With over $23 billion in annual revenue and a vast network of 5,000+ retail stores, Sherwin-Williams stands tall as the world’s largest paint and coatings company. It has spent more than 150 years building an industrial empire that touches everything from residential repainting to marine coatings and aerospace finishes. [1]

The company holds approximately 11.4% share of the global paints and coatings industry, with a particularly dominant footprint in North America. It also leads in the professional contractor segment, an area where brand loyalty, in-store tinting expertise, and distribution scale are critical.

However, in today’s hyper-competitive and innovation-driven market, even giants aren’t immune to challengers.

In the following sections, I’ll explore the top Sherwin-Williams competitors, analyzing their size, strategies, product innovations, and market reach. These companies are racing ahead in international markets, investing in R&D for sustainable coatings, powder paints, and smart technologies.

Did you know?The global paints and coatings market size is expected to exceed $217 billion by 2032, growing at a CAGR of 4.5%. The United States alone is expected to contribute $43.4 billion to the total market by 2032, driven by increasing demand for low-VOC and zero-emission coatings. [2]

Table of Contents

13. Hempel Group

Founded: 1915Revenue: $2.5 billion+

Geographic Focus: Europe, Asia, and the Americas

Core Rivalry: Protective coatings

Competitive Edge: Leading marine coatings specialist

Hempel Group is one of the world’s largest manufacturers and suppliers of protective coatings and paints. It has a presence in 100+ countries, with more than 25 production sites and 45 R&D centers.

The company serves a broad range of industries, from shipping and bridges to oil rigs, wind turbines, and commercial buildings. Unlike many paint companies that focus heavily on DIY retail, Hempel’s core business lies in high-performance industrial and protective coatings, where durability, corrosion resistance, and environmental compliance are critical.

It is owned by the Hempel Foundation, which reinvests profits into both business innovation and philanthropic causes such as science education, biodiversity, and sustainable development. This structure enables long-term thinking without short-term shareholder pressures.

In 2024, Hempel reported $2.5 billion in revenue and an adjusted EBITDA of $454 million, with a margin of 17.9%. The company also recorded a significant increase in free cash flow, reaching $161 million. [3]

12. Benjamin Moore

Founded: 1883Revenue: $1 billion+

Geographic Focus: North America

Core Rivalry: High-end residential segment

Competitive Edge: Premium product reputation, Independent dealer channel

Founded in Brooklyn, New York, Benjamin Moore has spent more than 140 years cultivating a strong reputation for quality, innovation, and color excellence.

In 2000, it became a wholly owned subsidiary of Berkshire Hathaway, allowing it to maintain operational independence while benefiting from Warren Buffett’s long-term ownership philosophy.

The company operates primarily in the residential and commercial paint markets, with its products distributed through a network of over 7,500 independently owned paint and decorating retailers, mostly in the US and Canada.

Unlike Sherwin-Williams, Benjamin Moore does not operate through company-owned stores. Instead, it follows a partnership-driven model that supports and empowers local retailers. This approach has helped the brand build a loyal customer base, particularly among contractors, interior designers, and high-end DIY homeowners.

Rather than pursuing mass-market volume like Sherwin-Williams or PPG Industries, Benjamin Moore focuses on delivering exceptional quality and craftsmanship at premium prices, positioning itself as a luxury brand in the paint industry.

Benjamin Moore’s signature offerings, including Aura, Regal, Select, and Ben lines, provide high-performance finishes with low or zero VOCs (volatile organic compounds). For example, products like Aura feature proprietary “Color Lock” technology that resists fading and maintains rich pigmentation for longer durations. [4]

11. Behr Paint

Revenue: $1.6 billion+

Geographic Focus: USA, Canada, Mexico

Core Rivalry: Consumer/DIY market

Competitive Edge: Exclusive partnership with The Home Depot

Behr Paint is a leading architectural coatings company for DIYers and professionals in North America, especially the US and Canada. Its color tools, mobile apps, and online paint calculators are widely used and appreciated by homeowners looking for a hassle-free painting experience.

The brand is best known for its premium interior and exterior wall paints, stains, primers, and specialty coatings. Its flagship products, such as Behr Premium Plus, Marquee, and Ultra, consistently receive top ratings for coverage, durability, and color accuracy from independent consumer reports.

As a wholly owned subsidiary of Masco Corporation, Behr operates a single-channel, exclusive distribution model. Its products are sold solely through The Home Depot.

The brand is well-regarded by consumers. In the 2023 J.D. Power Paint Satisfaction Study, Behr ranked highest in exterior paint satisfaction. Consumer Reports has also listed Behr Ultra and Marquee among its top-performing paints. [5]

10. 3Trees Coatings

Founded: 2002Revenue: $1.6 billion+

Geographic Focus: China

Core Rivalry: Asia’s high-growth construction & decorative segment

Competitive Edge: Green innovation, 3,000+ branded stores across China

3Trees Coatings’ corporate culture is centered on “Imitation of Nature” and sustainability. The company has developed “health +” formulations like air-purifying, antibacterial, and ultra-low-formaldehyde coatings. They have also invested in zero-carbon factories, green design, and social welfare initiatives.

In 2019, 3Trees ranked first in the coatings category on the list of “China’s 500 Most Valuable Brands,” with a brand value of $3.3 billion. The company became the exclusive paint supplier for the Beijing 2022 Winter Olympics and, in 2021, was ranked 8th globally in architectural decorative coatings by market capitalization.

In 2024, the company reported $1.65 billion in revenue and an operating profit of approximately $37 million. Around 2.4% of its revenue was invested in R&D, highlighting its commitment to technological innovation and the development of low-carbon products.

Today, 3Trees manages one of China’s largest coatings R&D networks with over 1,000 technical staff, 60 innovation teams, and 781 patents, launching over 8,000 SKUs and serving consumers via a distinctive “6‑in‑1” and “7‑in‑1” green building system. [6]

9. Jotun

Founded: 1926Revenue: $3 billion+

Geographic Focus: Asia, Middle East

Core Rivalry: Industrial and marine coatings

Competitive Edge: Marine coatings leadership

Jotun has a strong presence in protective coatings, decorative paints, marine coatings, and powder coatings. Its product portfolio is widely recognized in various industrial sectors, including shipping, offshore oil platforms, energy infrastructure, and architectural projects.

A major factor in Jotun’s success is its strong presence in the marine and protective coatings markets, particularly in Asia, the Middle East, and Northern Europe. The company is recognized as one of the top three global players in marine coatings, supplying anti-fouling and high-performance solutions to some of the world’s largest commercial fleets and shipbuilders.

Unlike many Western rivals, Jotun adopts a “Penguin Spirit” culture, emphasizing long-term relationships, low turnover, and decentralized operations. This unique organizational style has helped it navigate geopolitical challenges, supply chain risks, and price volatility.

In 2024, Jotun generated approximately $3 billion in revenue and recorded an operating profit of nearly $608 million. The company continues to be the world’s largest marine coatings supplier, holding an estimated 25% share of the global market. [7][8]

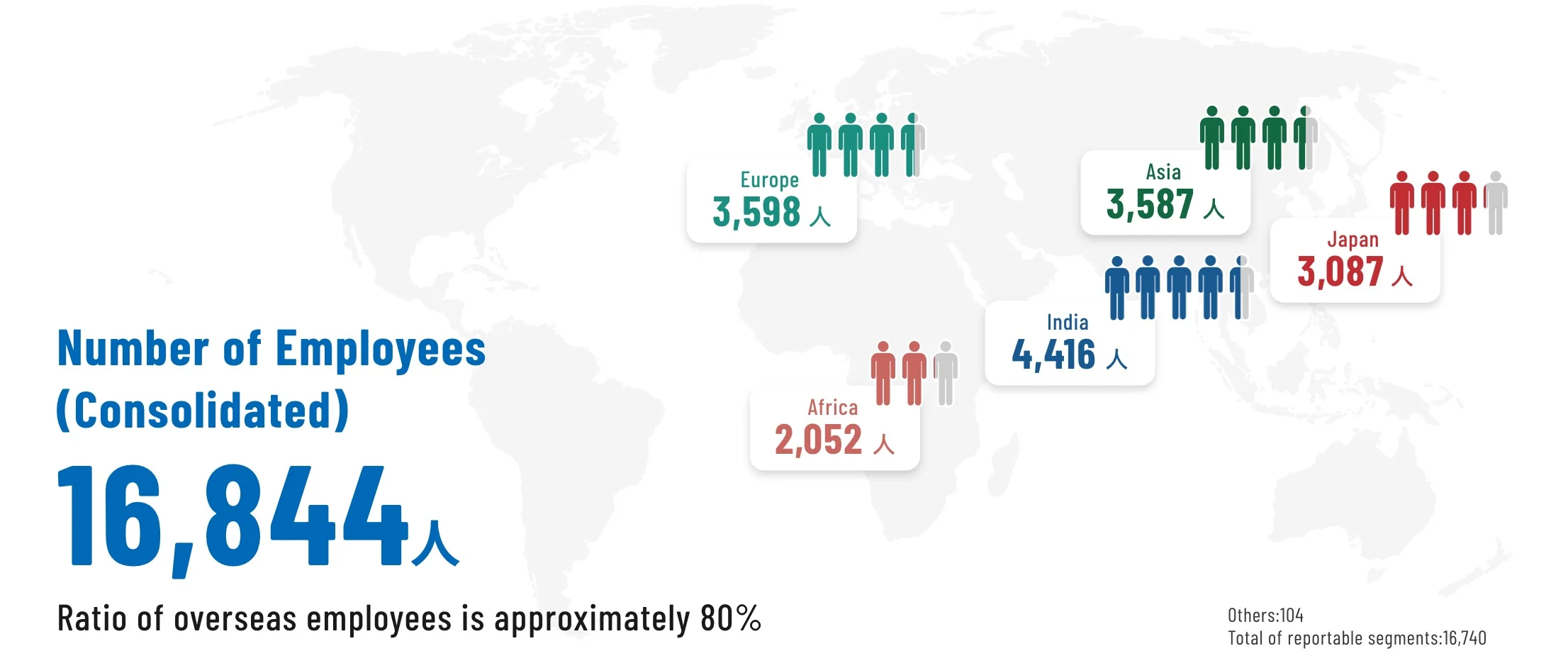

8. Kansai Paint

Revenue: $3.9 billion+

Geographic Focus: Asia-Pacific, India, Africa, Middle East

Core Rivalry: Select industrial and marine coatings

Competitive Edge: Strong foothold in emerging markets

Kansai Paint, one of Japan’s largest and oldest coatings manufacturers, operates in over 43 countries. Structured around three core product pillars (automotive, decorative, and industrial coatings), the company has consistently been among the top 10 global paint and coatings producers by revenue.

It has grown steadily through organic R&D investment and international expansion. They have made numerous acquisitions, including the Sadolin Group in East Africa and CWS in Europe, and established manufacturing operations across Asia, Africa, and the Americas.

Kansai drives revenues through product innovation, such as VOC-reducing powder coatings (patented in 1967), decorative functional paints, and electrostatic systems, plus regional manufacturing.

In terms of product mix, Kansai Paint’s portfolio skews heavily toward automotive and industrial coatings, although its Kansai Nerolac business (in India) contributes significantly to the decorative segment.

Kansai invests over $55 million annually in research and development, primarily distributed across five institutes and two R&D centers. In recent years, the company has expanded its environmental sustainability initiatives, focusing on the development of low-VOC, waterborne, and heat-reflective coatings.

7. Axalta Coating Systems

Founded: 1866 (as Herberts)Revenue: $4.1 billion+

Geographic Focus: America, Europe

Core Rivalry: Auto refinishing and transportation coatings

Competitive Edge: Dominance in the global automotive refinish market

Axalta Coating Systems develops high-performance coatings for various industries, with a primary focus on transportation and industrial applications. The company traces its origins to Herberts GmbH, founded in 1866, and later became part of DuPont. It was rebranded as Axalta in 2013 and became a publicly traded company in 2014.

Axalta’s business is heavily concentrated in automotive coatings, both for OEM manufacturers and aftermarket refinish businesses. It is one of the top two global suppliers of automotive refinishing coatings, competing head-to-head with giants like Sherwin-Williams and PPG. [9]

Their portfolio includes products under brands like Standox, Cromax, Spies Hecker, and Imron, each tailored to specific market tiers and application needs.

Today, Axalta operates in over 140 countries, employs around 13,000 people, and serves more than 100,000 customers. Its broad geographic and customer base helps protect its revenue from localized economic downturns. In FY 2025, the company reported $5.2 billion in net sales and generated a gross profit of $1.8 billion.

6. Asian Paints

Revenue: $4.1 billion+

Geographic Focus: India

Core Rivalry: Rising competition in MEA and South Asia

Competitive Edge: Unmatched distribution network, Strong consumer branding

Asian Paints is a market leader in decorative paints in India with a market share of over 50%, far ahead of competitors like Berger Paints, Kansai Nerolac, and AkzoNobel India.

The company makes interior and exterior wall paints, wood finishes, waterproofing solutions, adhesives, and wall textures, all offered through an extensive retail and distribution network of over 70,000 dealers in India alone

Asian Paints also diversifies through joint ventures with PPG in automotive and industrial coatings in India, and invests in home décor and services (such as modular kitchens, bath fittings, fabric). This supports recurring customer engagement and upselling in higher-margin lifestyle verticals.

The company has recently focused on developing products in the areas of health and hygiene, waterproofing, and sustainable coatings. One example is its Royale Health Shield Luxury Emulsion, an indoor antibacterial paint that uses silver ion technology to kill 99% of infection-causing bacteria on painted surfaces, helping create a more hygienic home environment. [10]

5. RPM International

Founded: 1947Revenue: $7.3 billion+

Geographic Focus: North America, Europe

Core Rivalry: Industrial coatings, waterproofing, & consumer retail

Competitive Edge: Brand diversification, Acquisition discipline

Unlike consumer-facing giants like Sherwin-Williams, RPM follows a “house of brands” strategy, managing over 100 brands across four key business segments: construction products, performance coatings, consumer group, and specialty products.

RPM International has acquired over 175 companies in the past 30 years. In the last decade alone, they’ve completed more than 50 acquisitions. The company currently employs around 17,300 people and operates over 120 manufacturing facilities in more than 120 countries.

RPM’s strength lies in its commercial, industrial, and OEM sectors, serving niche markets such as corrosion control, roofing systems, waterproofing, flooring solutions, and high-performance adhesives. Some of its well-known brands include Rust-Oleum, DAP, Stonhard, Varathane, and Tremco.

One of RPM’s key advantages is its resilience in downturns, as industrial coatings and repair materials tend to see steadier demand even when the broader housing or construction markets slow down. This stability has helped the company deliver consistent dividends for over 50 years, earning it a reputation as a reliable income stock for investors. [11]

4. BASF Coatings

Founded: 1965 (acquired by BASF)Revenue: $4.92 billion+

Geographic Focus: Europe, America

Core Rivalry: Competes in auto OEM and refinishing

Competitive Edge: Deep auto OEM integration, Chemistry-driven innovation

BASF Coatings is a division of the German chemical conglomerate BASF. It focuses heavily on the automotive OEM (original equipment manufacturer) and automotive refinish sectors, while also serving industrial, construction, and decorative markets in selected geographies.

As part of BASF’s broader portfolio (which includes everything from agrochemicals to plastics), the coatings business benefits from vast R&D resources and a deeply integrated value chain.

It operates from Münster, Germany, and has manufacturing and R&D facilities across Europe, Asia, and the Americas. It has strategic partnerships with major automakers, including BMW, Mercedes-Benz, and Hyundai.

In 2024, BASF Coatings expanded its e-coat and power coating lines to cater to demand from EV manufacturers. In 2025, renewed an exclusive Global Industry Partnership with WorldSkills International, supporting the training of automotive painters using Glasurit’s waterborne basecoat systems and digital platform Refinity. [12]

3. Nippon Paint Holdings

Founded: 1881Revenue: $3.31 billion+

Geographic Focus: Asia-Pacific

Core Rivalry: Competes on sustainability & price-performance

Competitive Edge: Cost Leadership in Emerging Markets

The rivalry between Nippon Paint and Sherwin-Williams reflects a classic East–West strategic contrast in the coatings industry. Nippon’s strength is rooted in the Asia-Pacific region, which accounts for over 75% of its total revenue.

Nippon Paint is primarily known for its hyper-localized strategy, where product design, branding, and marketing are tailored to each country. This approach has helped the company win over both price-sensitive and premium customers.

Today, it is a market leader in Japan, China, Malaysia, Vietnam, and Singapore, and continues to expand aggressively into the Middle East and South Asia.

Besides its dominant physical presence, Nippon has also invested heavily in digital transformation, smart coating technologies, and green chemistry, introducing innovations such as antibacterial wall coatings, heat-reflective exterior paints, and eco-friendly paint systems.

Decorative paints account for approximately 64% of Nippon’s total sales. Automotive coatings contribute around 12%, industrial coatings about 6%, and the remaining 11% comes from other segments, including fine chemicals and related products. [13]

2. AkzoNobel

Revenue: $11.47 billion+

Geographic Focus: Europe, Asia-Pacific, Latin America

Core Rivalry: Performance coatings and decorative paint

Competitive Edge: Brand strength & global footprint

Originally formed through a series of mergers, including the 1994 merger of Akzo (Netherlands) and Nobel Industries (Sweden), AkzoNobel’s roots date back to the 17th century through its historic connection to the Dutch chemical and pigment industries.

Today, the company operates in 150+ countries, making it one of the most internationally diversified players in the industry. It is best known for its decorative paints (residential and commercial applications) and performance coatings for industries ranging from marine and automotive to aerospace and infrastructure.

AkzoNobel employs over 35,000 people worldwide and manages an extensive portfolio of trusted regional and global brands like Dulux, Sikkens, and Interpon. It’s a market leader in Europe, Latin America, and parts of Asia.

When it comes to sustainability and eco-friendly paints, AkzoNobel arguably leads the field.. It is aggressively pursuing carbon-neutral production and pioneering low-VOC, water-based paints. Plus, its investments in digital color tools and AI-based tinting technologies have modernized its engagement with both professional painters and retail customers. [14][15]

1. PPG Industries

Revenue: $15.6 billion+

Geographic Focus: North America, Europe, Latin America

Core Rivalry: Architectural, automotive, & industry coatings,

Competitive Edge: Zero Trust and AI Security

PPG Industries is one of the oldest and most influential paint, coatings, and specialty materials companies in the world. Its product portfolio spans automotive, aerospace, industrial, marine, and architectural sectors.

PPG has built its dominance through strategic acquisitions like Tikkurila (Finland) and SigmaKalon (Netherlands), rapid international expansion, and a deep focus on technological innovation. Over the past two decades, the company has shifted its business mix dramatically, moving away from commodity glass and chemicals toward high-margin coatings and advanced materials.

A significant portion of its business comes from automotive OEM and refinish markets, where it holds long-standing relationships with major car manufacturers, including GM, Ford, Toyota, and Volkswagen. It also plays a leading role in aerospace coatings, supplying products to aviation giants such as Airbus and Boeing.

Unlike Sherwin-Williams, PPG does not operate a retail store network; instead, it sells its consumer paints through big-box stores like Home Depot and independent dealers.

PPG’s focus on sustainable coatings and smart materials has also elevated its global appeal. It consistently invests $410–430 million annually in R&D, producing advanced products such as anti-corrosion coatings, self-healing materials, and low-VOC decorative paints.

In 2025, PPG was recognized among Newsweek’s World’s Greenest Companies and was the only coatings company included in Barron’s list of the 100 Most Sustainable US Companies, where it ranked 62nd. [16]

Read More

Sources Cited and Additional References- About Us, A global leader in paints and coatings, Sherwin-Williams

- Industry Report, Paints and coatings market size and trend analysis, Fortune Business Insights

- Annual Report, Five-year summary and performance highlights, Hempel

- Patented Technologies, Top reasons painting contractors need Aura interior paint, Benjamin Moore

- Study, Inflation affecting paint prices as consumers become DIY, J.D. Power

- The Global Top 10, 3TREES reported total coatings revenue of RMB 12.105 billion, PCI

- Financial Report, Jotun’s long-term investment approach, Jotun

- Jotun, Long/short-term rating and outlook, Nordic Credit Rating

- Newsroom, Axalta wins market leadership award for global refinish products, Axalta

- Products, Royale Health Shield is equipped with silver ion technology, Asian Paints

- Newsroom, RPM declares quarterly dividend, RPM International Inc.

- Trade News, BASF Coatings renews partnership agreement with WorldSkills International, BASF

- Joshua Cooper, Nippon Paint reports record sales and operating profits, MarketScreener

- Intercrete 4890, Advanced water-based anti-carbonation coating, Akzo Nobel

- Media release, AkzoNobel Powder Coatings partners with coatingAI, Akzo Nobel

- Greta Edgar Borza, PPG recognized in Newsweek’s World’s Greenest Companies 2025 list, PPG