AutoZone is the largest automotive parts retailer in the United States, with more than 7,600 stores across the US, Mexico, Brazil, Puerto Rico, and the US Virgin Islands.

It employs nearly 30,000 people and services both DIY (Do-It-Yourself) customers and DIFM (Do-It-for-Me) professional repair shops, forming a dual-channel model that continues to drive its consistent revenue growth.

In FY 2025, the company generated $18.9 billion in net sales, solidifying its leadership in the $200 billion+ US aftermarket auto parts industry. [1]

However, AutoZone’s dominance doesn’t come without fierce competition. The aftermarket auto parts industry is fragmented yet highly competitive, with a few major national chains and thousands of regional retailers vying for market share.

The following sections will explore the top AutoZone competitors in depth, comparing their market reach, financial strength, strategic initiatives, and competitive edges.

Did you know?The average age of vehicles in the US has reached an all-time high of 12.6 years, driving stronger demand for the aftermarket industry. [2]

Table of Contents

14. Midas International

Founded in 1956Headquarters: Florida, USA

Revenue: $120 million+

Competitive Edge: Franchise model efficiency, Synergy under Mavis Tire Express Services

Midas runs a global network of franchised, licensed, and company-owned service centers, offering repairs, tire services, oil changes, brakes, mufflers & exhaust, steering/suspension, and other maintenance.

The company competes with AutoZone primarily in the vehicle maintenance and Do-It-For-Me (DIFM) segments of the automotive aftermarket. It operates approximately 2,100 locations across North America, including the United States, Canada, and Puerto Rico.

Midas International is a part of Mavis Tire Express Services Corp, one of the largest independent tire and auto service chains in North America. This affiliation gives Midas access to extensive supply chain resources, procurement power, and multi-brand synergies in tire sourcing, distribution, and maintenance expertise.

13. Edelbrock LLC

Founded in 1938Headquarters: California, USA

Revenue: $70 million+

Competitive Edge: Legendary brand heritage, R&D capabilities

Edelbrock is one of the most iconic and historically significant brands in the automotive performance aftermarket industry. Its identity is deeply tied to American motorsports and hot-rodding culture.

Its parts have powered legendary dragsters, NASCAR engines, and street performance builds since the 1950s. Their engineering excellence and “Made in the USA” manufacturing philosophy have cultivated one of the most trusted reputations in the industry.

The company operates under the umbrella of VPSE (Victerra Performance Systems & Equipment), a performance parts conglomerate formed through the merger of Edelbrock and COMP Performance Group in 2021.

Edelbrock’s product portfolio spans a wide range of high-performance engine components, including intake manifolds, carburetors, cylinder heads, camshafts, fuel systems, superchargers, exhaust systems, and powertrain accessories. It also produces Edelbrock Crate Engines and performance kits for both classic and modern vehicles.

Plus, Edelbrock operates advanced testing facilities, flow benches, and dyno labs, supporting rapid prototyping and precision tuning of components for modern vehicles and racing engines.

The company perfectly balances its heritage craftsmanship with new product innovation and digital expansion, selling directly to consumers through Edelbrock.com and through large retail partners like AutoZone and JEGS.

12. The Parts Authority

Headquarters: New York, USA

Revenue: $800 million+

Competitive Edge: Broad inventory & SKU depth

Parts Authority has grown into a coast-to-coast distribution company, emerging as a major player in the professional Do-It-For-Me (DIFM) automotive aftermarket.

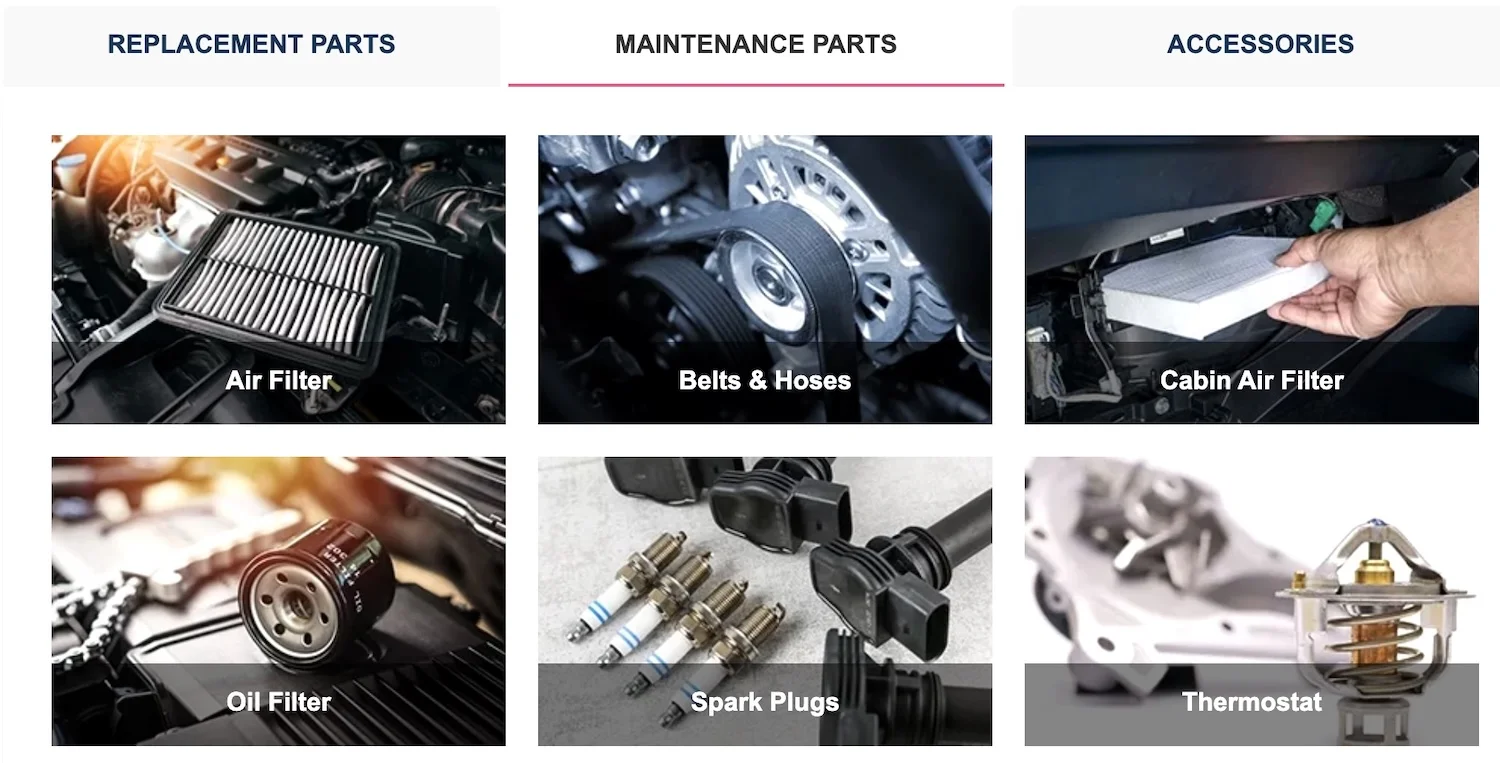

Its product portfolio encompasses mechanical replacement parts, brake systems, filters, batteries, lighting, electrical components, chemicals, tools, and accessories — spanning over 3 million SKUs from both OEM and premium aftermarket suppliers.

Unlike major retailers like AutoZone and O’Reilly, Parts Authority does not operate consumer-facing stores. Its business model focuses on B2B distribution, ensuring high availability, fast delivery, and reliable service to professional installers.

The company distributes major brands such as ACDelco, Bosch, Monroe, Denso, NGK, Raybestos, and Standard Motor Products, alongside its own private-label lines. Its customers include independent service centers, quick-lube chains, national fleets, and dealership networks.

Thanks to its advanced logistics network and regional hub system, Parts Authority offers same-day or next-day delivery across nearly all major U.S. markets.

In recent years, the company has grown through acquisitions of smaller distributors and regional specialists, including National Autobody and Gem Auto Parts. These moves have strengthened its presence in the import and European vehicle segments.

11. Meyer Distributing

Founded in 1937Headquarters: Indiana, US

Revenue: $200 million+

Competitive Edge: Massive product catalog & Category depth

Meyer Distributing is a wholesaler and distributor of automotive specialty products, including automotive accessories, wheels & tires, off-road/Jeep & performance aftermarket, RV, and towing goods.

The company is family-owned and operated, maintaining a reputation for reliability, deep inventory coverage, and exceptional delivery logistics.

Meyer’s catalog features more than 900 product lines and over 1 million SKUs, making it one of the most comprehensive distributors in the industry. Its customers include independent auto parts retailers, dealerships, warehouse distributors, e-commerce resellers, fleet managers, and specialty installers. [3]

The company has expanded its reach and capabilities through strategic acquisitions. For instance, in 2022, it acquired P&E Distributors (Goodlettsville, TN), strengthening its presence in the Southeastern US and enabling next-day or two-day delivery across all 50 states.

10. Uni-Select

Founded in 1968Headquarters: Boucherville, Canada

Revenue: $1.7 billion+

Competitive Edge: Market leadership in paint & body products

Uni-Select is a Canadian distributor for automotive replacement parts, paint and refinishing products, and industrial coatings. Its business model is centered on wholesale and distribution, connecting manufacturers with professional repair shops, independent retailers, and collision centers.

It operates through several well-known divisions, such as

- Bumper to Bumper (Canada-wide parts stores and service centers),

- FinishMaster (US leader in automotive paints and coatings), and

- Auto Parts Plus/Auto Parts Direct (serving local garages and smaller markets).

According to its “Aftermarket” data, Uni-Select distributes “more than 3 million replacement parts and over 60,000 paint products and related collision repair accessories.”

In 2023, it was acquired by LKQ Corporation. The acquisition integrated Uni-Select’s distribution network into LKQ’s North American business, further strengthening LKQ’s presence in Canada and the U.S. paint and body repair markets.

Despite now being under LKQ ownership, Uni-Select continues to function as an independent operating division and maintains its brand identity across Canada and the UK.

9. Jegs High Performance

Founded in 1960David’s 1970 Chevrolet Chevelle SS out of San Diego has a big block Chevy under the hood and a Nitrous Express system ready to unleash serious power. Finished in silver with bold black stripes, this classic rides on Weld wheels, stops with Wilwood brakes, and stays planted thanks… pic.twitter.com/gXCkS8xd7G

— JEGS Performance (@JEGSPerformance) November 5, 2025

Headquarters: Ohio, US

Revenue: $250 million+

Competitive Edge: Focuses exclusively on the performance & racing segment

Jegs High Performance’s rise mirrors the growth of the American performance and motorsport culture of the 1960s–1980s, when consumer enthusiasm for muscle cars and drag racing peaked. JEGS capitalized on this by offering hard-to-find, high-performance parts with mail-order convenience.

Today, it continues that legacy through digital innovation, providing enthusiasts with fast access to parts for street, race, off-road, and restoration applications. The company operates a combination of direct-to-consumer online retail, catalog distribution, and a flagship retail showroom in Delaware, Ohio.

Its e-commerce platform (JEGS.com) is one of the largest dedicated online marketplaces for performance parts in North America, featuring over 2 million SKUs from more than 400 aftermarket brands, including Holley, Edelbrock, K&N, MSD, Flowmaster, and its own JEGS private-label line

Although JEGS is smaller than large aftermarket chains like AutoZone or O’Reilly, it dominates a lucrative niche: the high-performance, motorsports, and enthusiast aftermarket — a sector worth over $10 billion and projected to surpass $14.7 billion by 2032. [4]

8. Discount Tire

Headquarters: Arizona, US

Revenue: $9.7 billion+

Employees: 30,800+

Competitive Edge: Category Leadership & Specialization, Digital integration

Discount Tire is the largest independent tire and wheel retailer in the United States, operating more than 1,300 stores across 39 states under the names Discount Tire and America’s Tire. Its business model is built on customer service, low pricing, and operational efficiency.

Discount Tire’s stores sell a wide range of tire brands (including Michelin, Goodyear, Bridgestone, Continental, Pirelli, and Cooper) alongside its own private-label offerings. It also provides related services such as tire installation, rotation, balancing, flat repair, and wheel alignment.

Unlike diversified retailers like AutoZone or Pep Boys, Discount Tire has remained deliberately specialized, making it the most trusted name in tire retailing for over six decades.

Plus, its online platforms — DiscountTire.com and its sister site TireRack.com (acquired in 2021) — have made the company a major player in the tire e-commerce space. By blending retail and digital channels, it operates a strong hybrid omnichannel model.

The company has also developed proprietary tools like “Treadwell”, which recommends tires based on vehicle type and driving behavior. [5]

7. Pep Boys

Founded in 1921Headquarters: Pennsylvania, US

Revenue: $2.2 billion+

Employees: 8,000+

Competitive Edge: Brand heritage, Full-service model

Pep Boys is one of the most recognized and enduring names in the US automotive aftermarket and service industry. Over its century-long history, it has built a reputation for being one of America’s first full-service auto parts retailers, combining do-it-yourself (DIY) retail, do-it-for-me (DIFM) repair , and tire installation under one roof.

In 2016, Icahn Enterprises LP acquired Pep Boys for approximately $1 billion, marking a significant shift in strategy. [6]

In recent years, the company has shifted heavily toward automotive service and maintenance operations. Its service centers specialize in brakes, oil changes, batteries, tire installation, and general mechanical repairs, generating the majority of its revenue from the DIFM segment.

Financially, Pep Boys make over $2 billion in annual revenue. While this figure is modest compared to AutoZone’s, the company’s strength lies in its strong customer trust and long-standing brand reputation.

It also provides fleet maintenance services for commercial operators and government agencies, creating steady, recurring revenue streams that are less affected by consumer spending cycles.

6. CarParts.com

Headquarters: California, US

Revenue: $580 million+

Employees: 1,500+

Competitive Edge: Price efficiency, Direct-to-door delivery

Unlike traditional brick-and-mortar competitors, CarParts.com operates a pure e-commerce model supported by strategically placed fulfillment facilities across the United States, providing 2-day shipping coverage to 95% of the US population. [7]

Its digital infrastructure, proprietary fitment algorithms, and data-driven inventory management systems form the backbone of its business model.

The company originally operated as US Auto Parts Network before rebranding to CarParts.com in 2020. Today, its catalog includes brake components, cooling systems, exterior auto body parts, lighting assemblies, mirrors, drivetrain components, suspension systems, and performance parts.

CarParts.com targets budget-conscious consumers looking for OEM-quality parts at affordable prices. It competes with AutoZone for price-sensitive DIY customers, enhancing its appeal through digital content, buying guides, and dedicated customer support. In 2024, the company generated $588.85 million in revenue.

5. LKQ Corporation

LKQ wrecking yard in Texas

LKQ wrecking yard in Texas

Headquarters: Tennessee, US

Revenue: $14 billion+

Employees: 46,000+

Competitive Edge: Consistent strategic acquisitions, Diverse product offering

LKQ (which stands for “Like Kind and Quality”) provides alternative and specialty automotive parts, serving both the aftermarket and collision repair industries. Its portfolio includes recycled OEM parts, aftermarket parts, remanufactured components, and specialty accessories.

With more than $14 billion in annual revenue, LKQ is one of the largest automotive parts distributors in the world. It operates in 40+ countries, including the US, Canada, Mexico, the United Kingdom, Germany, the Netherlands, and several other European and Latin American markets.

LKQ has acquired over 250 companies since its founding, allowing it to quickly expand into new regions and product categories. Key acquisitions such as Euro Car Parts and Rhiag have helped the company achieve a strong, continent-wide presence in Europe.

In recent years, the company has emphasised operational improvement: cost structure reduction, SKU rationalisation, stripping non-core assets, and portfolio simplification. For instance, in 2025, it announced over $125 million in cost reductions over 12 months.

4. AutoNation

Headquarters: Florida, US

Revenue: $27.9 billion+

Employees: 25,100+

Competitive Edge: Diversified business model, Strong capital return & cash flow

AutoNation is the largest automotive retailer and service network in the United States, and one of the most influential companies in the modern automotive ecosystem.

The company has revolutionized the fragmented dealership market by consolidating multiple brands under one corporate structure. It operates over 360 locations across the country, representing nearly 40 different automotive brands, including Toyota, Honda, Ford, BMW, Mercedes-Benz, and Chevrolet.

AutoNation’s revenue mix is approximately 49% new vehicles, 29% used vehicles, 17% parts and service, and 5% finance and insurance. [8]

Its aftermarket operations, including AutoNation Precision Parts, AutoNation Collision Centers, and AutoNation USA (used car retail brand), form a substantial, fast-growing segment. These businesses place AutoNation in direct competition with major aftermarket and service providers such as AutoZone and Pep Boys, particularly in the repair and parts replacement segments.

With its large scale and strong cash flow, AutoNation focuses heavily on returning capital to shareholders through share buybacks. In 2023, it repurchased approximately $864 million worth of shares, followed by $576 million in 2024.

3. Genuine Parts Company

Headquarters: Georgia, US

Revenue: $24 billion+

Employees: 63,000+

Competitive Edge: Global footprint, Strong B2B customer relationships

Genuine Parts Company (GPC) operates several well-known brands, most notably NAPA Auto Parts, which stands for the National Automotive Parts Association.

Over nearly a century, GPC has built an extensive international network spanning North America, Europe, Australia, and the Asia-Pacific region. It serves both retail customers and professional installers through an extensive distribution and franchise-based model. About 74% of its net sales come from North America, while Europe contributes roughly 16%. [9]

Its distribution network includes over 50 major distribution centers, each capable of handling tens of thousands of SKUs across automotive, heavy-duty, agricultural, and industrial segments.

When viewed as a competitor to AutoZone, GPC is a different kind of rival — one that operates more as a wholesale and B2B distribution powerhouse rather than a pure retail chain.

The company actively uses acquisitions to enhance its footprint, acquire regional distributors, expand store count, and enter new geographies. For example, in 2024, GPC acquired the largest independent NAPA store owner in the US (MPEC, 181 stores) to gain further control of the network.

2. Advance Auto Parts

Advance Auto Parts store in North Carolina

Advance Auto Parts store in North Carolina

Headquarters: North Carolina, US

Revenue: $8.6 billion+

Employees: 62,800+

Competitive Edge: Diverse brand network

Advance Auto Parts has expanded into a nationwide chain with about 5,100 stores across the United States, Canada, and Puerto Rico. This includes over 4,290 company-operated locations and more than 810 independently owned Carquest-branded stores.

Advance Auto operates through multiple brands, including Advance Auto Parts, Carquest, Worldpac, and Autopart International. Its Carquest brand, in particular, provides an expansive network of independently owned stores and affiliated partners that extend its reach across urban and rural markets.

At its core, the company aims to deliver a full-service customer experience. A typical Advance Auto Parts store carries 20,000 SKUs, while larger “hub” stores can hold up to 75,000 -85,000 SKUs.

In recent years, the company has prioritized business transformation and cost optimization, focusing on rebuilding profitability through improved inventory efficiency, stronger supplier relationships, and a restructured leadership team. [10]

1. O’Reilly Automotive

An O’Reilly store in North Carolina

An O’Reilly store in North Carolina

Headquarters: Missouri, US

Revenue: $17.4 billion+

Employees: 93,200+

Competitive Edge: Massive scale & store footprint

O’Reilly Automotive is one of the largest and most profitable automotive aftermarket retailers in North America. It operates more than 6,480 stores across the United States, Canada, and Mexico, with a strong focus on efficiency, customer service, and top-tier logistics.

Over the past seven decades, O’Reilly has grown into a leading player in both the DIY (do-it-yourself) and DIFM (do-it-for-me) segments, serving individual customers, repair shops, and fleet operators. Unlike AutoZone, which has traditionally led the DIY market, O’Reilly stands out for its strong presence in the commercial (DIFM) segment. [11]

Financially, the company has maintained double-digit earnings-per-share (EPS) growth for more than a decade. In FY 2025, it reported $17.46 billion in revenue and $8.98 billion in gross profit, reflecting a 6% year-over-year increase. [12]

O’Reilly is not just relying on stores: it’s investing in distribution centres to support scale. For instance, it acquired a 560,000-square-foot facility in Texas that will begin operations in 2027, serving around 350 stores. This investment will improve inventory replenishment speed, enhance service quality, and reduce stock-outs—critical factors in staying competitive in the auto parts industry.

Read More

Sources Cited and Additional- Industry Report, US automotive aftermarket size and trend analysis, GrandViewResearch

- Nishant Parekh, Average age of vehicles hits new record in 2024, S&P Global

- Company Overview, Meyer serves thousands of customers nationwide, LinkedIn

- Consumer Discretionary, Off-road high-performance vehicle market size and trend analysis, Skyquest

- Customer Stories, How Discount Tire became a market leader, Adobe Blog

- Media Center, Icahn Enterprises completes acquisition of Pep Boys, Pep Boys

- News, CarParts.com secures strategic investment from global industry leaders, PRNewswire

- News, AutoNation reports third quarter 2025 results, PRNewswire

- Financial Results, Genuine Parts Company reports Q4 and full-year 2024 results, GPC

- Steve Gelsi, Advance Auto Parts’ stock skids as retailer predicts weak sales, Market Watch

- Zacks Equity Research, Highlights of O’Reilly Automotive and Advance Auto Parts, Nasdaq

- Company Financials, Revenue and profit of O’Reilly Automotive throughout the years, Macrotrends