The global tire industry produces nearly 3 billion tires annually, serving passenger cars, trucks, buses, aircraft, agricultural machinery, construction equipment, and two-wheelers. [1]

In value terms, the global tire market is estimated at roughly $185 billion and projected to exceed $216 billion by 2030, making it larger than many entire automotive sub-sectors and comparable in scale to the global auto components industry. [2]

Scale is everything in tire manufacturing. A modern high-capacity tire plant can require investments of $500 million to over $1 billion, while raw materials such as natural rubber, synthetic rubber, carbon black, steel cord, and silica account for a substantial share of production costs.

Plus, the rise of EVs and sustainability regulations is further reshaping the competitive environment. EV-specific tires must handle higher torque, greater vehicle weight, and stricter noise requirements, pushing manufacturers to invest heavily in R&D.

At the top of this vast market sits a relatively small group of dominant manufacturers. I present the largest tire manufacturers that lead the global market through scale, technological innovation, and strong OEM partnerships.

Did you know?The global tire recycling market is estimated to reach $8.46 billion by 2030, growing at 3.71% CAGR. This steady growth is mainly driven by government bodies and construction companies, which are increasingly using recycled tire materials for road paving, sound barriers, and playground surfaces to improve durability and support sustainability goals. [3]

Table of Contents

16. Kumho Tire

Founded: 1960Headquarters: Gwangju, South Korea

Revenue: $3.36 billion+

Number of Employees: 5,000+

Competitive Edge: Strong balance of price and performance

Kumho Tire is a value-to-performance global player with a long history in passenger car and commercial vehicle tires. Over the decades, the company built its reputation through strong OEM relationships, particularly with Korean and Asian automakers.

Its product portfolio covers a full range of tires: from everyday passenger car tires (e.g., Solus, Sense series) to performance (Ecsta), eco-friendly (Ecowing), winter (Wintercraft), and specialty rubber products.

They have multiple manufacturing plants in South Korea, China, Vietnam, and the United States (Georgia), plus R&D centres across key markets to support localised product development and testing.

Kumho actively tests tires with embedded sensor modules that monitor pressure, temperature, and road wear in real-time. In 2025, the company partnered with Ansible Motion to integrate the Delta S3 Spin driving simulator. This enables engineers to “drive” a digital tire before a physical prototype is even built, reducing development time and costs by up to 40%. [4]

15. Giti Tire

Headquarters: Singapore

Revenue: $3 billion+

Number of Employees: 28,000+

Competitive Edge: AdvanZtech EV-ready strategy

Giti Tire is one of the largest global tire manufacturers to emerge from Southeast Asia, with a business model built around scale manufacturing, strong OEM relationships, and global exports.

It operates multiple large-scale manufacturing facilities, many of which are developed as export-focused plants supplying North America, Europe, and the Asia-Pacific.

The company markets multiple brands, such as Giti, GT Radial, Primewell, Runway, and Dextero. These brands target different market segments, from value to premium and performance.

It has emphasized next-generation tires such as those under its AdvanZtech EV-Ready strategy, targeting performance and eco-efficiency for electric and hybrid vehicles.

In 2024, Giti Tire ranked 9th worldwide by tire brand value. In 2025, it was awarded the “3 Hearts of Good Company” title for demonstrating corporate purpose impact across people, environment, governance, and economy. [5]

14. Apollo Tyres

Founded: 1972Headquarters: Haryana, India

Revenue: $3 billion+

Number of Employees: 17,500+

Competitive Edge: Strong focus on SUV

Apollo Tyres follows a dual-market, multi-brand strategy. It focuses on high volumes in emerging markets while building a premium presence in developed regions.

To support this approach, the company uses two global brands: Apollo for mass and commercial markets, and Vredestein for premium passenger vehicles. This helps Apollo Tyres balance scale with higher-value positioning.

It operates five manufacturing plants in India and two in Europe (the Netherlands and Hungary), producing tires for a broad array of vehicles, including passenger cars, two-wheelers, SUVs, trucks and buses, agricultural and industrial vehicles, and off-highway segments.

In 2025, the company earned an A- leadership score in Climate Change and Water Security, showcasing progress on environmental stewardship. Its long-term strategy is strongly focused on sustainability, with goals such as Net Zero emissions by 2050 and using 40% sustainable materials by 2030.

13. Balkrishna Industries

Headquarters: Mumbai, India

Revenue: $1.22 billion+

Number of Employees: 7,000+

Competitive Edge: Pure Off-highway specialization

Balkrishna Industries (BKT) is one of the world’s leading specialists in off-highway tires, operating in a niche that is fundamentally different from mass-market passenger tire manufacturing.

Unlike companies focused on cars and trucks, BKT concentrates almost entirely on agriculture, mining, construction, earthmoving, port, and industrial tires. They offer 3,200+ SKUs spanning cross-ply and radial constructions. [6]

The company supplies tires both as original equipment to equipment manufacturers and in the replacement market, especially in North America and Europe, where much of its business is aftermarket-oriented.

Financially, BKT reported $1.2 billion in net revenue in FY 2025. The company delivered strong profitability compared to peers, with an operating profit margin of 24% and a return on equity (ROE) of 15%.

12. Toyo Tires

Headquarters of Toyo Tires

Headquarters of Toyo Tires

Headquarters: Hyogo, Japan

Revenue: $3.9 billion+

Number of Employees: 11,200+

Competitive Edge: Focus on high-performance and off-road tires

Toyo Tires is a mid-sized Japanese tire manufacturer best known for its strong presence in the performance, SUV, and off-road tire segments. It designs, manufactures, and markets a broad range of tire products (including summer, winter, all-season, off-road, and commercial truck and bus tires) for both the Original Equipment (OE) and replacement markets.

Unlike mass-market manufacturers, Toyo has intentionally avoided aggressive expansion into ultra-low-cost or commodity tire categories. Instead, it emphasizes high-performance road tires (Proxes) and SUV/off-road tires (Open Country), where customer loyalty, brand differentiation, and aftermarket demand are strong.

In the United States, Toyo Tire has built a strong reputation among SUV, pickup truck, and off-road users, mainly because of its Open Country tire range. These tires usually sell at higher-than-average prices, especially in the all-terrain and mud-terrain segments.

The company operates distinct brands: Toyo, Nitto, and Silverstone. This strategy helps them target performance, premium, and value segments simultaneously, broadening market reach.

They also make industrial rubber and synthetic products, such as anti-vibration parts, hoses, and waterproof materials, contributing to broader mobility solutions.

11. Hankook Tire

Headquarters: Seongnam, South Korea

Revenue: $12.9 billion+

Number of Employees: 20,000+

Competitive Edge: Strong OEM penetration

Hankook Tire is South Korea’s largest tire manufacturer and one of the fastest-rising global players in the tire industry.

It has established manufacturing facilities in South Korea, China, Hungary, Indonesia, and the USA, with additional technical centres in Daejeon (Korea), Akron (USA), Hannover (Germany), Osaka (Japan), and China.

The company manufactures nearly 100 million tires annually and supplies them to 160+ countries worldwide, serving passenger cars, SUVs, light trucks, commercial vehicles, and performance segments.

Hankook Tire sells its products under several brands, including Hankook, Ventus, Laufenn, Kingstar, Dynapro, Smart, and VanTRa. These brands cover everything from premium to value segments, helping the company reach a wide range of customers and strengthen its global presence.

In 2025, Hankook introduced the Optimo sub-brand in Europe, broadening its product range to include more value-oriented offerings tailored for regional market needs.

10. Madras Rubber Factory

MRF OTR Tire

MRF OTR Tire

Headquarters: Madras, India

Revenue: $3.35 billion+

Number of Employees: 17,800+

Competitive Edge: Densest tire distribution networks in India

Madras Rubber Factory (MRF) is widely regarded as the benchmark brand for truck and bus tires in India, where reliability and durability matter more than price alone. Brand Finance has ranked it as one of the world’s strongest tire brands with a AAA- grade. [7]

From humble beginnings making latex balloons and gloves, MRF quickly moved into tread rubber production in 1952 and then tyre manufacturing in the early 1960s through a technical partnership with Mansfield Tire & Rubber Company of the USA.

It soon became a market leader in India’s tyre segment, capturing domestic market share and expanding internationally with exports throughout the Middle East and later North America

Today, MRF produces a broad range of tyres for passenger cars, two-wheelers, three-wheelers, commercial trucks and buses, off-the-road vehicles, farm tractors, as well as specialty tyres. It also manufactures tubes, flaps, conveyor belts, sports goods, paints, coatings, and toys (through Funskool).

Annual revenues have risen steadily from $2.51 billion in 2021 to $3.34 billion in 2025, reflecting sustained demand and market expansion.

They are now focusing on developing a dedicated range of tyres for the growing EV market. These are engineered with ultra-low rolling resistance, superior traction, and enhanced noise suppression. They have already begun supplying EV tyres to major OEMs across passenger, commercial, and two/three-wheeler segments.

9. Sumitomo Rubber Industries

Founded: 1909Headquarters: Hyogo, Japan

Revenue: $8 billion+

Number of Employees: 38,000+

Competitive Edge: Strong OEM relationships in Asia

Sumitomo Rubber Industries (SRI) is a Japanese multinational tire and rubber products manufacturer and a core company within the Sumitomo Group, one of Japan’s oldest and most prestigious business conglomerates.

It sells tires under well-known brands such as Dunlop, Falken, and Sumitomo Tires. While Dunlop contributes strong volume and OEM penetration, Falken targets enthusiast, motorsport, and performance segments, allowing SRI to balance scale with brand-led differentiation.

Beyond tires, SRI’s innovation also extends to sports equipment (golf, tennis) and industrial rubber products (flooring materials, vibration dampers, hoses, artificial turf).

However, the tire business accounts for the largest share of revenue (over 80%). In FY 2024, the company reported consolidated revenue of ~$8 billion, with total tire sales of over 103 million units.

In 2025, Sumitomo Rubber Industries (SRI) shared its long-term plan called R.I.S.E. 2035. The goal is to create new value from rubber by focusing on strength and reliability, innovation, smart solutions, and long-term growth.

As part of this vision, SRI plans to make premium tires account for 60% of its sales by 2030 and grow its non-tire businesses to contribute 30% of total earnings by 2035.

8. Zhongce Rubber

Headquarters: Zhejiang Province, China

Revenue: $6.4 billion+

Number of Employees: 18,000+

Competitive Edge: Unmatched production scale in China

Zhongce Rubber Group is China’s largest tire manufacturer by production volume. It produces tires for cars, trucks, motorcycles, bicycles, agricultural machinery, and other vehicles.

The Group has cultivated a broad portfolio of brands, including Chaoyang (its oldest and most popular domestic brand), Westlake, Goodride, Arisun, Trazano, and Yartu.

Westlake brand, in particular, has gained strong traction in North America, Europe, the Middle East, and Africa. Westlake tires compete in the value-to-mid-tier segments, offering competitive pricing with steadily improving quality.

Zhongce Rubber has a vast global reach. Its tires are sold through over 250,000 retail stores and distributed by more than 1,200 dealers worldwide.

The company operates over 11 large production bases, supported by advanced R&D and testing facilities. It invests heavily in technology and quality upgrades, including noise-testing labs, X-ray inspection systems, and collaborations with international engineering teams to improve product standards.

In 2025, Zhongce Rubber made its debut on the Shanghai Stock Exchange. It was one of the largest tire industry IPOs of the year, raising approximately $580 million. [8]

7. Yokohama Rubber Company

Yokohama Advan racing tires

Yokohama Advan racing tires

Headquarters: Hiratsuka, Japan

Revenue: $7 billion+

Number of Employees: 34,000+

Competitive Edge: Strong focus on SUVs and off-road vehicles

Yokohama Rubber Company is one of Japan’s most established tire manufacturers and a global mid-to-large-scale player, sitting between ultra-premium giants and low-cost mass producers.

Yokohama’s tire business is best known for its strong performance and off-road heritage, especially through its ADVAN and GEOLANDAR product families. While passenger car and light truck tires account for the majority of unit volume, truck and bus tires provide higher average selling prices and stable fleet-driven demand.

Beyond tires, the company also produces aluminum alloy wheels, high-pressure hoses, conveyor belts, marine hoses, and aerospace components. Although smaller than the tire division, this business adds earnings stability and leverages the company’s core rubber and polymer expertise.

In FY 2024, Yokohama exceeded $7 billion in consolidated sales revenue for the first time, with business profit rising to $859 million (12.3 % margin). In FY 2025, the company continued to show growth, with revenue up 12% year-on-year and business profit up over 20%.

6. Sailun Group

Founded: 2002Headquarters: Shandong Province, China

Revenue: $4.76 billion+

Number of Employees: 21,000+

Competitive Edge: Strategic overseas manufacturing, Rapid capacity expansion

Sailun Group is one of China’s largest and fastest-growing tire manufacturers. Founded in 2002, it has shown impressive growth and now distributes products to over 180 countries.

Its product portfolio is broad, covering passenger car tires, light truck and SUV tires, truck & bus tires, construction machinery tires, off-the-road (OTR) tires, and tire recycling solutions. It also produces semi-steel radial tires and full-steel radial tires.

By the end of 2024, Sailun reported $4.4 billion in operating revenue and $5.5 billion in total assets. In 2025, it completed the acquisition of Bridgestone’s Shenyang plant (for $37 million), strengthening its manufacturing presence in China’s commercial tire market.

5. Pirelli

Headquarters: Milan, Italy

Revenue: $7.5 billion+

Number of Employees: 30,000+

Competitive Edge: Exclusive partnerships with elite racing series

Pirelli is known less for sheer volume and more for its premium, high-performance positioning. Unlike mass-market rivals, Pirelli focuses almost entirely on high-value passenger car tires, particularly for luxury, sports, and prestige vehicles.

Its brand presence is uniquely tied to both everyday performance tires and high-profile motorsport engagement. In fact, it has been the exclusive tire supplier to the FIA Formula 1 World Championship for many years and also supplies tires to World Superbike and other racing series.

Pirelli invests heavily in research and development, with around 2,000 R&D professionals working on advanced tire technologies. It holds about 5,900 patents worldwide. Its innovative products, such as Elect tires for electric vehicles and Cyber tires with embedded sensors, demonstrate the company’s focus on future mobility needs. [9]

In terms of reach, the company operates commercially in over 160 countries, with a network of around 14,600 distributors and retailers, and a manufacturing footprint spanning 19 production sites across 12 countries.

4. Goodyear Tire & Rubber Company

Headquarters: Ohio, United States

Revenue: $18.3 billion+

Number of Employees: 68,000+

Competitive Edge: Global brand and heritage, Diverse Product Range

Goodyear manufactures tires for a broad range of vehicles, including passenger cars, commercial trucks, aviation, motorcycles, and heavy off-road machinery. It also supplies tires for motorsports and specialised applications.

The company has historically positioned itself as a balanced volume-and-value manufacturer. Passenger and light truck tires account for the largest share of unit volume, particularly in North America, where Goodyear is the market leader.

Commercial truck tires, aviation tires, and specialty products contribute to higher margins and help stabilize profitability during passenger vehicle cycles. In FY 2025, Goodyear reported $18.3 billion in revenue and $3.3 billion in gross profit, with tire unit volumes exceeding 150 million. [10]

Its presence is extensive: the company operates 57 facilities worldwide and runs 1,240 Goodyear tire and auto service centres. It has also set a goal to launch its first tire made entirely from sustainable materials by 2030. [11]

3. Continental

Headquarters: Hanover, Germany

Revenue: $27.2 billion+

Number of Employees: 95,000+

Competitive Edge: Strong OEM relationships with premium automakers

Continental is among the top four global tire manufacturers by sales. Passenger car and light truck tires make up most of its sales volume, while truck, bus, and specialty tires contribute higher profit margins.

Continental is perhaps best known to many consumers for its tire products, but its business is much broader. It develops and manufactures systems for brake systems, vehicle electronics, powertrain and chassis components, automotive safety systems, and advanced driver-assistance technologies. In fact, it is a key partner to nearly every major automobile manufacturer worldwide.

The tire segment brings in significant revenue through tire sales and related services for both vehicle manufacturers (OEMs) and aftermarket customers. In FY 2025, the Group generated over $27.23 billion in revenue and $6.79 billion in gross profit.

Their long-term strategy is centered on innovation and sustainability. The company invests roughly 10% of its sales in R&D, focusing on EV-ready tires, ultra-low rolling resistance, noise reduction, and sustainable materials. Plus, it has publicly committed to achieving over 40% renewable and recycled material usage by 2030.

2. Bridgestone

Headquarters: Tokyo, Japan

Revenue: $22 billion+

Number of Employees: 121,000+

Competitive Edge: Advanced materials & R&D capability

Bridgestone is a Japanese multinational tire and rubber-products giant, supplying tires for passenger cars, trucks, buses, aircraft, motorcycles, agricultural machinery, mining equipment, and motorsports.

The company is capital-intensive and vertically integrated. It designs compounds and manufactures tires (mixing, building, and curing), while also handling distribution, retail, and service networks in many markets.

In recent years, they have invested heavily in premium and EV-specific tire technologies, new manufacturing capacity in growth markets, and advanced R&D (including airless tire concepts and circular-economy initiatives).

The company has been actively working on airless tire technology and testing puncture-proof tire concepts (in collaboration with rivals like Michelin). In 2025, they showed significant progress, successfully testing airless tires that could carry around 1-ton loads at speeds of up to 60 km/h. [12]

1. Michelin

Headquarters: Clermont-Ferrand, France

Revenue: $26.7 billion+

Number of Employees: 125,000+

Competitive Edge: Premium brand & Pricing power

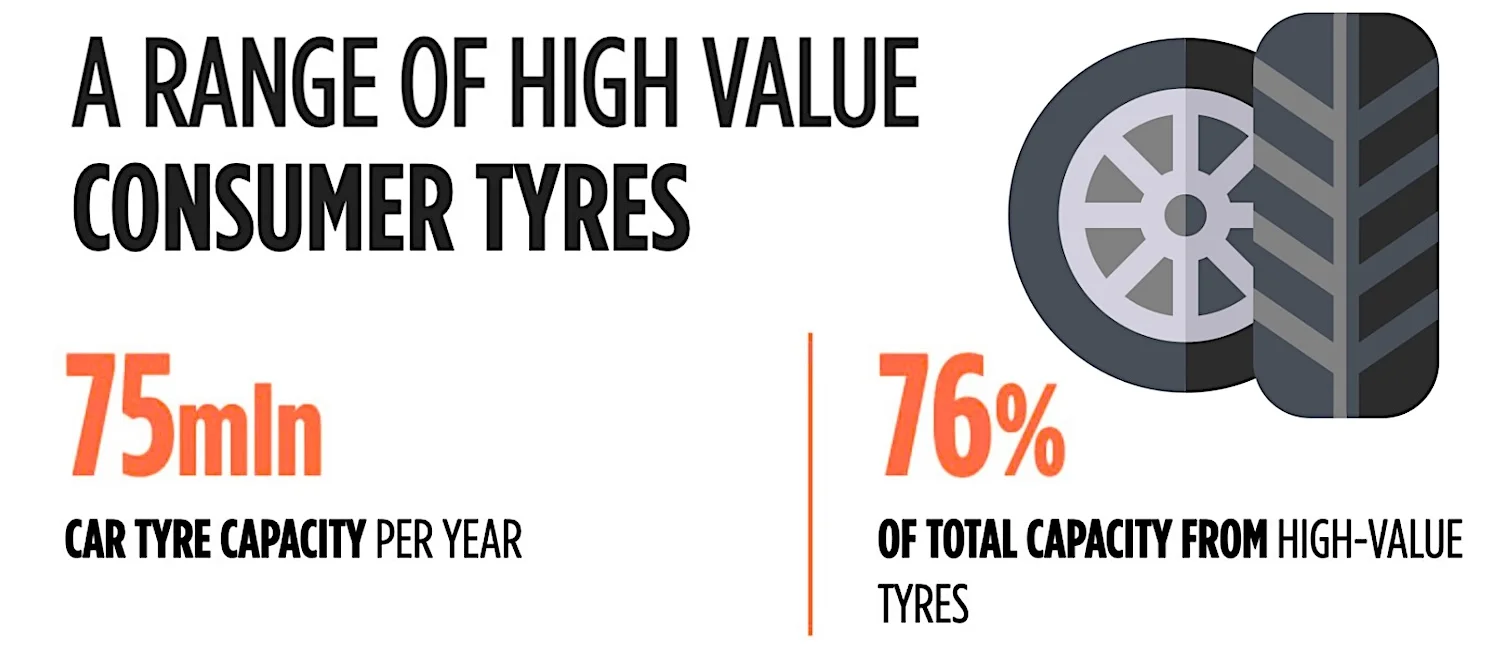

Michelin is the world’s largest tire manufacturer by annual revenue. In FY 2025, it generated about $26.7 billion in revenue, surpassing its closest competitors like Bridgestone and Goodyear.

What truly sets Michelin apart at scale is its strong focus on premium, high-performance tires. While passenger car tires represent the majority of unit volume, a substantial share of the company’s profits comes from commercial truck tires, specialty tires, aircraft tires, and high-end performance segments, where pricing power is substantially higher.

The company has long been at the forefront of technological innovation. It has pioneered the removable pneumatic tire, radial tire technology, and run-flat and asymmetric designs that enhance performance, safety, and longevity.

Beyond tires, the company has diversified into mobility services and travel publications, most famously the Michelin Guides, which rate restaurants and hotels worldwide.

They continue to follow the “Michelin in Motion 2030” strategy, which focuses on sustainable growth, expanding the use of high-tech materials, and reducing environmental impact. Key goals include a 50% reduction in carbon dioxide emissions by 2030 (compared to 2010 levels) and using 40% recycled or renewable materials by 2030. [13]

Read More

Sources Cited and Additional References- Paul M. Mayer, Emerging environmental impacts of tire wear particles, ScienceDirect

- Industry Report, Automotive tires market size & share analysis, ModorIntelligence

- Industry Report, The global tire recycling market size and trend analysis, GrandViewResearch

- TyrePress, Ansible Motion and Kumho Tire partners to develop next-generation digital tyres, LinkedIn

- News, Giti Tire was awarded the title of “3 Hearts of Good Company,” Giti Tire

- Insights and Forecast, Arvind Poddar unveils the story of this globally acclaimed brand, BKT

- MRF: India’s most valuable and fastest-growing tyre brand, BrandFinance

- News, Hangzhou’s Zhongce Rubber launches largest A-share IPO, eHangzhou

- History, The company focuses on the high-value tire market, Pirelli

- Company Financials, Goodyear’s gross profit throughout the years, Macrotrends

- News, Goodyear progresses along its path to a 100% sustainable-material tire, PR Newswire

- Vehicles, Bridgestone and Michelin test advances in puncture-free tyres, Financial Times

- Innovation, Michelin’s sustainable growth strategy for 2030, Michelin