Powerful, far-reaching, and intensely competitive — that’s the world BlackRock operates in. As the single biggest player in asset management, BlackRock oversees approximately $12.5 trillion in assets under management, giving it scale and market influence few financial firms can match. [1]

However, BlackRock isn’t alone at the top of a gigantic industry. Global asset managers collectively control well over $128 trillion — a gigantic figure that highlights why the stakes for performance, technology, and client relationships are so high. [2]

Competition among the largest firms, therefore, isn’t just about winning a few basis points of fees; it’s about steering huge flows of capital that affect markets, companies, and even public policy.

The winners are those who can build trust, reach a wide audience, and provide unique tools that keep clients loyal.

Below, I’ve highlighted the top BlackRock competitors — explaining who they are, where they hold advantages, and how major industry trends (like fee pressure and the rise of ESG demand) are reshaping the competitive map.

Did you know?BlackRock’s Aladdin platform is used by over 200 institutions, with over 100,000 end-users globally.

Table of Contents

13. Universal Investment

Founded: 1968AUM: $1.37 trillion+

Number of employees: 1,700+

Competitive Edge: Independence & lack of conflicts

Universal Investment is one of Europe’s leading third-party asset management and fund service platforms, with a strong reputation as an independent provider in the investment management market.

It not only offers asset management solutions but also fund administration, white-label funds, and front-to-back investment services. Currently, it manages and administers assets exceeding $1.37 trillion.

It doesn’t operate like a traditional asset manager like BlackRock. Instead, it acts as a platform provider, helping others bring investment products to market using its infrastructure. It serves as a backbone for the European financial industry by offering services such as fund structuring, administration, reporting, risk management, and regulatory compliance.

What makes Universal Investment stand out is its independence. It is privately held and majority-owned by the private equity firm Montagu, which gives it more flexibility and agility than bank-affiliated competitors. This ownership model allows the firm to adapt quickly to client needs and market trends.

12. T. Rowe Price Group

AUM: $1.73 trillion+

Number of employees: 8,150+

Competitive Edge: Active management expertise, Retirement solutions leadership

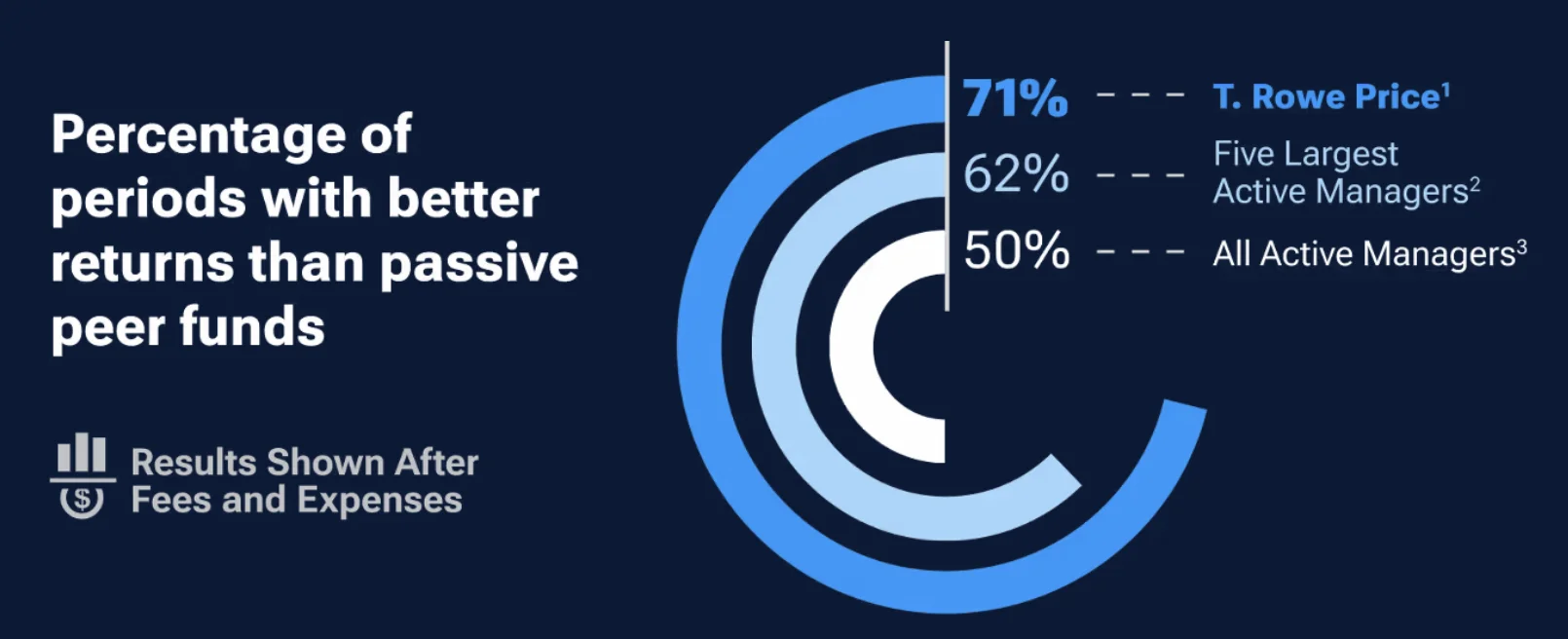

T. Rowe Price Group is one of the most respected global asset managers, renowned for its disciplined active management approach and long-term investment philosophy

Unlike some peers that rely heavily on passive products, T. Rowe Price has maintained a reputation for delivering consistent performance through active strategies across equities, fixed income, retirement solutions, and multi-asset portfolios.

The Group is particularly strong in the retirement investment space, with more than 12 million clients worldwide, many of whom are long-term savers entrusting the firm with 401(k) plans, IRAs, and retirement funds. In 2025, their target-date retirement AUM reached about $520 billion.

That same year, Goldman Sachs agreed to invest up to $1 billion in T. Rowe Price (through open market purchases), and the two firms are collaborating to offer co-branded alternative investment products aimed at high-net-worth investors and retirement wealth channels. [3]

11. Franklin Templeton

AUM: $1.62 trillion+

Number of employees: 9,000+

Competitive Edge: Strong fixed income and liquidity expertise

Franklin Templeton has decades of experience in managing active funds, where research-driven strategies help generate alpha. It is well-known for its active investment expertise, especially in global equities, fixed income, emerging markets, and multi-asset strategies.

Its $4.5 billion acquisition of Legg Mason in 2020 greatly expanded its scale and added several notable specialist firms to its portfolio, including Western Asset Management (fixed income), Clarion Partners (real estate), and Martin Currie (equities).

In 2024, Franklin Templeton acquired Putnam Investments, adding complementary capabilities and significantly expanding its defined-contribution retirement business. Before the deal, Putnam managed about $142 billion in assets. [4]

Today, the company serves clients in more than 150 countries, with a diverse base that includes retail investors, financial advisors, pension funds, sovereign wealth funds, corporations, and endowments.

10. Amundi

AUM: $2.66 trillion+

Number of employees: 5,300+

Competitive Edge: European leadership & distribution power

Amundi was founded through the merger of the asset management arms of Crédit Agricole and Société Générale. Despite being a relatively young company compared to century-old rivals, Amundi has quickly risen to prominence with its focus on scale, efficiency, and innovation.

Today, it manages more than $2.6 trillion in assets, placing it in direct competition with global giants like BlackRock and Vanguard. Its strong European presence is complemented by significant expansion in Asia, particularly in Japan, South Korea, and China.

Its client base is highly diversified, including institutional investors (pension funds, sovereign wealth funds, insurers), corporate treasuries, and retail investors through partnerships with banks and distributors.

Financially, Amundi brings in about $4 billion in annual revenue, mostly from management fees. In the first half of 2025, it recorded around $61 billion in net inflows. ETF inflows more than doubled year over year, rising to about $22.2 billion in H1 2025 compared to $10.5 billion in H1 2024. [5]

9. Allianz Group

AUM: $2.35 trillion+

Number of employees: 156,000+

Competitive Edge: Integration of insurance & asset management

Allianz Group is one of the world’s largest financial services companies, with a dual focus on insurance and asset management.

Allianz offers a broad range of services, including health insurance, property and casualty coverage, asset management through PIMCO and Allianz Global Investors, credit insurance, and assistance services. It operates in more than 70 countries and serves over 128 million individual and corporate clients.

As of today, the Group manages over €2.5 trillion in AUM, making it one of the top asset managers worldwide. Within this, PIMCO alone manages over $1.7 trillion, primarily in fixed income, while Allianz Global Investors contributes over $600 billion across equities, multi-asset, and alternatives.

The Group also emphasizes sustainable & impact investing. In 2024, AllianzGI reached €222 billion in sustainability- and impact-focused strategies, with 64% of its mutual fund AUM being sustainable funds.

8. BNY Mellon Investment Management

AUM: $2.1 trillion+

Number of employees: 4,500+

Competitive Edge: Multi-Boutique Specialist Firms under an Umbrella

BNY Mellon IM is the investment management division of The Bank of New York Mellon Corporation, one of the world’s oldest and most respected financial institutions.

What makes it unique is its multi-boutique structure, which combines the expertise of several autonomous investment firms under one umbrella. These boutiques (such as Newton Investment Management, Insight Investment, and Mellon) each specialize in different areas like equities, fixed income, alternatives, or ESG-focused strategies.

This model enables BNY Mellon IM to offer investors a range of investment philosophies, risk-return profiles, and global market perspectives.

In 2024, BNY Mellon acquired Archer Holdco, bringing in advanced technology-driven managed account solutions. This move strengthens its services for both institutional clients and retail/wealth management customers.

In 2025, BNY Mellon was appointed investment manager and custodian for OpenEden’s tokenized US Treasury fund, managing nearly $300 million. This marks a key step in combining asset management and custody services for tokenized funds. [6]

7. Invesco

AUM: $2.06 trillion+

Number of employees: 8,400+

Competitive Edge: ETF and thematic capability

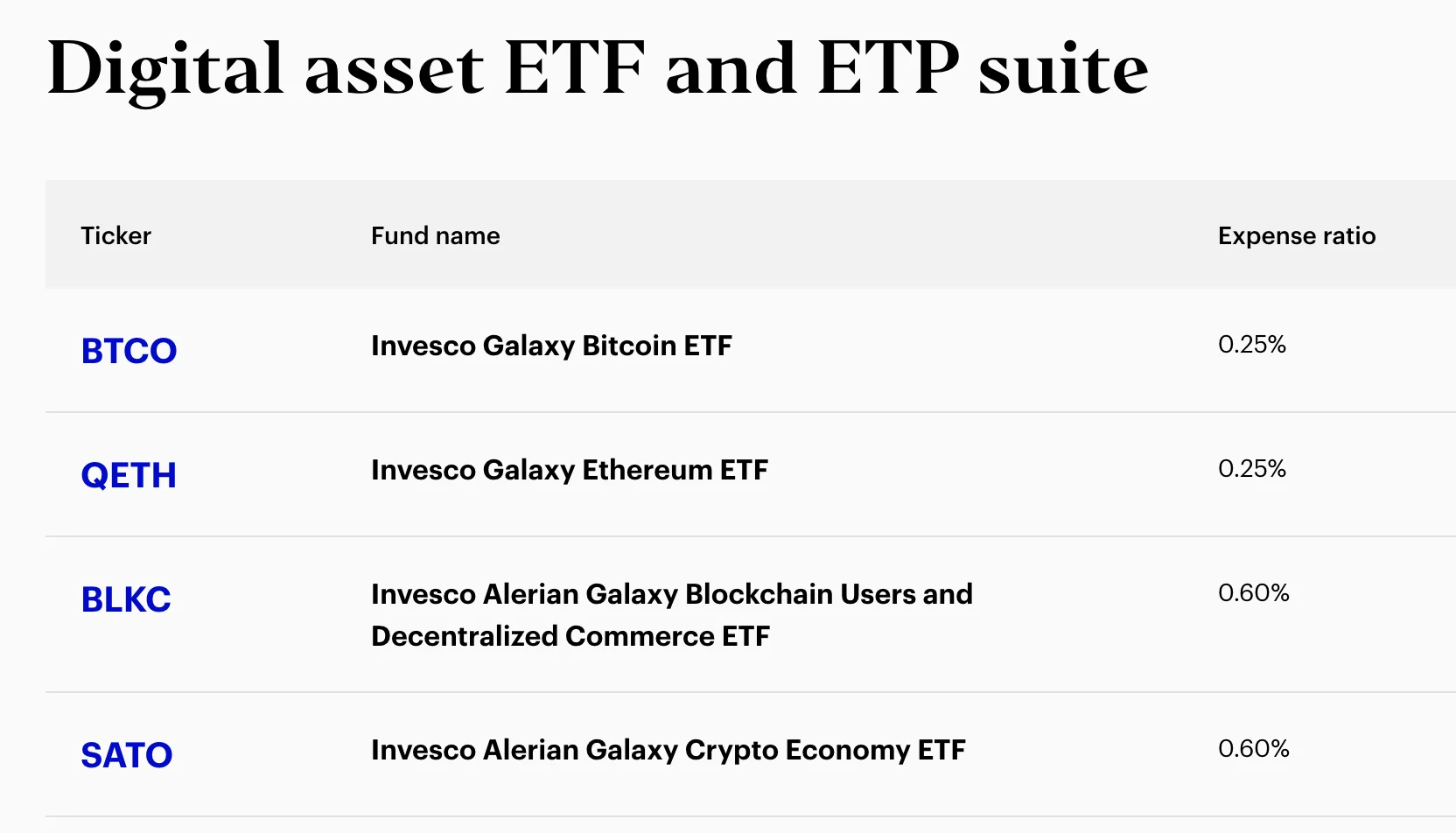

Invesco is one of the largest independent investment management companies, offering a wide range of active and passive investment capabilities across equities, fixed income, multi-asset, alternatives, and ETFs.

It is quite popular for its ETF franchise under the Invesco QQQ Trust (QQQ), which tracks the Nasdaq-100 Index and is one of the largest and most traded ETFs globally, with over $380 billion in assets.

Invesco’s competitive edge lies in its diversification and independence. Unlike some competitors that are part of larger banking or financial conglomerates, Invesco operates as a pure investment management company.

In 2025, Invesco achieved a record-high AUM, driven by both net inflows and market gains. Its fee revenue comes from a mix of management fees, performance fees, and rising income from ETFs and index products.

Geographically, the firm is truly global, with major footprints in North America, EMEA (notably the U.K. and Ireland hubs for UCITS products), and the Asia Pacific (including a notable India presence that has recently been reshaped via a local transaction).

6. Morgan Stanley Investment Management (MSIM)

AUM: $1.7 trillion+

Number of employees: 4,600+

Competitive Edge: Specialization in thematic / climate & ESG investing

Morgan Stanley’s asset management strategy emphasizes active management and alternatives, setting MSIM apart from passive-focused competitors like BlackRock and Vanguard.

MSIM goes beyond traditional stocks and bonds, offering significant alternatives, growth equity, and credit funds, such as the Expansion Capital funds and 1GT Climate Private Equity, as well as private credit. This approach provides higher-margin opportunities and diversifies revenue.

The firm benefits from Morgan Stanley’s global brand, capital strength, and research depth, which reinforce client trust and enable innovative investment products. Plus, its balanced mix of institutional clients, retail investors, and alternative strategies ensures both scale and stability in a competitive market.

In 2024, MSIM’s AUM grew to $1.66 trillion, up nearly 14% YoY, reversing the long-term net outflows seen in 2023. Long-term net inflows for the year totaled about $18 billion, mainly from fixed income and liquidity/overlay products. Equities experienced some outflows, reflecting investors’ preference for income-focused and lower-volatility investments. [7]

5. Goldman Sachs Asset Management (GSAM)

Founded: 1986AUM: $3.17 trillion+

Number of employees: 2,000+

Competitive Edge: Strong track record in private credit/direct lending

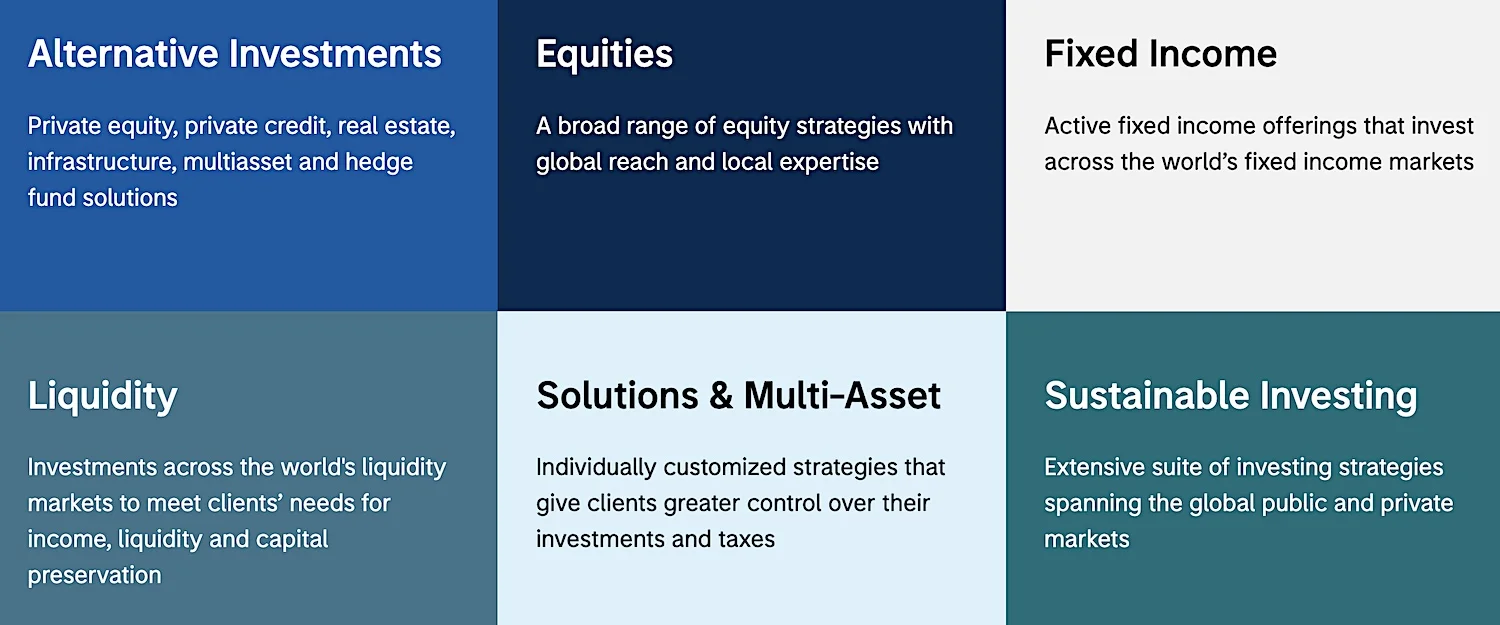

GSAM manages a broad range of assets, including equities, fixed income, alternatives (like private credit, private equity, and real assets), cash/liquidity solutions, and multi-asset strategies.

Being part of Goldman Sachs gives GSAM credibility, research reach, access to high-quality deal flow, and institutional relationships. Many large institutions and pension funds are comfortable working with Goldman for large or complex mandates.

In 2024, Goldman Sachs’ broader Asset & Wealth Management (AWM) business reported record assets under supervision. The company stated that its AWM arm delivered its 28th consecutive quarter of long-term fee-based net inflows. That year, its AWM segment surpassed the target of more than $10 billion in “management and other fees” alone. [8]

These days, GSAM has been expanding its products focused on sustainability and ESG. For example, it launched the Global Environmental Transition Equity Fund (an EU/UK Article 8 fund), providing exposure to sectors like extraction, power generation, and transportation.

4. J.P. Morgan Asset Management

AUM: $4.3 trillion+

Number of employees: 12,000+

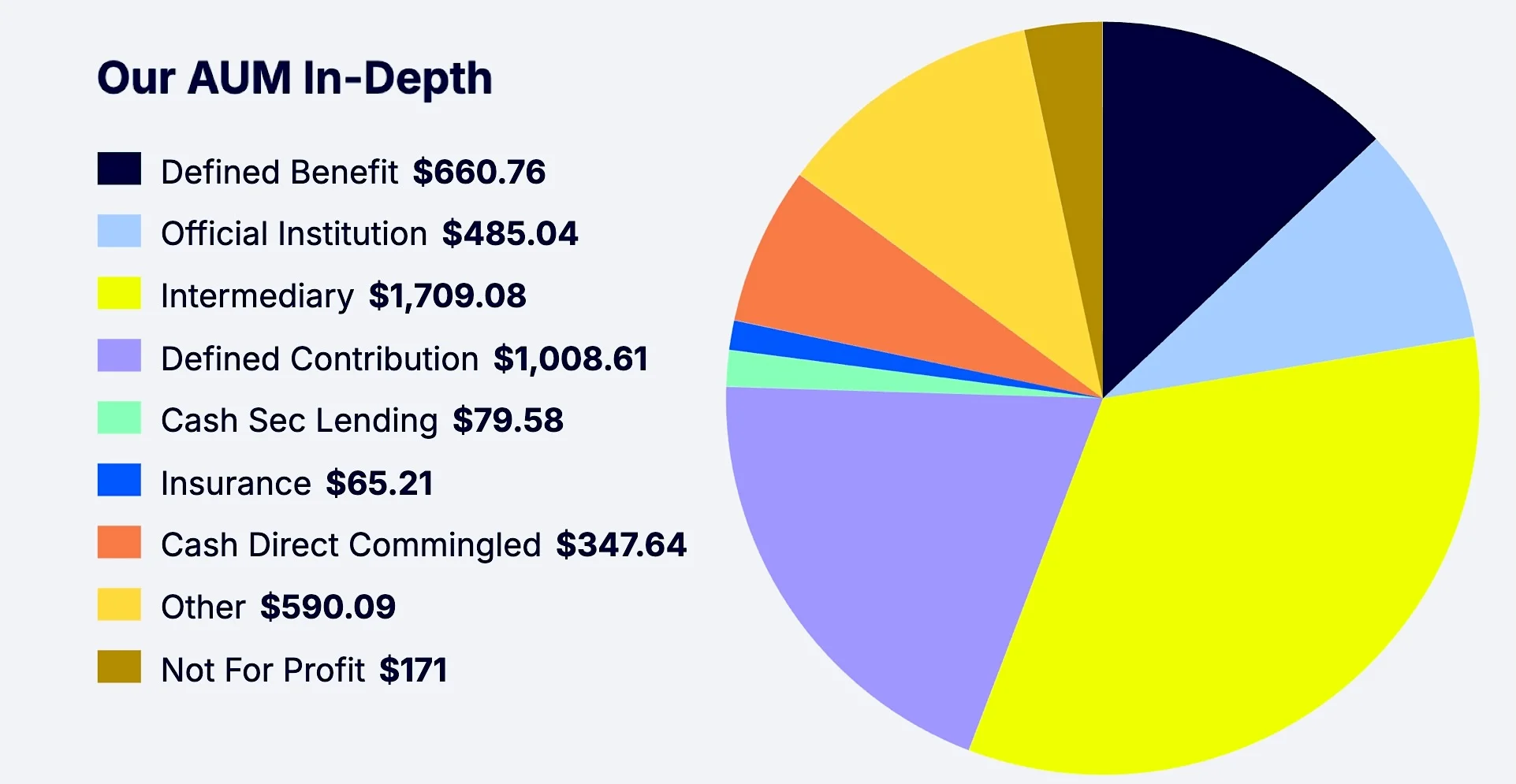

Competitive Edge: Technology & research infrastructure

JPMAM is one of the world’s most diversified asset managers, part of JPMorgan Chase & Co. This provides advantages in balance sheet strength, distribution, client trust, and global relationships — but also brings higher shareholder expectations for margins and returns.

It manages a wide range of investment offerings, including active and passive strategies, alternatives, multi-asset, private markets, thematic funds, cash, liquidity, and short-term instruments. Plus, it serves a diversified set of clients, ranging from institutions and pension funds to high-net-worth individuals.

In 2024, JPMAM experienced strong investor demand, with net asset inflows of $486 billion. The firm raised fees by 21% that year and achieved a record revenue of $5.8 billion.

In 2025, JPMAM launched its largest actively managed ETF, the JPMorgan Active High Yield ETF, supported by a $2 billion commitment from an external investor. The fund invests at least 80% of its assets in high-yield, non-investment-grade debt securities. [9]

3. Fidelity Investments

AUM: $6.4 trillion+

Number of employees: 77,000+

Competitive Edge: Strong active management reputation

Fidelity has evolved from a conventional mutual fund company into a diversified financial corporation that competes directly with industry leaders like BlackRock, Vanguard, and State Street.

Today, it has an expansive presence across asset management, brokerage services, retirement planning, and wealth management.

In 2024, Fidelity had roughly $5.9 trillion in AUM in its own funds and managed accounts, up from about $4.9 trillion a year earlier. In FY 2025, the number reached $6.4 trillion.

In 2024, its Assets Under Administration, which includes non-discretionary assets and brokerage client assets, rose to nearly $15.1 trillion. That same year, its revenue jumped to a record $32.7 billion, up 16% YoY, driven by strong performance across actively managed equity and fixed income funds, as well as inflows into money market products. Operating income also rose 21%, reaching $10.3 billion.

In 2025, Fidelity launched “Fidelity Trader+” — an upgraded trading platform for active retail investors. It offers real-time analytics, customizable charts, and specialized tools for frequent traders, signaling the company’s push to better serve self-directed, more advanced retail clients. [10]

2. State Street Investment Management

AUM: $4.7 trillion+

Number of employees: 2,500+

Competitive Edge: Scale in passive/index + institutional trust

State Street Investment Management is the asset management arm of State Street Corporation, one of the oldest and most established financial institutions in the US.

It is popular for pioneering the first ETF in the US, the SPDR S&P 500 ETF (SPY), which remains the world’s largest and most traded ETF with over $650 billion in assets.

Its investment solutions cover most asset classes, including both active and passive styles, as well as various geographic regions. This includes indexing, quantitative investing, cash and short-duration fixed income products, target-date funds, and retirement plan services.

By the end of 2024, its AUM had reached $4.7 trillion, representing a nearly 15% increase from the previous year, driven by strong market performance and approximately $146 billion in net inflows.

State Street Investment Management has a long track record of launching innovative products and expanding client reach. In 2024 alone, they launched more than 90 new products globally, more than the total number launched in the previous three years combined.

They serve governments, institutions, financial advisors, and individual investors. The firm reports strong client satisfaction and loyalty, with about 97% of its servicing revenue retained. [11]

1. Vanguard Group

Founded: 1975Did you know? In 1982, Vanguard opened its first walk-in investment center in Center City Philadelphia. pic.twitter.com/d5lUdXqbEm

— Vanguard (@Vanguard_Group) September 25, 2025

AUM: $ 11 trillion+

Number of employees: 20,000+

Competitive Edge: Runs index funds at very low expense ratios

Known for its innovative client-owned structure and cost-efficient approach, Vanguard has reshaped the investment model, particularly through its pioneering role in index funds and ETFs. With over 50 million investors worldwide, Vanguard is one of the largest providers of retirement accounts, ETFs, and mutual funds.

Vanguard competes on the lowest possible fees (index fund leadership), whereas BlackRock competes both on scale for passive products (iShares) and on delivering bespoke, higher-fee solutions for institutions (active, alternatives, advisory).

In 2024, Vanguard was the largest recipient of net US ETF inflows, attracting about $308.2 billion. In 2024 and 2025, the Group launched several new ultra-short Treasury, short-duration ETFs, and cash-management ETFs to meet demand for liquidity and yield management solutions.

On the tech and client-experience front, Vanguard has upgraded its digital platforms and uses behavioral finance and AI “nudges” to guide investors. For example, these prompts helped move more than $6.2 billion in idle cash into diversified portfolios. [12]

Read More

Sources Cited and Additional References- Financial Services, AUM of BlackRock throughout the years, Statista

- Press Release, Global asset management industry hit a new record high, BCG

- Yun Li, T. Rowe Price shares jump after deal with Goldman Sachs, CNBC

- Press Release, Franklin Templeton acquires Putnam Investments, Franklin Templeton

- Company News, Amundi’s record inflows drive strong H1 performance, Investing.com

- Sustainability, BNY appointed investment manager for OpenEden’s tokenised US Treasury fund, Reuters

- Financial Highlights, Morgan Stanley Q4 and full year 2024 earnings results, SEC

- Annual Report, Growth in more durable revenues within AWM, Goldman Sachs Group

- Press Release, JP Morgan Asset Management hits market with largest active ETF launch, JP Morgan

- Suzanne McGee, Fidelity launches new trading platform for retail investors, Reuters

- Our Story, Letter from Chairman and CEO Ronald P. O’Hanley, State Street

- Andrew Welsch, How Vanguard wants to ‘nudge’ you to be a better investor, Barron’s