Founded in 2006, HubSpot has evolved from a niche inbound marketing software into one of the most influential customer relationship management (CRM) and marketing automation platforms in the global SaaS ecosystem.

HubSpot’s customer base has expanded to 278,000 customers globally, generating over $3 billion in annual revenue primarily through subscriptions. Today, they have 15 global offices and over 8,700 employees.

The platform simultaneously competes with enterprise CRM leaders, marketing cloud platforms, SMB-focused SaaS providers, open-source tools, and vertical-specific solutions.

Below, I present the top HubSpot competitors. Each one challenges HubSpot on different dimensions, such as price, depth of functionality, scalability, customization, or ecosystem strength.

Did you know?

The CRM software market is one of the largest segments of enterprise software, with estimates suggesting it could exceed $145 billion by 2029. Meanwhile, the global marketing automation market size is projected to surpass $15.5 billion by 2030, growing at a CAGR of 15.3%.

Table of Contents

16. EngageBay

Founded in 2018Headquarters: Wilmington, Delaware, US

Users: 28,000+

Competitive Edge: Unified Contact & Pipeline Management

EngageBay is an all-in-one CRM and business automation platform that unifies marketing, sales, and customer support into a single cloud-based solution designed for small- to mid-sized businesses (SMBs) and startups.

The platform is organized into several “bays” or modules (All-in-One Suite, Marketing Bay, Sales & CRM Bay, and Service Bay), allowing customers to choose bundled suites or specific modules based on their needs.

Its CRM provides a 360° view of customers, enabling synchronized sales, marketing, and support activities, as well as automated nurture sequences triggered by customer behavior. The platform incorporates AI tools (such as AI email marketing and chatbot automation) to handle repetitive tasks and boost productivity

Plus, its integration options include connections to Zapier, Shopify, Stripe, QuickBooks, and other popular tools, enhancing its flexibility and reducing tech stack fragmentation.

15. DevRev

Founded in 2020Headquarters: Palo Alto, California, US

Clients: 1,000+

Competitive Edge: Dev-centric CRM approach

DevRev is an AI-native business operating system and developer-centric CRM platform designed to unify customer support, product development, and revenue workflows into a single system of record.

The platform’s core idea is to help companies build and grow products by bringing developers, support teams, product managers, and customers into a unified workflow.

DevRev’s technology (including a knowledge graph and patented data unification tools) enables real-time analytics, conversational search, and AI-driven workflows across disparate data sources (tickets, emails, logs, etc.). [3]

DevRev has attracted significant attention in the enterprise SaaS ecosystem due to its strong technical architecture and AI-first design. Its AI capabilities focus on issue categorization, routing, prioritization, and customer-product insights, helping teams move faster as organizations scale.

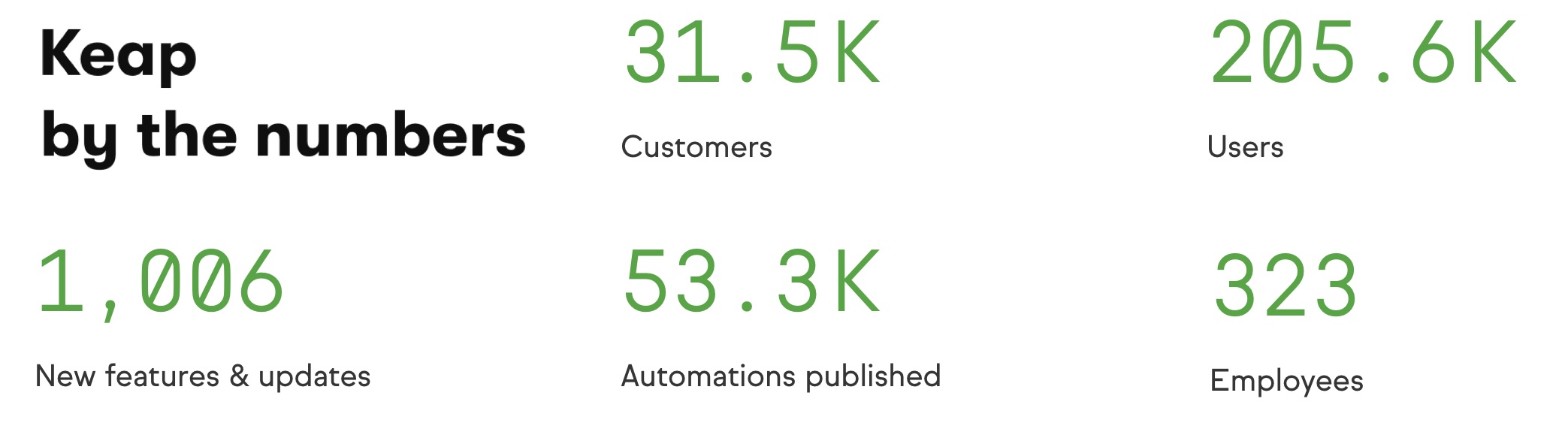

14. Keap

Headquarters: Chandler, Arizona, US

Users: 200,000+

Competitive Edge: Visual automation builder, Focus on small businesses

Keap is an all-in-one CRM and sales/marketing automation platform. Its core mission is to simplify growth by combining lead and contact management, automated follow-ups, sales pipeline tools, and e-commerce functions into a single interface.

Users can create sophisticated sequences (for example, incoming leads trigger automated emails, text follow-ups, appointment reminders, or invoices) without manual work.

The platform is frequently praised for its visual automation builder and drag-and-drop campaign design, which lets business owners map customer journeys without coding.

Its tools are especially useful for service-based businesses (consultants and agencies) and small e-commerce operations that benefit from tight integration between marketing and transactions.

Keap continues to expand its integrations, connecting with tools such as Gmail, PayPal, QuickBooks, Stripe, and Zapier. It currently serves over 200,000 small businesses worldwide and aims to reach 1 million by 2030.

13. ActiveCampaign

Founded in 2003Headquarters: Chicago, Illinois, US

Users: 180,000+

Competitive Edge: Broad integration ecosystem, Strong price-to-feature ratio

ActiveCampaign combines marketing automation, email marketing, sales CRM, and AI-enhanced insights within one unified platform to help businesses grow revenue and streamline customer journeys.

The platform is best known for its advanced visual automation builder, which lets businesses design complex, behavior-based customer journeys across email, CRM stages, SMS, site messaging, and integrations. It also connects with over 900 third-party apps and services, increasing flexibility and reducing the need for multiple tools.

Unlike traditional CRMs that prioritize data storage and reporting, ActiveCampaign emphasizes action-based automation, helping businesses respond dynamically to customer behavior in real time.

From a market positioning perspective, ActiveCampaign occupies the middle ground between basic email tools and full CRM platforms like HubSpot. It appeals to companies that want enterprise-level automation capabilities without enterprise-level pricing or complexity.

ActiveCampaign has experienced strong growth over the last decade: its annual revenue reached $290.5 million in 2024, reflecting consistent adoption across industries and its growing footprint among small-to-medium businesses (SMBs) and larger enterprises alike.

In 2025, across all ActiveCampaign accounts, the platform powered 2.5 million automations, helped businesses add 93.7 million net new subscribers, and delivered 109 billion emails through 10.4 million campaigns, while achieving an average email open rate of 40.4% and an average click-through rate of 6.7%. [4]

12. ClickFunnels

Founded in 2014Headquarters: Eagle, Idaho, US

Users: 160,000+

Competitive Edge: Ease of creating high-converting funnels

Founded in 2014, ClickFunnels popularized the concept of pre-built conversion funnels, allowing users to create landing pages, upsells, downsells, and checkout flows without needing technical expertise.

Its core functionality includes funnel builders, landing pages, checkout pages, email automation, membership sites, and basic CRM capabilities. It allows businesses to rapidly deploy revenue-generating funnels, often within hours rather than weeks.

ClickFunnels’ emphasis is on conversion mechanics rather than long-term relationship management, making it fundamentally different from traditional CRM platforms.

Strategically, ClickFunnels is often chosen when HubSpot is perceived as too complex, too CRM-centric, or too expensive for early-stage or creator-led businesses.

Since launch, the company has experienced rapid revenue growth, scaling from nearly zero to more than $265 million in annual revenue by 2023, and serving 160,000+ paying customers. [5]

In fact, it has fostered a passionate community known as “Funnel Hackers” — entrepreneurs, marketers, and business owners deeply engaged with funnel strategies and digital marketing education.

11. GetResponse

Founded in 1998Headquarters: Gdańsk, Poland

Users: 400,000+

Competitive Edge: Strong deliverability and analytics

GetResponse is a cloud-based digital marketing and automation platform that helps businesses engage with audiences, grow their contact lists, and drive revenue through email, automation, landing pages, webinars, and e-commerce tools.

It is designed to serve small to mid-sized businesses, marketers, ecommerce teams, and content creators who want to run multi-channel marketing campaigns from a single platform rather than a collection of point solutions.

The platform promises a 99% deliverability rate for email campaigns globally and provides a unified workspace that combines AI-powered content generation, automation workflows, landing page builders, push notifications, and SMS campaigns. [6]

Businesses that rely heavily on campaigns, funnels, webinars, and promotions (but do not require advanced CRM pipelines) often view GetResponse as a more cost-effective alternative to HubSpot.

It is trusted by more than 400,000 businesses across 160+ countries and integrates with over 150 third-party tools, including e-commerce platforms like Shopify and WooCommerce. This makes it easy for marketers to connect data, automate communications, and convert prospects to customers effectively.

GetResponse also supports content monetization with tools to create and sell online courses, paid newsletters, and premium content, helping businesses monetize audiences beyond just email sends.

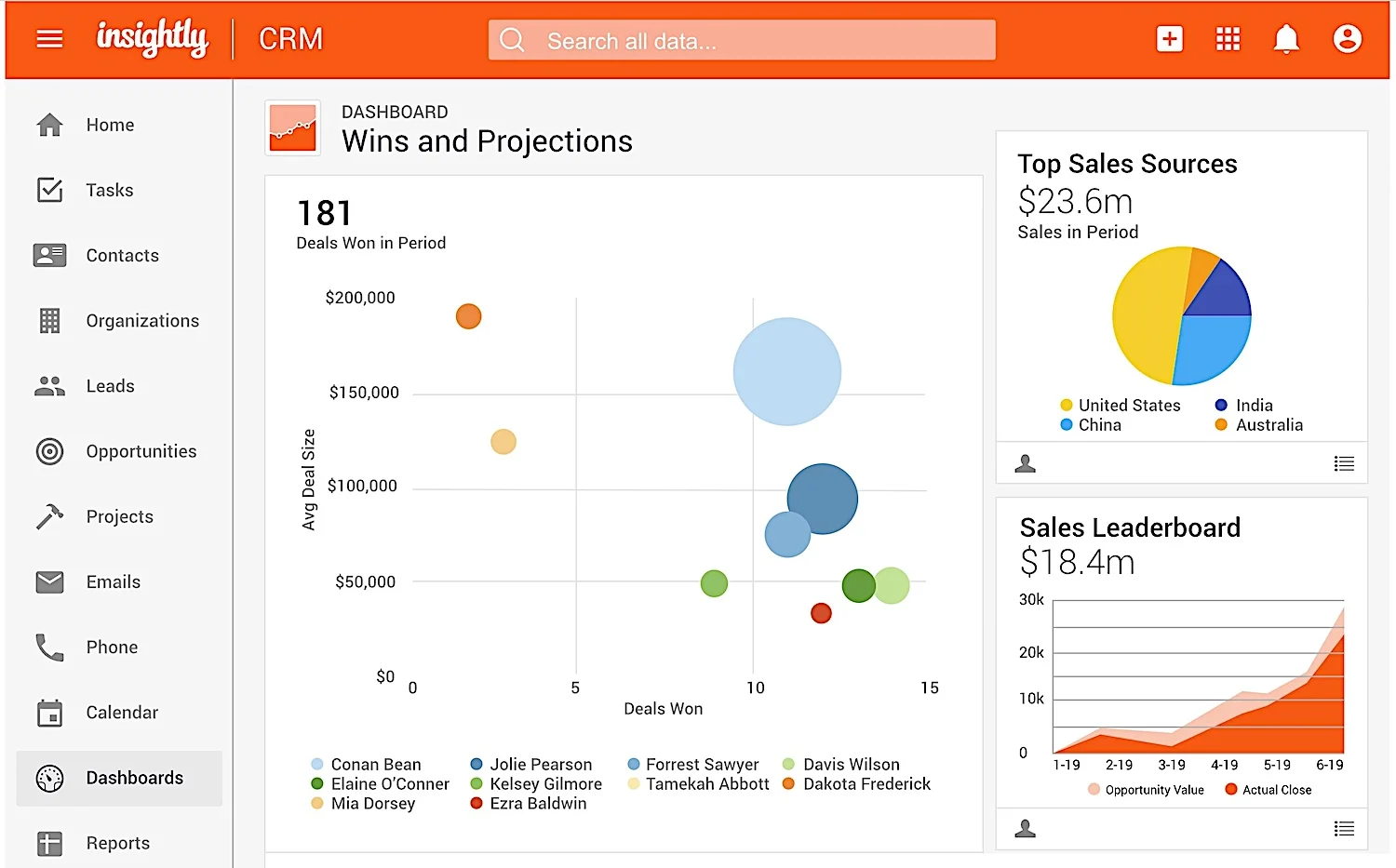

10. Insightly

Headquarters: San Francisco, California, US

Pricing: Starts at $29 per month per user

Competitive Edge: Broad Integration Ecosystem

Insightly’s CRM emphasizes workflow automation, sales and opportunity management, contact tracking, and data-driven insights — all with an interface that’s built for ease of use and rapid adoption.

Its platform has evolved over time to include AI-powered features, workflow automation, drag-and-drop pipelines, custom dashboards, and mobile access, helping teams increase productivity and accelerate deal cycles.

More specifically, companies using Insightly can easily track leads, manage contacts, automate processes, and visualize sales pipelines, reducing manual administrative work and improving cross-team collaboration.

The platform also offers project management functionality and AppConnect integrations with tools such as Gmail, Outlook, Slack, QuickBooks, Shopify, and others.

Insightly is quite popular as an intuitive CRM that balances power with affordability. The clear, tiered pricing ($29 – $99 per user/month) provides budget visibility and aligns with typical team structures.

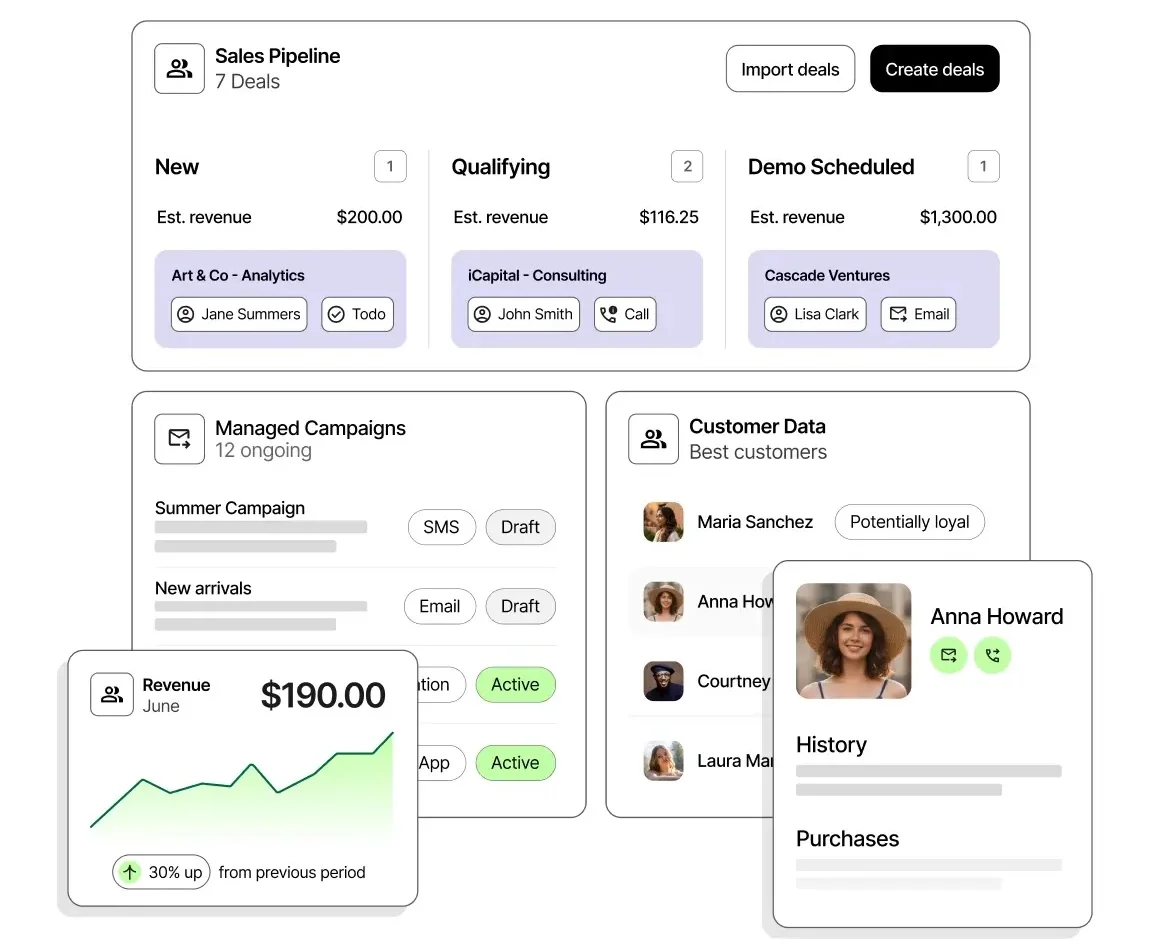

9. Brevo

Headquarters: Paris, France

Users: 600,000+

Competitive Edge: Multi-channel marketing, Flexible pricing

Brevo is a cloud-based marketing and customer engagement platform that helps businesses communicate with customers across multiple channels (including email, SMS, WhatsApp, web push, and chat) from a single unified interface.

It combines traditional email marketing with modern automation, CRM features, and transactional messaging tools. Plus, it offers CRM storage and landing pages.

The platform is built to be intuitive yet powerful, enabling users to launch email campaigns quickly with a drag-and-drop editor, pre-built templates, advanced automation workflows, and segmentation tools — all without heavy technical overhead.

Data from 2024 shows sharp growth across engagement channels, including a 69.6% increase in SMS users, a 927.5% surge in push notification usage, 31.1 million web wallet passes, and rising WhatsApp engagement. This highlights how customers are using Brevo to diversify their communication strategies. [7]

Brevo operates globally, with a particularly strong presence in Europe, where it has benefited from early compliance with GDPR and strict data protection standards. As of today, Brevo serves over 600,000+ customers.

8. Oracle Eloqua

Founded in 1999Headquarters: Austin, Texas, US

Pricing: Starts at $2,000 per month

Competitive Edge: Enterprise-class marketing automation

Oracle Eloqua is a premium enterprise B2B marketing automation platform and a core component of Oracle Customer Experience (CX).

It is designed to manage highly sophisticated, data-driven B2B marketing operations. It allows enterprises to orchestrate advanced lead nurturing, account-based marketing, behavioral tracking, multi-channel campaigns, and closed-loop attribution across large contact databases.

As part of Oracle, Eloqua benefits from deep integration with Oracle CRM, Oracle Sales, Oracle Service, Oracle Data Cloud, and Oracle Analytics. This allows enterprises to connect marketing automation directly with sales execution, customer data, and financial systems — creating a unified view of the customer lifecycle.

Oracle makes its advanced AI features available to all Eloqua customers. These include both generative and traditional AI tools, such as fatigue analysis, send-time optimization, and account intelligence, which help improve campaign performance and team productivity. [8]

From a market positioning perspective, Eloqua is valued for its depth of capabilities rather than ease of use. Compared to HubSpot, Eloqua’s pricing is less transparent, significantly higher, and less flexible, but enterprise buyers accept this due to scale, reliability, and vendor consolidation.

7. SAP CRM

Initial Release: 1972Headquarters: Walldorf, Germany

Pricing: Starts at $50 per user per month

Competitive Edge: Industry-specific solutions, Enterprise governance & compliance

SAP CRM is a part of SAP Customer Experience (CX). It competes with HubSpot at the upper extreme of the CRM and customer experience market.

While HubSpot targets SMBs and growing mid-market companies with a marketing-led, ease-of-use platform, SAP CRM addresses companies with thousands of employees, complex ERP environments, and deeply integrated operations.

What sets this platform apart is its integration with SAP’s broader enterprise ecosystem, which includes ERP, analytics, supply chain, and finance. This enables end-to-end business transformation where customer data and back-office operations are tightly connected.

Plus, SAP offers industry-specific CRM/CX workflows and templates for sectors like automotive, retail, utilities, and more, giving businesses bespoke capabilities out of the box. It also integrates AI and predictive analytics (for example, intelligent recommendations and pipeline forecasting) into its CRM tools, enhancing efficiency across sales and marketing.

6. Pipedrive

Headquarters: New York City, US

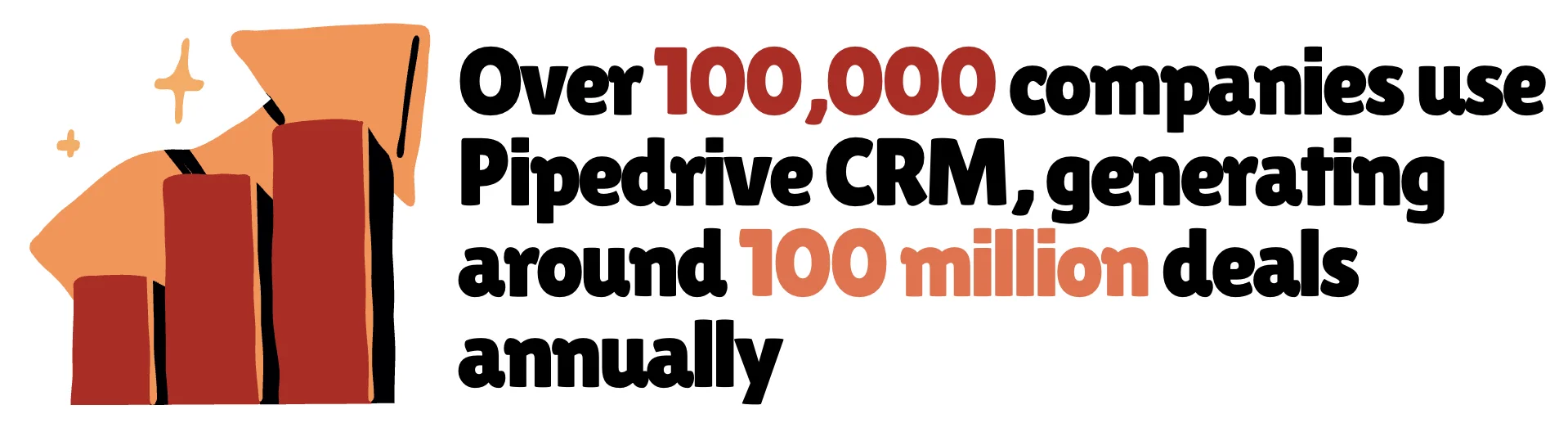

Number of Users: 100,000+

Competitive Edge: Sales-first product design, Visual pipeline simplicity

Pipedrive is a sales-focused CRM platform built specifically for small and mid-sized businesses that want a clear, visual, and execution-oriented approach to managing sales pipelines.

At its core, Pipedrive is centered around a deal-driven pipeline model, where every lead and opportunity is visually tracked through customizable stages. It emphasizes daily sales activity (including calls, emails, meetings, and follow-ups) rather than complex marketing automation or enterprise reporting.

Pricing is the major competitive factor between HubSpot and Pipedrive. While HubSpot’s Sales Hub pricing can escalate as users adopt higher tiers or combine multiple hubs, Pipedrive offers predictable per-user pricing, making it easier for small teams to scale without cost surprises.

The platform has grown steadily since its inception, achieving “unicorn” status in 2020 with a majority investment from Vista Equity Partners. Today, it is trusted by more than 100,000 businesses across 179+ countries, with offices across Europe and the United States. [9]

5. Freshworks

Headquarters: San Mateo, California, US

Number of Users: 74,000+

Competitive Edge: Freddy AI assistant, Strong customer support

Freshworks builds intuitive, easy-to-use solutions to help businesses deliver excellent customer and employee experiences.

Its product suite includes tools for CRM (Freshsales), customer support (Freshdesk), IT service management (Freshservice), marketing automation (Freshmarketer), collaboration, and HR (Freshteam) — all developed to simplify workflows for growing companies across industries.

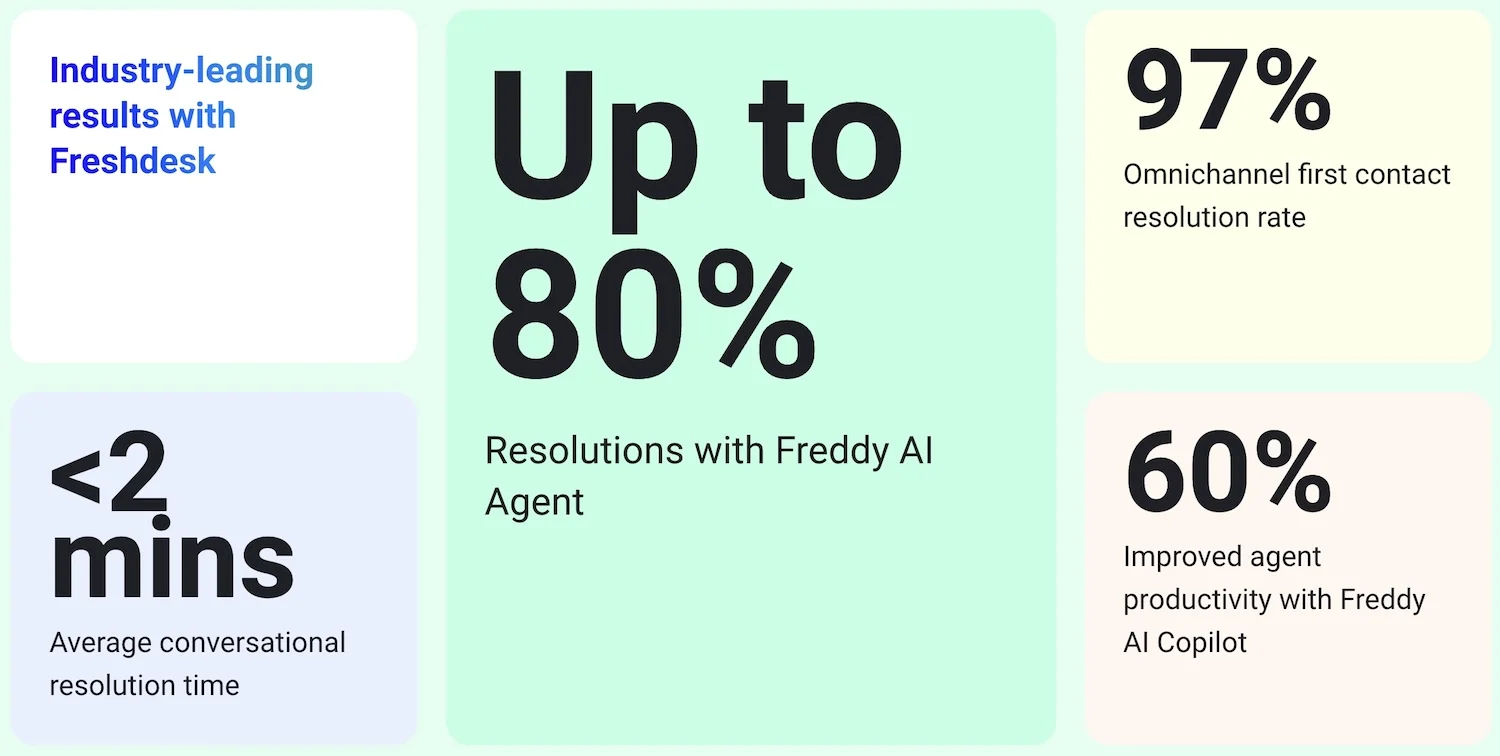

Freshworks differentiates itself by delivering powerful SaaS products that are quick to implement, require minimal technical overhead, and include built-in AI capabilities via its Freddy AI assistant. The AI helps teams automate support tasks, personalize engagement, and resolve issues faster.

Freshworks competes with HubSpot on simplicity, pricing transparency, and customer support excellence. Its biggest advantage over HubSpot is in customer service and IT support. Many companies choose Freshdesk or Freshservice instead of HubSpot Service Hub when they need robust ticketing, omnichannel support, SLAs, and IT workflows rather than marketing-focused service solutions.

Freshworks has expanded its customer base to over 74,600 customers worldwide, and notably shifted upmarket, with a growing share of mid-market and enterprise clients contributing a larger portion of annual recurring revenue. [10]

4. Microsoft Dynamics 365

Launched in 2016Headquarters: Washington, US

Pricing: ~$50 to $180+ per user/month (varies by module)

Competitive Edge: AI & Copilot integration

Microsoft Dynamics 365 combines CRM and enterprise resource planning (ERP) capabilities with analytics and data intelligence. It is designed to help businesses manage sales, marketing, finance, supply chain, and operations — all through a unified platform that connects people, processes, and data.

The platform is widely used by mid-market to enterprise customers across industries such as retail, manufacturing, finance, healthcare, and professional services.

A major strength of Dynamics 365 is its native integration with Microsoft 365 (Outlook, Excel, Teams, SharePoint) and Azure cloud services. Sales representatives can manage pipelines inside Outlook, customer service agents can collaborate via Teams, and executives can analyze real-time dashboards through Power BI.

Microsoft continues to embed Copilot and AI features across its CRM modules, enhancing autonomous data insights, sales forecasting, and customer intent prediction, and enabling businesses to adopt AI across customer engagement and back-office workflows. [11]

3. Adobe Marketo Engage

Founded in 2006Headquarters: San Jose, California, US

Pricing: Starts at $25,000 per year for small businesses

Competitive Edge: Enterprise-grade marketing automation

Marketo Engage is a core component of Adobe Experience Cloud, Adobe’s multi-billion-dollar digital experience and marketing software portfolio.

Marketo is designed to manage complex, high-volume, multi-channel B2B marketing operations. It supports advanced email marketing, lead management, account-based marketing, campaign orchestration, behavioral tracking, and analytics at scale.

Unlike SMB-focused platforms, Marketo is built for businesses with long sales cycles, multiple buying stakeholders, and sophisticated demand-generation strategies, often involving sales and marketing teams of hundreds or thousands of users.

Since it’s a part of Adobe, it benefits from deep integration with Adobe Analytics, Adobe Target, Adobe Journey Optimizer, and Adobe Real-Time Customer Data Platform.

In 2025 TrustRadius reports, Marketo Engage has been highlighted for strong customer satisfaction, robust automation capabilities, and excellent implementation support, with nearly 90% of users indicating they would repurchase. [12]

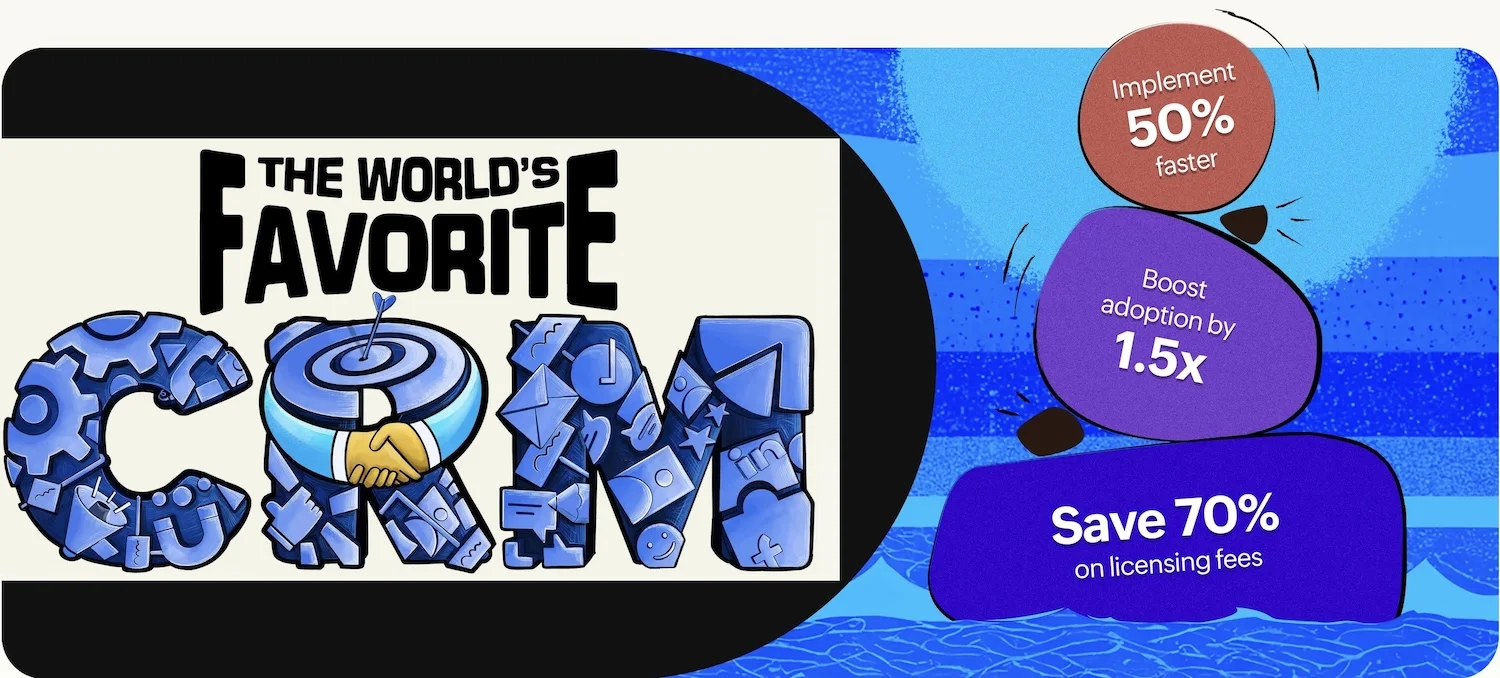

2. Zoho CRM

Headquarters: San Francisco, California, US

Number of Users: 300,000+

Competitive Edge: Unmatched price-to-feature ratio

Zoho CRM provides capabilities such as lead and deal management, workflow automation, pipeline tracking, and AI-powered insights to boost efficiency and drive revenue growth across customer touchpoints.

It integrates natively with other Zoho apps (like Zoho Campaigns and Zoho Desk) and hundreds of third-party tools, making it a versatile option for businesses with diverse operational needs.

Zoho CRM competes directly with HubSpot Sales Hub and Marketing Hub, offering advanced automation, multichannel communication, and analytics at a significantly lower price point. The entry-level paid tier with expanded capabilities (lead scoring, sales automation) costs around $14–$20 per user per month.

In recent years, Zoho has enhanced its AI capabilities with Zia, a built-in assistant that provides predictive analytics, anomaly detection, and sales recommendations.

This platform is widely used by small and mid-sized businesses, startups, and growing enterprises that want full CRM functionality without enterprise-level complexity or pricing.

1. Salesforce

Headquarters: San Francisco, California, US

Number of Users: 150,000+

Competitive Edge: AI-driven CRM, Deep customization & extensibility

Salesforce pioneered the idea of delivering enterprise software entirely over the cloud — long before “SaaS” became an industry standard. Today, the company generates over $39 billion in annual revenue, making it the undisputed market leader in the global CRM industry, with a market share of over 20%, more than its next several competitors combined.

Salesforce is HubSpot’s most powerful and structurally different competitor. While HubSpot built its brand around ease of use, inbound marketing, and freemium adoption, Salesforce dominates through depth, customization, and enterprise scale.

In CRM and sales automation, Salesforce competes directly with HubSpot’s Sales Hub, but targets businesses with larger sales teams, longer deal cycles, and more complex pipelines. In marketing, Salesforce Marketing Cloud competes with HubSpot Marketing Hub, especially among enterprises running high-volume, multi-channel campaigns across email, social, advertising, and commerce.

They have more than 150,000 paying enterprise and mid-market customers worldwide, spanning industries such as manufacturing, technology, financial services, retail, and healthcare.

In fact, Salesforce’s Data Cloud platform processes 30 trillion transactions per month and connects/unifies 100 billion records every day.

In 2025, Salesforce announced a $15 billion investment in San Francisco to accelerate AI adoption and establish an AI incubator hub. The same year, it launched Agentforce 360, a platform empowering partners to build and sell AI-driven agents. [13]

Read More

- 16 Best Market Research Companies

- 17 Salesforce Competitors and Alternatives

- 13 Best Sales Tracking Software For Small Businesses

- Products, What is CRM?, HubSpot

- Industry Report, Marketing automation market analysis, Grand View Research

- DevRev, The Conversational AI redefines how humans and machines work together, Businesswire

- Alexa Drake, How ActiveCampaign made marketing autonomous, ActiveCampaign

- John Parkes, ClickFunnels grew into a $100-million business in just 5 years, ClickFunnels

- Deliverability, Outstanding email deliverability rate of 99%, GetResponce

- Benchmark, Running a successful marketing campaign, Brevo

- Oracle, Eloqua releases advanced AI features for all customers, MarketingCube

- The Story in Numbers, Pipedrive reaches 100,000 customers, Pipedrive

- Financial Highlights, Freshworks reports third quarter 2025 results, Freshworks

- Learn, Microsoft Dynamics 365 release wave 1 plan, Microsoft

- Report, Customers rate Adobe Marketo Engage at the top, Adobe for Business

- Jaspreet Singh, Salesforce to invest $15 billion in San Francisco as AI race heat up, Reuters