Warby Parker has transformed the global eyewear market over the past decade by challenging legacy pricing models and reshaping how consumers buy glasses. Its seamless integration of digital retail, home try-on experiences, and in-store eye exams has made it one of the most recognized disruptors in modern retail.

Today, the brand operates over 276 retail stores across North America and serves over 2.6 million active users.

In FY 2025, it generated $821 million in revenue, marking steady, double-digit YoY growth. The average revenue per customer (ARPC) reached $316, reflecting rising consumer loyalty and product diversification into contacts, sunglasses, and accessories.

Still, the company faces intense competition. The global eyewear market, valued at roughly $220-$250 billion, is largely controlled by a handful of conglomerates and optical giants. [1]

Below, I’ve featured the top Warby Parker competitors, analyzing how they differ in business models, market reach, financial performance, and strategic positioning in the fast-changing optical industry.

Did you know?The US eyewear market (Warby Parker’s primary battleground) is projected to exceed $62.7 billion by 2030, growing at a CAGR of 7.4%. The growth is fueled by increasing screen time, myopia prevalence, and the mainstreaming of eyewear as a fashion accessory.

With over 63% of American adults wearing prescription glasses, the potential customer base continues to expand. [2]

Table of Contents

13. Hoya Corporation

Founded in 1941Headquarters: Tokyo, Japan

Employees: 38,000+

Competitive Edge: Lens innovation and medical-grade technology

Hoya Corporation is one of Japan’s leading multinational optical and healthcare technology companies, known for its innovations in lenses, imaging, and medical devices. Its product portfolio spans eyeglass lenses, contact lenses, medical endoscopes, intraocular lenses, semiconductor photomasks, and other precision instruments.

Over the decades, Hoya has built a reputation for precision engineering, reliability, and high-performance optics used in both consumer and industrial sectors.

Products like Hoya’s Nulux, Hoyalux, and Sync III lenses exemplify advanced designs that improve vision sharpness and comfort. The company’s proprietary coating technologies (such as Hi-Vision LongLife and BlueControl) enhance durability, clarity, and protection from blue light, giving Hoya an edge in the digital age.

Unlike Warby Parker, which operates as a direct-to-consumer eyewear retailer, Hoya functions as a B2B optical technology manufacturer and lens supplier. However, both target the same end-consumer outcome: delivering superior vision correction and eyewear experiences.

Hoya’s competitive focus lies in lens innovation, optical precision, and medical-grade technology. It provides the lens materials and coatings that many eyewear retailers (including some competitors of Warby Parker) rely on. In that sense, Hoya is a technology enabler of the global eyewear ecosystem.

12. Prive Revaux

Founded in 2017Headquarters: Florida, USA

Parent: Safilo Group

Competitive Edge: Celebrity-backed brand image, Mass-market reach

Privé Revaux is a fast-growing eyewear brand that has reshaped the perception of affordable luxury in the optical industry. It was co-founded by serial entrepreneur David Schottenstein along with celebrity visionaries like Jamie Foxx, Hailee Steinfeld, and Ashley Benson.

The company offers handcrafted frames made from durable acetate, featuring polarized lenses and anti-glare coatings. Priced between $29 and $49, it stands out as one of the most affordable eyewear brands with a premium look and feel.

In 2020, the Safilo Group acquired a majority stake in Privé Revaux, strengthening its operational capabilities. In 2025, Privé Revaux launched a curated line of polarized sunglasses exclusively for Walmart Vision Centers and Walmart.com, marking a strategic move into mass retail and expanding its presence beyond niche and online channels.

11. GlassesUSA

Headquarters: New York, USA

Employees: 200+

Competitive Edge: Affordability, Data-driven personalization platform

GlassesUSA has built a strong presence in the e-commerce optical industry by offering a vast catalog of over 3,800 frames from both in-house and designer brands.

Its business model is centered around offering eyewear at prices up to 70% lower than traditional optical retailers. This price advantage is achieved by bypassing intermediaries and manufacturing several of its own frame lines, including brands like Muse, Amelia E., and Ottoto.

The online platform offers personalization through advanced virtual try-on technology and AI-driven recommendations. It leverages machine learning algorithms to recommend frames based on face shape, style preferences, and prior purchases.

10. EyeBuyDirect

Founded in 2005Headquarters: Texas, USA

Parent: EssilorLuxottica

Competitive Edge: Low-cost frames, Parent company support

EyeBuyDirect combines affordable pricing, digital innovation, and modern style. It operates under EssilorLuxottica, the global optical giant that also owns leading brands like Ray-Ban and Oakley.

EyeBuyDirect handles the entire process (from frame design and manufacturing to packaging and shipping) under one ecosystem. This level of vertical integration allows it to offer complete prescription glasses starting from as little as $6 per pair. [4]

Its catalog spans 3,000+ frame styles, including optical glasses, sunglasses, blue light–filtering lenses, and premium designer collaborations. It also integrates augmented reality tools and facial mapping technology, allowing customers to “try on” frames virtually.

According to a Microsoft Advertising case study, EyeBuyDirect achieved a 393% year-over-year increase in conversions and a 149% rise in return on ad spend (ROAS) through dynamic remarketing. [5]

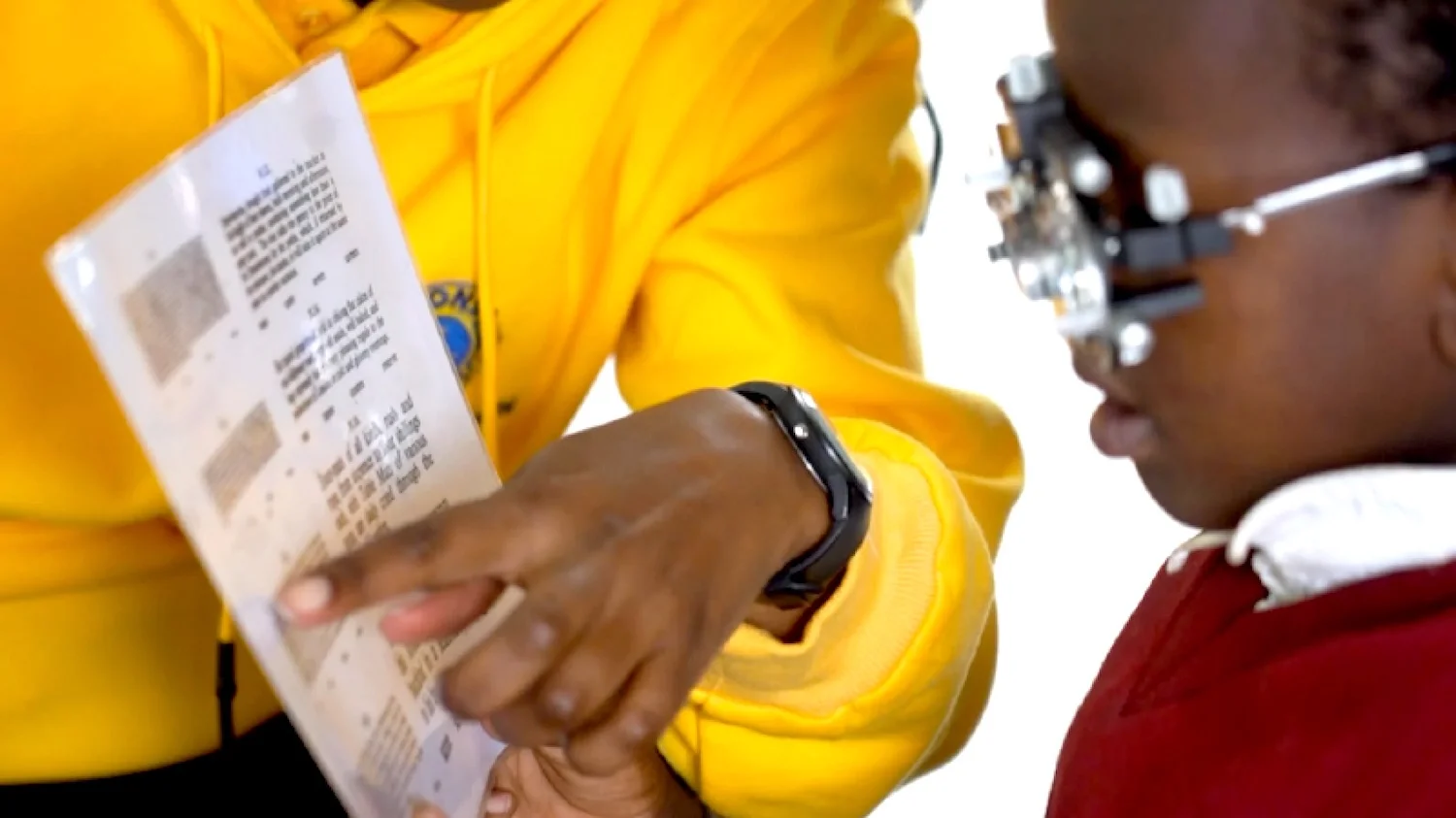

Plus, the CSR (Corporate Social Responsibility) initiatives, such as the Buy 1 Give 1 program (in partnership with Vision for Life and the Essilor Vision Foundation), align the brand with socially conscious consumers and reinforce its reputation as both accessible and ethical.

9. Tom Ford Eyewear

Headquarters: Texas, USA

Parent: Marcolin Group

Competitive Edge: High-end brand equity, Italian craftsmanship

Tom Ford Eyewear embodies the sophistication, boldness, and modern glamour associated with the Tom Ford name. The brand’s signature features include bold frame silhouettes, meticulous detailing, and the iconic metal “T” logo on the temples of many frames.

It is manufactured and distributed under license by the Marcolin Group. Each frame is made with precision in Italy, reflecting the partnership between Tom Ford’s design sensibility and Marcolin’s artisanal manufacturing expertise.

Tom Ford eyewear collections are known for their refined materials (such as acetate, titanium, and metal alloys) and premium polarized lenses. In essence, the brand focuses not on value or volume, but on luxury branding, high-fashion design, exclusivity, premium craftsmanship, and global distribution.

8. FramesDirect

Headquarters: Texas, USA

Parent: EssilorLuxottica

Competitive Edge: Parent company backing, Broad designer selection

Founded by two optometrists, Dr. Dhavid Cooper and Dr. Guy Hodgson, FramesDirect was among the first companies to sell prescription eyewear, sunglasses, and contact lenses directly to consumers via the internet.

Over time, the company expanded its product range to include designer frames, prescription sunglasses, high-index lenses, and a wide selection of major brands. Today, it has an inventory of over 100,000 styles from more than 200 brands.

FramesDirect operates as a subsidiary of EssilorLuxottica, which acquired it in 2010. The acquisition gave FramesDirect access to advanced lens technology, state-of-the-art manufacturing, and global distribution networks.

What distinguishes FramesDirect in the optical e-commerce space is its combination of authentic branded eyewear, verified prescription accuracy, and quick global delivery. Unlike Warby Parker, FramesDirect functions as a multi-brand online retailer, offering consumers an extensive range of third-party eyewear brands.

Its website offers tools for lens customization, virtual try-on, and prescription upload, making it a one-stop shop for glasses, contact lenses, and sunglasses.

The company has also partnered with optometrists to ensure prescription accuracy and customer satisfaction, maintaining a strong balance between digital convenience and clinical integrity.

7. Maui Jim

Headquarters: Padua, Italy

Revenue: $1.7 billion+ (for Kering Eyewear)

Competitive Edge: Premium lens technology and optical performance

Maui Jim is renowned for its high-polarized sunglasses and strong association with outdoor lifestyles and optical innovation. It manufactures both prescription and non-prescription sunglasses and optical lenses, offering hundreds of models across lifestyle, sport, and luxury collections.

The company’s signature innovation lies in its proprietary PolarizedPlus2 lens technology, which enhances color, clarity, and contrast while eliminating glare and blocking 100% of harmful UV rays.

Despite its beach-town origins, Maui Jim’s rise has been remarkable. By the 2010s, it had become one of the top five premium sunglass brands globally, competing with giants like Ray-Ban, Oakley, and Persol.

The brand maintained strong financial performance, generating an estimated $350 million in annual revenue before being acquired by Kering Eyewear (the luxury eyewear arm of the Kering Group) in 2022. The acquisition accelerated its international growth, allowing it to leverage Kering’s global distribution network and expand the brand worldwide. [6]

6. Marcolin Group

Headquarters: Longarone, Italy

Revenue: $625 million+

Competitive Edge: Italian craftsmanship, Prestigious brand portfolio

Marcolin Group has built a global presence as a major designer, manufacturer, and distributor of high-quality optical frames and sunglasses. It has a capacity to produce 14 million+ frames annually.

Its business model is more B2B/B2B2C (licensed manufacturing + distribution) rather than Warby’s pure retail/consumer brand model.

Marcolin operates primarily through licensing agreements with high-end and lifestyle brands. Its portfolio includes globally recognized names such as Tom Ford, Guess, Bally, Moncler, Zegna, Timberland, Kenneth Cole, GCDS, and Harley-Davidson, among others.

Renewal of exclusive licences (for example, GUESS eyewear extended to 2040) illustrates the long-term strength of its brand partnerships.

In 2025, VSP Vision signed an agreement to acquire Marcolin from PAI Partners and minority shareholders. The aim is to expand VSP’s eyewear distribution and bring Marcolin’s brand/licensing portfolio into VSP’s ecosystem. [7]

5. National Vision Holdings

Headquarters: Georgia, USA

Revenue: $1.89 billion+

Competitive Edge: Nationwide retail network, Vertically integrated supply chain

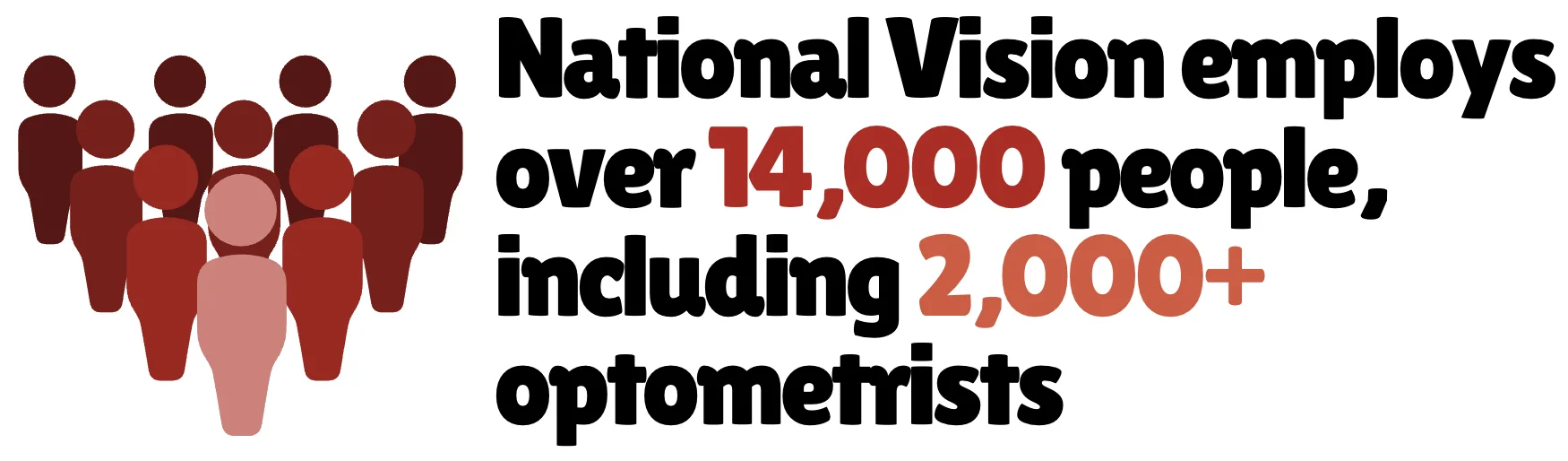

National Vision Holdings offers affordable eye care services and eyewear products through a diverse portfolio of brands. It operates more than 1,200 stores across the country under well-known banners, such as America’s Best Contacts & Eyeglasses, Eyeglass World, Vista Optical, and Fred Meyer Optical.

The company’s integrated model, combining optical retail and optometric services, has been crucial to its success. This co-location strategy generates recurring revenue from eye exams, prescriptions, and eyewear sales.

With a network of over 2,000 optometrists and independent eye care professionals working in its stores, National Vision has effectively captured a large share of middle-income customers seeking a convenient, one-stop eye care solution.

In 2025, the company unveiled a new brand identity as part of its strategic transformation. This includes a new logo/visual identity, a stronger focus on purpose, and a modernised brand across its retail brands, starting with America’s Best. [8]

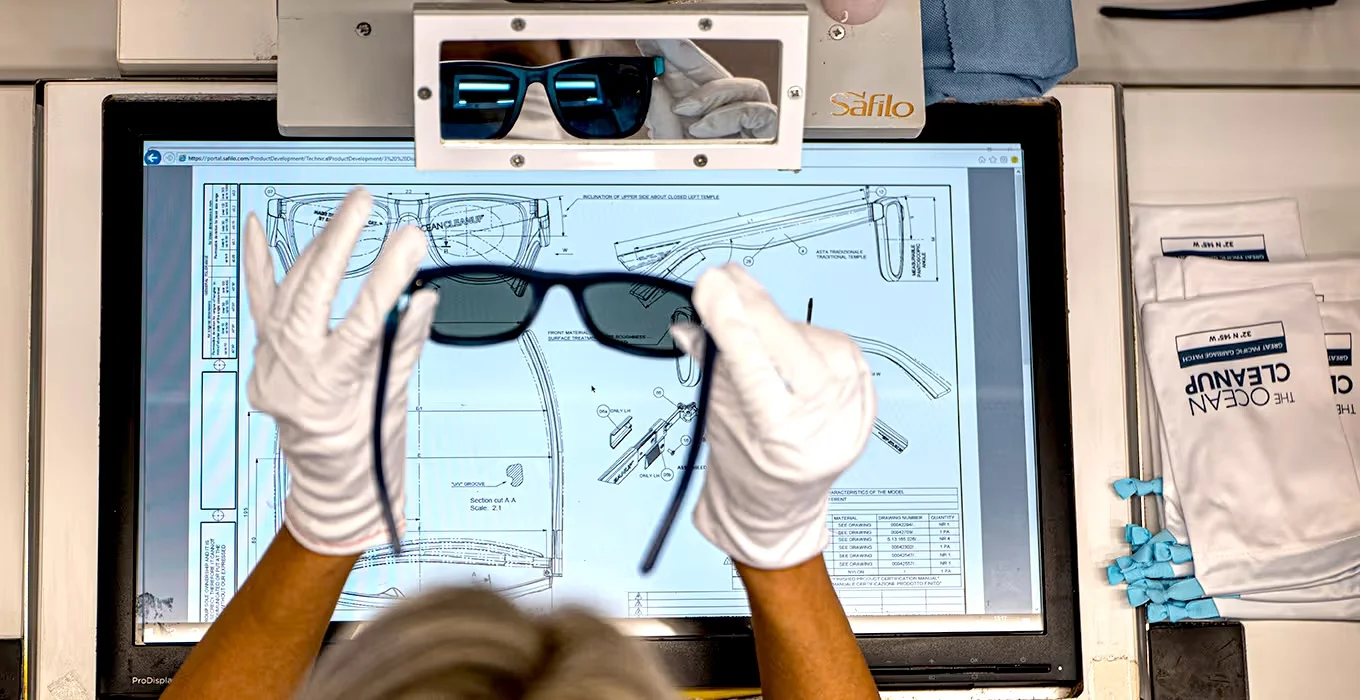

4. Safilo Group

Headquarters: Padua, Italy

Revenue: $1.1 billion+

Competitive Edge: Strong Italian design roots, Vast brand portfolio

Safilo Group is one of the world’s oldest eyewear manufacturers, with a legacy that spans over 90 years. It makes prescription frames, sunglasses, and sports eyewear across 70+ countries, serving millions of customers through both owned brands and licensed luxury lines.

Their products are sold in over 100,000 retail outlets, including optical stores, department stores, and e-commerce channels.

While Warby Parker operates primarily through a direct-to-consumer retail and digital model, Safilo competes through its multi-brand portfolio, global licensing agreements, and wholesale distribution network. It manages a vast portfolio that caters to various lifestyle segments, from sports and outdoor (Smith Optics) to fashion and luxury (Hugo Boss, Carrera, Marc Jacobs).

Safilo perfectly combines Italian craftsmanship with modern manufacturing technologies. It produces tens of millions of frames every year, emphasizing quality control, durability, and sustainability. In recent years, the company has invested in eco-friendly materials, such as bio-based and recycled acetate, and has promoted environmentally conscious collections across its brands.

3. Zenni Optical

Headquarters: California, USA

Revenue: ~$400 million

Competitive Edge: Economies of scale, Cost control

Zenni Optical is a US-based online eyewear retailer that has revolutionized the optical industry through its ultra-affordable, direct-to-consumer model. Its mission is simple: make quality, stylish eyeglasses accessible to everyone, with prices starting as low as $6.95 per pair.

The company offers over 2,000 frame styles and has achieved significant global scale, having sold more than 70 million pairs of frames worldwide.

They have embraced technological innovation to enhance customer experience. Their virtual try-on tools, powered by facial recognition and augmented reality, have made online eyewear shopping intuitive and engaging.

For Warby Parker, Zenni Optical represents a competitive threat in the price-sensitive online eyewear segment — customers who value the lowest price and online convenience may choose Zenni over Warby.

2. Johnson & Johnson Vision Care

Headquarters: Florida, USA

Revenue: $1.5 billion+

Competitive Edge: Deep scientific foundation, Clinical credibility

Johnson & Johnson Vision Care (a division of healthcare giant Johnson & Johnson) provides eye health products and vision solutions. It focuses on contact lenses and vision-care products, while expanding into surgical and implantable technologies through its Surgical Vision division.

It primarily operates under the ACUVUE brand, which dominates the global contact lens market. It serves over 44 million patients every year across 100+ countries, maintaining a strong presence in North America, Europe, and the Asia-Pacific region.

In recent years, J&J Vision Care has expanded beyond incremental advances in contact lens technology (such as improved materials, daily disposables, and multifocal or astigmatism options) to embrace the broader vision-care ecosystem. This includes surgical products like intraocular lenses for cataract and refractive surgery, digital platforms for eye-care professionals, emerging markets, and specialty areas such as myopia management in children.

For instance, J&J announced new data for the ACUVUE OASYS MAX 1-Day for astigmatism in 2025, demonstrating superiority vs a key competitor. [9]

While Warby Parker excels with its direct-to-consumer model, stylish designs, and transparent pricing, J&J Vision Care draws its strength from scientific innovation, clinical expertise, and strong global brand trust.

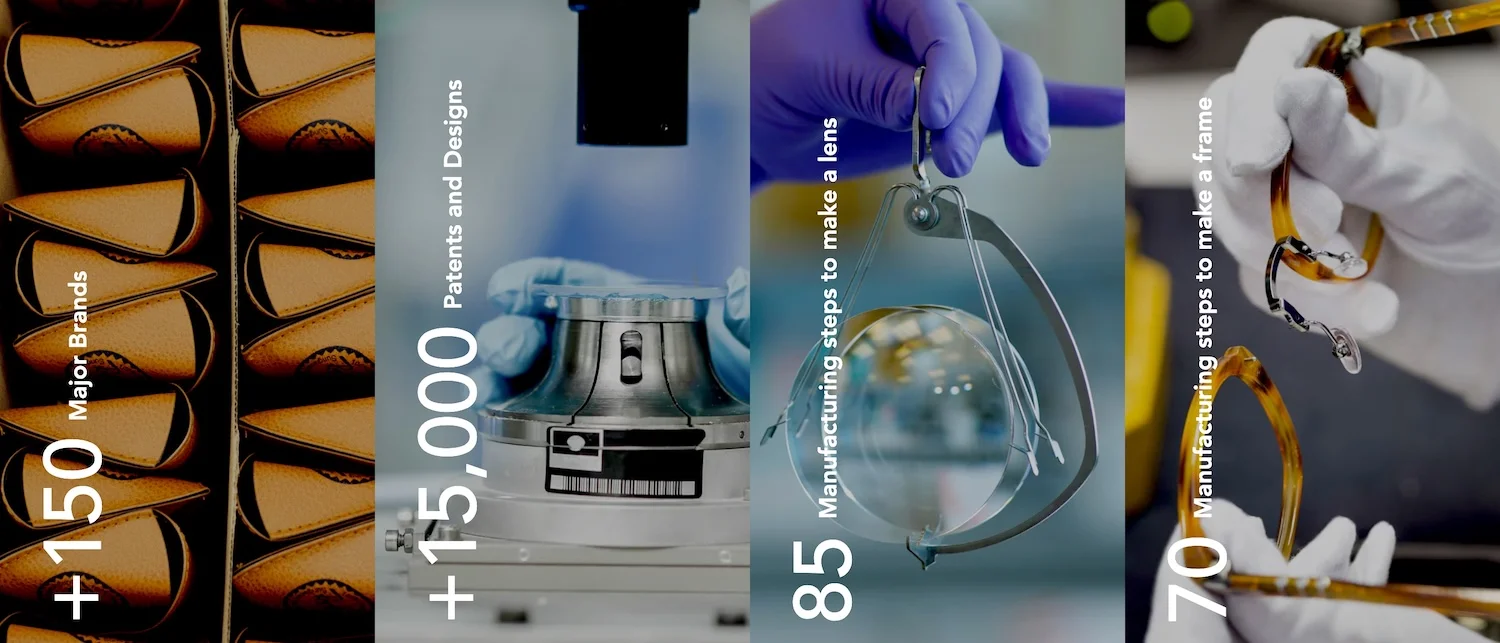

1. EssilorLuxottica

Headquarters: Paris and Milan

Revenue: $28.6 billion+

Competitive Edge: Vertical integration, Extensive brand portfolio

EssilorLuxottica was formed through the merger of France’s Essilor International (a pioneer in ophthalmic lenses) and Italy’s Luxottica Group (the largest global frame and retail conglomerate).

It is now the undisputed leader of the global eyewear and vision care industry, a vertically integrated empire that controls everything from lens technology and frame design to retail and distribution.

The company operates in 150+ countries and employs more than 199,000 people across its manufacturing, retail, and R&D divisions. It invests over $680 million annually in R&D, supporting cutting-edge optical innovations such as Transitions photochromic lenses and Varilux progressive lenses. [10]

EssilorLuxottica manages an extensive network of over 18,000 retail outlets, including renowned chains such as LensCrafters, Pearle Vision, Target Optical, and Sunglass Hut.

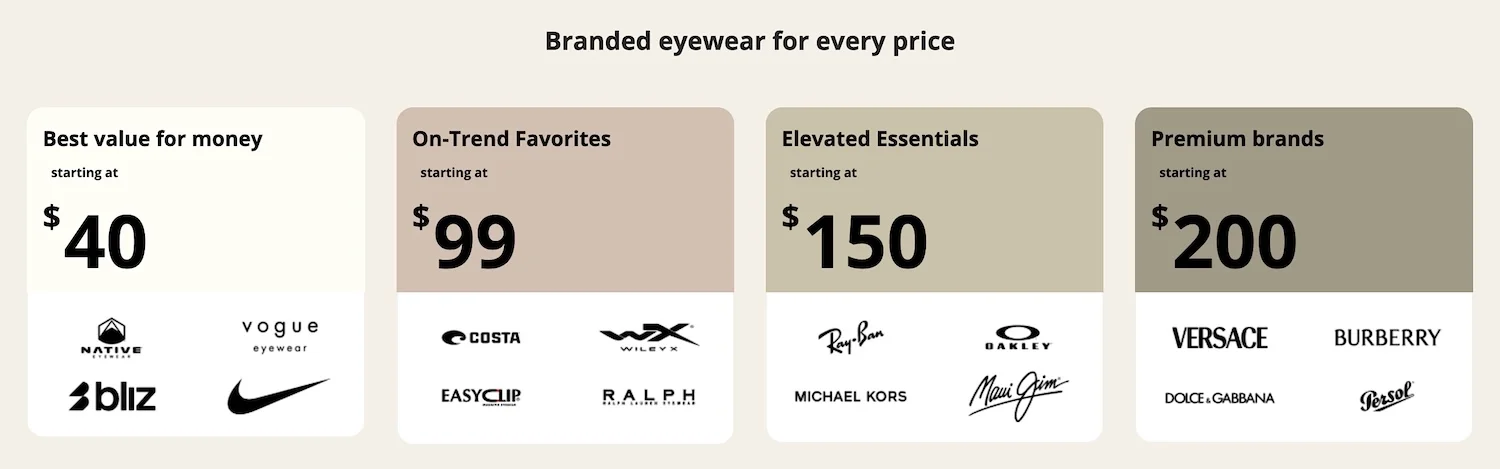

It also owns some of the world’s most iconic eyewear brands, including Ray-Ban, Oakley, Persol, Vogue Eyewear, and Oliver Peoples, and holds exclusive licensing agreements with Prada, Chanel, Armani, Burberry, and Dolce & Gabbana, among others. This gives the conglomerate control over both luxury and mass-market price segments.

Plus, Luxottica’s ownership of retail giants such as LensCrafters and Target Optical gives it access to millions of US customers. Meanwhile, its licensing deals ensure near-total dominance in the luxury eyewear category. In contrast, Warby Parker’s business model focuses on affordability, transparency, and direct engagement.

Read More

Sources Cited and Additional- Industry Report, Eyewear market size and trend analysis, GrandViewResearch

- Learn, How many people wear glasses?, Warby Parker

- Privé Revaux, Exclusive Privé Revaux sunglass collection launches at Walmart, PR Newswire

- EyeBuyDirect, Eyebuydirect rebrand cements new positioning that empowers individuality, PR Newswire

- Success Stories, Eyebuydirect increased conversions by targeting existing shoppers, Microsoft Advertising

- Finance, Kering Eyewear completes the acquisition of Maui Jim, Kering

- Company Announcements, VSP Vision acquires Marcolin from PAI Partners and other shareholders, VSP Vision

- News Releases, NV unveils bold new brand identity as part of strategic transformation, National Vision

- Investor news, J&J unveils new data demonstrating superior clarity of vision, Johnson & Johnson

- Company Highlights, EssilorLuxottica’s R&D investment throughout the years, Macrotrends