A private equity firm is like an investment management company that invests in privately held or non-public businesses using funds raised from various investors. These investors include high-net-worth individuals, insurance companies, pension funds, endowments, and other institutional investors.

In private equity, the people who provide the money are called limited partners (LPs). Their risk is limited to the amount they invest, and they don’t get involved in running the fund. The fund is managed by general partners (GPs), who make all the investment decisions and take full responsibility for the fund’s performance.

How Private Equity Works?

Private equity firms acquire significant ownership in private companies through direct investments. They then implement aggressive strategies to increase the overall value of these companies, aiming for a profitable resale or, in some instances, an early initial public offering (IPO).

Even though many private equity firms now use more specialized investment strategies, some traditional approaches are still very common, such as leveraged buyouts, distressed investing, and growth capital.

Below, we’ve compiled a list of the world’s largest private equity firms based on assets under management (AUM), funds raised, and investment performance.

Did you know?

Despite economic challenges, the global private equity industry is expected to have more than $18.3 trillion in assets under management (AUM) by the end of 2027. And if we include hedge funds, the total AUM for all alternative assets could reach $23.3 trillion by that time.

Table of Contents

15. Vista Equity Partners

Founded: 2000AUM: $100 billion+

Headquarters: Texas, United States

Competitive Edge: Deep software specialization, Proprietary operational framework

Vista Equity Partners is one of the largest and most successful tech-focused private equity firms with $75 billion of assets under management. Since its inception in 2000, Vista Partners has invested in more than 70 companies with a net transaction value of over $173 billion.

It is based in Austin, Texas, and has four other offices across the United States. Some of its noteworthy investments and buyouts include Cvent (event management software) for $1.6 billion, Ping Identity for $600 million, and Pipedrive (CRM) for $1.5 billion.

In 2018, PitchBook ranked Vista Partners as the top investor in the software industry, ahead of Thoma Bravo and KKR. That same year, Buyouts magazine named Vista’s $4.75 billion sale of Marketo to Adobe the Deal of the Year.

In 2022, Vista, together with Evergreen Coast Capital, bought Citrix Systems for $16.5 billion. The following year, Vista and Blackstone acquired Energy Exemplar for $1.6 billion.

In 2025, the firm launched a new evergreen fund (for non-US private‐wealth investors) to provide access to its private-equity platform beyond the traditional institutional investor base.

14. Warburg Pincus

Founded: 1966AUM: $87 billion+

Headquarters: New York, United States

Competitive Edge: Global growth investing expertise, Sector diversification

The history of Warburg Pincus dates back to 1939, when the prominent Warburg banking family established E.M. Warburg & Co. It merged with the financial consultancy firm Pincus. Co in 1966 to form E.M. Warburg, Pincus & Co.

The new firm specializes in venture investing. It managed some of the largest venture capital funds in the 1980s and 1990s. Warburg Pincus is also the founding member of several venture capital associations in the United States.

However, after the 1970s, the firm gradually developed strategies to invest in more mature companies (private equity), which later became the firm’s focus. Today, Warburg Pincus focuses exclusively on growth investments across sectors, including financial services, healthcare, real estate, technology, and business services.

Since its inception, Warburg Pincus has invested $100 billion in more than 100 companies globally.

In 2025, it formed a $300 million strategic partnership with Madison International Realty (a real estate secondaries firm) to target real estate secondary transactions (data centres, logistics, residential, etc.) via its “Capital Solutions” arm.

13. Bain Capital

Founded: 2000AUM: $205 billion+

Headquarters: Texas, United States

Competitive Edge: Consistent long-term fund performance

Bain Capital is a Boston-based alternative investment firm that engages in venture capital, fixed-income (credit), private equity, and sector-focused investment cycles. The firm was established by management consultancy Bain & Company as a separate entity in 1984.

In its early years, Bain Capital focused on venture deals, making profitable investments in companies such as Staples, Inc. (an office supply retailer), and Gartner Group. But by the late 1980s, the firm changed its investment approach to focus on private equity through growth capital and leveraged buyouts.

During the 2000s buyout boom, Bain Capital was involved in several high-profile transactions, including those of Toys “R” Us (toy and baby products retailer), Dunkin’ Brands, and Hospital Corporation of America. The buyout of technology and financial services company SunGard by Bain and other PE firms was one of the largest in recent history.

During that time, Bain Capital (along with its partner PE firms) committed more than $25 billion across several large retail businesses in the US and Africa.

In 2025, the firm announced an investment in HSO, a global leader in Microsoft Cloud & AI business applications (under “Tech Opportunities”), reflecting increased focus on the AI sector.

12. Apollo Global Management, Inc.

AUM: $900 billion+

Headquarters: New York, United States

Competitive Edge: Value-oriented investment philosophy

Founded in 1990, Apollo manages a diverse range of investment funds across different asset classes, including private equity, credit, real estate, and infrastructure.

With an AUM of over $69 billion in private equity, Apollo manages a diverse portfolio across sectors. It has been involved in transactions across technology, healthcare, consumer goods, energy, and more.

Apollo is a publicly traded company, and its shares are listed on the NYSE under the ticker symbol APO.

The success of its flagship private equity funds is evident in the impressive 39% Gross Internal Rate of Return (IRR) and a solid 24% Net IRR since their inception. The expertise behind these achievements lies with 100+ investment professionals who manage a diverse portfolio across 190+ companies.

In 2022, Apollo acquired Athene, a retirement services business, and the US asset management business of Griffin Capital. The same year, it purchased Tenneco for $7.1 billion. Apollo also added California-based grocer Cardenas, UK-based housebuilder Miller Homes, and Chicago-based grocer Tony’s Fresh Market to its portfolio.

In 2023, Apollo expanded its holdings with the acquisition of the American industrial company Arconic. In 2025, it launched a dedicated sports-investment vehicle, Apollo Sports Capital.

The firm is actively deploying capital in infrastructure, renewables, data‐centre and digital real-assets, while also using public or market exits for liquidity.

11. The Carlyle Group Inc.

Founded: 1987AUM: $470 billion+

Headquarters: Washington, DC, United States

Competitive Edge: Emphasis on “solutions” (secondaries, co-investments)

The Carlyle Group is a Washington, D.C.-based private equity firm known for its expertise in leveraged buyouts and a highly diverse portfolio of companies. According to the Private Equity International (PEI) 300 index, the Carlyle Group led the industry in total capital raised between 2010 and 2015.

Unlike most top private equity firms, Carlyle Group has a strong presence in the defense industry, with stakes in companies such as Booz Allen Hamilton, one of the world’s largest defense consulting firms.

In the 1990s, the group made several high-profile defense acquisitions, the most famous being United Defense Industries in 1997 for $850 million. The company was later taken public and was eventually acquired by UK’s BAE Systems. Other industries in which Carlyle Group has a vested interest are technology and business services, healthcare, media, and finance.

In 2005, a consortium of The Carlyle Group, Clayton, Dubilier & Rice, and the private equity division of Merrill Lynch acquired The Hertz Corporation (one of the largest car rental companies in the world) in a $15 billion leveraged buyout deal.

The next year, Carlyle Group (along with Blackstone Group and TPG Capital) completed an even larger transaction, the $17.6 billion takeover of Freescale Semiconductor. It was the largest leveraged buyout in the tech industry at the time.

Apart from the traditional, corporate private equity platform, the firm also offers specialized investment solutions through AlpInvest Partners, which utilize a wide range of strategies within the private equity asset class. AlpInvest has about $60 billion in assets under management and more than $74 billion in capital commitments since its inception.

AlpInvest functions as a private equity investment manager for some of the world’s largest pension funds and endowments.

Its main investment strategies include primary funds (or FOFs), in which institutions hold portfolios of other investment funds rather than investing directly in companies, and co-investments, in which they acquire a minority stake in a company alongside a financial sponsor or other private equity investors.

In 2022, the Carlyle Group bought Dainese (an Italian motorcycle kit and clothing company), Abingworth (a transatlantic bioscience investment firm), and Incubeta (an international marketing agency).

Then, in 2023, it invested in Anthesis Group (a leading provider of sustainability services for businesses) and Seiko PMC (a manufacturer of paper and ink chemicals).

Carlyle’s secondaries/solutions business (through its AlpInvest Partners unit) has raised a large fund to acquire older private equity stakes. For example, Carlyle raised $20 billion for this secondaries business, marking a major strategic shift.

10. Silver Lake

Founded: 1999AUM: $110 billion+

Headquarters: Menlo Park, California, US

Competitive Edge: Unmatched expertise in mega-cap technology deals

Founded in 1999, Silver Lake grew rapidly alongside the global rise of software, semiconductors, digital commerce, and consumer-tech platforms. Today, it manages more than $110 billion in combined assets and committed capital.

Unlike firms that specialize in traditional leverage buyout or operational restructuring, Silver Lake focuses on growth-driven, innovation-led transformations. Its portfolio companies often operate in global markets, with many exceeding $1 billion+ in annual revenue and possessing significant competitive moats, such as IP ownership, dominant platform positions, or network effects.

Over the past two decades, Silver Lake has executed numerous high-profile transactions involving companies like Dell Technologies, Airbnb, Alibaba Group, Skype, Unity Software, Zendesk, Agoda, Broadcom, Seismic, SoFi, and Endeavor.

Its portfolio companies collectively generate over $260 billion in annual revenue and have an Aggregate enterprise value of over $1 trillion.

In recent years, Silver Lake has increased the size of its bets, focusing on large transactions and mega-cap tech companies.

For example, in 2025, Silver Lake (alongside other investors) agreed to acquire Electronic Arts (EA) for $55 billion in an all-cash transaction. This deal is one of the largest take-privates in the gaming sector and signals Silver Lake’s willingness to lead mega-scale investments.

9. Insight Partners

AUM: $90 billion+

Headquarters: New York, United States

Competitive Edge: Software/Technology-centric expertise

Insight Partners is best known for backing high-growth software, SaaS, and technology-enabled companies at scale. It focuses almost exclusively on cloud infrastructure, cybersecurity, data platforms, fintech, and digital enterprise solutions.

Over its nearly three decades of operation, Insight has invested in over 875 companies globally and helped more than 55 portfolio firms reach an IPO.

Some well-known names backed by Insight Partners include OpenAI, Shopify, Monday.com, Databricks, Pluralsight, WalkMe, Wix, Lightricks, Checkmarx, Calm, and JFrog, among others.

Insight’s core differentiator is combining capital with operating expertise. It doesn’t just write cheques, but also maintains a dedicated “Onsite” team of experts to support its portfolio companies with product strategy, growth marketing, geographic expansion, and scaling operations.

In 2025, the company announced a partnership/investment in 3Ventures Group to build and fund AI-centric startups in Saudi Arabia, covering digital-health, fintech, smart infrastructure, logistics, and industrial transformation.

8. Clayton, Dubilier & Rice

Founded: 1978AUM: $82 billion+

Headquarters: New York, United States

Competitive Edge: Operational-first mindset, Strong track record

Clayton, Dubilier & Rice (CD&R) is known for buying established businesses and then growing them through operational improvements. It emphasizes “building businesses,” combining its investment capital with real hands-on expertise.

CD&R often brings in former CEOs and experienced operators to advise or take on key roles. This approach helps the companies boost their margins, scale up, and refine their overall strategy.

Over its history, the firm has invested across a diverse set of industries (including industrials, consumer, healthcare, business services, technology, and financial services), giving it a broad footprint but with an operating-centric mindset.

In recent years, CD&R’s steady flow of deals and activities has continued to mark it as a major player. For instance, in 2025, the firm agreed to acquire Sealed Air Corporation for $10.3 billion, demonstrating its willingness to perform large-scale deals.

7. Hellman & Friedman LLC

Founded: 1984AUM: $107 billion+

Headquarters: San Francisco, United States

Competitive Edge: Platform-led value creation via digital enablement

Hellman & Friedman LLC is a San Francisco, California-based private equity firm that mainly focuses on leveraged buyouts and growth capital. It was founded in 1984 by two former investment bankers, Warren Hellman and Tully Friedman.

Before establishing the company, Hellman was a founding partner at a venture capital firm, Hellman, Ferri Investment Associates (now known as Matrix Partners). Tully Friedman co-founded another PE firm, Friedman Fleischer & Lowe (FFL Partners), in 1997.

Hellman & Friedman has a track record of earning quick returns on its investments. In February 2000, the firm acquired a 37.5% stake in Formula One Group (the holding company behind the FIA Formula One World Championship) for about $750 million. The firm sold its stake to a German media company in less than a month for a hefty profit.

Through investments in growth opportunities, Hellman & Friedman has generated early profits from companies such as AlixPartners (consulting), Getty Images, Goodman Global (heating and air conditioning), and Axel Springer (publishing).

6. Thoma Bravo

Founded: 2008We’re thrilled to announce the completion of our strategic growth investment in @BlueMatrixTeam, a trusted investment research and publishing platform serving some of the world’s largest investment banks and research analysts.

Read more: https://t.co/2GYiqpn8Rj

— Thoma Bravo (@thomabravo) January 4, 2024

AUM: $180 billion+

Headquarters: Chicago, United States

Competitive Edge: Global expansion & geographic diversification

Thoma Bravo, LP, is a US-based private equity firm specializing in technology and software investments. Since its inception in 1980, the firm has invested in or acquired more than 300 technology companies, totaling $85 billion in value.

In 2020, its flagship buyout fund (Thoma Bravo XIV) raised a record $17.8 billion, the largest tech-focused private equity fundraising at the time. It was only eclipsed by Silver Lake Partners’ $20 billion fundraising in 2021.

A joint research study published in 2019 by Dow Jones and HEC Paris, an international private business school in France, ranked Thoma Bravo as the best-performing PE firm on aggregate, based on funds raised between 2005 and 2014. Its funds have a net annual return of 30%, which is higher than that of some of the largest PE firms.

Thoma Bravo has a long-standing, illustrious history. The firm succeeded Thoma Cressey Equity Partners, a middle-market investment firm that broke out from Golder Thoma & Co. in 1998. Golder Thoma & Co. (GTCR) is widely acknowledged as a pioneer of the consolidation investment strategy.

5. TPG Capital

Founded: 1992AUM: $250 billion+

Headquarters: Texas, United States

Competitive Edge: Thematic/region focus & innovation prioritisation

TPG Capital, formerly Texas Pacific Group, is a large investment firm that engages in private and public equity and credit (debt) markets. TPG manages multiple separate funds for strategic investments, including leveraged buyouts, distressed securities, venture capital, and sector-focused equity.

Some of the firm’s largest and most notable transactions include the buyout of Continental Airlines in 1993, Burger King in 2002, Neiman Marcus (with Warburg Pincus) in 2005, and Freescale Semiconductor in 2006.

In April 2008, during the height of the credit crisis, TPG invested more than $7 billion in Washington Mutual, a savings bank company.

Just a few months later, in September, Washington Mutual filed for bankruptcy after the US government announced the takeover of its largest subsidiary, WaMu Bank, costing TPG a ton of money. This deal is often branded as one of the worst in the history of private equity.

In 2023, TPG acquired another investment firm, Angelo, Gordon & Co., for $2.7 billion. In the same year, TPG and Francisco Partners acquired the web-tracking and analytics firm New Relic for $6.5 billion.

In 2025, the firm announced a definitive agreement under which TPG (via its private equity platform) will acquire PTC’s industrial connectivity & IoT businesses, namely the Kepware and ThingWorx units.

That same year, TPG’s impact arm, The Rise Funds, made a strategic investment in Healthcademia, a global healthcare education company operating in Europe and Latin America that focuses on professional training, upskilling, test prep, and more.

4. EQT AB Group

EQT AB headquarters in Stockholm

EQT AB headquarters in Stockholm

AUM: $300 billion+

Headquarters: Stockholm, Sweden

Competitive Edge: Real‐assets/infrastructure & transition assets focus

EQT Partners is one of the world’s largest investment organizations, investing primarily in northern and central Europe, North America, and China. The firm has two main business segments: Private Capital, which includes private equity venture funds, and Real Estate.

The EQT Private Equity makes investments in mid and large-cap companies through control and co-control investment strategies. For smaller companies, including family-owned businesses, it focuses on growth investing.

The investment group was established in 1994 by AEA Investors, a US-based private equity firm, and Investor AB, the largest investment holding company in Sweden controlled by the prominent Wallenberg family.

As of June 2021, EQT Partners had 26 active funds with investments in nearly 100 companies across the US, Europe, and Asia. The total annual revenue of EQT portfolio companies exceeds $34 billion. In 2023, EQT Partners revealed its plan to buy Zeus Company for $3.4 billion.

As of today, approximately 40% of EQT’s invested capital is in Europe, 40% in the US, and 20% in Asia, which demonstrates its geographic breadth.

3. CVC Capital Partners

CVC Capital headquarters in St Helier

CVC Capital headquarters in St Helier

AUM: $230 billion+

Headquarters: St Helier, Jersey

Competitive Edge: High-performing flagship buyout funds like Fund IX

CVC Capital Partners is perhaps the largest among top private equity firms based outside the United States, with over $204 billion in total assets under management and $200 billion in capital commitments since its inception.

The firm was initially established in 1981 as Citigroup’s venture capital arm in Europe. After almost a decade of investing in early-stage startups, the firm expanded into private equity, focusing on leveraged buyouts. CVC eventually broke out from the American banking group in 1993 to establish itself as an independent private equity firm.

CVC raises funds in two cycles: one for Europe (CVC European Equity Partners) and another for Asia (Capital Partners Asia Pacific). Additionally, funds for buyouts or growth investments in the U.S. are raised from time to time.

The first widely acknowledged investment by CVC Capital Partners in the early 2000s was in Formula One Group. The company was later acquired by US-based Liberty Media Corporation in 2016.

Between 2010 and 2015, CVC acquired majority stakes in companies such as Wireless Logic (an M2M service provider), Sky Betting & Gaming, Tipco (betting operators), and Douglas AG (a German cosmetics retailer).

In 2021, CVC bought Unilever’s tea business for $5.6 billion. In 2023, it went on to acquire Sogo Medical, a major pharmacy operator in Japan, for $1.2 billion. Then in 2025, CVC purchased about a 20% stake in International Schools Partnership (ISP), valuing the company at around €7 billion. ISP runs a global network of more than 100 K–12 schools across 25 countries.

CVC has shifted its business model from being purely a traditional buy-out/private-equity firm, to a multi‐strategy private markets manager. Their “one platform, seven strategies” model now includes Private Equity, Credit, Secondaries, Infrastructure, and more

2. KKR & Co. Inc

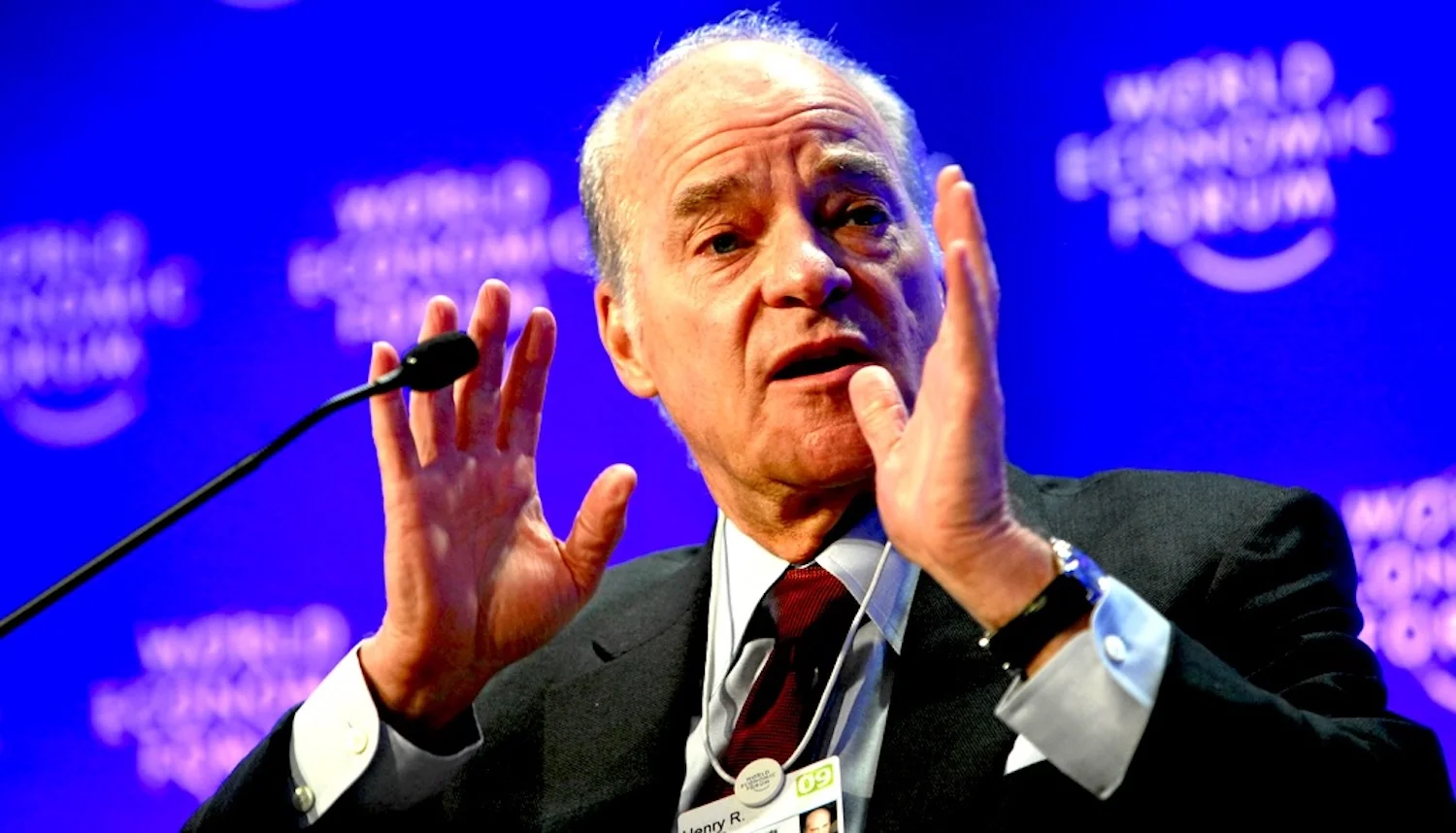

KKR founding partner Henry Kravis at the Economic World Forum in 2009

KKR founding partner Henry Kravis at the Economic World Forum in 2009

AUM: $686 billion+

Headquarters: New York, United States

Competitive Edge: Global investment platform across all major asset classes

KKR & Co. Inc. is one of the biggest names in the private equity industry, with a total enterprise value of $650 billion for its completed PE deals (as of December 2020) and portfolio companies generating $238 billion in annual revenue.

The firm is named after three of its founding partners, Jerome Kohlberg, Henry Kravis, and George R. Roberts, who initially completed a series of private equity investments in the 1960s and 70s on behalf of Bear Stearns, a defunct New York-based investment bank. The three left Bear Stearns to establish their own firm in 1976.

In 1988, KKR successfully carried out the buyout of RJR Nabisco in an astronomical $31.1 billion deal. The deal remained the largest leveraged buyout on record until 2007, when it was surpassed by KKR and TPG Capital’s buyout of TXU Energy.

KKR & Co. was the primary catalyst in the leveraged buyout boom of the 1980s, during which the firm made four multi-billion-dollar buyout deals (excluding RJR Nabisco).

KKR has made significant investments in energy and digital companies. In 2014, the firm bought a 30 percent stake in Acciona Energy, which operates renewable energy generating facilities (mostly wind farms) globally, for $567 million. In 2017, it acquired WebMD in a $2.8 billion deal.

In 2023, KKR acquired Simon & Schuster for $1.6 billion and Potter Global Technologies for an undisclosed amount from Gryphon Investors. It also bought a stake in PR firm FGS Global and in Catalio Capital Management.

In 2025, KKR executives noted that “half of our global distributions in private equity are going to come out of Asia”, signalling a strong push and liquidity generation focus in that region.

1. The Blackstone Group

AUM: $1.2 trillion+

Headquarters: Washington, DC, United States

Competitive Edge: The most diversified alternatives patform, Unmatched scale,

The Blackstone Group Inc. was founded as a strictly merger-and-acquisition advisory firm in 1985. But after just two years of advisory services, the firm entered the private equity business by raising $630 million in funds from institutions, such as the General Motors pension fund and Prudential Insurance Company.

Over the years, Blackstone Group has expanded into other alternative asset areas, including real estate, insurance, and hedge fund solutions. Still, corporate private equity remains its core focus.

In 2002, Blackstone raised a record $6.45 billion for its fourth buyout fund, which helped the firm finalize the largest PE deal of the year (the $4.7 billion TRW Automotive buyout). Blackstone was also involved in a mega $11.3 billion buyout of financial services and technology company SunGard in 2005.

Other notable club deals (buyouts involving two or more PE firms) in which Blackstone has either led or participated are TDC (2005), Neilson Holdings (2006), and Hilton Worldwide (2007).

In 2023, Blackstone bought Cvent (a cloud-based event software provider) for $4.6 billion, Energy Exemplar (energy market analytics and simulation software firm) for $1.6 billion, Civica (a UK-based software company) for $2.5 billion, and a majority stake in Sony Payment Services from Sony Bank.

The firm emphasises “megatrends” such as AI, digital economy, power/infrastructure and life sciences. In a 2025 article, they said their ability to identify and act on these early gives an edge.

Blackstone is currently the largest private equity firm in terms of assets under management and total capital commitments. The majority of its private equity transactions are leveraged buyouts.

Frequently Asked Questions

Who Invests In Private Equity Funds?

Private equity funds allow institutional investors, such as pension funds, endowments, foundations, and insurance companies, to diversify their portfolios. Apart from large institutional investors, private equity funds have become a preferred choice for high-net-worth individuals and family offices.

Where Are The Most Private Equity Firms?

In the US alone, there are an estimated 19,000 private equity funds. In fact, 13 out of the 15 largest firms on this list are based in the US. Following the U.S., notable presence is seen in Great Britain, China, and Canada.

How Do Private Equity Funds Generate Profits For Their Investors?

Private equity firms generate profits through various means. They can receive a consistent influx of cash from debt repayments or operational profits of the companies in their portfolio. Improving business operations and facilitating expansions contribute to this income.

Over time, private equity firms typically cash in their investments by selling portfolio companies for a profit or by making them public through initial public offerings (IPOs). The majority of these profits are then distributed to the firms’ investors or limited partners (LPs).

How Do Private Equity Firms Make Money?

Private equity firms make money through fees and carried interest. The first and foremost fee paid by investors is a management fee, which is usually 2% of their committed capital annually. This fee is levied by PE firms regardless of whether they generate a profit.

The second major income source is carried interest, which is basically a performance fee. When a private equity firm makes profits from the companies it invests in, it usually keeps about 20% of those profits. This carried interest makes up a large part of the firm’s overall earnings.

Read More