Founded in 2003, Splunk has established itself as a leader in the field of business data analytics and monitoring. Its capabilities extend across multiple domains, including IT operations, business intelligence, and security, allowing businesses to derive valuable insights and make informed decisions.

For fiscal 2024, Splunk generated $4.22 billion, up from $3.65 billion in fiscal 2023. Of this total amount, license revenues were $810.1 million, cloud services accounted for $503.4 million, and sales from Maintenance and Services were $172.6 million. [1]

Although Splunk remains a leading solution, businesses often seek alternatives for reasons such as cost-effectiveness and specific feature requirements. Plus, competition drives innovation, promoting the development of new tools that offer unique functionalities and cater to broad use cases.

In this article, we’ve explored the best Splunk competitors and alternatives available in the market. We’ve featured both commercial and open-source tools, covering their functionality and business aspects.

Did you know?Splunk holds over 1,100 patents and employs more than 8,000 people. In 2023, it was acquired by Cisco for $28 billion in an all-cash deal. [2]

Table of Contents

13. Mezmo

Released in 2015 Total Funding: $108.4 millionWorried about protecting sensitive data in your #telemetry logs? Try out our interactive demo showcasing how to safeguard your data without compromising analysis: https://t.co/6blyJZX8oi

PS – We’ll be at #RSAC if you wanna see it in real-time. Just stop by booth #239! pic.twitter.com/6oUzBMgikF

— Mezmo (@mezmodata) May 3, 2024

Estimated Number of Users: 3,000+

Mezmo Telemetry Pipeline is like a smart highway for your data. It helps your data move efficiently, getting it to the right place at the right time, while also saving you money and making your team more effective.

How does it help? It makes sure you only pay for what you need by filtering out unnecessary data. It also breaks down communication barriers by sending the right data to the right team. Security events go to the security team, alerts go to ITOps, and so on, ensuring everyone has the information they need.

Plus, Mezmo works seamlessly with popular platforms like DataDog, Splunk, and Prometheus, making your existing tools even better.

In 2022, Mezmo ranked number 695 on Inc.’s annual list of the 5000 fastest-growing companies in the USA. It was also included in Y Combinator’s Top Companies list in the same year and had previously been recognized in the Deloitte Technology Fast 500 a year before that.

So far, Mezmo has raised $108.4 million through 8 funding rounds. It is backed by 21 investors, including Emergence, TI Platform Management, and NightDragon. [3]

12. Fluentd

Estimated Number of Users: 5,000+

Fluentd is a perfect open-source tool for log aggregation and centralized logging. It allows you to collect, consolidate, and analyze log data from distributed systems and apps.

Unlike many other platforms, Fluentd has a rich ecosystem of plugins and integrations that extend its functionality and adaptability to different use cases and environments. Currently, there are 1,100+ plugins available for Fluentd. [4]

It also seamlessly integrates with container runtimes such as Docker and Kubernetes, making it easier to monitor and manage logs across dynamic and ephemeral infrastructure.

Their documentation claims that Fluentd is used by more than 5,000 businesses, with the largest user collecting logs from 50,000+ servers.

According to 6sense, Fluentd has a 1.11% market share in the “Log Management” segment. The majority of its customers come from the US (53%), followed by the UK (10%) and India(8%). [5]

11. Logz.io

Estimated Number of Users: 1,400+

Logz.io offers a comprehensive observability platform for monitoring, troubleshooting, and securing modern cloud apps and environments. It is used by DevOps and IT operations to gain visibility into system health, diagnose complex issues, and optimize performance.

The platform also helps businesses meet compliance and governance requirements by providing functions for log retention, access controls, and audit logging. More specifically, it supports data retention policies, role-based access control, and audit trails, ensuring data integrity and compliance with regulations like GDPR, HIPAA, PCI, and DSS.

While Logz.io holds less than 0.1% market share in the “Data Analytics” segment, the majority of its customers are in the company size range of 100-249 employees. [6]

So far, the platform has raised a total of $121.9 million through 7 funding rounds. It is backed by 11 investors, including General Catalyst, OpenView, and Pitango VC. [7]

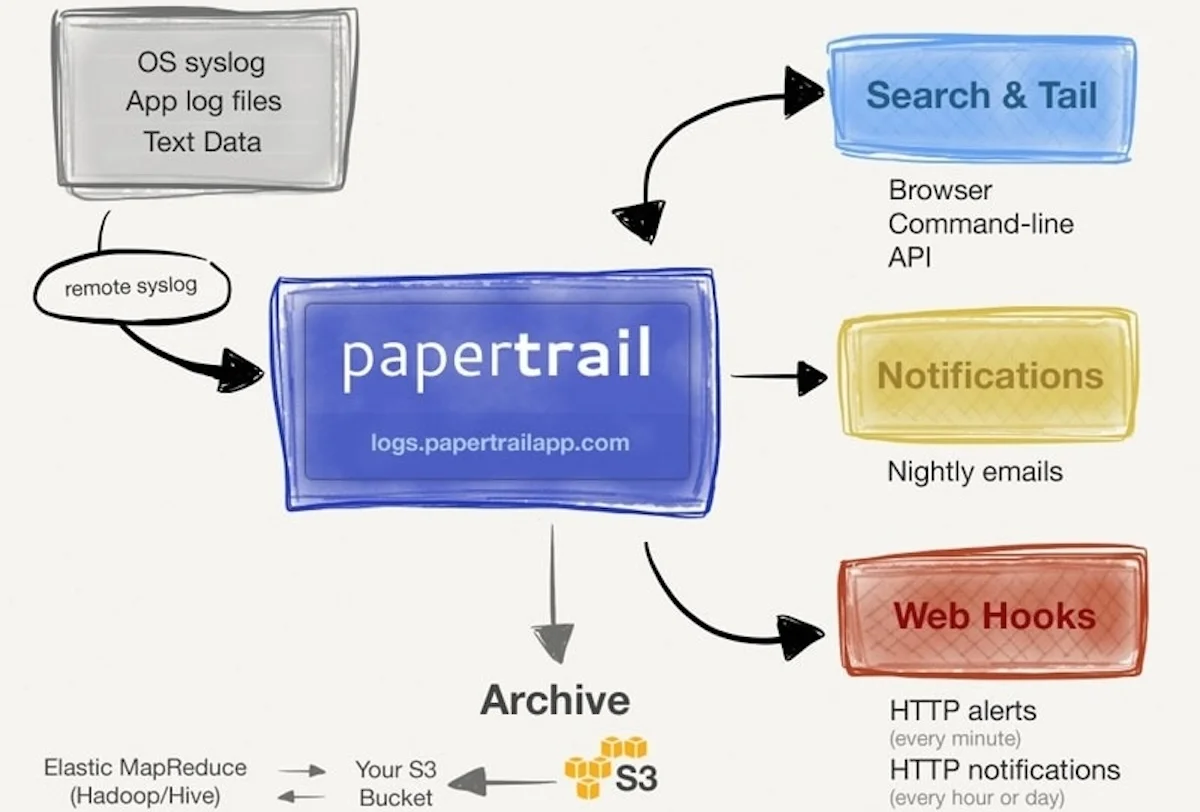

10. Papertrail

Estimated Number of Customers: 2,000+

Owned by SolarWinds, Papertrail offers a cloud-based log management and analysis platform. Developers use this platform to monitor application logs in real time, detect errors and performance issues, and troubleshoot issues quickly.

Many businesses use it to gather and analyze log data for compliance audits, security investigations, and incident response purposes. [8]

According to 6sense, Papertrail has a 0.24% market share in the Log Management segment. Most of its customers in this segment have company sizes ranging from 100 to 249 employees. Some of its biggest customers outside the US include Dentsu, Nedbank, Flight Centre, and Saint-Gobain SA. [9]

9. Apache Kafka

Released in 2011 Starting Price: Free and open-sourceWhy is Kafka fast?

Kafka achieves low latency message delivery through Sequential I/O and Zero Copy Principle. The same techniques are commonly used in many other messaging/streaming platforms.

The diagram below illustrates how the data is transmitted between producer and… pic.twitter.com/FOwoG0xz8q

— Bytebytego (@bytebytego) June 30, 2023

Estimated Number of Users: 50,700+

Apache Kafka was originally developed by LinkedIn and later open-sourced under the Apache Software Foundation. It is a distributed event streaming platform used for developing real-time data pipelines and applications.

It allows companies to ingest, process, and distribute data streams across various systems and apps. Most businesses use it for centralized log aggregation and analytics, gathering logs from multiple sources like servers and networking devices.

Known for its low latency, fault tolerance, high throughput, and outstanding performance, Kafka can handle thousands of messages per second. According to their official website, more than 80 of the Fortune 100 companies trust and use Kafka. [10]

Kafka dominates the “Queueing, Messaging, and Background Processing” segment with over 39.7% market share, leading ahead of RabbitMQ (with 28.3%), IBM MQ (7.1%), and Apache ActiveMQ (5.7%). [11]

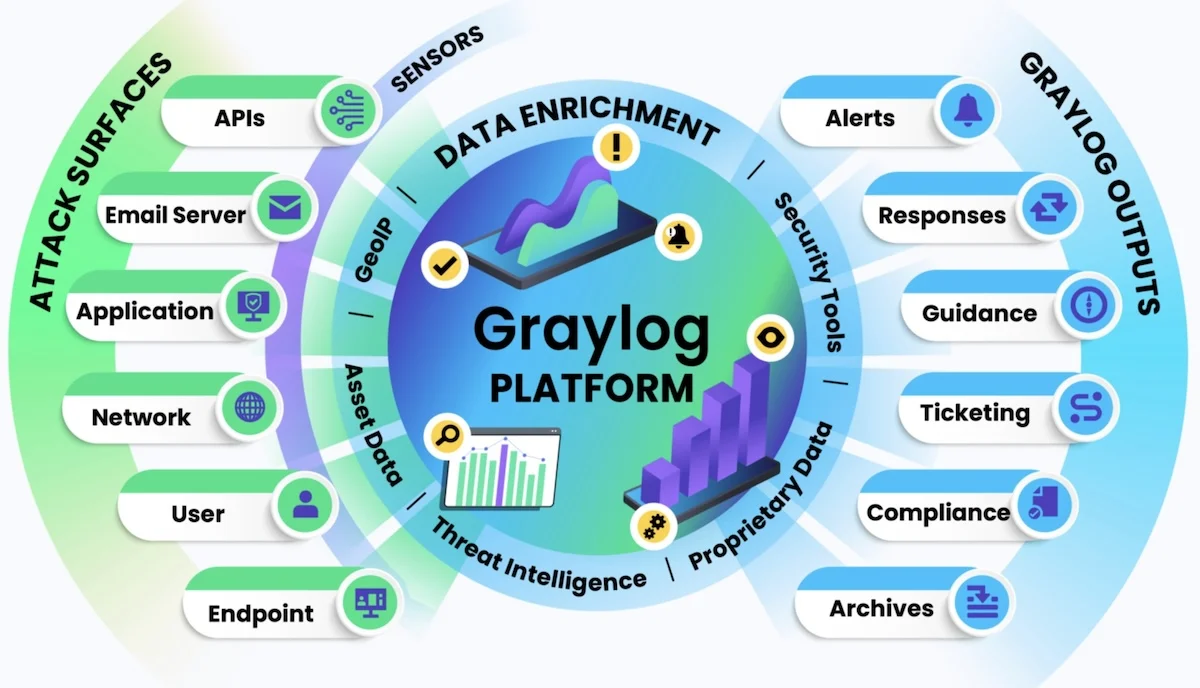

8. Graylog

Starting Price: $1550 per month for 10 GB per day Annual Revenue: $5.5 million+

Estimated Number of Users: 200,000+

Graylog is an open-source log management and security analytics platform that allows you to monitor system performance, troubleshoot issues, and ensure compliance with security and regulatory requirements.

It seamlessly integrates with Security Information and Event Management (SIEM) tools, offering advanced threat detection and incident response.

According to its official website, Graylog customers have achieved up to a 263% return on investment (ROI). The platform has effectively reduced cybersecurity risks, compliance audits, and fines by up to 10%. [12]

Regarding the company’s financial performance, it generated $5.5 million in revenue in 2023. With 120 employees, this results in a revenue-per-employee ratio of $45,833.

To date, Graylog has secured a total of $71.4 million through seven funding rounds. In their most recent funding round, they raised $9 million in equity and $30 million in debt. [13]

They are backed by 10 big investors, including Harbert Growth Partners and Silver Lake Waterman.

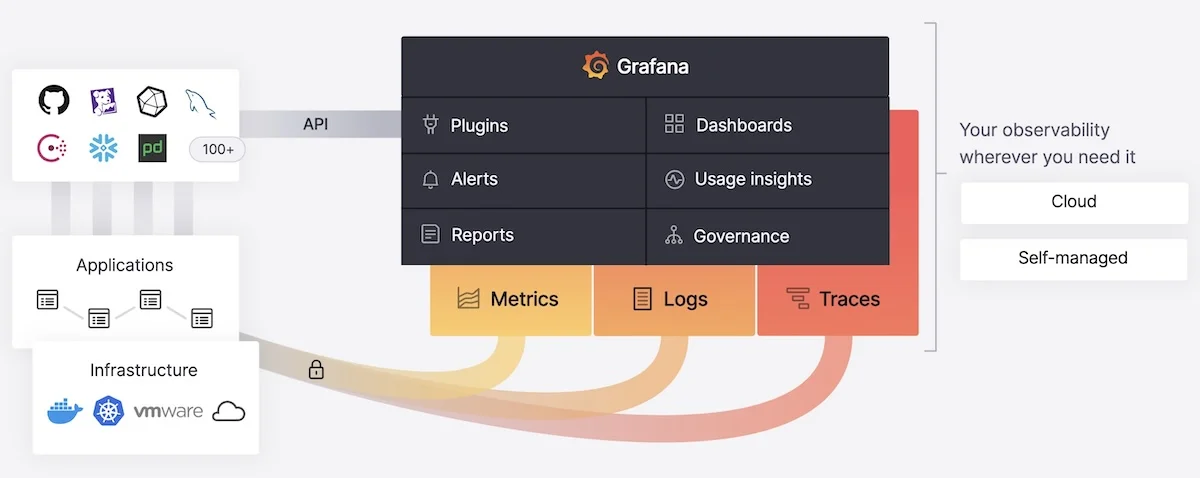

7. Grafana

Estimated Number of Users: 20,00,000+

With Grafana, you can visualize and understand complex data through customizable dashboards and graphs. It is commonly used for monitoring infrastructure metrics like CPU usage, memory utilization, disk space, and network traffic.

Grafana seamlessly integrates with application performance monitoring tools such as Zipkin or Jaeger to visualize app traces and diagnose performance issues.

Plus, it can track IoT devices and sensor data in real-time. You can connect Grafana to IoT platforms like Telegraf or MQTT to visualize telemetry data and monitor device health and status.

Many organizations integrate Grafana with databases like Microsoft SQL Server PostgreSQL, or MySQL to query and visualize customer metrics, sales data, and financial performance indicators.

The platform has performed really well since its inception. It has raised over $535 million through 6 funding rounds, with the latest (Series D) round occurring in 2022. [14]

As of 2024, the company has over 20 million users worldwide and has more than 3,000 paying customers, including PayPal, Sony, eBay, Bloomberg, and JPMorgan Chase. [15]

6. Sumo Logic

Estimated Number of Users: 3,500+

Sumo Logic offers a centralized platform for monitoring and troubleshooting applications, infrastructure, and security events across distributed environments.

It can be used for business intelligence purposes, allowing companies to examine log data and gain insights into customer behavior, operational efficiency, and market trends.

In 2023, Sumo Logic was acquired by a private investment firm, Francisco Partners, for $1.7 billion. In the same year, Sumo Logic made $300 million in annual revenue. [16]

As of today, more than 3,500 companies use Sumo Logic’s services. Among these customers, 35% have annual revenue exceeding $1 billion, approximately 22% are medium-sized, and 38% are small companies with annual revenue less than $50 million. [17]

The majority of those companies are in the Information Technology and Services (25%), Computer Software (19%), and Financial Services (6%) industry.

5. SolarWinds

Released in 1999 Annual Revenue: $759 million+ (2023)SolarWinds reports strong Q1, beats revenue, and raises adjusted EBITDA guidance with continued progress: $193.3M total Q1 revenue (+4% YoY), 36% Q1 subscription ARR YoY growth, $695.3M total ARR (+7% YoY), and 97% customer retention rate. $SWI https://t.co/m0zSKIlYk6 pic.twitter.com/Si3Z6h6dMk

— SolarWinds (@solarwinds) May 2, 2024

Estimated Number of Users: 317,000+

SolarWinds is a comprehensive IT infrastructure management software suite that offers solutions for system management, security management, network monitoring, application performance, and database performance.

It allows companies to track, analyze, and optimize various components of their IT infrastructure. Thousands of small and mid-size businesses use SolarWinds to optimize resource utilization, identify performance bottlenecks, and ensure the reliability of critical applications.

SolarWinds has shown steady growth in the last five years. In 2023, it made $759 million in annual revenue, up 5.47% from the previous year. It had approximately 317,000 customers, with around 800 of them generating annual revenue exceeding $100,000. [18]

As of 2024, SolarWinds commands an 18% market share in the “Network Administration and Management” segment. [19]

4. LogRhythm

Released in 2003 Annual Revenue: $170 million+ (2023)Empower your SOC with LogRhythm Axon’s community-driven approach to security! Share, customize, and collaborate for stronger defenses. Together, we’re unstoppable. Learn more > https://t.co/hsPUHSb6HT

— LogRhythm (@LogRhythm) April 26, 2024

Estimated Number of Users: 4,000+

LogRhythm integrates log management, network monitoring, user activity monitoring, and security analytics into a unified platform.

It offers more than 1,100 preconfigured correlation rules, designed to identify and correlate security events across various data sources. These rules are based on regulatory requirements, industry best practices, and threat intelligence, allowing companies to detect suspicious activities, anomalous behavior, and potential security threats effectively. [20]

Plus, with over 950 third-party and cloud integrations, LogRhythm seamlessly connects with a broad range of security tools and services.

LogRhythm has secured over $126.3 million through 7 funding rounds, with major investors including Riverwood Capital and Next47. In 2023, its annual revenue reached $170 million. Considering its 200 employees, this translates to a revenue-per-employee ratio of $850,000. [21]

According to Enlyft, LogRhythm holds a 2.5% market share in the Security Information and Event Management (SIEM) segment. About 67% of its customers are in the US, and 8% are in the UK. [22]

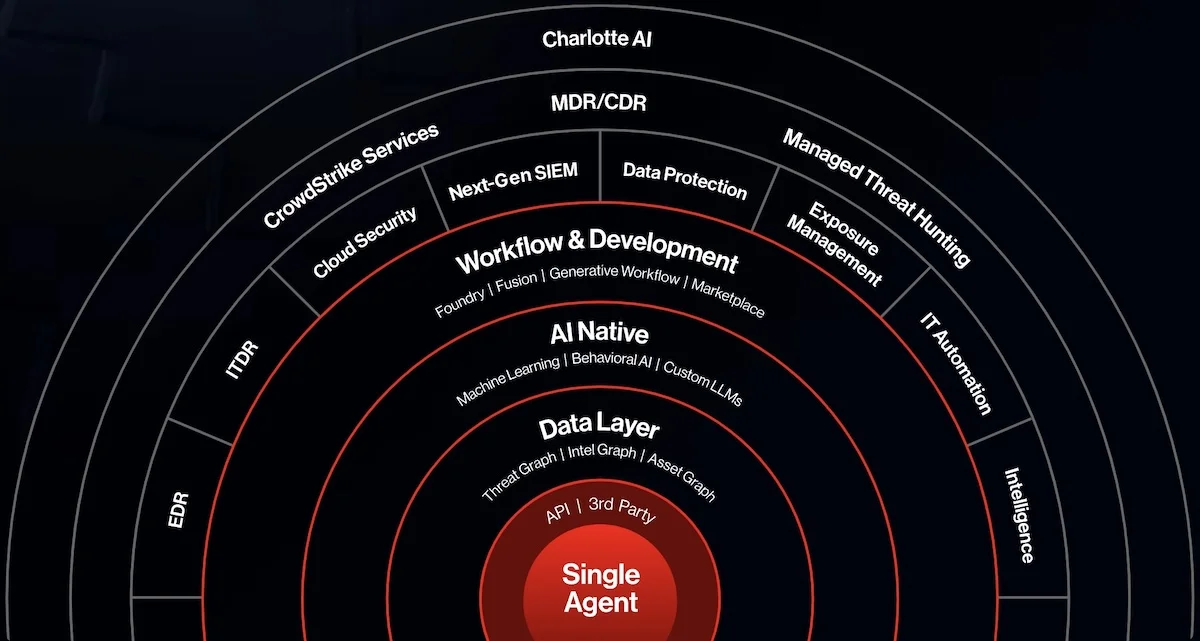

3. CrowdStrike

Number of Subscribers: 23,000+

CrowdStrike provides endpoint security solutions developed to protect companies from cyber threats, identify and respond to security incidents, and safeguard critical assets across their digital infrastructure.

Its lightweight agents operate efficiently in cloud, hybrid, and on-premises environments, offering continuous visibility and protection across the entire endpoint ecosystem (including laptops, desktops, servers, and IoT devices).

CrowdStrike holds a 23.54% market share in the “Endpoint Protection” segment. Its revenue for the twelve months ending January 2024 reached $3.05 billion, marking a notable 36.3% increase from the previous year. Subscription revenue amounted to $2.87 billion, up from $2.11 billion in fiscal 2023. [23]

In terms of financial performance, the company generated $1.16 billion in net cash from operations, up from $941 million in fiscal 2023. Plus, its free cash flow rose to $938.2 million from $676.8 million in fiscal 2023.

As per the official report, 61 of the Fortune 100 and 514 of the Fortune 1,000 companies use CrowdStrike.[24]

2. Dynatrace

Number of Enterprise Customers: 3,600+

Dynatrace provides you with a comprehensive and AI-powered approach to application performance management and observability. Its AI engine, Davis, continuously analyzes massive volumes of telemetry data to identify anomalies, spot root causes of issues, and provide actionable insights for optimization.

This platform is utilized by more than 3,600 large companies across 90+ countries. These companies are involved in various industries, including software, retail, manufacturing, banking, and insurance.

In 2023, Dynatrace was named leader in the Gartner Magic Quadrant for Application Performance Management and Observability. It also ranked first (out of 19 vendors) across all six use cases in the Gartner Critical Capabilities for APM and Observability report. [25]

In the same year, Dynatrace achieved $1.36 billion in annual revenue and $1.1 billion in gross profit, marking a 24.4% and 25.3% increase from the previous year.

With a market cap of over $13.55 billion, it is currently among the 1,300 most valuable companies worldwide. [26]

1. Datadog

Founded in 2010 Annual Revenue: $2.13 billion (2023)Datadog Synthetic Monitoring enables you to create and configure robust end-to-end test suites to monitor all of your environments. Check out our free product brief to learn more: https://t.co/cPDD6yoZEI

— Datadog, Inc. (@datadoghq) May 1, 2024

Number of Customers: 27,300+

Datadog allows companies to monitor their entire stack, including applications, databases, servers, and networks, all from a single platform. It provides real-time metrics, logs, and events across hybrid cloud and multi-cloud environments.

Unlike Splunk which has a broader focus on data analytics and visualization, the Datadog ecosystem is primarily focused on cloud-native technologies, DevOps tools, and modern application stacks.

According to 6sense, Datadog holds a 2.77% market share in the “Network Monitoring” segment. More than 80% of its customers are in the US, followed by Canada and the UK with 4% each. [27]

In 2023, the company made $2.13 billion, with an EBITA of $12 million. It had more than 27,300 customers, of which 396 customers had an annual revenue of over $1 million and 3,190 were making more than $100,000. [28]

Read More

13 Best Datadog Competitors and Alternatives

13 Best AIOps Platforms To Enhance IT Operations

Sources Cited and Additional References- Zacks Equity Research, Splunk (SPLK) beats Q4 earnings estimates on solid revenues, Yahoo Finance

- Will Stickney, Cisco completes acquisition of Splunk, Splunk

- Company Overview, Mezmo financials, Crunchbase

- Plugins, List of all plug-ins, Fluentd

- Log Management, Market share of Fluentd, 6Sense

- Data Analytics, Market share of Logz.io, 6Sense

- Company Highlights, Logz.io financials, Crunchbase

- Homepage, Papertrail makes log management easy, SolarWinds Papertrail

- Log Management, Market share of Papertrail, 6Sense

- Powered By, Kafka is used by thousands of companies, Apache Kafka

- Queueing, Messaging, and Background Processing, Market Share of Apache Kafka, 6Sense

- White Paper, Analyzing the economic benefits of Graylog Security, Graylog

- Kyle Wiggers, Log analysis and security firm Graylog raises $9M in equity, $30M in debt, TechCrunch

- Company Highlights, Grafana Labs financials, Crunchbase

- Michelle Tan, ‘The Story of Grafana’ documentary: From one developer’s dream to 20 million users worldwide, Grafana Labs

- Carmen Harris, Francisco Partners completes acquisition of Sumo Logic, Sumo Logic

- Customers, Explore our customer stories in different industries, Sumo Logic

- Jenne Barbour, SolarWinds announces Q4 and full-year 2023 results, SolarWinds

- Network Administration And Management, Market share of SolarWinds, 6Sense

- Homepage, Security made easy, LogRhythm

- Company financials, LogRhythm’s revenue is $170 million, Zippa

- LogRhythm, Companies using LogRhythm, Enlyft

- News Release, CrowdStrike reports fourth quarter and fiscal year 2024 financial results, CrowdStrike

- Cybersecurity’s AI-native platform, Trusted by organizations of all sizes, CrowdStrike

- Complimentary Report, Dynatrace ranked #1 in 6 of 6 Use Cases in 2023 Gartner Critical Capabilities, Dynatrace

- Dynatrace, Market capitalization and history of Dynatrace, CompaniesMarketCap

- Network Monitoring, Market share of Datadog, 6Sense

- Financial Highlights, Datadog announces Q4 and fiscal year 2023 results, Datadog