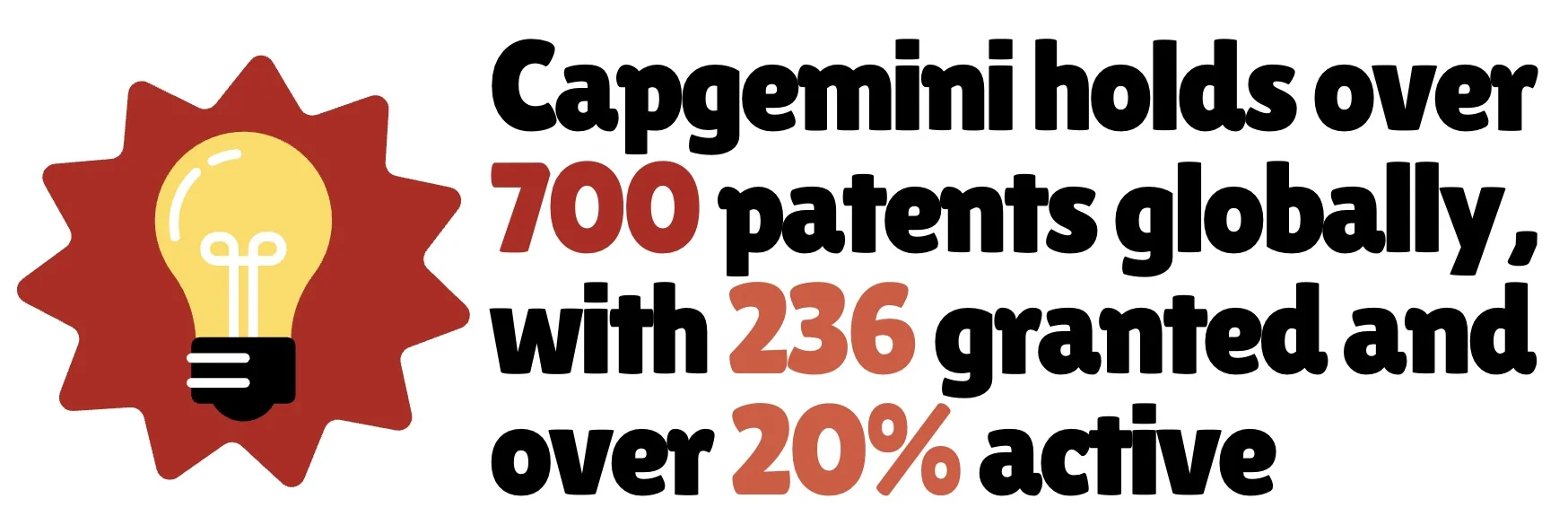

Plus, HCL’s engineering-driven DNA gives it a strong advantage in product design, embedded systems, and R&D outsourcing. The company holds more than 2,200 patents worldwide.

In recent years, HCL has launched several major AI-focused initiatives, including “AI Force” and “Enterprise AI Foundry,” along with programs aimed at training tens of thousands of employees in generative AI and related skills.

10. Boston Consulting Group (BCG)

Headquarters: Massachusetts, United States

Revenue: $13.5 billion+

Number of Employees: 331,000+

Competitive Edge: Proprietary frameworks like BCG Matrix and Experience Curve

BCG provides strategic consulting services to the world’s leading corporations, governments, and nonprofit organizations, focusing on innovation, transformation, digital strategy, and sustainability.

It is famous for introducing several foundational concepts in business strategy, including the Growth-Share Matrix (BCG Matrix), which revolutionized corporate portfolio management by helping companies allocate resources based on market growth and market share.

The firm runs subsidiaries and specialized units that extend its consulting scope into digital innovation, AI, and sustainability. For instance, BCG Digital Ventures helps clients incubate and launch new businesses, while BCG X integrates AI and data-driven decision-making into strategy consulting.

BCG fosters a culture of collaboration and intellectual excellence, attracting top talent from leading business schools and universities worldwide. It consistently ranks among the best employers globally, featuring prominently on Glassdoor’s Best Places to Work and Fortune’s 100 Best Companies to Work For lists.

The firm has also seen rapid growth in AI-related services, which now make up a significant share of its business, with estimates suggesting that AI and generative AI projects contribute around 20% of its total revenue.

9. Infosys

Founded in 1981Headquarters: Bengaluru, India

Revenue: $19.7 billion+

Number of Employees: 331,000+

Competitive Edge: Proprietary platform like Topaz (AI) and Cobalt (Cloud)

Infosys is one of the world’s most recognized names in information technology consulting and digital services, representing the strength of India’s IT revolution.

The company is known for transforming itself repeatedly in response to global technology shifts, from being a traditional outsourcing firm in the 1990s to a digital and AI-led consulting enterprise in the 2020s.

Infosys has built strong vertical capabilities across industries such as financial services, retail, healthcare, energy, manufacturing, and telecommunications, with BFSI alone contributing roughly 30% of total revenue.

Its AI and automation platform, Infosys Topaz, and cloud transformation suite, Infosys Cobalt, are at the core of its next-generation business strategy.

In FY 2025, the company completed over 400 generative AI projects — a nearly 75% increase from the previous year. It also reported that more than 270,000 of its 331,000+ employees are now “AI-aware” through upskilling initiatives, with over 24 million hours of training conducted globally. [5]

8. Cognizant Technology Solutions

Cognizant’s top clients

Cognizant’s top clients

Headquarters: New Jersey, United States

Revenue: $20.4 billion+

Number of Employees: 343,800+

Competitive Edge: Operational efficiency, Agile delivery

Founded as a division of Dun & Bradstreet, Cognizant has evolved into a global leader with a strong presence in industries like healthcare, financial services, manufacturing, life sciences, and communications.

The company’s growth story has been defined by its ability to adapt to technological disruption while maintaining cost efficiency. Over the last decade, it has transitioned from a traditional IT services vendor to a digital-first consultancy, focusing on AI, automation, cloud, and data-driven transformation.

Cognizant has made more than 30 strategic acquisitions over the past few years to expand its digital, cloud, and software engineering capabilities, including Softvision, Zenith Technologies, and Inawisdom.

In 2024 alone, Cognizant secured 29 large deals (so-called “large” meaning perhaps more than $100 million contract value). The company is investing heavily in AI training for its workforce and launching platforms like Neuro AI and Flowsource, which signal a shift to higher-value services.

Amid macroeconomic pressures in the IT services market, Cognizant has focused on improving operational efficiency to sustain its profitability. In FY 2025, the company reported an operating margin of 15.4%. [6]

7. Capgemini

Headquarters: Paris, France

Revenue: $25 billion+

Number of Employees: 349,400+

Competitive Edge: Engineering Depth, Cloud migration expertise

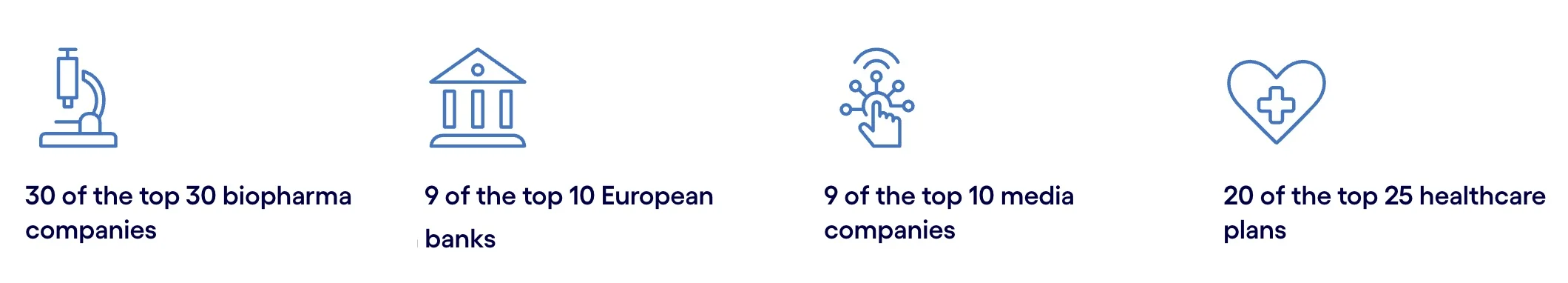

Capgemini is known for combining deep business expertise with cutting-edge technology, serving clients across sectors such as banking, automotive, manufacturing, telecommunications, public sector, energy, and consumer goods.

The company’s structure is organized into key service segments: Strategy & Transformation (Capgemini Invent), Applications & Technology, Operations & Infrastructure, and Engineering & R&D (Capgemini Engineering).

Capgemini leverages its partnership with hyperscalers such as AWS, Microsoft Azure, and Google Cloud to deliver AI-driven services.

The Capgemini Cloud Platform, for instance, enables clients to migrate, modernize, and manage complex IT ecosystems, while Capgemini Invent, its strategy and innovation arm, delivers high-value consulting in customer experience, sustainability, data strategy, and business model innovation.

In 2020, Capgemini acquired Altran Technologies for €3.6 billion, strengthening its engineering and R&D capabilities. The acquisition led to the creation of Capgemini Engineering, a division that now employs over 52,000 engineers and scientists across more than 30 countries. [7]

Plus, Capgemini’s strong focus on sustainability and inclusive growth is evident through its “Net Zero by 2040” initiative and growing investments in Green IT and ESG consulting.

6. IBM Consulting

Headquarters: New York, United States

Revenue: $20.6 billion+

Number of Employees: 160,000+

Competitive Edge: Technical depth and proprietary technology access

IBM Consulting is among the world’s largest technology and strategy consulting organizations, specializing in digital transformation, cloud services, AI, data analytics, cybersecurity, and business process consulting.

The company has undergone a major evolution in the past ten years, transitioning from traditional IT services to a cloud- and AI-driven consulting powerhouse. This transformation was accelerated by IBM’s $34 billion acquisition of Red Hat in 2019, which enabled the company to pivot towards hybrid cloud integration. [8]

Today, IBM Consulting works closely with major cloud hyperscalers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, while leveraging its own Red Hat OpenShift platform to build hybrid and multicloud solutions.

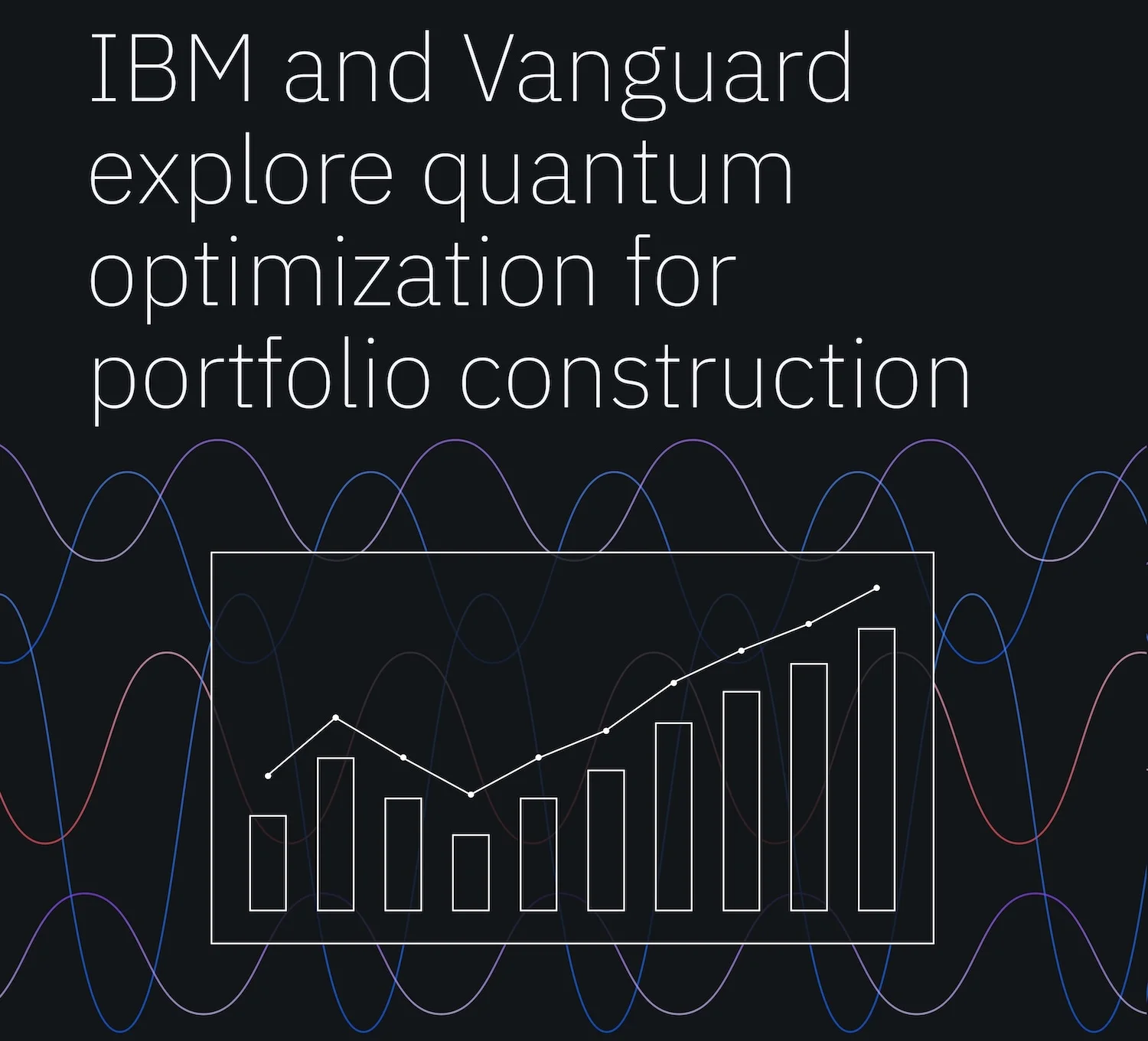

It also serves as a major systems integrator for AI and automation technologies, implementing IBM’s Watson AI, Watsonx data and AI platform, and quantum computing solutions into client operations.

The company is emphasizing its generative AI and hybrid cloud capabilities. For instance, in Spain, IBM stated that its generative AI business portfolio in 2024 was $5 billion, of which nearly $4 billion came from IBM Consulting.

In 2024, IBM Consulting generated over $20.69 billion in revenue, compared to $19.98 billion in 2023.

5. Tata Consultancy Services (TCS)

Founded in 1968What happens when 281K professionals collaborate with AI? They create solutions and history! TCS AI Hackathon, the largest global AI hackathon ever, didn’t just yield ideas and breakthroughs but also powered the beginning of a human-led AI-first culture at #TCS.

— Tata Consultancy Services (@TCS) October 17, 2025

Headquarters: Mumbai, India

Revenue: $31 billion+

Number of Employees: 593,300+

Competitive Edge: Diverse service portfolio, operational efficiency and margins

TCS is one of the world’s most valuable IT services and consulting firms, forming the crown jewel of the Tata Group, India’s oldest and most diversified business conglomerate.

The company’s rise has been deeply rooted in its commitment to long-term client partnerships and large-scale digital transformation projects. Over the past 20 years, it has become the backbone of digital modernization for many Fortune 500 enterprises, offering end-to-end IT services, consulting, and business solutions.

About 48% of TCS’s revenue comes from North America, with Europe contributing roughly 32%. Its clients include nearly half of Fortune 500 companies, many of whom have worked with TCS for over a decade.

With an operating margin of about 24% and a net margin of around 19%, TCS continues to demonstrate its ability to deliver profitable services at scale. These strong margins give the company the flexibility to invest in new capabilities and enhance client value.

In FY 2025, TCS invested heavily in workforce development, completing 56 million learning hours to support digital and AI-driven transitions. Senior leadership also highlighted that generative AI will likely reduce traditional back-office and call-center roles, signaling a shift in its business model and workforce structure. [9]

4. KPMG International

Founded in 1987Headquarters: London, England

Revenue: $38.4 billion+

Number of Employees: 275,200+

Competitive Edge: Governance-focused approach and long-term client relationships

KPMG International is one of the world’s leading professional services networks and a core member of the “Big Four” accounting firms. Its operations are divided into three major service lines: Audit, Advisory, and Tax & Legal.

In FY 2024, EY’s Audit division generated about $13.4 billion in revenue, the Advisory segment brought in around $16.3 billion, and Tax & Legal Services contributed approximately $8.7 billion.

Region-wise, the Americas accounted for $15.2 billion, Europe, the Middle East, and Africa (EMA) contributed $17.2 billion, while the Asia-Pacific region generated $6.0 billion.

Over the past decade, the firm has undergone a major digital transformation to modernize its audit methodologies and expand its consulting and technology advisory practices. It has been particularly aggressive in AI-driven assurance and digital audit innovation. [10]

In 2024, the firm invested over $1.7 billion in those priority areas and deployed thousands of Microsoft Copilot licences and training for its workforce.

KPMG’s proprietary platforms, like KPMG Clara, use AI, automation, and advanced analytics to enhance audit accuracy, transparency, and efficiency across global engagements.

3. Ernst & Young (EY)

Headquarters: London, England

Revenue: $53.2 billion+

Number of Employees: 400,000+

Competitive Edge: Deep financial, legal, and compliance understanding

EY is one of the world’s largest professional-services networks and one of the “Big Four.” Its core mission, “Building a Better Working World,” reflects its commitment not just to financial assurance but also to helping clients navigate the transformative challenges of digitization, sustainability, and governance.

In the last 10 years, EY has invested heavily in AI, blockchain, and data assurance. It launched EY.ai, a global platform designed to help clients safely deploy and govern artificial intelligence, and has built more than 120 blockchain projects across supply chains and financial services.

EY reports that over 75% of its employees have used its proprietary large-language-model platform, “EYQ.” Innovation remains one of its core strengths — the company invests more than $1 billion each year in building AI-driven platforms and products.

In FY 2025, EY recorded $53.2 billion in revenue, up 4% from the previous year, with nearly half of that coming from the Americas region. [11]

2. PricewaterhouseCoopers (PwC)

PwC clients worldwide

PwC clients worldwide

Headquarters: London, England

Revenue: $55.4 billion+

Number of Employees: 370,000+

Competitive Edge: Trusted advisor status, especially in regulated/regime-heavy transformations

PricewaterhouseCoopers, universally known as PwC, was formed through the merger of Price Waterhouse (founded in 1849) and Coopers & Lybrand (founded in 1854).

Its services are divided into three major business lines: Assurance (Audit), Advisory (Consulting), and Tax & Legal Services. Of these, Advisory/Consulting has been the fastest-growing.

The Advisory segment directly competes with Accenture’s Strategy & Consulting and Operations divisions. PwC’s consulting services now encompass digital strategy, cloud transformation, data analytics, AI integration, cybersecurity, and ESG advisory, mirroring many of Accenture’s capabilities.

The company is emphasizing analytics, generative AI, and transformation services as strategic growth areas. In FY 2024, they invested around $1.5 billion in AI initiatives and rolled out platforms such as ChatPwC (the network’s internal AI platform) to ~200,000+ employees. [12]

Plus, PwC’s deep expertise in risk management, financial modeling, and ESG compliance makes it a trusted advisor for large enterprises dealing with complex regulatory and sustainability issues.

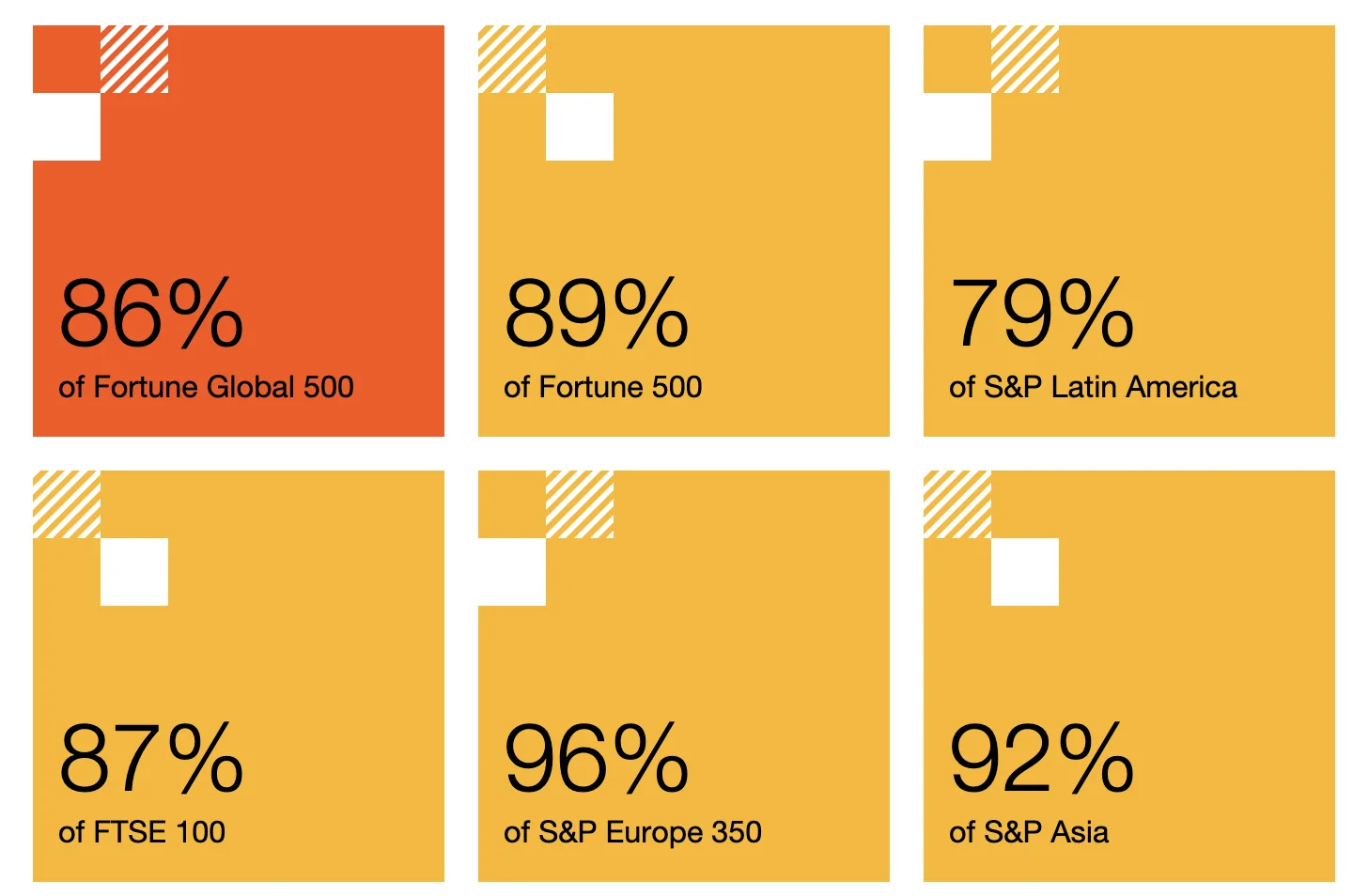

PwC serves more than 180,000 clients across 149 countries, including 86% of the Fortune Global 500 companies.

1. Deloitte

Deloitte helped a global bank modernize its 2-decade-old legacy system

Deloitte helped a global bank modernize its 2-decade-old legacy system

Headquarters: London, England

Revenue: $70 billion+

Number of Employees: 470,000+

Competitive Edge: Multidisciplinary model, industry depth, & global reach

Deloitte is one of the largest and most influential professional services firms worldwide, often regarded as the global leader among the “Big Four.”

It is arguably the closest competitor to Accenture, often going head-to-head in consulting, digital transformation, cloud migration, and risk management services. While Accenture is purely a consulting and technology company, Deloitte enjoys a multidisciplinary advantage, combining its traditional audit and tax businesses with a fast-growing consulting arm.

Both firms compete for high-value enterprise contracts in areas like cloud strategy (AWS, Azure, Google Cloud partnerships), AI-driven analytics, cybersecurity, and sustainability advisory.

In recent years, Deloitte’s consulting and advisory services have become a significant growth engine. For instance, the firm’s consulting service line (including technology and transformation) has overtaken audit & risk as the largest revenue line.

In FY 2025, Deloitte reported global revenue of $70.5 billion, marking a 4.9% year-over-year increase. The firm announced plans to double its growth in Saudi Arabia within the next three years through its “Silicon-2-Service” initiative, which focuses on accelerating AI adoption. In India, Deloitte aims to reach $5 billion in revenue by 2030. [13]

The company already works with more than 90% of Fortune Global 500 firms, along with governments, NGOs, and financial institutions across major markets worldwide.

Read More

- 13 BlackRock Competitors and Alternatives

- 24 Apple Competitors and Alternatives

- 17 Fast-Growing Biotech Startups

- Accenture Fact Sheet, Annual and quarterly revenue of the group, Accenture

- ICT, Professional services market size and trend analysis, Precedence Research

- Investor News, DXC Technology reports Q4 and FY 2025 results, DXC Technology

- Vinod Mahanta, Consultancy top 4 earnings pass billion-dollar mark in FY24, The Economic Times

- Business, Infosys’ Gen AI projects up 75% to 400 in FY25, MoneyControl

- Company Highlights, Cognizant Technology’s operating margin throughout the years, Macrotrends

- Capgemini Engineering, Capgemini brings together its engineering and R&D expertise, Capgemini

- Press Release, IBM closes landmark acquisition of Red Hat for $34 billion, Red Hat

- Q4 Financial Results, TCS headcount rises 625 QoQ, Livemint

- Press Release, Robust growth for KPMG as global revenues rise 5.1%, KPMG

- Zoe Hu, EY revenue rises despite slump in transactions, FNLondon

- Cika Andy, PwC global revenues rise to $55.4 billion, PwC Global

- Financial Highlights, Deloitte reports FY 2025 revenue, Deloitte