Founded in 2003 and once known primarily for defense and intelligence contracts, Palantir now generates over $3.11 billion in annual revenue and serves more than 1,560 clients globally, spanning finance, manufacturing, healthcare, and the military. But its dominance is no longer uncontested.

As Palantir continues to gain commercial traction and deepen its commitment to artificial intelligence through its new AI Platform (AIP), the company is entering a market that is becoming more crowded and competitive.

Understanding its rivals is crucial, not only to assess Palantir’s long-term positioning but also to grasp the dynamics of the booming analytics and AI software industry, which is projected to exceed $402 billion globally by 2032, with a compound annual growth rate of 25.5%. [1]

Below, I’ll explore Palantir’s top competitors across core verticals (including commercial analytics, AI/ML platforms, government tech, and cloud infrastructure), by analyzing their business models, product offerings, market penetration, and competitive advantage.

Did you know?Spending on AI and analytics in the defense, intelligence, and government sectors is projected to reach $18.39 billion by 2030, growing at a CAGR of 12.46%. [2]

Table of Contents

14. Alteryx

Founded: 1997 (as SRC)Revenue: $970 million+

Number of customers: 8,300+

Rivalry Angle: Enterprise intelligence

Competitive Edge: Analytics process automation

Alteryx enables users to prepare, blend, and analyze data without code, leveraging a combination of visual workflows, AutoML, NLP, and low-code automation capabilities.

More specifically, the Alteryx One platform unifies the analytics capabilities into a single suite, combining data prep, generative AI copilots, cloud orchestration, and governance across desktop and cloud deployment models.

The platform is primarily aimed at business analysts and operational staff, rather than deep-tech developers or military analysts. It excels in ease of use, fast onboarding, and wide departmental adoption within an enterprise.

With over 700,000 users and strong connectivity to platforms like Snowflake, Databricks, AWS, and Google Cloud, Alteryx continues expanding its ecosystem reach.

13. Loggly

Founded: 2009Number of customers: 10,000+

Rivalry Angle: Enterprise analytics

Competitive Edge: Intelligent log summarization and anomaly detection

Loggly is a cloud-based log management and analytics platform designed to help developers, IT teams, and businesses monitor and troubleshoot their applications and infrastructure in real time.

The platform centralizes logs from various sources (servers, apps, containers, etc.), parses them, and turns them into structured, searchable data that can be visualized and acted upon. Its agentless logging approach allows users to send data over HTTP/Syslog without the need for proprietary software on each server.

Loggly can process terabytes of log data daily and integrates with tools like GitHub, Jira, Slack, AWS, and Docker. Its search speeds, real-time alerting, and visualization capabilities make it an ideal DevOps and SecOps companion.

Plus, Loggly benefits from the SolarWinds brand, giving it access to enterprise-level customer bases and the credibility associated with one of the oldest IT performance management companies. [3]

12. Qlik

Number of customers: 40,000+

Rivalry Angle: Analytics dashboards & real-time insights

Competitive Edge: Full-stack integration from data ingestion to AI

Qlik is one of the most widely recognized analytics platforms that serve major global brands in the finance, healthcare, manufacturing, and government sectors.

Its flagship products — QlikView and Qlik Sense — run on Qlik’s Associative Engine, allowing users to explore relationships across large datasets with unmatched flexibility. The platform can be deployed on-premises, in the cloud, or via a hybrid model, making it adaptable for a wide variety of enterprise needs.

The Associative Engine and AI-enhanced insights allow even non-technical users to find hidden relationships within data, making analytics more accessible across the enterprise.

Qlik’s embedded generative AI agents, including Qlik Answers and Discovery Agent, enhance its analytics environment with intelligent capabilities.

Qlik Answers processes unstructured data and provides natural-language responses with clear source transparency. Discovery Agent monitors structured data proactively, detects anomalies, explains their significance, and recommends next steps.

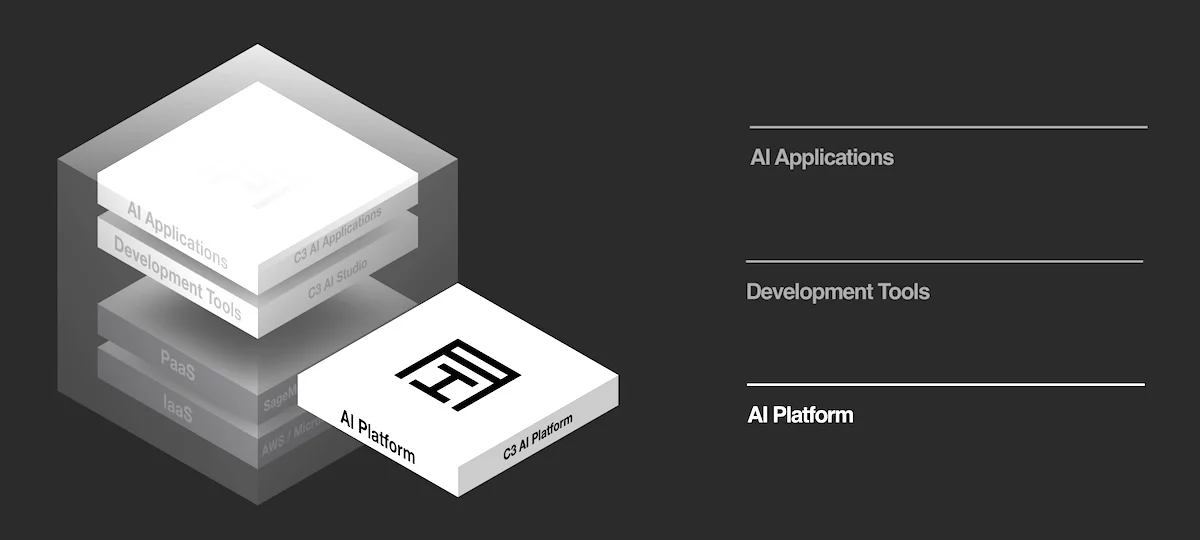

11. C3.ai

Revenue: $390 million

Number of customers: 200+

Rivalry Angle: Large enterprise AI deployments

Competitive Edge: Prebuilt vertical apps and scalable deployment

C3.ai offers a comprehensive suite of tools designed for the large-scale development, deployment, and operation of AI and IoT applications. These tools help organizations build AI solutions at scale, accelerate deployment timelines, and extract actionable insights from complex datasets.

The company has been instrumental in bridging data infrastructure with predictive AI capabilities, serving both public and private sector clients. Some of its notable clients include the US Department of Defense, Shell, Baker Hughes, Engie, and Con Edison.

Supported by strong partners (including Azure, AWS, Google Cloud, and McKinsey/QuantumBlack), C3.ai is strategically positioned as Microsoft’s preferred AI app provider on Azure, accelerating go-to-market reach. [4]

In FY 2025, the company generated $389.1 million in total revenue, reflecting nearly 25% YoY growth. Approximately 85% of this revenue came from subscription-based services.

10. SAS Institute

Revenue: $3.2 billion+

Number of customers: 70,000+

Rivalry Angle: Analytics and AI for healthcare & finance

Competitive Edge: Comprehensive statistical depth

SAS Institute, or simply Statistical Analysis System, has long prioritized statistical rigor, predictive analytics, and comprehensive enterprise-grade software platforms.

While Palantir focuses on operational analytics and decision platforms (especially in mission-critical sectors), SAS offers enterprise-grade analytics and vertical AI decisioning using domain-specific models. The two often coexist or compete directly in industries such as financial services, healthcare, and other highly regulated environments.

At the heart of its offering is SAS Viya, a cloud-native analytics and AI platform, designed for enterprise decisioning at scale. Futurum Group’s benchmarking showed that Viya delivers 4.6 times greater productivity than competing tools, such as Python–MLflow stacks. [5]

With decades of domain expertise, SAS has consistently been ranked as a leader by Chartis Research across more than 20 risk-related categories, including anti-money laundering (AML), credit risk, pricing, and market risk.

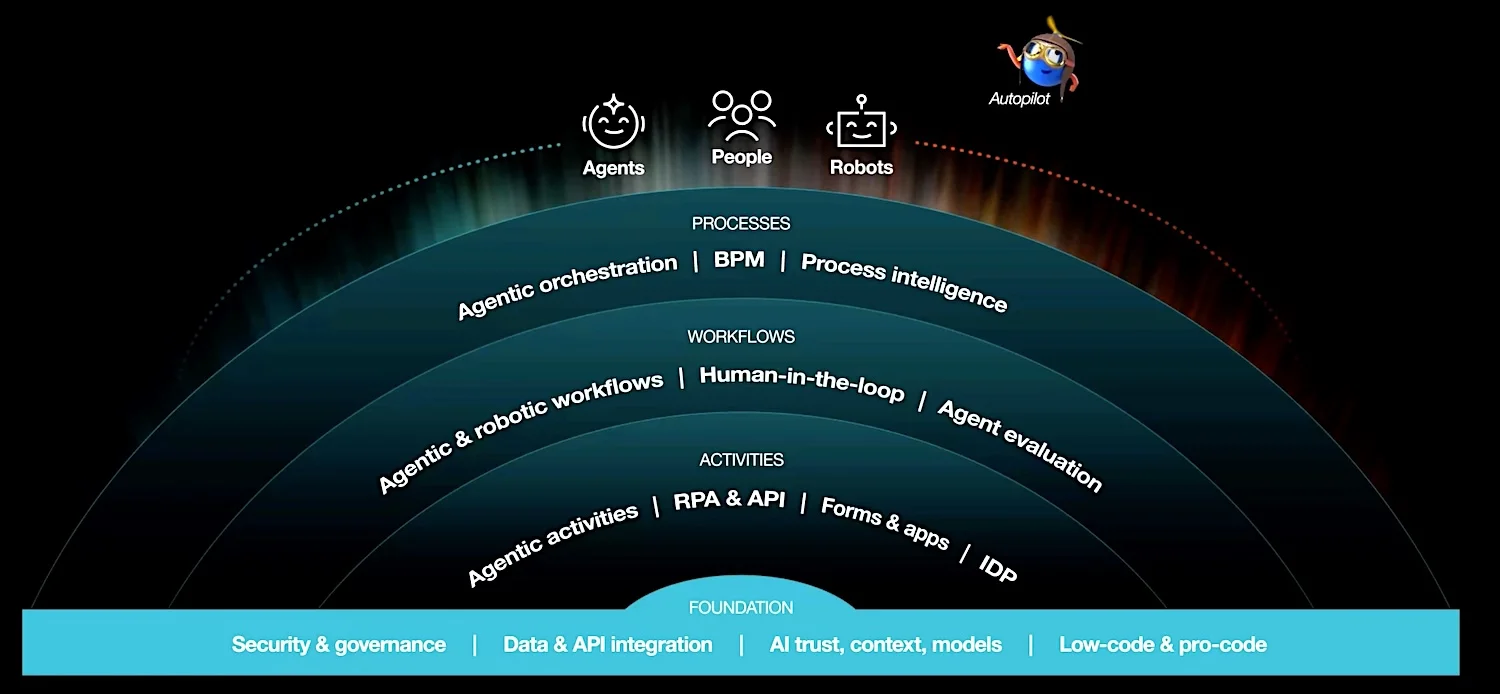

9. UiPath

Revenue: $1.45 billion+

Number of clients: 10,800+

Rivalry Angle: AI workflows

Competitive Edge: End-to-end enterprise automation platform

UiPath pioneered Robotic Process Automation (RPA) and has evolved into a broader intelligent automation and AI agent platform, combining low‑code tools with Gen AI.

While UiPath and Palantir serve different foundational purposes, both aim to accelerate decision-making and efficiency at the enterprise level — Palantir through data fusion and analysis, and UiPath through automation.

UiPath focuses on automating repetitive digital processes such as data entry, form processing, and workflow coordination. These are the areas where human efforts can be replaced by bots.

The company has already surpassed 10,000 customers globally, including several major Fortune 500 firms. Notable clients include Generali, Uber, Chipotle, GE, and NASA.

Its annual revenue has exceeded $1.45 billion, driven primarily by licensing and subscriptions. Plus, the company has maintained high gross margins (over 80%), thanks to its software-centric business model and cloud-native platform.

In 2025, the company acquired Peak, a UK-based firm specializing in agentic AI for inventory and pricing optimization, signaling a stronger commitment to advancing its operational AI capabilities. [6]

8. Booz Allen Hamilton

Revenue: $11.96 billion+

Number of clients: 160+ federal clients

Rivalry Angle: Defense analytics, National security contracts

Competitive Edge: Deep integration within US federal systems

Founded over a century ago, Booz Allen Hamilton (BAH) has played a crucial role in shaping the strategies of major US government agencies and commercial enterprises.

While historically known for its management consulting prowess, the firm has increasingly become a major player in the defense, intelligence, analytics, and AI consulting sectors, especially in national security and public sector missions.

Although Booz Allen is not a product-first company like Palantir, it operates as a hybrid of services and productized consulting. It delivers tailored solutions in analytics, quantum computing, and mission-specific AI applications across various sectors, including defense, finance, energy, and healthcare.

AI and analytics are now at the core of BAH’s identity. The company claims to be the top provider of federal AI services, with AI contract obligations growing from $252 million in FY 2021 to $538 million by FY 2023, totaling over $1.1 billion during those years.

In 2024, Booz Allen and Palantir jointly launched defense innovation projects, developing prototypes within 45 days by combining Palantir’s data platforms with Booz Allen’s delivery and systems engineering expertise.

In FY 2025, BAH reported annual revenue exceeding $11.9 billion, supported by a workforce of over 34,200 employees across the United States and international locations. Nearly 98% of its revenue came from US government contracts, with key clients including the Department of Defense (DoD), intelligence agencies such as the NSA and CIA, and various federal civilian agencies. [7]

7. Oracle (Analytics Cloud & Autonomous DB)

Released: 2017 (Autonomous DB)Revenue: $49.2 billion+ (Cloud and License business)

Number of users: 430,000+ (Oracle Cloud)

Rivalry Angle: Competes in enterprise data and ERP analytics

Competitive Edge: Global compliance certifications, Deep enterprise relationships

Through offerings like Oracle Analytics Cloud (OAC) and Oracle Autonomous Database (OADB), the company provides end-to-end tools for data ingestion, management, analysis, and visualization.

OAC is a unified, browser-based SaaS platform that blends self-service visualization, enterprise reporting, and augmented analytics. In users’ hands, it enables drag-and-drop dashboards, natural-language queries, automatic ML-driven data enrichment, forecasting, and anomaly detection.

OAC supports over 50 data sources and bridges to other Oracle SaaS (NetSuite, Fusion) or third‑party systems with seamless integration.

OADB, on the other hand, is an industry-first self-managing, self-securing, and self-repairing database that automates tuning, patching, and security without human intervention. It is targeted at organizations seeking zero-downtime and highly scalable data environments.

Both Oracle Analytics Cloud (OAC) and Oracle Autonomous Database (OADB) are designed with native AI support, rather than relying on add-ons. Emerging features such as Database 23c AI, vector search, and AutoML enable a unified data-to-AI pipeline within a single integrated stack. [8]

In 2025, Oracle launched its Defense Ecosystem, providing federal agencies with access to Palantir’s AI tools through Oracle Cloud Infrastructure’s (OCI) secure cloud platform and extensive compliance certifications.

6. Google Cloud (Vertex AI & BigQuery)

Released: 2010 (BigQuery)Revenue: $50 billion+ (for Google Cloud)

Number of users: 1,000,000+

Rivalry Angle: Data integration & insights at scale

Competitive Edge: Tight coupling with Google Ads & Analytics

Google Cloud offers two cornerstone technologies at the intersection of AI and analytics: BigQuery, its cloud-native data warehouse, and Vertex AI, its unified machine learning and generative AI platform.

BigQuery can process petabyte-scale queries with millisecond-level latency, offering seamless SQL-based access to structured, semi-structured, and unstructured data. For instance, Verizon’s BigQuery deployment supports approximately 3,500 users, runs around 50 million queries, manages 35,000 data pipelines, and handles over 40 petabytes of data. [9]

On the other hand, Vertex AI, introduced in 2021, has become Google’s flagship product for end-to-end AI model development, training, and deployment. It allows enterprises to build and manage custom LLMs, fine-tune pre-trained models, and operationalize ML pipelines.

Vertex AI supports integrations with PaLM 2, Gemini, and open-source models. More than 1 million developers have built generative AI solutions using Vertex, and tens of thousands of companies are using it to fine‑tune or deploy LLMs like Gemini, Codey, Imagen, and Anthropic’s Claude models.

Interestingly, 90% of all generative AI unicorns run their AI workloads on Google Cloud, reflecting strong adoption among the next generation of AI-first companies.

5. Amazon Web Services (AWS SageMaker & Bedrock)

Released: 2017 (SageMaker)Revenue: $120 billion+ (for AWS as whole)

Number of users: 100,000+

Rivalry Angle: Foundry vs AWS ML ecosystem

Competitive Edge: Scale and infrastructure maturity

Among AWS’s extensive portfolio of over 200 cloud services, two of its most impactful offerings in the fields of AI/ML and data analytics are Amazon SageMaker and Amazon Bedrock.

Launched in 2017, SageMaker is AWS’s fully managed service that allows developers and data scientists to build, train, and deploy machine learning models at scale. It supports various tools, including notebooks, built-in algorithms, distributed training, model monitoring, and MLOps pipelines — all integrated with AWS’s storage (S3), compute (EC2), and security services (IAM).

According to Amazon, more than 100,000 customers have chosen AWS machine learning services, including SageMaker, to address business challenges and foster innovation. These users are managing millions of models, training models with billions of parameters, and generating hundreds of billions of predictions every month. [10]

Amazon Bedrock, introduced in 2023, allows companies to build and scale generative AI applications using pre-trained foundation models from providers such as Anthropic, Meta, Cohere, Stability AI, and Amazon’s own Titan models (without having to manage the infrastructure).

Bedrock is built for ease-of-use and is increasingly embedded across industries, from retail chatbots to pharma R&D simulations. Since its launch, it has been adopted by thousands of enterprise users due to its serverless and API-based nature.

4. Microsoft (Azure Synapse & Azure OpenAI)

Revenue: $75 billion+ (from Azure)

Number of clients: 60,000+

Rivalry Angle: Scalable AI infrastructure, LLM deployment for enterprises

Competitive Edge: Exclusive OpenAI partnership

Among Microsoft’s many offerings, Azure Synapse Analytics and Azure OpenAI Service have emerged as two of its most powerful tools, directly competing with Palantir.

Azure Synapse Analytics, launched in 2019, is a limitless analytics platform that unifies data integration, enterprise data warehousing, and big data analytics into a single offering. It enables users to query data using both serverless and provisioned resources, providing the flexibility needed for dynamic enterprise use cases.

On the AI side, Azure OpenAI Service, launched in 2021, is Microsoft’s commercialized version of OpenAI’s large language models (LLMs), including GPT-4 and Codex. It provides businesses access to advanced generative AI via secure Azure environments.

Microsoft has over 60,000 enterprise customers using AI-related services through Azure. In FY 2025, Azure surpassed $75 billion in annual revenue, marking a 34% YoY increase driven by growth across all workloads.

Together, Synapse and Azure OpenAI enable customers to manage the entire data-to-intelligence pipeline, from ingesting terabytes of structured/unstructured data to building and deploying generative AI applications at scale.

Compared to Palantir, which offers depth in bespoke data operations, Microsoft offers scale, versatility, and prebuilt integrations. Microsoft also wins in developer adoption due to its vast partner network and enterprise developer ecosystem. However, Palantir remains more competitive in security-first, heavily regulated, or complex analytical environments.

3. IBM (Watson & Analytics Division)

Created: 2004 (Watson)Number of clients: 40,000+

Rivalry Angle: Government + Enterprise AI + Legacy modernization

Competitive Edge: Decades of trust, Focused on heavily regulated industries

The Watson & Analytics Division has emerged as one of IBM’s most high-profile bets on artificial intelligence and enterprise analytics.

The Watson platform originally gained fame for its natural language processing capabilities but has since been refocused toward practical enterprise uses. IBM has integrated Watson’s capabilities into broader AI-infused solutions such as Watsonx, an open, scalable AI and data platform.

Watsonx allows enterprises to build, train, tune, and deploy both foundational and industry-specific AI models. By early 2024, it had already achieved over $3.5 billion in cost savings and had become fully conversational. For instance, the HR chatbot handled 94 % of employee queries, contract automation improved drafting cycles by 80 %, and the enterprise logged over 3.9 million hours saved via AI agents deployed across operations. [11]

IBM Analytics complements Watson by offering a data fabric approach across its IBM Cloud Pak for Data, which integrates data governance, business intelligence, machine learning, and data virtualization into a single platform.

Unlike many newer AI startups, IBM’s Watson solutions serve thousands of enterprise and government clients, including partnerships with the US government, the Mayo Clinic, NASA, and Lufthansa.

2. Databricks

Revenue: $3.7 billion+

Number of clients: 15,000+

Rivalry Angle: AI-native data science and enterprise LLM deployment

Competitive Edge: Heavily committed to open source

Founded by the original creators of Apache Spark, Databricks was built on the foundational idea that data engineering, analytics, and machine learning should be unified in a single platform.

The heart of Databricks is the Lakehouse Platform, which supports both structured and unstructured data. Built with open standards and optimized for collaboration among data teams, it allows seamless movement from raw data ingestion to analytics and model training — all within a single environment.

The platform serves more than 15,000 customers globally, including prominent companies such as Shell, Comcast, Block, Regeneron, and Rivian. What sets it apart is its deep AI-native infrastructure, which enables companies to build, train, and deploy LLMs and AI applications at scale using familiar tools like Python and SQL.

In recent years, Databricks has made strategic acquisitions to boost its generative AI and real-time data processing capabilities. For example, it acquired MosaicML in 2023, a platform that lets organizations train their own custom LLMs at a fraction of the cost.

Databricks is also heavily committed to open source. Most of its foundational technologies (including Spark, Delta Lake, MLflow, and Koalas) are available for free and widely adopted across industries. In 2024, they open-sourced DBRX, a 132-billion-parameter mixture-of-experts LLM modeled on MosaicML technology, which outperformed LLaMA 2 and Grok in benchmarks.

By mid‑2024, Databricks was growing at ~60 % YoY, hitting an annualized revenue run rate of $2.4 billion. By 2025, that run rate had climbed to $3.7 billion, with YoY growth still around 50%. [12]

1. Snowflake

Revenue: $3.84 billion+

Number of clients: 11,000+

Rivalry Angle: Commercial analytics & cloud-native AI/ML workloads

Competitive Edge: Native support for semi-structured and unstructured data

Snowflake is a comprehensive Data Cloud platform that unifies data storage, processing, engineering, sharing, AI workloads, and monetization into one multicloud solution. It runs atop AWS, Azure, and Google Cloud and separates compute from storage, giving customers elastic scalability and granular pay‑per‑use pricing.

The company has been actively expanding into AI/ML and unstructured data processing via its Snowpark and Cortex offerings, challenging not only legacy data players like Oracle and Teradata but also newer rivals like Databricks and Palantir.

It has become a dominant force in cloud data warehousing, consistently reporting over 25% growth year-over-year. It serves more than 11,000 customers worldwide, including over 740 of the Forbes Global 2000. [13]

Plus, Snowflake maintains a strong net revenue retention rate of 126%, indicating that existing customers spend 26% more each year. Its gross margins remain solid, ranging between 62% and 67%.

Both Snowflake and Palantir operate in the enterprise data market, but they approach it from fundamentally different angles. Palantir focuses on operational decision-making and high-level intelligence, emphasizing custom workflows and government-grade security. In contrast, Snowflake is designed for storing, processing, and sharing data, with an emphasis on scalability, developer flexibility, and advanced analytics.

Read More

- 13 Best Data Science Companies In The World

- 13 Best Datadog Competitors and Alternatives

- 14 AI Startups To Track [Emerging Giants]

- Technology, Data Analytics market size and trend analysis, Fortune Business Insights

- Industry Report, AI and analytics in defense market size and share analysis, Mordor Intelligence

- Frederic Lardinois, SolarWinds acquires log-monitoring service Loggly, TechCrunch

- Bill McColl, C3.ai stock volatile as CEO puts some shares for sale, Investopedia

- Newsroom, SAS is the only leader in 4 analyst AI evaluations in 2024, PR Newswire

- Newsroom, UiPath acquires Peak to launch vertically specialized agents, UiPath

- Chip Cutter, This company gets 98% of its money from the US Government, WSJ

- Lindsay Clark, Foundry and AI platform available in OCI, The Register

- Sean Kerner, BigQuery is 5x bigger than Snowflake and Databricks, VentureBeat

- Anne Mickan, Securely running AI algorithms for 100,000 users on private data, AWS Blog

- IBM, Will AI make IBM the world’s most productive company?, Bloomberg

- Jordan Novet, Databricks’ annualized revenue reaches $3.7 billion, CNBC

- Financial Results, Snowflake reports Q4 and FY 2025 results, Snowflake