The construction industry in the United States is one of the largest and most economically critical sectors, generating over $2.2 trilion in annual project activity and supporting more than 8.2 million direct jobs across residential, commercial, industrial, and infrastructure markets. [1]

From highways, airports, and power plants to hospitals, data centers, and mega-manufacturing facilities, construction touches almost all segments of the US economy. At the top of this vast ecosystem sit a relatively small group of very large construction companies that execute the nation’s most complex, capital-intensive, and high-risk projects.

Below, I’ve featured the largest construction companies in the US, analyzing their scale, revenues, workforce size, and competitive advantages.

These firms are not just builders: they are industrial operators, risk managers, and infrastructure enablers whose performance directly influences national productivity, economic growth, and long-term resilience.

Did you know?The U.S. construction market is set to grow strongly, with its total value expected to cross $3.27 trillion by 2033, expanding at an annual growth rate of 4.9%. Infrastructure is the fastest-growing area within the market, projected to grow at an impressive 14.7% CAGR through 2033. [2]

Table of Contents

16. KB Home

Founded: 1957Headquarters: Los Angeles, California

Revenue: $6.5 billion+

Number of Employees: 2,300+

Competitive Edge: Built-to-order personalization, Sustainability leadership

Established in 1957 as Kaufman & Broad Building Company, the firm pioneered affordable suburban homebuilding and was the first homebuilder listed on the NYSE.

As of today, KB Home has built nearly 700,000 homes since its inception and operates in over 45markets across 20+ US states. It primarily targets first-time buyers and those moving up to their next home.

Over the past few years, the company has built a strong reputation for sustainability. It has delivered more Energy Star-certified homes than any other major US builder and consistently uses energy-efficient construction methods, helping buyers reduce long-term ownership costs.

KB Home has also been actively investing in land acquisition and development, committing over $2.8 billion in 2024 to expand future community offerings and support growth. In FY 2025, it delivered 12,902 homes, generating a net income of over $428.8 million. [3]

15. Primoris Services Corporation

Founded: 1960Headquarters: Dallas, Texas

Revenue: $7.4 billion+

Number of Employees: 15,000+

Competitive Edge: Long-term contract relationships

Primoris Services Corporation focuses on essential, long-life infrastructure assets, such as pipelines, power systems, utility networks, rail, and heavy civil projects that form the backbone of modern economies.

These assets are capital-intensive, highly regulated, and designed to operate for 30-50+ years, creating durable demand for Primoris’ services.

Plus, aging US infrastructure, increased electrification, renewable energy integration, and pipeline safety regulations have driven sustained capital spending — tailwinds that align directly with Primoris’ core competencies.

Strategically, Primoris occupies a middle ground between mega-EPC (Engineering, Procurement, and Construction) firms and smaller regional contractors. It is large enough to handle complex, multi-state programs, yet focused enough to avoid the extreme risk exposure associated with ultra-megaprojects.

In 2024, the company reported $6.36 billion in revenue, up about 11.4% from 2023, mainly driven by growth in its Energy segment. For FY 2025, revenue is around $7.45 billion, showing continued momentum as major energy and utility projects move forward and existing orders are completed.

14. Taylor Morrison

Founded: 2007Headquarters: Scottsdale, Arizona

Revenue: $8.3 billion+

Number of Employees: 3,300+

Competitive Edge: Strong brand reputation & customer trust

Taylor Morrison operates primarily in the mid-market and move-up housing segments, with growing exposure to entry-level and active-adult communities.

In 2024, the company reported about $8.17 billion in revenue, growing 10% year over year. That year, it delivered 12,896 homes and maintained healthy gross margins of over 24%. [4]

The company’s contribution to the US housing market is significant. In FY 2025, it accounted for roughly 5.2% of total US homebuilding revenue, placing it among the top ten homebuilders nationally.

Plus, Taylor Morrison has earned recognition for customer trust, being ranked “America’s Most Trusted Home Builder” for over a decade based on independent surveys.

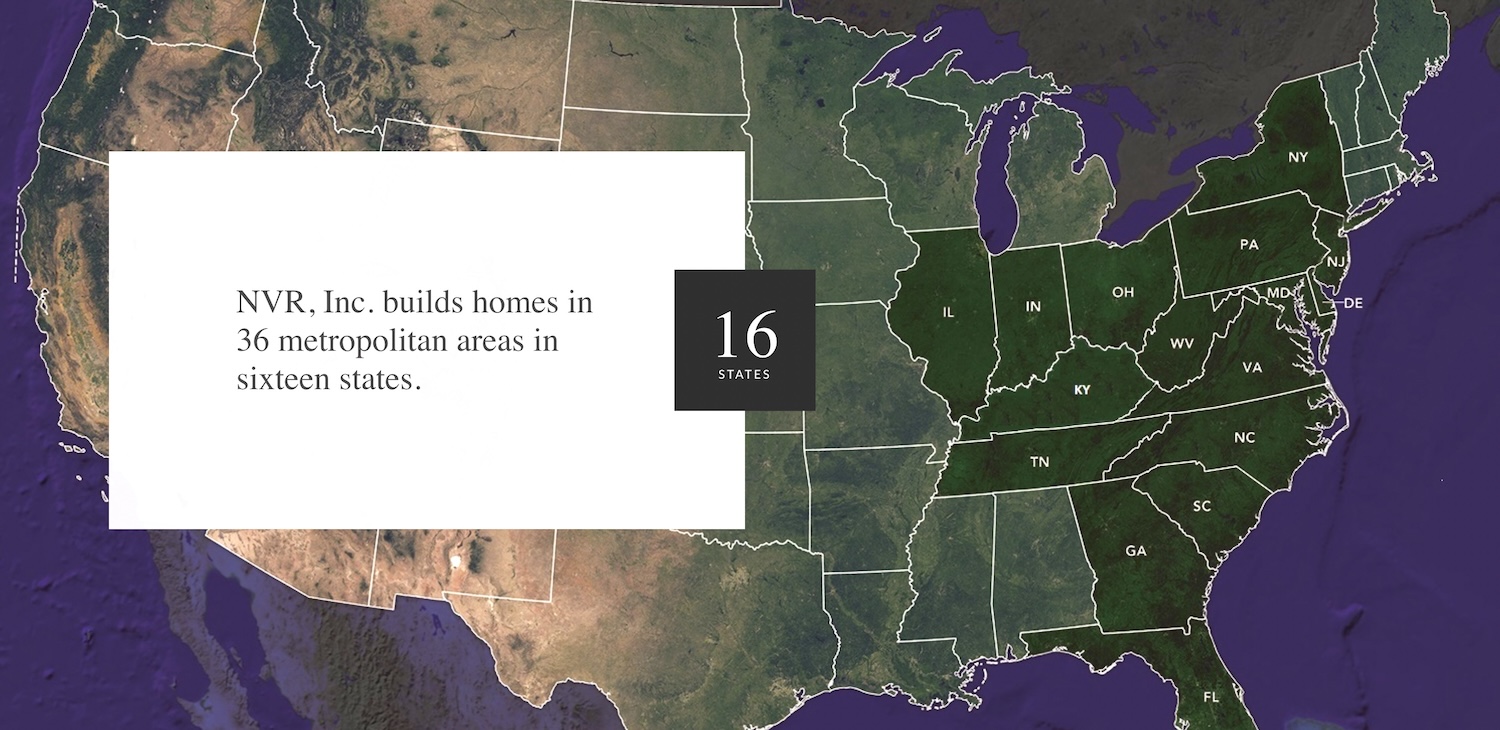

13. NVR

Headquarters: Reston, Virginia

Revenue: $10.4 billion+

Number of Employees: 6,000+

Competitive Edge: Disciplined, asset-light business model

NVR is one of the most distinctive and consistently profitable residential construction companies, known for its asset-light, capital-efficient homebuilding model.

Unlike most builders that own vast land banks, NVR deliberately avoids heavy land ownership. It constructs homes primarily on optioned lots owned by third-party land developers. This approach has allowed NVR to grow into a top-tier US homebuilder while maintaining exceptionally high returns on capital across housing cycles.

The company historically demonstrated remarkable profitability and conservative financial management. In fact, it was one of the few major builders that remained profitable through the 2008 housing downturn and maintained strong returns on equity via its efficient land strategy.

Today, NVR generates over $10.4 billion in annual revenue and more than $2.37 billion in gross profit. Its stock is among the highest-priced shares on the NYSE, reflecting investor confidence in its long-term fundamentals. [5]

12. Toll Brothers

Founded: 1967Headquarters: Fort Washington, Pennsylvania

Revenue: $10.9 billion+

Number of Employees: 4,900+

Competitive Edge: Luxury market focus

Toll Brothers is the largest luxury homebuilder in the United States. Over nearly six decades, the company has expanded far beyond its regional roots: today, it builds high-end single-family homes, townhomes, and condominiums in more than 60 markets across 24 states and Washington, DC.

In FY 2025, it achieved record home sales revenue of over 10.96 billion, an increase from the previous year despite persistent headwinds in the housing market.

Toll Brothers doesn’t just build houses: it designs, markets, finances, and customizes homes, sells master-planned communities with amenities like golf courses and clubhouses, and offers a full range of interior options and smart-home technologies.

Their average selling prices consistently rank among the highest in the industry, with typical luxury homes fetching prices near or above $970,000.

11. DPR Construction

Headquarters: Redwood City, California

Revenue: $10.8 billion+

Number of Employees: 11,000+

Competitive Edge: Deep expertise in data centers & life sciences sectors

DPR Construction is the fastest-growing commercial construction company, known for delivering highly complex, technology-intensive buildings. It has deliberately focused on advanced facilities, such as technology campuses, data centers, life sciences laboratories, healthcare facilities, and higher-education projects.

In fact, DPR specializes in technically demanding facilities, often integrating advanced techniques like Building Information Modeling (BIM), Integrated Project Delivery (IPD), Virtual Design & Construction (VDC), and lean construction methods to enhance cost certainty, quality, collaboration, and innovation.

In 2024, DPR, alongside Turner Construction and Mortenson, was awarded a $10 billion contract by Meta Platforms to build a major data center in Richland Parish, Louisiana. [6]

Today, it ranks among the 10 largest general contractors in the United States, with reported annual revenues exceeding $10.8 billion.

10. Jacobs Solutions

Founded: 1947Headquarters: Dallas, Texas

Revenue: $12 billion+

Number of Employees: 43,000+

Competitive Edge: Broad, Multidisciplinary Capabilities

Jacobs Solutions is a diversified engineering, consulting, and construction services company, operating at the center of infrastructure, environmental, defense, and space projects. In many of these domains, the cost of failure is not financial alone, but strategic or national in scope.

Unlike traditional contractors that focus primarily on physical construction, Jacobs plays an important role upstream and across the full project lifecycle, from planning and design to program management, systems integration, and long-term operations support.

The company is growing at a decent rate. In 2026, it was appointed to deliver Engineering, Procurement, and Construction Management (EPCM) services for the Hut 8 AI data center project in Louisiana.

They have also emphasized growth in emerging markets like India, particularly in semiconductor and electronics infrastructure projects

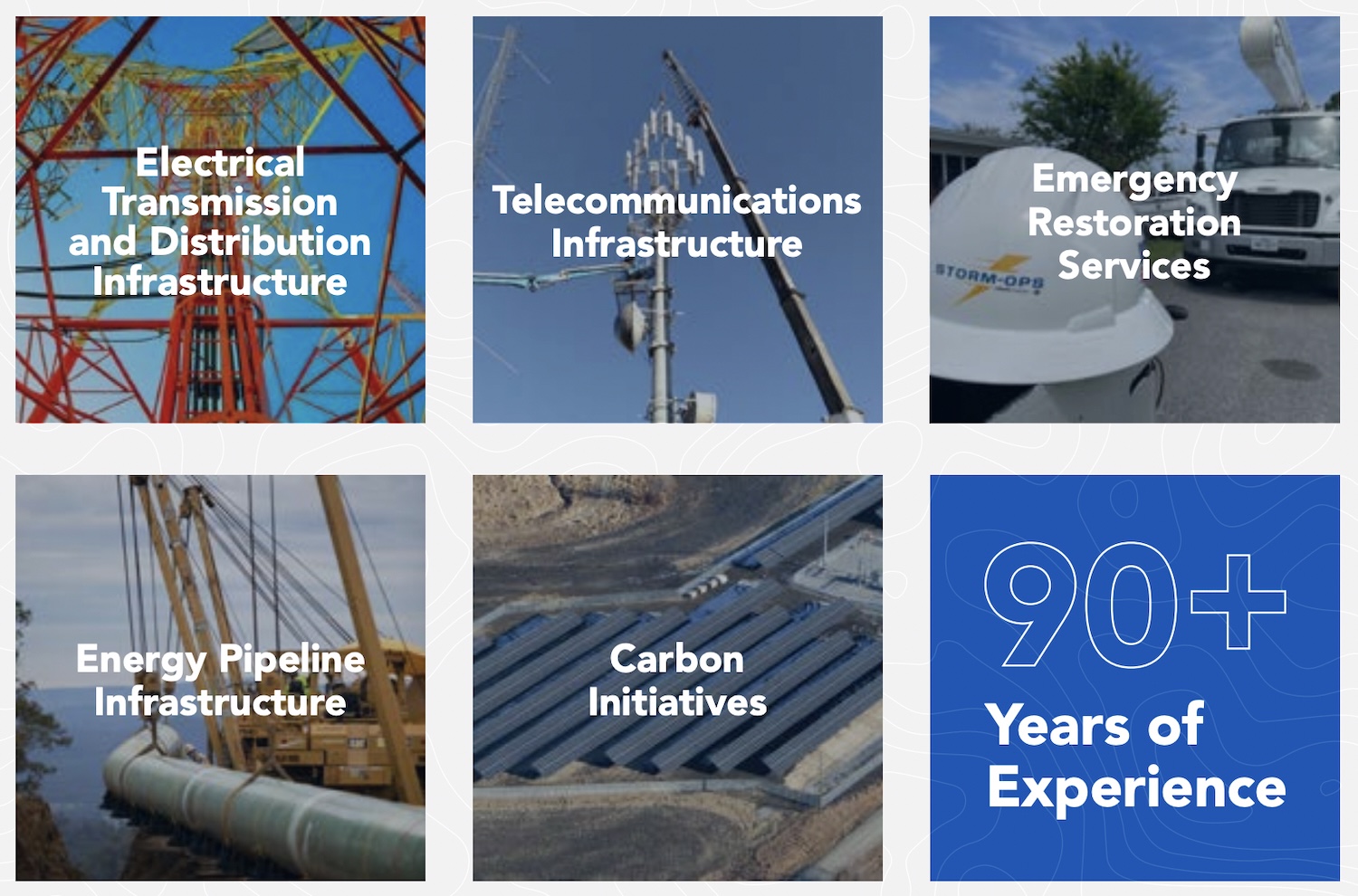

9. MasTec

Headquarters: Coral Gables, Florida

Revenue: $13.7 billion+

Number of Employees: 32,000+

Competitive Edge: Strong exposure to telcom, renewables & grid upgrades

MasTec was formed in 1994 through a merger of legacy firms and quickly became a publicly traded infrastructure contractor on the NYSE. It builds complex energy, utility, communications, and industrial infrastructure across North America.

In recent years, the company has captured market growth by participating in major trends like 5G telecommunications deployment, renewable energy infrastructure, grid modernization, and pipeline projects.

Its clean energy segment (which focuses on renewable energy projects, power generation facilities, and grid modernization) brings in over $4 billion a year.

In FY 2025, the company generated more than $13.76 billion in total revenue, up 12.99% year over year. Gross profit reached $1.72 billion, marking a 10.41% annual increase. [7]

8. Fluor Corporation

Founded: 1912Fluor achieves mechanical completion on BASF’s new Verbund site project in China https://t.co/2X8jMWmL17 pic.twitter.com/h0dP2wQGJQ

— Fluor Corporation (@FluorCorp) January 9, 2026

Headquarters: Santa Ana, California

Revenue: $15.5 billion+

Number of Employees: 27,000+

Competitive Edge: Longstanding engineering legacy, Global diversification

Fluor Corporation is a globally diversified engineering, procurement, and construction (EPC) company. Its project portfolio spans energy, mining, chemical, infrastructure, and government services.

Unlike vertical building contractors or residential homebuilders, Fluor operates almost exclusively in large-scale, technically complex projects, where engineering depth and risk management are as crucial as construction execution.

The company has continued to secure notable engineering and construction work, including contracts for the Highland Valley Copper Mine Life Extension Project and involvement in the second production train for LNG Canada.

In 2025, Fluor revealed plans to divest its Zhuhai fabrication yard in China, reflecting a strategy to optimize its global assets and focus on higher-value project execution. [8]

7. Emcor

Founded: 1994Headquarters: Norwalk, Connecticut

Revenue: $16.2 billion+

Number of Employees: 46,000+

Competitive Edge: Diversified service portfolio, Energy transition exposure

Emcor Group is one of the largest specialty construction and building services companies, especially prominent in mechanical and electrical construction and industrial/energy infrastructure

It’s a Fortune 500 and S&P 500-listed company, with over 46,000 employees and operations across roughly 420 locations. In 2025, it was ranked second on Engineering News-Record’s Top 600 Specialty Contractors list.

Emcor has a diverse client base, including data centers, life sciences, biotech facilities, government buildings, industrial plants, and oil & gas facilities, making it a key player in both construction and ongoing operational services

In 2025, the Group acquired Miller Electric Company, a Florida-based electrical contractor with expertise in systems integration and energy solutions, adding substantial revenue and technical capabilities to its US Electrical Construction segment. [9]

6. PulteGroup

Founded: 1950Headquarters: Atlanta, Georgia

Revenue: $17.6 billion+

Number of Employees: 6,800+

Competitive Edge: Multi-brand strategy, Nationwide scale

PulteGroup is one of the most established residential construction companies in the US, consistently ranking among the top three to five homebuilders by revenue and units delivered. To date, it has delivered more than 800,000 homes throughout the United States.

The company markets homes through a suite of well-known brands, such as Pulte Homes, DiVosta Homes, Del Webb, John Wieland, Centex, and American West. Each brand is tailored to different buyer demographics and regional market needs.

They serve a broad customer base, from first-time buyers and move-up families to active-adult and luxury buyers. In 2024 alone, they delivered 31,219 homes and earned $3.08 billion in net income, achieving a 27.5% return on equity.

In 2025, PulteGroup expanded its Del Webb brand into new regions, including California and Florida, and partnered with robotics technology firms to explore innovative construction techniques.

5. Turner Construction

A $1.7 billion public health laboratory in New York is being developed by Turner Construction and Gilbane Building Company

A $1.7 billion public health laboratory in New York is being developed by Turner Construction and Gilbane Building Company

Headquarters: Hudson Boulevard East, New York

Revenue: $20 billion+

Number of Employees: 15,000+

Competitive Edge: Urban mega-project expertise

Turner Construction is the largest commercial building contractor in the US, widely famous in vertical construction. Unlike infrastructure-heavy firms, Turner specializes in complex buildings, including data centers, stadiums, airports, laboratories, hospitals, office towers, and large mixed-use developments.

The company employs over 15,000 people and completes more than 1,500 projects annually through its North American network of offices. It is also expanding its presence in Europe, Asia, and India through Turner International and regional offices.

Turner applies Lean construction principles and collaborative delivery methods such as Integrated Project Delivery (IPD), Construction Management At-Risk (CMAR), and Target Value Design to minimize waste, optimize cost, and align teams around project goals.

The company has been on a growth trajectory in recent years. In 2024, it reported over $20 billion in revenue, secured more than $26 billion in new contracts, and sustained strong demand across data center, healthcare, sports, and education sectors.

By mid-2025, its backlog had surpassed $39 billion, reflecting a robust project pipeline and continued client confidence. [10]

4. Bechtel Corporation

Founded: 1898Headquarters: Reston, Virginia

Revenue: $58.2 billion+

Number of Employees: 50,000+

Competitive Edge: Diversified sector presence, Strong backlog and project pipeline

Bechtel Corporation is one of the world’s most influential construction, engineering, and project management firms. Its portfolio includes nuclear power plants, large-scale transportation corridors, LNG terminals, mining complexes, and national infrastructure programs (projects in which individual contract values can exceed $5 billion).

Its work spans the project lifecycle, from planning and design through engineering, procurement, construction, commissioning, and, in some cases, operations. This makes Bechtel a one-stop partner for megaprojects that governments and corporations entrust with their most ambitious builds.

Bechtel’s projects include legacy infrastructure classics such as the Hoover Dam, the Trans-Alaska Pipeline System, and the Channel Tunnel (Eurotunnel), as well as modern global ventures, ranging from metro rail systems in the Middle East to large energy and industrial complexes.

The company’s scale is reflected in its backlog and new bookings. In 2024, Bechtel won nearly $17 billion in new work and reported backlog exceeding $58 billion.

3. Kiewit Corporation

Headquarters: Omaha, Nebraska

Revenue: $16.8 billion+

Number of Employees: 31,800+

Competitive Edge: Mega-project capability, Employee-owned culture

Kiewit Corporation is dominant in heavy civil, transportation, power, and energy infrastructure. It operates almost entirely in the complex, capital-intensive infrastructure segment, executing projects that often exceed $500 million and can reach multiple billions of dollars per contract.

Its work includes highways, bridges, rail systems, power plants, pipelines, mining facilities, and major industrial projects.

Unlike many contractors that subcontract most labor, Kiewit self-performs a large portion of work. This gives it tighter control over quality, safety, scheduling, and cost execution. The company logs over 70 million direct-hire craft hours annually across projects of all types.

Plus, Kiewit is one of the largest employee-owned companies in the United States, giving it a unique edge where long-term performance and operational excellence matter more than short-term quarterly results.

This ownership model has historically resulted in lower project failure rates, stronger safety records, and higher retention of skilled engineers and craft professionals.

2. Lennar

Headquarters: Miami, Florida

Revenue: $34.2 billion+

Number of Employees: 12,500+

Competitive Edge: Unmatched production scale

Lennar operates at a scale that few homebuilders can match. It is a dominant force in single-family housing, master-planned communities, and entry-level to move-up homes, with operations spanning over 30 states and dozens of metropolitan markets.

Over its long history, Lennar has built more than one million homes for American families, cementing a massive legacy of national presence and brand recognition.

The company’s footprint extends well beyond home construction. It has built a vertically integrated ecosystem that includes mortgage origination and title insurance, enabling it to capture additional revenue per home while improving sales conversion rates.

In FY 2025, Lennar delivered 82,583 new homes (a 3% increase year-on-year), showcasing its massive residential production scale. It reported $34.2 billion in total revenue and about $2.1 billion in net profit. [11]

1. D. R. Horton

Founded: 1978Headquarters: Arlington, Texas

Revenue: $34.3 billion+

Number of Employees: 14,340+

Competitive Edge: Operational discipline in tough markets

D. R. Horton is the largest homebuilder in the United States by volume, a position it has held consistently for many years (since 2002). In FY 2025 alone, it delivered 84,863 homes to families across the US.

The company focuses on simplicity, speed, and cost control. It avoids overly complex home designs, luxury customization, or speculative land exposure. Instead, it prioritizes standardized product lines, rapid construction cycles, and disciplined land acquisition.

Horton operates in 36 states and 125+ markets, spreading risk and capturing growth opportunities across regions. Its scale enables bulk purchasing of materials and efficient construction logistics, thereby reducing per-unit costs.

The company also offers integrated services, including mortgage financing, title services, and lot ownership through its majority stake in Forestar Group, further amplifying its influence in the residential real estate value chain. [12]

In recent years, Horton has intensified sales incentives and pricing strategies (such as offering promotional mortgage-rate buydowns in some markets) to stimulate demand in a cautious buyer environment.

Read More

- 18 Best Science And Technology Research Labs In The World

- 13 Largest Lithium Mining Companies In The World

- 19 Tallest Buildings In The World

- Business & Economy, Monthly construction spending data, US Census Bureau

- Industry Report, US construction market size and trend analysis, Market Data Forecast

- News details, 2025 Q4 and full year results, KB Home

- Newsroom, The Q4 and full year results, Taylor Morrison

- Ricardo Pillai, A bull case of NVR Inc., Yahoo Finance

- Insight, Meta to invest $10 Billion in Louisiana data center campus, Turner

- Company Financials, Gross profit of MasTec throughout the years, Macrotrends

- New Releases, Fluor to divest its Zhuhai fabrication yard in China, Fluor

- Investor Relations, Emcor acquires Miller Electric Company, Emcor Group

- Insight, Turner’s growth is recognized with leadership across key market sectors. Turner

- Newsroom, The Q4 and full year results, Lennar

- Investor Relations, D.R. Horton and Forestar announce merger agreement, D.R. Horton