IKEA is the most influential player in the global home-furnishings industry. The company generates annual retail sales of more than €44.6 billion, operates in 60+ markets, and serves over 900 million store visitors each year. [1]

In fact, IKEA sets pricing, design, and supply-chain benchmarks that competitors must either match or strategically avoid.

Only a few retail brands combine mass-market affordability, global sourcing, and flat-pack logistics on such a scale, which is why IKEA is often treated as the industry’s reference point.

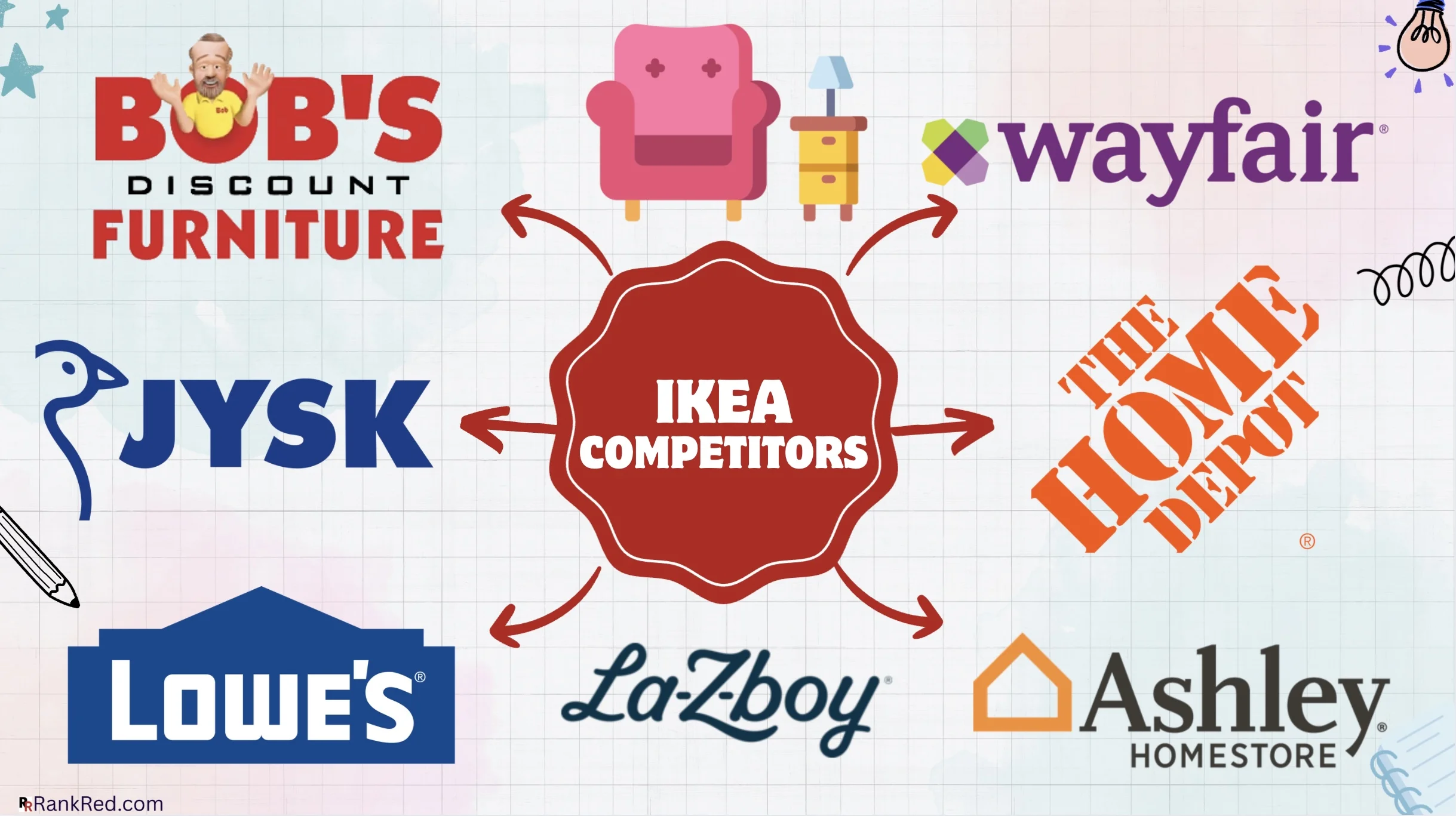

Today, this giant faces multiple categories of rivals, each targeting different parts of the value chain. We present the top IKEA competitors that are not just reacting to a dominant incumbent but actively reshaping how furniture is designed, sold, delivered, and reused.

Did you know?The global furniture market size is projected to exceed 1.33 trillion by 2033, growing at a CAGR of 6.8%. Meanwhile, the US furniture market is expected to grow at a 6.2% annual rate over the forecast period. [2]

Table of Contents

17. Leroy Merlin

Founded: 1923Headquarters: Lille, France

Number of Stores: 400+

Parent: Groupe Adeo

Competitive edge: Breadth of DIY & home improvement solutions

Leroy Merlin is a French-headquartered home improvement, DIY (do-it-yourself), garden, and interior décor retail chain with a long history dating back to 1923. Today, it’s a part of Groupe Adeo, which is majority-owned by the French Mulliez family — the same group behind other major retail brands in Europe.

Its business model is centered on large-format self-service stores, extensive product assortments, DIY expertise, and assisted-sales services.

For instance, a customer renovating a kitchen may choose Leroy Merlin for cabinets, countertops, fixtures, installation services, and storage, whereas IKEA primarily competes on modular kitchens and self-installation.

The brand operates more than 400 stores across 12+ countries, including key markets such as France, Spain, Italy, Poland, Portugal, Brazil, and China, and employs well over 100,000 people.

Geographically, it benefits from dense store coverage, particularly in Southern and Western Europe, where IKEA stores are fewer and often located on city outskirts.

16. Nitori

Nitori store in Osaka

Nitori store in Osaka

Headquarters: Sapporo, Japan

Number of Stores: 1,000+

Annual Revenue: $6 billion+

Competitive edge: Value-driven pricing, Deep vertical integration

Nitori is often described as “Japan’s answer to IKEA” due to its strong value positioning and broad product range.

Its product portfolio extends from large furniture items (sofas, beds, tables) to everyday household goods, allowing customers to outfit entire rooms with coordinated pieces at competitive prices.

The store network exceeds 1,000 locations globally, including its domestic flagship Nitori and Deco Home stores in Japan, international outlets across Asia (China, Taiwan, Malaysia, Singapore, Thailand, Vietnam, Hong Kong), and select US presence under the AKi-Home banner.

In FY 2025, Nitori reported consolidated revenue of about ¥928.95 billion (over $6 billion). Looking ahead, it plans to expand to around 3,000 stores worldwide and target ¥3 trillion (about $20 billion) in revenue by 2032. [3]

15. Bob’s Discount Furniture

Headquarters: Manchester, Connecticut, US

Number of Stores: 200+

Annual Revenue: $2 billion+

Competitive edge: Rapid expansion, Engaging retail experience

Bob’s Discount Furniture is one of the fastest-growing value-oriented furniture retailers in the US, built around a simple promise: deliver stylish, ready-to-use furniture at consistently low prices.

Since its founding, the company has expanded rapidly outside its New England roots, capturing share in the Northeast, Mid-Atlantic, Midwest, and West Coast as it grew from a handful of locations to a major US retailer. Today, it operates over 200 stores in 26 states.

Bob’s retail experience is quite different: their stores often feature in-store cafés with complimentary refreshments and “The Outlet” sections for slightly imperfect products, creating a more engaging environment than typical furniture showrooms.

Bob’s is recognized as one of the leading furniture retailers in the US, consistently ranking among the Top 10 by sales on industry lists such as Furniture Today’s Top 100. In FY 2025, the company generated over $2 billion in sales, reflecting both physical store strength and rising e-commerce. [4]

14. Conforama

Founded: 1967Headquarters: Seine-et-Marne, France

Number of Stores: 200+

Competitive edge: Strong European Presence

Conforama is one of Europe’s popular mass-market furniture and home-appliance retailers, with particularly strong roots in France and Southern Europe.

Unlike design-led retailers, Conforama prioritizes price accessibility and immediate functionality over modularity or long-term system-based furnishing. Their sofas, mattresses, beds, wardrobes, and dining furniture represent high-volume categories, often sold in coordinated collections.

At its peak, the company operated hundreds of large-format stores across Europe and generated over €3 billion in annual revenue, serving millions of households. Its French subsidiary often reported substantial revenue from furniture and home goods sales.

However, like many mid-range retailers, Conforama has been pressured by inflation, more price-sensitive consumers, and growing online competition. Even so, it stands out through frequent promotions, bundle offers, and financing options, which appeal to budget-conscious households looking to furnish entire rooms quickly.

13. Steelcase

Founded: 1912Headquarters: Michigan, US

Annual Revenue: $3.2 billion+

Competitive edge: Workplace Design Leadership

Steelcase is one of the world’s largest manufacturers of office furniture, operating at the intersection of furniture design, workplace research, and enterprise-scale manufacturing.

Unlike mass-market home furniture retailers, Steelcase focuses primarily on commercial, corporate, educational, and institutional environments. It has broadened its portfolio to include desks, collaborative furniture, storage systems, architectural and space-planning solutions, and ergonomic seating.

The company competes with IKEA primarily in the office and workplace furniture segment, especially as IKEA has expanded its B2B and home-office offerings.

Steelcase operates through a network of more than 770 dealers and retail partners, with a strong presence across North America, Europe, and Asia-Pacific. In 2025, the company maintained solid financial momentum, generating annual revenue of around $3.25 billion. [5]

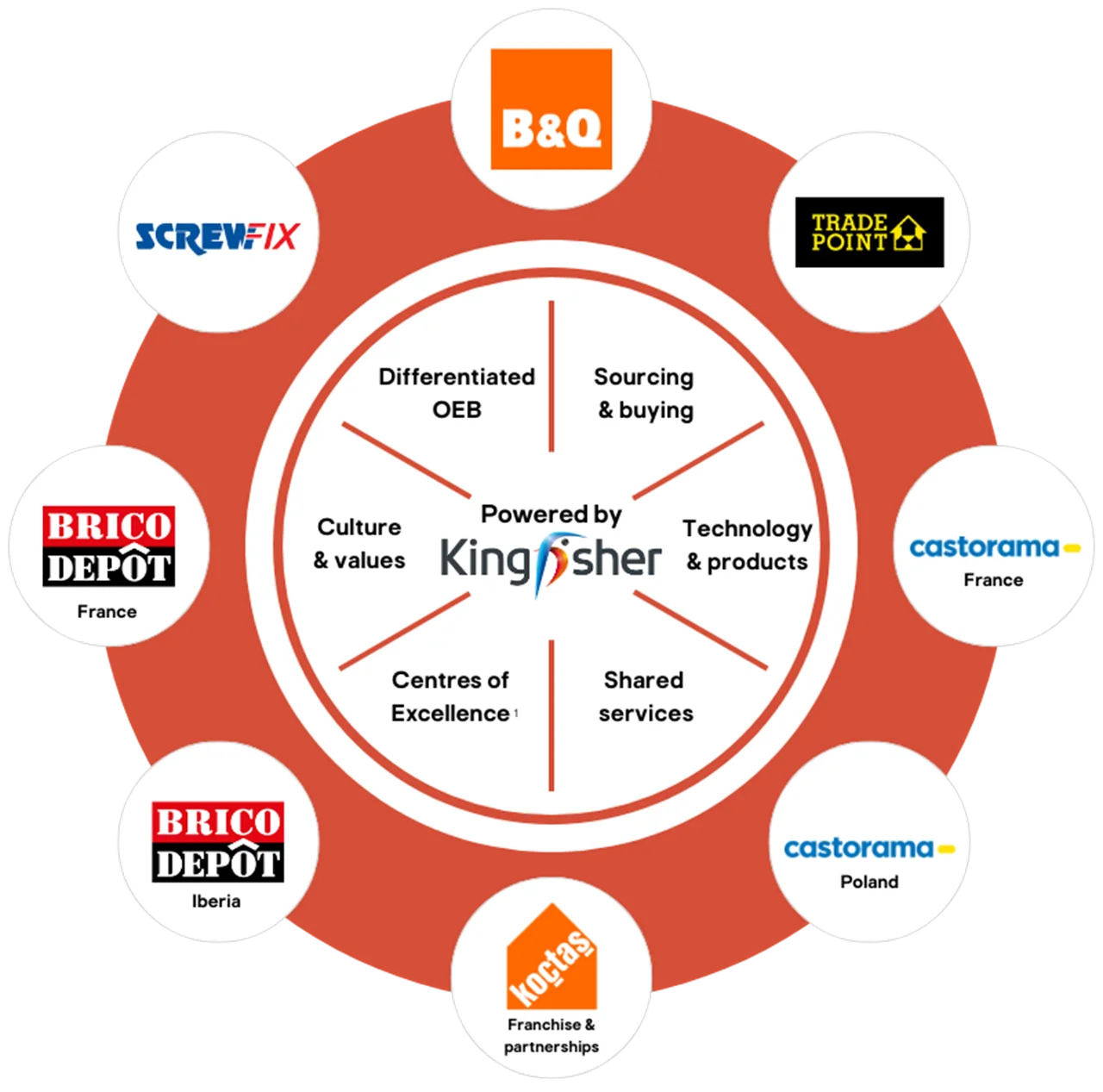

12. Kingfisher plc

Headquarters: London, UK

Number of Stores: 1,900+

Annual Revenue: $17.2 billion+

Competitive edge: Broad multibrand retail portfolio

Kingfisher plc is one of Europe’s largest home-improvement retail groups, operating a portfolio of well-known brands that collectively serve tens of millions of customers every year.

Rather than functioning as a single-format retailer, Kingfisher’s strength lies in its multi-brand, multi-country strategy, with major banners like B&Q, Castorama, Brico Dépôt, and Screwfix.

Operationally, the group has invested heavily in unified sourcing, private-label development, and supply-chain standardization across its brands. It generates over $17 billion in annual revenue, supported by a footprint of more than 1,900 stores across the UK, France, Poland, Iberia, and other European markets.

The group competes with IKEA in functional furniture, kitchen, bathrooms, storage, and outdoor living, rather than in full-room lifestyle furnishing. Its brands focus on project-based solutions for customers renovating, upgrading, or maintaining homes.

11. Muji

Founded: 1980Headquarters: Tokyo, Japan

Number of Stores: 1,400+

Annual Revenue: $5 billion+

Competitive edge: Minimalist design philosophy

Muji (short for Mujirushi Ryohin, meaning “no-brand quality goods”) is a Japanese lifestyle and home-furnishings brand built around the philosophy of simplicity, functionality, and restraint.

Unlike traditional furniture retailers that compete through branding, logos, or decorative excess, Muji deliberately minimizes visual identity, allowing materials, proportions, and usability to define the product.

The company has expanded its range to thousands of products and is aligning itself with a growing consumer preference for minimalist, sustainable living. Their product portfolio spans furniture, storage, home accessories, kitchenware, apparel, cosmetics, stationery, and even prefabricated housing concepts.

Financially, Muji has gained strong momentum in recent years. In FY 2025, consolidated revenue rose to $5.5 billion, up 18.6% year over year, while operating profit increased by more than 30%. This growth was mainly driven by strong sales in both domestic and international markets, especially across East Asia. [6]

10. Bed Bath & Beyond

Founded: 1971Headquarters: Union, New Jersey, US

Annual Revenue: $1 billion+

Competitive edge: Leverage nostalgia and legacy awareness

At its peak, Bed Bath & Beyond (BBBY) operated 1,000+ large-format stores across the US and Canada. However, after years of mounting competitive pressure from rivals like Amazon, Walmart, Target, and Wayfair, the original BBBY chain filed for Chapter 11 bankruptcy in April 2023 and closed all its stores.

In the last couple of years, the company underwent a major structural shift, transitioning from a traditional big-box retailer into a digital-first brand. The Bed Bath & Beyond name now primarily operates as an online-focused home retail platform, leveraging brand recognition, customer data, and supplier relationships.

In fact, it is executing a hybrid revival strategy that blends an online retail presence with a fresh rollout of smaller-format stores under the Bed Bath & Beyond Home banner.

Today, the revived brand is building on its nostalgia and legacy while refreshing its value proposition for modern consumers, offering everyday home products such as décor, kitchenware, seasonal items, and small furniture. [7]

9. Williams-Sonoma

Founded: 1956Headquarters: San Francisco, California, US

Number of Stores: 510+

Annual Revenue: $7.9 billion+

Competitive edge: Unmatched scale and footprint

Williams-Sonoma is one of the most influential premium home-furnishings groups in the world, operating a portfolio of highly recognizable lifestyle brands, including Pottery Barn, West Elm, Williams-Sonoma (kitchen-focused), GreenRow, and Rejuvenation.

Furniture is a major revenue driver for the group, particularly in categories like sofas, beds, dining furniture, storage, and home office. Their average selling prices are significantly higher than those of mass-market competitors. West Elm, in particular, has become one of the most recognizable modern furniture brands globally.

Williams-Sonoma is also a major e-commerce retailer, with digital sales accounting for a substantial share of the revenue mix alongside brick-and-mortar stores spread across the US, Canada, Puerto Rico, Australia, and the UK, plus franchise operations in parts of the Middle East and Asia.

In FY 2025, the group reported $7.9 billion in revenue and a net profit of $1.1 billion, reflecting its broad retail reach and financial scale. [8]

8. Walmart

Founded: 1962Headquarters: Bentonville, Arkansas, US

Number of Stores: 10,770+

Annual Revenue: $703 billion+

Competitive edge: Unmatched scale and footprint

Walmart is the world’s largest retailer by revenue, and while it is not a furniture specialist, it is one of the most powerful companies shaping the global furniture and home-goods market.

With a vast assortment spanning apparel, grocery, electronics, and home, Walmart sells millions of furniture units annually across home office, outdoor, living room, and bedroom categories. Its unmatched scale allows it to set aggressive price points that influence competitors across the industry.

The company operates more than 10,770 stores (including Supercenters, discount stores, and neighborhood formats), with approximately 270 million weekly customers visiting its physical and online channels.

Furniture purchases at Walmart often occur as add-on or replacement buys, bundled with everyday essentials. This gives Walmart a structural advantage over destination furniture retailers that rely on planned trips and high-consideration purchases.

Walmart competes with IKEA in low-cost, ready-to-assemble, and ready-to-use furniture. The overlap is strongest in everyday categories such as TV stands, bookcases, desks, beds, storage units, kids’ furniture, and outdoor furniture.

7. Target

Headquarters: Minneapolis, Minnesota, US

Number of Stores: 1,980+

Annual Revenue: $105 billion+

Competitive edge: Broad product p

Target is a major American retail corporation that operates a broad range of discount department and big-box stores. These stores offer general merchandise, including home furniture, décor, appliances, and lifestyle products, at competitive prices.

Target operates more than 1,989 stores across the United States, each selling a wide range of products (from clothing and electronics to home essentials). Alongside its physical stores, the company has a strong online presence, supported by digital shopping, loyalty programs, and convenient same-day services like Drive Up.

Perhaps Target’s biggest strength is its sheer scale: it employs over 400,000 team members and reaches more than 75% of the US population within 10 miles of a store.

It competes with IKEA primarily in affordable, small-to-mid-sized furniture and home décor, especially for urban renters and first-time home furnishers.

There is significant overlap in prices between Target and IKEA across categories like bookcases, desks, TV stands, storage units, and kids’ furniture. However, Target generally avoids complex modular systems and instead emphasizes easy-to-assemble or near-ready products.

6. Lowe’s

Founded: 1921Headquarters: Mooresville, North Carolina, US

Number of Stores: 1,750+

Annual Revenue: $84 billion+

Competitive edge: Broad product portfolio, Fast logistics speed

Lowe’s is a leading American home improvement retailer that operates a large network of big-box stores offering products for home construction, maintenance, flooring, décor, appliances, tools, and garden supplies.

These offerings enable the company to attract a mix of do-it-yourself (DIY) homeowners, do-it-for-me (DIFM) customers, and professional contractors. The DIY customers, in particular, make up nearly 70% of its total sales.

The company emphasizes durability, customization, and immediate availability. Customers can often purchase furniture and have it installed or delivered within days, a contrast to IKEA’s self-assembly and destination-store model.

In 2025, Lowe’s acquired Artisan Design Group (ADG) for ~$1.33 billion, strengthening its Pro business capabilities. The same year, it also acquired Foundation Building Materials (FBM) for $8.8 billion, bringing ~370 locations into its portfolio and expanding its reach into wholesale interior building products and professional markets. [9][10]

5. La-Z-Boy

Headquarters: Monroe, Michigan, US

Number of Stores: 550+

Annual Revenue: $2.1 billion+

Competitive edge: Iconic brand recognition, Vertical integration

La-Z-Boy is one of the most recognizable comfort-focused furniture brands in the world. It is best known for pioneering the modern recliner and building a brand identity around ergonomics, durability, and relaxation.

The company offers sofas, sectionals, recliners, chairs, ottomans, and home décor, primarily for living rooms. They manufacture their own products and distribute them through a mix of company-owned stores, franchised retail galleries, and e-commerce channels.

La-Z-Boy operates 220 company-owned stores and around 370 furniture galleries across the United States. This helps them maintain a strong physical retail presence alongside digital sales.

The company also owns or partners with multiple sub-brands and product lines, including England Furniture, American Drew, Hammary, Kincaid, and the modern upholstered brand Joybird. This allows it to serve diverse customer tastes and price points.

In FY 2025, La-Z-Boy reported approximately $2.11 billion in revenue, representing modest year-over-year growth even amid broader industry challenges.

Compared to IKEA, La-Z-Boy sells furniture at higher price points due to its heavier construction, manual and power reclining mechanisms, and domestic manufacturing. IKEA mainly attracts first-time furniture buyers and renters, while La-Z-Boy focuses on homeowners, aging populations, and comfort-oriented families.

4. Home Depot

Headquarters: Atlanta, Georgia, US

Number of Stores: 2,340+

Annual Revenue: $166 billion+

Competitive edge: Captures professional & retail dual market

Home Depot is the largest home improvement chain in the world, operating over 2,340 big-box stores across the US, Canada, and Mexico.

Although the company primarily focuses on home improvement supplies and building materials, it also carries a broad range of home décor, furniture, lighting, flooring, and garden products, serving both DIY consumers and professional contractors.

Unlike IKEA, Home Depot also offers tools, appliances, construction materials, electrical products, flooring, plumbing, and garden products. This way, the company tries to capture both project-based and lifestyle purchases.

In recent years, Home Depot has stepped up its acquisition of specialty distribution companies, including GMS Inc. These moves strengthen Home Depot’s presence in the professional construction market and help diversify its revenue beyond its traditional retail stores. [11]

3. Ashley Furniture Industries

Headquarters: Chicago, Illinois, US

Number of Stores: 3,600+

Annual Revenue: $10 billion+

Competitive edge: Vertical integration & Manufacturing control

Ashley’s operational scale is vast. It encompasses manufacturing facilities in the US and overseas, including major plants, distribution centers, and sourcing offices across Asia and North America.

The company’s supply chain and production cycle support its vast product lineup, which includes upholstered furniture, case goods, bedroom sets, dining furniture, and mattresses.

In 2024, Ashley acquired Resident Home, broadening its product offerings into new mattress and bedding accessory categories, adding depth to its portfolio, and giving shoppers more choices in complementary product lines. [12]

Ashley Furniture operates both company-owned and independently licensed stores. It has over 1,100 dedicated Ashley HomeStores, and its products are also sold through more than 20,000 partner storefronts across around 155 countries worldwide.

Compared to IKEA, which emphasizes self-assembly, modularity, and minimalist Scandinavian aesthetics, Ashley targets customers who prefer fully assembled furniture, thicker upholstery, and a more traditional American style.

2. Jysk

Headquarters: Brabrand, Denmark

Number of Stores: 3,600+

Annual Revenue: $7.2 billion+

Competitive edge: Compact-store efficiency model

Jysk is one of Europe’s largest affordable home-furnishings retailers, known for bringing Scandinavian-style furniture and home essentials to mass-market consumers. The company’s approach resonates with budget-conscious shoppers seeking practical, well-designed products without the premium pricing often found in high-end furniture retailers.

It focuses on bedrooms, living rooms, dining rooms, storage, and home textiles, with mattresses and sleep products forming a particularly strong revenue pillar.

The company operates a global network of over 3,500 stores across 50+ countries, spanning Europe, the Middle East, and parts of Asia and Africa. These stores include a mix of company-owned outlets and franchise locations.

Jysk stores tend to be smaller and more accessible than typical big-box furniture stores, allowing new market entrants in urban and suburban locations (which are often underserved by larger retailers).

1. Wayfair

Headquarters: Boston, Massachusetts, US

Number of Stores: 10+ (operates mostly online)

Annual Revenue: $11.85 billion+

Competitive edge: Assortment scale and data-driven merchandising

Wayfair is one of the world’s largest online-first home furnishings retailers, built almost entirely around e-commerce rather than physical stores.

The company operates a portfolio of retail brands (including Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold) serving customers across the United States, Canada, the United Kingdom, and parts of Europe.

It offers a massive catalog of home products, from sofas and beds to décor, lighting, kitchenware, and outdoor furnishings. The platform hosts over 30 million products sourced from 20,000+ suppliers worldwide, giving consumers unprecedented breadth and variety under one digital roof.

Operationally, Wayfair has invested heavily in logistics infrastructure through its CastleGate fulfillment network, large-item delivery hubs, and last-mile partnerships. [13]

It competes with IKEA primarily on convenience, assortment depth, and online dominance, rather than on in-store experience or flat-pack economics. While IKEA attracts customers through destination stores and low prices, Wayfair targets consumers who prefer home delivery, a wide choice, and minimal assembly planning.

Read More

- Walmart Marketing Strategy: 16 Proven Ideas

- 13 Best Retail Inventory Management Software

- 13 Shopify Competitors And Alternatives

- Retail Sales Performance, Year in a Review, IKEA

- Industry Report, Furniture market size and trend analysis, Grand View Research

- Nitori Holdings, the Japanese home furnishing retail chain plans to open its first store in India, Businesswire

- Emma Thorne, Bob’s Discount Furniture eyes IPO, LinkedIn

- Press Releases, Steelcase named first in home equipment and furnishings category by FORTUNE, Steelcase

- Company Highlights, Ryohin Keikaku FY25/8 presentation, Investing

- Chris Morris, Bed Bath & Beyond is back, Yahoo Finance

- Company Highlights, Williams Sonoma’s net income throughout the years, MacroTrends

- Press Releases, Lowe’s completes acquisition of Artisan Design Group, Lowe’s

- Press Releases, Lowe’s agrees to acquire Foundation Building Materials, Lowe’s

- Company News, The Home Depot and its subsidiary SRS Distribution acquire GMS, The Home Depot

- Ashley HomeStores, Ashley and Resident announce acquisition, PR Newswire

- Kelly Stroh, Wayfair expands logistics offering to include multichannel service, Supply Chain Dive