China’s automotive industry is, by far, the largest in the world. In 2023, China produced over 30.16 million vehicles (including 26.1 million passenger cars and 4 million commercial vehicles), accounting for almost one-third of the world’s vehicle production:

China has firmly established itself as the world’s largest exporter of cars. In 2022, the country exported over 3 million vehicles, accounting for 11.5% of its total production. This achievement placed China as the world’s second-largest car exporter, just after Japan.

By 2023, China set a new benchmark, exporting a record-breaking 5.2 million vehicles, surpassing Japan to claim the title of the world’s largest car exporter for the first time.

By 2024, China solidified its position by exporting 6.41 million vehicles, reflecting a 23% year-on-year increase. The total export value reached $117.35 billion, marking a 15.5% rise compared to the previous year. With these figures, China maintained its status as the world’s leading auto exporter in 2024.

Origin of the Chinese Auto Industry

The origin of the Chinese auto industry can be traced back to the mid-19th century, when Changan Automobile was established in 1862 in Shanghai as a defense manufacturing factory.

However, it was not until the 1950s that the Chinese automotive industry made any notable progress. Auto imports and technology transfers from the Soviet Union played a crucial role in the country’s initial growth of domestic auto production. The first-ever Chinese car produced entirely domestically was the Dongfeng CA71 in 1958.

Throughout the 1980s and 1990s, China developed significant manufacturing capabilities in the passenger vehicle segment, largely due to multiple foreign joint ventures and favorable government policies. The industry experienced explosive growth, both in production and exports, after China’s entry into the WTO in 2001. Since then, the industry has been a pillar of China’s economic growth.

Below, we have listed the top Chinese car brands that are leading the nation’s auto sector. Our ranking criteria are based on the company’s annual revenue, brand popularity, and number of car units sold.

Table of Contents

13. XPeng Motors

Founded in 2014

Annual Revenue: $6.95 billion+

XPeng Motors, also known as Guangzhou Xiaopeng Motors Technology, develops intelligent EVs that integrate advanced technologies such as autonomous driving and smart connectivity.

Its vehicle lineup includes models such as the G3 SUV, P5 sedan, and P7 sedan, all equipped with the company’s proprietary XPILOT driver assistance system and Xmart OS intelligent in-car operating system.

They are committed to maintaining a technological edge over competitors through active investments in research and development. In FY 2025, the company allocated nearly $984 million to R&D, marking a 32.2% year-over-year increase.

At present, the company is focused on expanding its international presence, particularly in Europe. In 2024, it made its official entry into the Spanish market, introducing three electric models: the G6 and G9 SUVs, and the P7 sedan. The plan is to establish a strong foothold in the premium EV segment by introducing a new model in Europe each year.

In FY 2025, the company generated $6.95 billion in revenue, marking a record 49.47% growth compared to the previous year. Its gross margin rose to an all-time high of 17.3%, while vehicle margins improved to around 14.3%

12. Li Auto

Li L7

Li L7

Founded in 2015

Annual Revenue: $20 billion+

Annual Sales: 500,000+

Li Auto is currently the best-selling Chinese EV startup. Founded in 2015, the company designs and manufactures premium electric vehicles for the domestic market. In July 2020, after operating for five years, Li Auto went public on the NASDAQ, raising $1.1 billion in the process.

Li Auto stands out as a promising electric vehicle startup because it focuses on producing range-extended electric vehicles (REEVs/EREVs), a unique segment in the EV market.

A range-extended vehicle is a type of electric vehicle that comes with an auxiliary power unit (usually a small IC engine) to recharge the vehicle’s battery while it’s running. Despite having an internal combustion engine, EREVs are considered environmentally friendly because the IC unit is only used to charge the battery.

Last week, we welcomed @Li_Auto_ to the @Nasdaq family!

Li Auto is an innovator in China’s new energy vehicle market. Li Auto designs, develops, manufactures and sells premium smart electric SUVs.#LiAutoIPO #NasdaqListed pic.twitter.com/teuNI85jgR

— Nasdaq Exchange (@NasdaqExchange) August 3, 2020

Li Auto EREVs use a standard 1.5L in-line four engine as an extender. They have three popular EV models –

- Li Auto L9 (full-size SUV) powered by a 44.5 kWh battery

- Li Auto L8 (mid-size SUV) powered by a 40.9 kWh battery

- Li Auto L7 (mid-size SUV) powered by a 44.5 kWh battery

The company also revealed its first BEV, called Li Auto Mega, in November 2023. It is a minivan that runs purely on electricity rather than a hybrid drivetrain.

Li Auto now runs more than 2,260 supercharging stations with over 12,300 charging stalls. In 2025, the company’s annual revenue exceeded $20 billion, with a gross profit margin of about 20%.

11. Nio

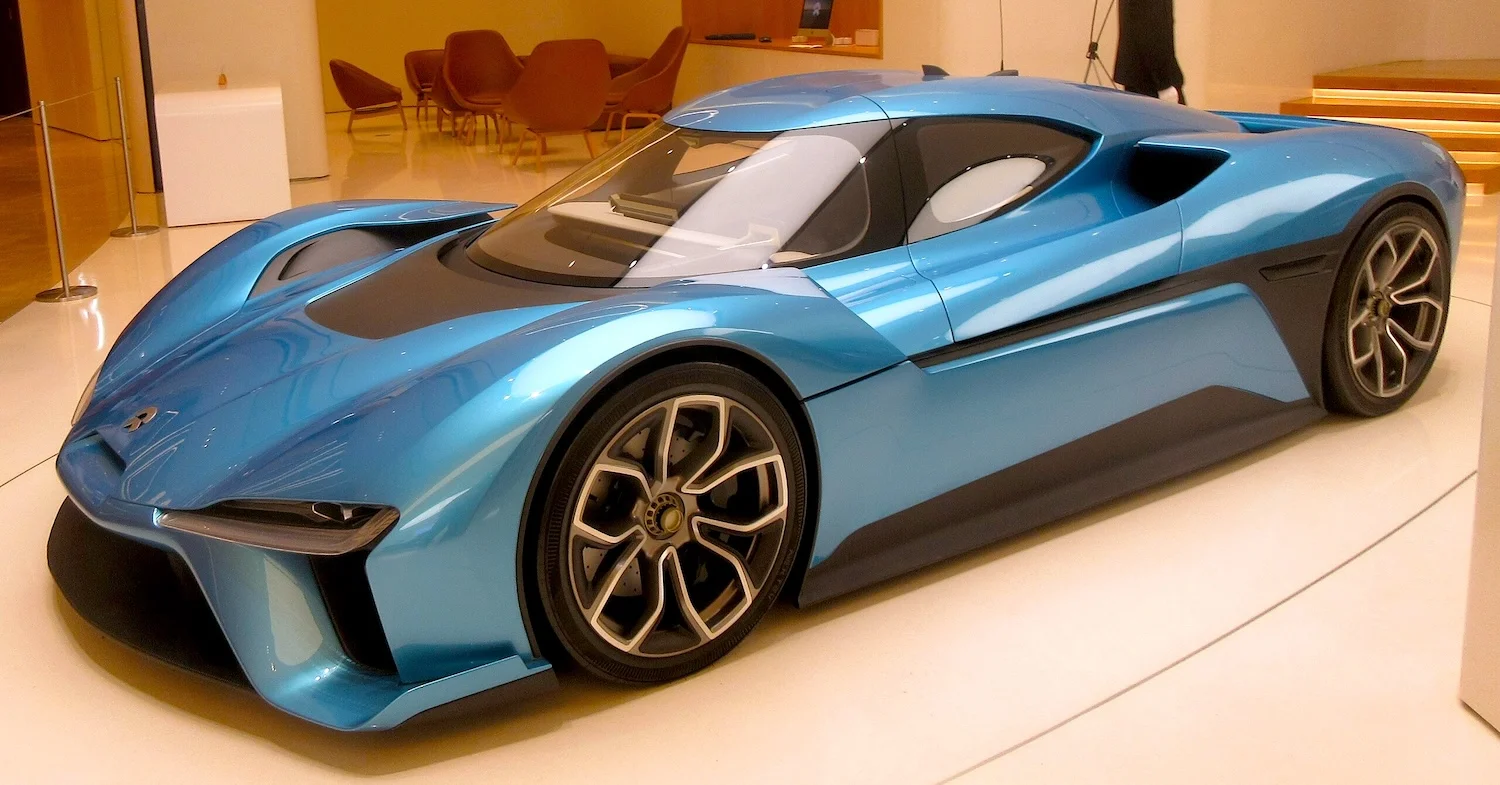

Nio EP9

Nio EP9

Founded in 2014

Annual Sales: 221,970

Nio is another increasingly popular smart EV startup from China. The company was founded in 2014 as NextEV but was rebranded as Nio in 2016.

Although the EV company offers a range of battery-electric sedans and SUVs, you would be surprised to know that Nio’s first-ever product was an electric sports car – Nio EP9 (track-only). The car has a total power output of 1,341 hp and a range of about 427 km.

Apart from manufacturing EVs, Nio also builds battery swapping and supercharging stations for its customers. As of October 2023, Nio has 2,000 power swap stations and 3281 charging stations in China. In Europe, Nio has built 27 Power Swap Stations and 11 Power Charger Stations.

Similar to Tesla’s FSD, Nio boasts its own ADAS software known as Navigate-on-Pilot Plus. NOP+ advanced driver assist software is based on its NT 2.0 platform, which is powered by NIO Adam supercomputer based on four Nvidia Drive Orin systems-on-a-chip (SoC).

According to Nvidia, the NIO Adam supercomputer has a computing performance of 1000 TOPS. In July 2023, Nio announced that NOP+ is out of its beta phase and is now live for customers in the Beijing area. Nio is only the second Chinese EV maker to do so after XPeng’s City NPG Advanced Driver Assist System.

In 2024, NIO delivered 221,970 vehicles, up 38.7% from the previous year. Its main brand accounted for 201,209 units, while the newly launched Onvo sub-brand added 20,761 deliveries. In the first half of 2025, NIO delivered 114,150 vehicles, marking a 30.6% YoY increase.

10. Leapmotor

Meet the #C10 for a new driving fun, igniting the vitality of new energy. #C10 is not just an option, it’s a lifestyle. Add some green to your drive with the #C10! #Leapmotor pic.twitter.com/26UlljUE02

— Leapmotor (@Leapmotorglobal) January 13, 2024

Founded in 2015

Annual Sales: 293,724

Leapmotor is an electric vehicle manufacturing company based in Hangzhou, China. Founded in 2015, the company is known for its tech-first EV ecosystem and the cost-effectiveness of its products.

Leapmotor leverages its in-house R&D capabilities to develop core EV components, such as traction motors and ECUs, and actively embraces a cooperation-based approach to faster growth. Their hatchback model, the T03, is one of the most affordable smart electric cars in Europe.

Its proprietary “Four Leaf Clover” central architecture, which consolidates vehicle computing and reduces complexity, exemplifies its ambition to not just build EVs but also license its tech to other automakers.

Leapmotor’s EV technology has even attracted interest from both domestic and foreign automakers. Back in 2020, Leapmotor signed a partnership with state-owned automaker FAW to research and co-develop smart EV-related products.

Then, in 2023, Stellantis, the owner of brands such as Dodge, Jeep, and Maserati, invested 1.5 billion euros to acquire a 20% stake in the company. Both companies will establish an international joint venture to accelerate Leapmotor EV sales globally.

In 2024, the company delivered 293,724 vehicles, exceeding its annual goal of 250,000 units. By 2025, it achieved its first profitable half-year, reporting a net profit of $4.2 million.

9. Dongfeng Motor Corporation

Mengshi M-Hero 917

Mengshi M-Hero 917

Founded in 1969

Revenue: $14.7 billion+

Dongfeng Motor Corporation is one of China’s four largest state-owned auto manufacturers, alongside SAIC, FAW Group, and Changan Automobile.

The company produces and markets passenger vehicles under multiple brand names (and sub-brands), including Aeolus, Mengshi, Forthing, Voyah, and Dongfeng eπ. It also manufactures passenger vehicles under JVs with foreign automakers such as Nissan, Honda, and Peugeot.

In 2021, Dongfeng Motor sold 3.2 million vehicles, about 79% of which were foreign-branded cars built under JVs. In 2023, Dongfeng sold 671,702 vehicles, out of which 231,000 units were exported.

The company has made a few notable foreign investments in the past. In 2012, Dongfeng acquired T Engineering AB, a Swedish engineering firm, to establish its first R&D facility outside of China.

Then, in 2014, it acquired a 14.1% stake in the French PSA Group for $930 million. Five years later, in 2019, after PSA Group merged with Fiat Chrysler Automobiles (FCA) to create Stellantis, Dongfeng retained a 9.14% stake in the newly formed entity.

However, since 2021, Dongfeng has been reducing its stake in Stellantis and, in the process, has generated more than $2.5 billion in cash. Stellantis is the world’s fourth-largest automaker after Toyota, Volkswagen, and Hyundai Motors.

In 2025, Dongfeng announced a major restructuring plan: its state-owned parent company will take Dongfeng Motor Group private, while separately listing its electric vehicle arm, Voyah, on the Hong Kong Stock Exchange (HKEX).

8. FAW Group

Hongqi Guoli | Image Courtesy: Wikimedia Commons

Hongqi Guoli | Image Courtesy: Wikimedia Commons

Founded in 1953

Annual Sales: 411,777 (2024)

Annual Revenue: $89.5 billion+ (for the whole Group)

FAW Group, or First Automobile Works, is the second-largest Chinese state-owned auto manufacturer based in Changchun, Jilin province. Founded in 1953, it is also the second-oldest automobile company in the country after Changan Automobile.

During its initial years, FAW exclusively produced commercial trucks that were based on Soviet designs. However, by 1958, the company shifted its focus towards passenger vehicles, more specifically luxury sedans, to cater to the needs of political elites.

FAW’s first passenger car was the Dongfeng CA71 sedan, which is also the very first passenger vehicle made in China. In 1958, the company launched the country’s first mass-production model, the Hongqi CA72. The Hongqi brand (meaning “red flag”) is recognized as the oldest passenger car brand in China.

FAW continues to produce and market luxury passenger cars under the Hongqi brand. The other two passenger car brands that operate under FAW are Bestune and Oley. Apart from passenger vehicles, the company manufactures buses, trucks, and auto parts.

FAW Group is one of China’s leading automakers by total sales. In 2023, the company sold around 732,000 vehicles (excluding JVs), out of which about 490,000 were passenger cars. The Chinese automaker has JVs with Toyota, Volkswagen, and GM.

Between 2023 and 2025, FAW plans 30 NEV products, including 8 for Hongqi, 6 for Bestune, and 10 commercial EVs from Jiefang

Key Fact: Many people mistakenly believe that the Hongqi CA72 was the first car ever made in China. In reality, it was the first production model that succeeded the Dongfeng CA71.

7. BAIC Group

Stelato S9

Stelato S9

Founded in 1958

Annual Revenue: $67.58 billion+

Beijing Automotive Group (BAIC Group) is a Chinese state-owned enterprise that produces a diverse range of vehicles, including passenger cars, commercial vehicles, and new energy vehicles. As a state-owned enterprise, it benefits from government support, providing financial stability and policy advantages.

A key aspect of BAIC’s strategy involves joint ventures with international automakers, notably Hyundai and Mercedes-Benz. These partnerships have enabled technology transfer, enhanced production capabilities, and expanded market reach. In fact, a significant portion of BAIC’s sales has historically come from these joint ventures, with 88% of its sales in 2021 attributed to Beijing Benz and Beijing Hyundai.

In 2023, BAIC reported a revenue of $67.58 billion, accompanied by a 17.6% year-on-year increase in vehicle sales, with approximately 1.7 million vehicles sold.

In 2024, BAIC Motor and Hyundai Motor Company agreed to invest $1.1 billion in their joint venture, Beijing Hyundai, signaling a deeper commitment to the Chinese market. That same year, BAIC’s R&D investment surpassed $1.8 billion, focusing on smart cockpits, chips, and intelligent driving.

6. Changan Automobile

Changan’s Avatr 12

Changan’s Avatr 12

Founded in: 1862

Annual Sales: 2.68 million (2024)

Revenue: $20.22 billion (2024)

Chang’an Automobile is the oldest and one of the largest auto manufacturers in China. It produces a wide range of passenger vehicles, including compact cars, sedans, SUVs, and commercial vehicles, such as microvans and light trucks.

As a state-owned company, Chang’an not only has a rich history but is also an increasingly popular car brand, at least domestically. It is a Fortune 500 company.

The origin of Chang’an can be traced back to 1862 during the period of the Tongzhi Restoration. Named after the Tongzhi Emperor (ninth emperor of the Qing Dynasty), the Tongzhi Restoration was an attempt to industrialize and modernize the Chinese economy.

Chang’an was initially founded as the ‘Shanghai Foreign Gun Bureau,’ which was responsible for importing foreign weapons. By the 1880s, the company had begun local weapons production and had become one of the most significant arms suppliers to the late Qing Dynasty.

It was not until 1959 that the company produced its first vehicle – Changjiang Type 46, a Chinese copy of the iconic Willys Jeep. Today, Chang’an produces passenger cars under four major brands, namely, Chang’an, Oshan, Deepal, and Avatar. It also manufactures cars under JVs with Ford and Mazda for the domestic market.

In 2020, the company sold just over 1.3 million vehicles, rising to 1.8 million in 2022 and 2.09 million in 2023. Much of this recent growth has been driven by Changan’s electric vehicle brands, Deepal and Avatr.

Avatr is a premium EV brand that produces fully electric sedans and SUVs for the Chinese market. What makes it particularly interesting is that it was co-developed by Changan, CATL (the world’s largest EV battery manufacturer), and Huawei Technologies.

By leveraging their expertise in various areas of EV technology, these three companies have developed a common platform called CHN to create what they describe as a ‘new generation of smart electric vehicles.’

Changan has outlined an ambitious plan to launch 45 new models worldwide over the next five years, including 37 new energy vehicles (NEVs). The company is also advancing solid-state battery technology, with mass production targeted for 2027.

5. Great Wall Motors

Haval Cool Dog SUV | Image Courtesy: Wikimedia Commons

Haval Cool Dog SUV | Image Courtesy: Wikimedia Commons

Founded in 1984

Annual Sales: 1,233,292

Revenue: $24.38 billion+

Great Wall Motor (GWM) is China’s largest SUV manufacturer and one of the leading automobile companies in the country by sales. Apart from SUVs, the company is also known for its range of crossovers and pickup trucks.

Before 2010, GWM marketed all its cars under one single brand. However, in 2013, the company expanded its brand portfolio to include its various products. Today, it operates two core brands — Haval and GWM — alongside three specialty brands: WEY, Ora (EVs), and Tank (luxury SUVs).

In 2019, Great Wall Motors also entered into a JV (Spotlight Automotive) with BMW to manufacture electric MINI (British brand) cars in China.

Like most other Chinese auto manufacturers, GWM is also trying to exploit the rising electric vehicle market with its EV-focused brand, Ora (short for ‘Open, reliable and alternative’) and Haval. The automaker sold nearly 124,000 EVs in 2022.

GWM has always been an export-focused company. It was one of the first Chinese automakers to sell its products internationally and also one of the first to enter the European Union. Since 2021, Australia has been the biggest export market for GWM.

As of today, GWM has over 700 international sales channels and exports its vehicles to 170+ countries. The company has unveiled its “New Four Modernizations” strategy, which focuses on localization in production, operations, branding, and supply chains. Looking ahead, GWM aims to achieve annual overseas sales of 1 million units by 2030.

Fact: Great Wall Motor appeared in the popular Dakar Rally between 2010 and 2015 with modified Haval 3 and Haval 8 models. The team achieved its best position in the 2012 and 2013 events when it finished 6th.

4. Chery

Chery Holdings Group sold 212,076 cars in November, achieving a year-on-year sales growth of 111%, breaking the 200,000 mark for the second consecutive time this year and setting a new monthly sales record.#Chery pic.twitter.com/39WSGfONj5

— Chery International (@CheryAutoCo) December 5, 2023

Founded in 1997

Annual Sales: 2,603,916 (2024)

Revenue: $65.52 billion

Chery Automobile is a state-owned company and one of the largest automakers in China. Founded in 1997, Chery is a relatively young company compared to other large government-owned automotive companies in the country.

Chery Auto produces passenger cars, sedans, and SUVs under the Chery brand, as well as commercial vehicles under the Karry brand. The company also manufactures passenger cars under several smaller brands, including Exeed, Jetour, Chery NEV, and iCar.

Historically, Chery has been one of the top Chinese auto exporters. According to the China Association of Automobile Manufacturers (CAAM), in 2022, the annual export of Chinese vehicles totaled 3.1 million, with Chery Group accounting for 452,000 units.

In 2024, Chery Holding exported 1,144,588 vehicles, marking a strong 21.4% YoY increase. Its new energy vehicle (NEV) sales surged 232.7% YoY to 583,569 units. In total, the company sold 2.6 million vehicles during the year, up 38.4% from 2023, with revenue climbing by more than 50%.

The company has more than 1,500 distribution and service outlets in 80+ countries. Like most other Chinese auto companies, Chery focuses on independent research and innovation. It has four R&D centers in China, the United States, Germany, and Brazil.

Chery is a member of Harmony Intelligent Mobility Alliance (HIMA), an alliance of automotive companies in China that co-develops smart cars with technology company Huawei. Under this collaboration, Chery has developed the Luxeed S7 sedan, featuring Huawei’s ADS 2.0 self-driving system, which includes self-parking capabilities.

3. SAIC Motor

Urban SUV, the electric way.#MG #MGUK #MGMotor #MGMotorUK #MGZSEV #SUV #EV #ElectricSUV pic.twitter.com/FdCaM8sViH

— MG Motor UK (@MGmotor) January 8, 2024

Founded in: 1955

Annual Sales: 4.6 million (2024)

Revenue: $91.41 billion

SAIC Motor, earlier known as Shanghai Automotive Industry Corporation, is the largest state-owned car manufacturing company in China. In 2023, SAIC sold approximately 5.02 million vehicles, solidifying its position as the top domestic automaker for the 18th consecutive year. It is a Fortune 500 company.

Although SAIC was founded in the 1950s, it achieved the status of a large passenger vehicle manufacturer only in recent years.

One of the primary reasons behind its emergence was the joint cooperation with Volkswagen in 1984, which brought major foreign auto technology to China. It signed another major joint venture with General Motors in 1997. Both the JVs are still in operation.

From 2010 to 2022, SAIC sold the highest number of vehicles among the largest Chinese auto companies and was only surpassed by BYD in 2023. SAIC-owned brands include IM Motors (EV), Rising Auto, Maxus, Roewe, and MG Motors.

Out of all, MG is perhaps the most popular auto brand under SAIC. The origin of the brand can be traced back to the 1920s, when it was established as Morris Garages Limited in Oxford, England. It is mostly known for producing affordable sports cars.

MG offers a wide range of products, including sedans, hatchbacks, and crossover SUVs. It also produces an electric sports car. It is one of the best-selling brands in many countries, including Australia, Mexico, Thailand, and India.

However, in terms of total sales, the company’s leading brand is Wuling, a joint venture between SAIC Motor, General Motors, and Guangxi Auto. Focused mainly on the domestic market, Wuling produces sedans, SUVs, and minivans, and in 2023, it accounted for nearly half of the company’s total sales.

In 2025, SAIC Motor partnered with Huawei to co-develop smart electric vehicles. The company also strengthened its strategic collaboration with battery giant CATL, focusing on after-sales battery support and expanding overseas service networks.

2. Geely

Lynk & Co 08

Lynk & Co 08

Founded in: 1986

Annual Sales: 2,176,567

Revenue: $33.11 billion+ (2024)

Geely, short for Zhejiang Geely Holding Group, is one of the largest privately owned automakers in China.

Founded in 1986, Geely has created a massive auto empire that involves some of the world’s most popular companies, such as Volvo Cars, Lotus, and Benelli (through a subsidiary). It also has a significant stake in British auto manufacturer Aston Martin.

The group conducts its automotive business, both foreign and domestic, through several separate divisions. Its original business division, Geely Auto, produces compact sedans and SUVs mainly for the domestic market but also exports them abroad.

As it stands, Geely Auto produces and markets passenger vehicles under five brands –

- Geely: The group’s best-selling brand, manufactures conventional/IC cars

- Lynk & Co: Semi-premium brand

- Geometry: Entry-level EV brand

- Zeekr: Luxury EV brand, and

- Galaxy: Premium EV brand

Zeekr, Geely’s luxury EV brand, was founded in 2021 and competes with Chinese EV startups like Nio. Recently, Zeekr has co-developed an all-electric robotaxi with Google’s Waymo, which is undergoing testing.

Geely Group also produces passenger vehicles under brands such as Polestar, Radar (high-end pickup trucks), Jidu Auto, Ji Yue (JV with Baidu), and Smart (JV with Mercedes-Benz). Its operations in Volvo, Lotus, commercial vehicles, and JVs are conducted under separate divisions.

Geely’s acquisition of Volvo Cars in 2010 is now considered one of the most successful large merger deals in recent history. Under Geely, the company has been able to make a turnaround and is now profitable. On the flip side, Geely now has access to Volvo-developed technologies.

In 2022, Geely DHE1.5 surpassed BYD’s Xiaoyun to become the world’s most energy-efficient engine with a Brake Thermal Efficiency of 43.32%. This means that the engine converts 43.32% of chemical energy to movement.

In 2024, Geely Auto achieved record sales of 2,176,567 vehicles, up 34% YoY. Growth was fueled by robust international expansion, with exports climbing 57% to 414,522 units, and a near doubling of new energy and electrified vehicle sales, which reached 888,235 units.

1. BYD Auto

Inviting luxury for the fiercely untamed.#BYD #BuildYourDreams pic.twitter.com/Y4mEZ09sO6

— BYD Global (@BYDGlobal) February 9, 2024

Founded in: 2003

Annual Sales: 4.27 million+ (2024)

Revenue: $107 billion (for BYD Group)

BYD is perhaps the most recognized Chinese EV brand in the world. It is not only the largest manufacturer of passenger EVs but also one of the largest producers of battery electric buses and trucks in China. The company sells passenger battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) globally.

Although BYD Auto was established in 2003, the company didn’t start production of electric vehicles until 2008, when it introduced the F3DM, a plug-in hybrid electric version of its first IC model, BYD F3.

The F3DM was the world’s first mass-produced plug-in electric passenger vehicle. It was replaced by BYD Qin and subsequently BYD Qin Plus, which became one of the best-selling plug-in electric cars in the world.

What is fueling BYD’s growth in the international markets?

In 2023, BYD exported about 242,000 units in 70 countries, compared to just over 55,000 units the previous year. Due to this massive fourfold surge in demand and better market response, BYD has also entered into shipping. It will build an entire fleet of specialized ships to transport thousands of cars to Europe and other export markets.

What’s more? BYD outsold Tesla in quarterly numbers for the first time in the 4th quarter of 2023. The key drivers behind BYD’s dominance are its advanced technology and highly competitive pricing.

Over the years, BYD has made several key advancements in EV technology. One such technology is the BYD Dual mode hybrid platform (including DM-i/DM-p/DMO), which is currently used in its plug-in hybrid electric cars.

The DM-i hybrid technology focuses on making EVs more energy efficient, while DM-p technology prioritizes performance. BYD has a dedicated engine for its PHEVs called ‘Xiaoyun.’ The engine has a high compression ratio of 15:1 and a Brake Thermal Efficiency of 43%.

BYD has also developed a lithium-iron-phosphate battery, dubbed the Blade Battery, which, according to the Chinese automaker, offers better energy density and is safer than conventional LFP batteries.

In 2023, Tesla announced that it would start using BYD Blade batteries with faster charging for its Model Y at the Berlin Gigafactory. It shows BYD’s technological prowess and its potential, which led the world’s richest investor, Warren Buffett, to invest in the company.

In 2024, BYD set a new record with global sales of 4.27 million new energy vehicles (NEVs), up 41.26% from the previous year. Nearly 90% of BYD’s sales were generated from the Chinese market.

References

- 2024 car production statistics – International Organization of Motor Vehicle Manufacturers (OICA)

- China overtakes Japan as world’s top car exporter – BBC Global

- China exported nearly 6.4 million vehicles in 2024 – Reuters

- Production of cars in China from 2013 to 2025, by type – Statista

Read More

A well written compilation of history, monetary background, government involvement,

involvement in world markets, sales, photos and ranking of Chinese cars . A viewpoint from all the important views of products not known generally in America.