In an era where climate change poses unprecedented threats to our planet (as evidenced by a rise in global temperatures of approximately 1.2°C since pre-industrial levels), sustainable startups are emerging as beacons of innovation and hope. [1]

Consumers are one of the biggest forces behind this growth. Surveys indicate that 80% of global shoppers are willing to pay an average premium of 9.7% for products that are sustainably sourced and ethically produced. [2]

Governments and regulations are accelerating this momentum. Policies like the EU Green Deal (aiming for net-zero emissions by 2050) and the US Inflation Reduction Act, which allocates $369 billion for clean energy and climate initiatives, are directly fueling startup growth.

In this article, I’ll explore some of the leading sustainable startups that are shaping a low-carbon future, from transforming how we power cities to changing what we eat and wear.

Did you know?About 6,469 startups are operating in the sustainability sector out of over 452,000 companies, illustrating strong early-stage activity. The green technology and sustainability development market is projected to reach $185.2 billion by 2034, growing at a staggering CAGR of 22.9%. [3][4]

Table of Contents

13. Nitricity

Founded in 2018Headquarters: Oslo, Norway

Total Funding: $88 million+

Mission: To electrify and decentralize fertilizer production

Competitive Edge: Low-carbon, organic fertilizer

Nitricity is reimagining nitrogen fertilizer production by electrifying the process and localizing manufacture using air, water, renewable energy, and recycled almond shells. This approach significantly reduces reliance on fossil-fuel-based supply chains.

Fertilizer manufacturing is responsible for approximately 2% of global CO₂ emissions and nearly 1.4% of global energy consumption, primarily due to its reliance on the Haber-Bosch process, which is powered by fossil fuels. Nitricity offers an innovative alternative by generating fertilizer using only air, water, and renewable electricity. [5]

Nitricity’s organic, plant-based fertilizer is pathogen-free, odor-free, and designed for irrigation-line application. It’s certified for organic farming and enhances the region’s circular bioeconomy by converting local byproducts into nutrient-rich inputs.

12. Charm Industrial

Founded in 2018Headquarters: San Francisco, USA

Total Funding: $108 million+

Mission: Remove CO₂ permanently by turning biomass into bio-oil & biochar

Competitive Edge: High-profile offtake partners

Charm Industrial converts biomass waste into bio-oil and injects it underground for long-term carbon sequestration. Unlike many carbon capture firms that focus on direct air capture or point-source capture, Charm leverages agricultural and forestry residues, which represent an underutilized and massive source of carbon-rich material.

The company’s technology not only sequesters carbon but also creates renewable industrial feedstocks that can displace fossil-derived products. Since its first pilot projects, Charm Industrial has successfully removed over 8,000 tons of CO₂ from the atmosphere.

They have secured large-scale offtake agreements, including $53 million from Frontier Climate for 112,000 tons (2024–2030), a substantial purchase commitment of around 28,000 tons from JPMorgan Chase, and a biochar-focused contract with Google to remove 100,000 tons of CO₂ by 2030.

11. Pano AI

Founded in 2020Headquarters: San Francisco, USA

Total Funding: $89 million+

Mission: Leverage AI & imaging to protect natural ecosystems from wildfires

Competitive Edge: AI-first platform, 360° camera coverage

Pano AI has revolutionized wildfire detection with an integrated system of AI, ultra-high-definition cameras, satellite data, and real-time monitoring. It equips firefighters, landowners, and communities in 10 US states, 5 Australian states, and British Columbia, Canada, covering over 30 million acres of high-risk terrain.

Their network of rotating 360° cameras, combined with advanced AI models trained on billions of images, can detect even the faintest traces of smoke, whether day or night, and even in fog or snow. Human analysts then review the detections to ensure accuracy. [6]

The technology’s impact is striking. In one case in Colorado, Pano AI detected the Bear Creek Fire early and provided precise GPS coordinates. Thanks to that intelligence, firefighters were able to contain the blaze to just three acres.

In 2023, Pano AI was named one of Fast Company’s Most Innovative Companies, and in 2025, TIME honored them among its 100 Most Influential Companies.

10. Enode

Headquarters: Oslo, Norway

Total Funding: $17 million+

Mission: Connect and optimize distributed energy resources

Competitive Edge: One API, wide device coverage

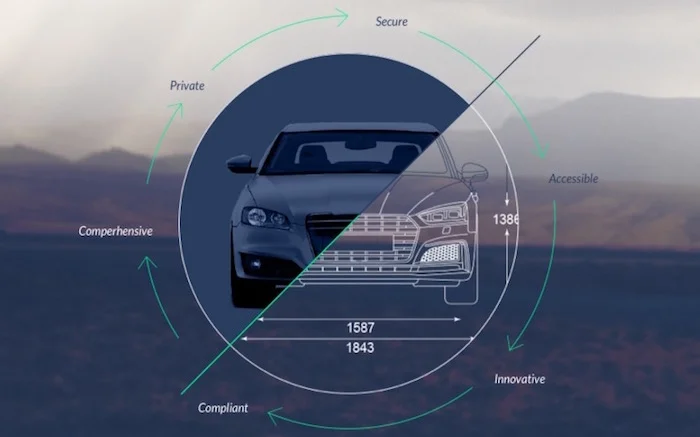

Enode is focused on building the digital backbone for a clean energy future by connecting millions of distributed energy assets to the grid.

It offers a unified API infrastructure that enables developers and energy companies to integrate smart energy hardware such as EVs, solar inverters, home batteries, and thermostats into their applications via a single integration point.

Think of Enode as “Plaid for energy,” enabling real-time data access and control across diverse devices and brands. The platform allows seamless connection to over 1,000 energy devices spanning 80+ OEM brands across more than five hardware categories.

Enode’s system is already powering usage for more than 250 million energy customers worldwide, managing over 100 GWh of energy through its platform. Users achieve an average energy savings of up to 25% when utilizing Enode’s Smart Charging feature.

9. Epoch BioDesign

Founded in 2019Headquarters: London, United Kingdom

Total Funding: $35 million+

Mission: Build a truly circular economy for plastics and textiles

Competitive Edge: Proprietary enzyme engineering platform

Epoch BioDesign develops engineered enzymes that can break down traditionally non-recyclable plastics and transform them into sustainable raw materials. This approach addresses two pressing global challenges: plastic pollution and dependency on fossil fuel–based chemical inputs.

Unlike traditional recycling (which either degrades polymer quality or relies on energy-intensive chemical processes), Epoch’s biorecycling platform can depolymerize persistent materials like nylon and polyester at room temperature, producing high-purity chemical building blocks with minimal energy input.

More specifically, their enzyme-driven process eliminates toxic solvents and operates at low temperature and atmospheric pressure, offering better yields (>90%), lower carbon emissions, and price parity.

According to industry estimates, more than 400 million tons of plastic waste are produced annually worldwide, with over 70% ending up in landfills or oceans. Epoch BioDesign operates at the intersection of waste management and circular chemistry, targeting a market projected to surpass $183 billion by 2032 for sustainable plastic alternatives and enzymatic recycling technologies. [7][8]

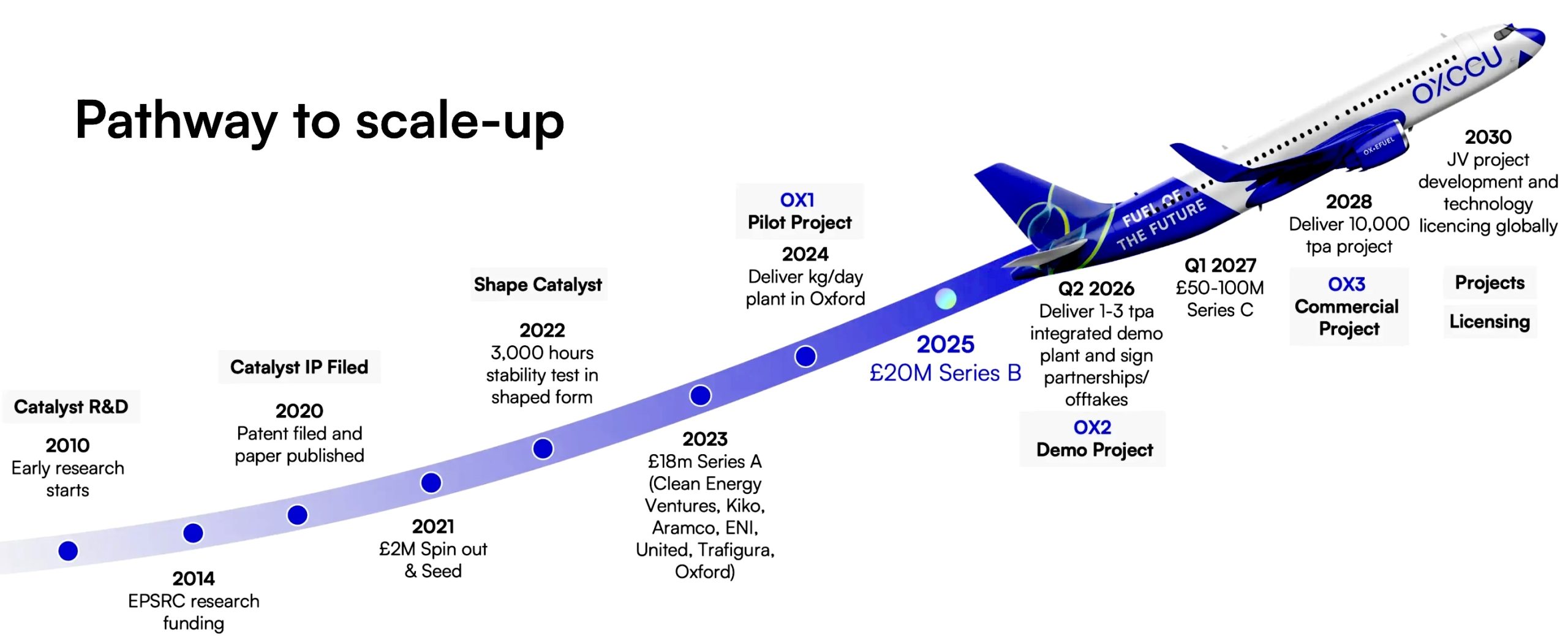

8. OXCCU

Headquarters: Oxford, United Kingdom

Total Funding: $25 million+

Mission: Turn CO₂ into sustainable fuels and chemicals

Competitive Edge: Single-step conversion into long-chain hydrocarbons

Founded as a spin-out from Oxford University, OXCCU is tackling one of the most pressing challenges of the energy transition: decarbonizing industries that are hard to electrify, particularly aviation, shipping, and heavy chemicals.

The aviation sector alone contributes about 2.5% of global CO₂ emissions (roughly 1 billion tonnes annually), making sustainable aviation fuel (SAF) a critical market. OXCCU’s solution directly targets this segment.

Unlike conventional green fuel technologies that rely on multiple costly steps, OXCCU has developed a breakthrough single-step catalytic process that transforms captured CO₂ and green hydrogen into hydrocarbons.

In 2024, the company launched its OX1 demonstration plant at London Oxford Airport, producing about 1 kg (around 1.2 liters) of synthetic fuel per day. It is the world’s first pilot converting CO₂ and H₂ directly to SAF via a single-step process.

Projections indicate that OXCCU’s technology can reduce SAF capital expenditure by nearly 50% and lower per-ton fuel costs by 25% compared to traditional RWGS + FT pathways.

With the SAF market expected to surpass $402 billion by 2050, growing at an annual rate of 26.2%, OXCCU is positioning itself at the forefront of this rapidly expanding sector. [9]

7. Greenlyte Carbon Technologies

Founded in 2022Headquarters: Essen, Germany

Total Funding: $26 million+

Mission: Develop low-energy, liquid-sorbent DAC

Competitive Edge: Process yields green hydrogen as byproduct

Greenlyte Carbon Technologies uses its proprietary liquid-sorbent direct air capture (DAC) technology to extract CO₂ from ambient air. The process involves absorption, precipitation as hydrogen carbonate, and electrolysis-based desorption, which produces CO₂ along with green hydrogen as a valuable byproduct, while simultaneously regenerating the sorbent.

Their pilot plant, commissioned in 2023, captures about 100 tons of CO₂ per year, validating the tech. Greenlyte reports an energy requirement of around 600 kWh per ton of CO₂, significantly lower than that of typical DAC systems.

This efficiency enables a potential removal cost of approximately $80 per ton, compared to industry averages of $600-$1,000 per ton.

The company aims to remove 100 million tonnes of CO₂ annually by 2050 and has received notable recognition, including being named to the Norrsken Impact/100 list and featured on a Times Square billboard in 2024.

6. Rondo Energy

Headquarters: Alameda, USA

Total Funding: $160 million+

Mission: Replace fossil-fuel-based heat with renewable-powered heat batteries

Competitive Edge: 24/7 Renewable heat, 40+ year life

Rondo Energy focuses on delivering zero-carbon industrial heat and power solutions, two of the hardest-to-decarbonize sectors in the world.

Industrial processes account for nearly 30% of global greenhouse gas emissions, with around 50% of this attributed to heat generation. The company addresses this challenge with its Rondo Heat Battery, a thermal energy storage solution that converts renewable electricity into stored heat, which can then be used directly in manufacturing and other industrial processes. [10]

The Rondo Heat Battery captures surplus renewable electricity (e.g., wind/solar) and stores it as thermal energy in superheated refractory bricks (up to 1,500 °C), achieving over 98% efficiency from electricity IN to heat/steam OUT.

The system is modular, designed for decades of service (40+ year lifespan), unlimited cycling, and seamless integration for industries from cement and metals to food & beverage.

The combination of low-cost input, scalability, and practical integration gives Rondo a strong edge over competitors in hydrogen, advanced batteries, and carbon capture.

5. Ohmium

Founded in 2020Headquarters: Fremont, USA

Total Funding: $295 million+

Mission: Accelerate decarbonization through PEM electrolyzer

Competitive Edge: Hyper-modular design & rapid scaling:

Ohmium designs, manufactures, and deploys advanced Proton Exchange Membrane (PEM) electrolyzers, facilitating the shift toward renewable hydrogen at a commercial scale. It has emerged as one of the most promising startups addressing hard-to-decarbonize industries like steel, chemicals, and heavy transport.

In 2024, the company launched a state-of-the-art gigafactory in Doddaballapura, India. This facility spans nearly 14,000 m² and holds an initial production capacity of 2 GW per year, expandable to 4 GW. It is designed to cut up to 4 million tonnes of CO₂ emissions annually, equivalent to the carbon absorption of 180 million trees. [11]

Ohmium’s electrolyzers are engineered with semiconductor-level precision. They are about the size of a car, stackable, and easy to install. Deployment can be completed within three weeks, with installation costs reduced by 80 – 90% compared to traditional methods. Smaller-scale units also help reduce project risk, as the failure of one unit only slightly decreases total capacity.

4. Redwood Materials

Headquarters: Nevada, USA

Total Funding: $1.87 billion+

Mission: Build a circular supply chain for lithium-ion batteries

Competitive Edge: High recovery efficiency

Established by Tesla co-founder J.B. Straubel, Redwood Materials set out to build a circular supply chain for lithium-ion batteries. It aims to reduce the environmental footprint and cost of EV battery production by recapturing and reusing critical materials like lithium, nickel, cobalt, and copper.

The company has developed proprietary processes that can recover over 95% of key elements from end-of-life (EOL) batteries, as well as production scrap. By 2022, it was already receiving enough EOL batteries each year to supply materials for about 60,000 new EVs.

By 2030, Redwood aims to produce 500 GWh per year of cathode active materials (CAM) and anode copper foil, which would be sufficient to power 5 million EVs. [12]

Impressively, Redwood already recycles more than 70% of all lithium-ion batteries in North America and is moving toward domestic production of CAM, which Business Insider has described as the “new black gold.” [13]

3. Heirloom

Founded in 2020Headquarters: San Francisco, USA

Total Funding: $203 million+

Mission: Remove of CO₂ from atmosphere at affordable cost

Competitive Edge: Cost and scalability via common materials

Heirloom focuses on direct air capture (DAC) of CO₂ using naturally abundant minerals. Unlike many other carbon capture companies that rely on energy-intensive processes, Heirloom harnesses accelerated mineralization, a process that enhances how natural rocks absorb CO₂ from the atmosphere.

More specifically, Heirloom uses limestone, a cheap and abundant mineral, to capture CO2 from the air. Normally, limestone naturally absorbs CO2 over many years, but Heirloom speeds this up to just three days. They first take CO2 out of limestone, creating a material that quickly “soaks up” CO2 from the atmosphere like a sponge. [14]

In 2023, the company launched North America’s first commercial DAC facility in Tracy, California, capable of capturing nearly 1,000 metric tons of CO₂ per year. They have set an ambitious mission of removing 1 billion tonnes of CO₂ from the atmosphere by 2035. [15]

In 2025, United Airlines invested in Heirloom via its Sustainable Flight Fund, securing rights to purchase 500,000 tons of CO₂, either for sequestration or conversion into sustainable aviation fuel.

2. Form Energy

Founded in 2017Headquarters: Massachusetts, USA

Total Funding: $1.13 billion+

Mission: Develop low-cost, multi-day energy storage systems

Competitive Edge: Safe chemistry and manufacturing control

Form Energy focuses on developing multi-day energy storage systems using low-cost and abundant materials, most notably iron-air batteries.

Unlike conventional lithium-ion batteries, which excel in short-duration applications, Form Energy’s innovation aims to store electricity for 100 hours or more, making it suitable for supporting grids during renewable intermittency (such as cloudy days or low-wind periods)

Their breakthrough “reversible rusting” iron-air batteries offer multi-day storage at dramatically lower cost, claimed to be 10 times cheaper than lithium-ion for similar durations. [16]

After years of R&D, the company’s first manufacturing plant, Form Factory 1, is now fully operational in West Virginia. The 550,000 sq ft facility is located on the site of a former steel mill. Trial production began in 2024, and by 2028, the plant is expected to expand to more than 1 million sq ft, reach an annual capacity of 500 MW, and employ around 750 people.

1. Climeworks

Headquarters: Zurich, Switzerland

Total Funding: $1 billion+

Mission: Remove CO₂ from the air

Competitive Edge: Strong client and project pipeline

Climeworks is a Swiss pioneering company in carbon dioxide removal technology, specializing in direct air capture (DAC) systems that extract CO₂ directly from the atmosphere. It aims to remove billions of tons of CO₂ from the atmosphere annually.

The company operates over 15 DAC plants worldwide, with Europe’s most notable being in Iceland. Its two flagship facilities are Orca (launched in 2021) and Mammoth (inaugurated in 2024). The Orca captures up to 4,000 tons of CO₂ annually, while Mammoth raises the bar to 36,000 tons of CO₂ per year, leveraging geothermal energy and partnering with Carbfix for underground mineral storage.

Climeworks is also working on Generation-3 DAC technology, which utilizes advanced structured sorbent materials housed in modular cubes. This version doubles CO₂ capture per module, reduces energy consumption by half, and extends filter lifespan threefold. It aims to achieve capture costs of $250 to $350 per ton and net removal costs of $400 to $600 per ton by 2030. [17]

Climeworks has secured multi-year deals with several major companies, including Microsoft, British Airways, SAP, Stripe, and JPMorgan Chase, ensuring revenue predictability and scale. In 2024, they signed a 40,000-ton CO₂ removal agreement with Morgan Stanley (through 2037) and another large partnership with British Airways. [18]

Read More

Sources Cited and Additional References- Climate change, Humans are responsible for global warming, United Nations

- Survey, Consumers willing to pay 9.7% sustainability premium, PwC

- Report, Sustainability outlook and market trends, StartUs Insights

- Industry Analysis, Green technology and sustainability market size, Precedence Report

- Stefano Menegat, Greenhouse gas emissions from nitrogen synthetic fertilisers in agriculture, Nature

- James Temple, Pano AI and its fire-detecting AI, MIT Tech Review

- Beat Plastic Pollution, Over 400 million tonnes of plastic are produced every year, United Nations

- Analyzing Competitor Moves, Enzymatic recycling growth outlook, DataInsightsMarket

- Energy and Natural Resources, Sustainable aviation fuel market, Transparency Market Research

- Manufacturing, Industrial sector is turning net zero goals into practice, World Economic Forum

- News, Ohmium launches PEM Electrolyzer Gigafactory, Ohmium

- Rebecca Bellan, Redwood Materials raises $1B to expand US battery supply chain, TechCrunch

- Alistair Barr, A Tesla cofounder digs deep for the new black gold, Business Insider

- News, Heirloom raises $150 million Series B to scale commercial direct air capture, BusinessWire

- News, Heirloom unveils America’s first commercial Direct Air Capture facility, Heirloom

- Climate Solutions, Form Energy is revitalizing West Virginia, The Washington Post

- Press Release, Next generation tech powers Climeworks’ megaton leap, Climeworks

- H. Claire Brown, Climeworks strikes 40,000-ton carbon removal deal with Morgan Stanley, WSJ