Germany has long been synonymous with quality craftsmanship, precision engineering, and automotive excellence. From the luxurious comfort of a Mercedes-Benz to the sleek lines of a Porsche, German cars have left an indelible mark on roads across the world.

In fact, one in every five cars worldwide comes from a German brand. Germany has 44 automobile assembly and engine production plants, which produce more than a third of all cars made in Europe. [1]

The automotive industry is highly innovative and plays a crucial role in the German economy. As per reports, the automobile companies based in Germany spent over 30 billion on R&D in 2022. [2]

In this article, we will feature top-performing German car brands, and explore their production capacities, revenues, and their enduring legacy on a global scale.

These car companies are at the forefront of shaping the future of mobility, pioneering safety innovations, and pushing the boundaries of autonomous driving technology.

Did you know?

In 2023, the German automobile industry generated nearly $602 billion in total sales, up from $540 billion the previous year. [3]

However, despite this growth, the number of employees in German automobile manufacturing has been declining since 2018. In 2022, around 774,300 people worked in this industry, down from 857,000 people in 2016. [4]

Table of Contents

8. Mercedes-AMG

Founded in 1967The ultimate silver lining to seaside driving. #SL63#MercedesAMG #AMG #AMGLife #AMGThrill #AMGContentDays

Mercedes-AMG SL 63 4MATIC+ | Energieverbrauch kombiniert: 13,2‒12,8 l/100 km | CO₂-Emissionen kombiniert: 299‒291 g/km | CO₂-Klasse: G pic.twitter.com/smwcc9t8qt

— Mercedes-AMG (@MercedesAMG) April 16, 2024

Parent: Mercedes-Benz Annual Revenue: $1.4 billion

Employees: 2,700+

Mercedes-AMG is a higher-performance subsidiary of Mercedes-Benz. The AMG stands for Aufrecht, Melcher, Großaspach, which are the names of its founders.

It produces a broad range of performance vehicles, including SUVs, sedans, coupes, convertibles, and sports cars. These vehicles feature powerful and more refined engines, enhanced handling, and distinctive styling cues compared to their standard Mercedes-Benz counterparts.

Plus, most of these vehicles incorporate advanced features like AMG Performance 4MATIC all-wheel drive, AMG Ride Control adaptive suspension, and intelligent driver assistance systems adapted for high-performance driving.

The company’s annual sales are projected to surpass $1.48 billion in 2024 and are expected to exceed $1.58 billion by 2028, with a CAGR of 1.69%. Moreover, their unit sales are projected to reach 9,894 vehicles by 2028. [5]

7. Maybach

Mercedes-Maybach 6 | Concept car unveiled in 2016

Mercedes-Maybach 6 | Concept car unveiled in 2016

Parent: Mercedes-Benz Annual Sales: 21,600 units (in 2022)

Initially, Maybach developed engines for aircraft and zeppelins and later transitioned to luxury vehicles. Today, it is closely integrated with Mercedes-Benz, sharing platforms and components with S-Class models.

The super luxury edition of the Mercedes-Benz S-Class, GLS-Class, and EQS SUV are produced under the Mercedes-Maybach name. These models are produced in limited numbers, with a focus on exclusivity and customization.

The modern Maybach models, such as the S680 and S580, target the ultra-luxury segment, competing with brands like Bentley and Rolls-Royce.

2022 was a phenomenal year for Mercedes-Maybach. The company delivered 21,600 units to customers, up 37% from the previous year. This growth was supported by strong performance in China, Japan, and Korea, where the company sold more than 1,100 cars per month. [6]

In 2023, Mercedes-Maybach experienced even greater success, with a 19% increase in vehicle sales. Both the GLS and S-Class versions performed well across all key regions. Plus, they launched an all-electric EQS SUV version in the US market. [7]

6. Porsche

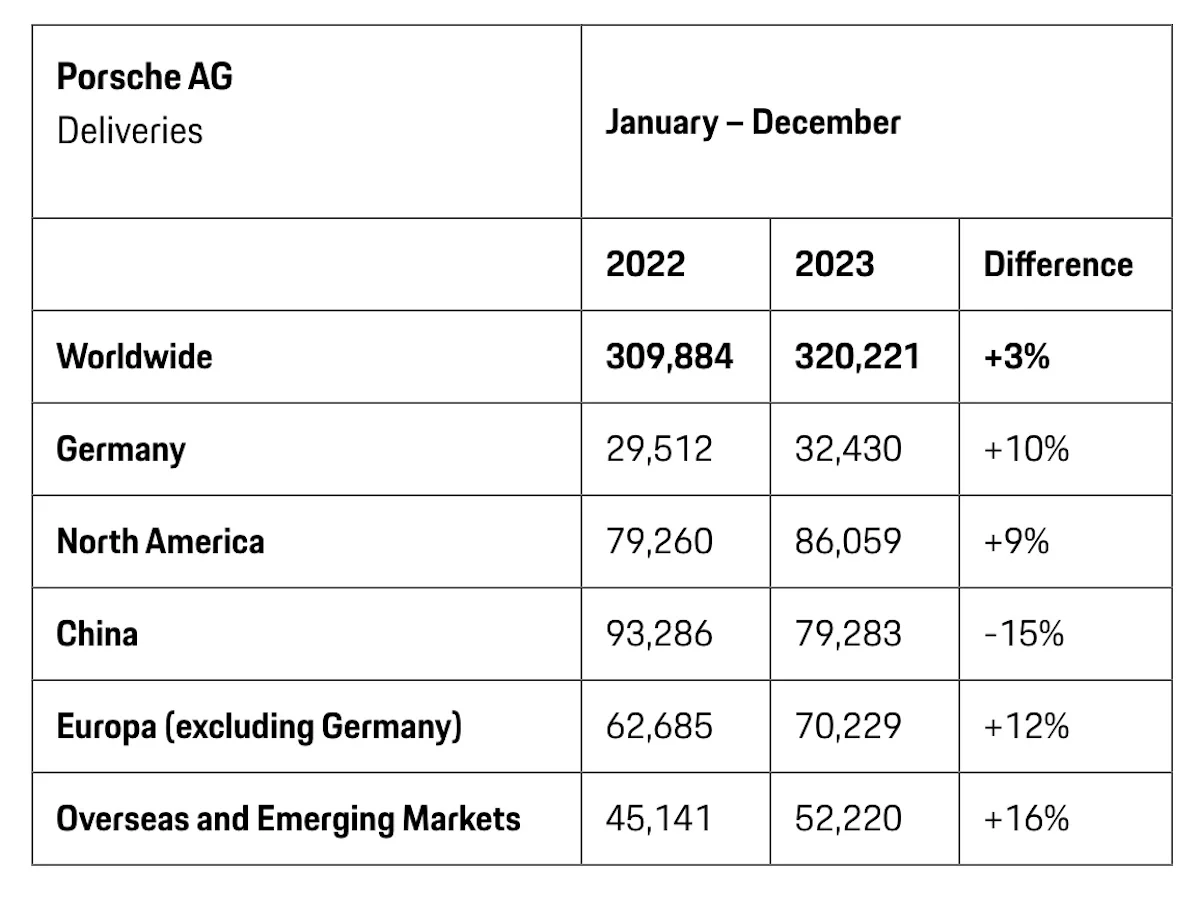

Majority Stakeholders: Volkswagen (75%), Porsche Holding (12.5%) Production Output: 320,221 units (2023)

Annual Revenue: $39.85 billion

Porsche initially provided automotive development work and consulting, but it later gained popularity for its creation of the Volkswagen Beetle and the Porsche 356, the company’s first production sports car.

Porsche has come a long way since then. In recent years, it has embraced electric mobility by introducing the Porsche Taycan, its first all-electric sports car. Taycan combines Porsche’s performance heritage with advanced electric propulsion technology, offering superfast acceleration, long-range, and precise handling.

In 2023, Porsche sold a total of 320,221 units, up 3% from the previous year. The majority of these sales, amounting to 86,059 deliveries, came from North America. In Europe, excluding Germany, the company delivered 70,229 cars, while in Germany, it delivered 32,430 units. [8]

The Cayenne emerged as the model with the highest number of deliveries.

The Porsche 911 saw the largest surge in popularity among all model lines, with a remarkable 24% increase from 2022. About 50,146 units were sold worldwide.

Similarly, the Taycan also experienced substantial growth, with 40,629 customers receiving their new cars, marking a 17% increase from 2022.

In terms of revenue, the company experienced steady growth from $11.6 billion in 2011 to almost $40 billion in 2023. [9]

5. Opel

Parent: Stellantis Production Output: 670,000 units (2023)

Annual Revenue: $11.8 billion (2022)

Opel is known for manufacturing a broad range of vehicles from compact cars to executive sedans and utility vehicles.

The company grew significantly in 2023, with a revenue increase of 15%, the highest growth rate in over two decades. Their worldwide sales reached nearly 670,000 units. [10]

During the same period, they achieved a market share of 5.3% in their home country, Germany, and recorded a market share of 6% in both the UK and Turkey.

Like other big automakers, Opel is heavily investing in electrification to meet evolving market trends and regulatory requirements. They have introduced hybrid and electric models, like the Opel Grandland X Hybrid and Opel Corsa-e, as part of their commitment to sustainable mobility.

These electric vehicles have been well-received by customers, with nearly 90,000 EVs sold in 2023, marking an impressive 22% increase compared to the previous year.

4. Audi

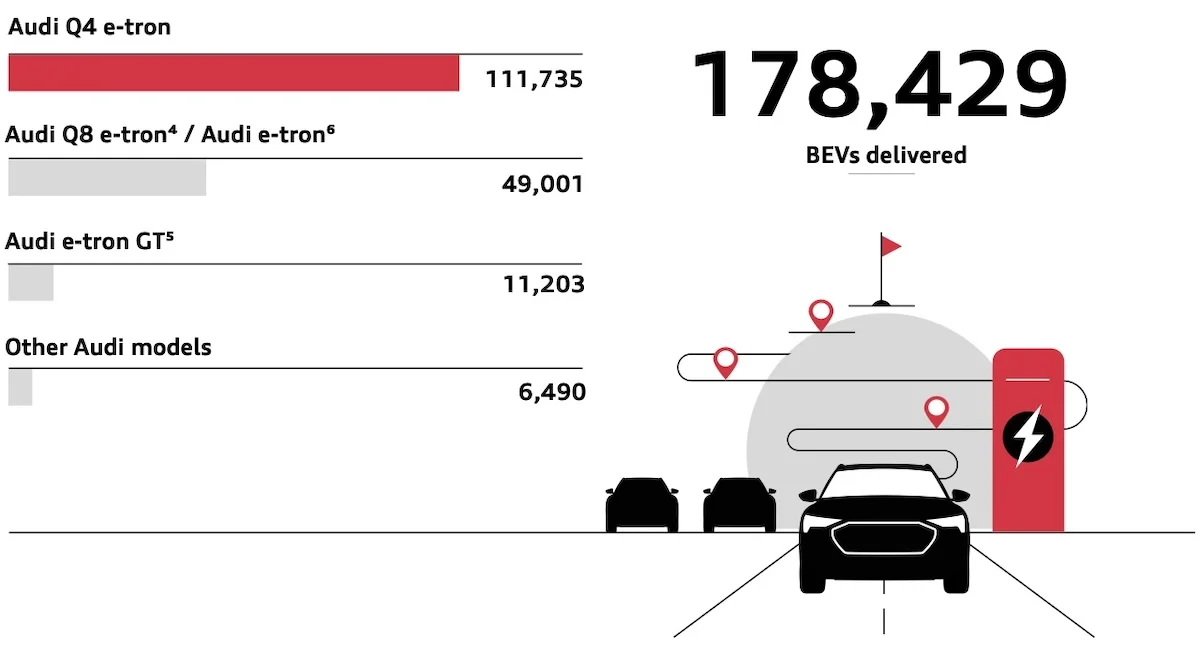

Source: Audi annual report 2023

Source: Audi annual report 2023

Parent: Volkswagen Group Production Output: 1,918,912 units (2023)

Annual Revenue: $74.6 billion (2023)

Founded by August Horch, the brand name “Audi” is derived from the Latin translation of Horch’s surname, which means “listen.”

Audi quickly became popular for its innovative designs and advanced engineering, including the creation of the first left-hand drive production car in 1921.

Its logo, which contains four interlocking rings, represents the four founding companies of Auto Union: Audi, DKW, Horch, and Wanderer. In 1932, these companies merged to form Auto Union, which ultimately became Audi.

The company has shown remarkable performance since then. In 2023, they achieved annual sales of 1,918,912 units. Despite global challenges in the automotive industry, Audi maintained a strong revenue of $74.6 billion.

This impressive achievement translated into a substantial operating profit of $6.7 billion, with an operating market of 9%. They had a net cash flow of $5 billion. [11]

Audi allocated 7.8% of its revenue to R&D, ensuring its competitiveness in the ever-evolving automotive landscape. Plus, they maintained a balanced approach to investment, with a capex ratio of 4.7%, allowing for strategic investment in technology and facilities while preserving financial stability.

3. Mercedes-Benz

Founded in 1926Stepping forward to the circular economy approach.

Conserving resources is part of this: we’re aiming to increase the share of secondary raw materials in our new vehicle fleet up to 40% by 2030.

Tomorrow drives #MercedesBenz: https://t.co/7uByEQAG8n#Sustainability pic.twitter.com/5q07sl9u60

— Mercedes-Benz (@MercedesBenz) April 19, 2024

Parent: Mercedes-Benz Group Production Output: 2,491,600 units (2023)

Annual Revenue: $166.28 billion (2023)

The brand name “Mercedes-Benz” combines the names of two early automotive pioneers: Gottlieb Daimler, the founder of Daimler-Motoren-Gesellschaft, and Karl Benz, the founder of Benz & Cie. In 1926, these companies merged to form Mercedes-Benz.

Today, Mercedes-Benz has a global presence with manufacturing facilities, R&D centers, and a giant network of dealerships worldwide. The company’s reputation for luxury and reliability has earned it a loyal customer base and established it as a leader in the premium car segment.

In 2023, despite facing supply-chain constraints, the company managed to sell 2,491,600 units. Their free cash flow also saw a significant increase, reaching $12 billion, up from $8.6 billion in 2022. [12]

Furthermore, the sales of fully electric Mercedes-Benz vehicles soared to 222,600 units, marking a remarkable 73% increase from the previous year. Specifically, sales of the EQE Sedan surged by 120% worldwide, while battery electric vehicle (BEV) sales more than doubled (167%) in the USA. [12]

2. BMW

Founded in 1916Sunshine, skylines and a spectacular line-up.#BMWXM #BMW #BMWM pic.twitter.com/AuhcH1R02V

— BMW (@BMW) April 14, 2024

Majority Stakeholders: Public (50.7%), Stefan Quandt (25.8%), Susanne Klatten (20.9%) Production Output: 2,253,835 units (2023)

Annual Revenue: $168.77 billion (2023)

Known for its dynamic performance, iconic design, and innovative technology, BMW has grown into one of the world’s leading premium automotive brands. It sells cars under the BMW, Rolls-Royce, and MINI brands.

In 2022, BMW was the 7th largest automobile company by revenue. In 2023, it was ranked 46th in the Forbes Global 2000. In the same year, it made $168.7 billion in annual revenue. [13]

With quarterly sales of over 107,800+ units, BMW is currently the third best-selling European automotive company in the USA. [14]

BMW’s fully electric vehicles have been embraced by customers worldwide. In 2023, they delivered a total of 330,596 units to buyers, marking an impressive 92% increase from the previous year. [15]

The company has revealed its ambitious plans for EVs aiming for them to constitute half of its total sales by 2030. If successful, this initiative will substantially boost BMW’s electric passenger car market share in Europe, which currently stands at 1%.

1. Volkswagen

Founded in 1937What’s up, North America?

New #battery cell gigafactory in Ontario, Canada. Production starts in 2027!

#ScoutMotors returns with all-electric rugged SUVs & pick-ups by 2026.

75 years of @VW of America & 70 years of @Volkswagen_MX!Swipe for more

— Volkswagen Group (@VWGroup) April 13, 2024

Parent: Volkswagen Group Production Output: ~9,240,000 units (2023)

Annual Revenue: $343.9 billion (2023)

Volkswagen is one of the largest automobile companies worldwide by sales and production volume. More specifically, it is the second largest automaker after losing its first spot to Toyota in 2020.

Its name translates to “people’s car” in German, reflecting its core mission to create affordable and accessible vehicles for the masses. And indeed, the company has been remarkably successful in achieving this goal.

In 2023, Volkswagen sold nearly 9.24 million vehicles across the world, up 11.8% from 8.26 million in the previous year. It generated $343.9 billion in annual revenue and achieved operating results of $24.12 billion. [16]

By 2025, approximately every second unit delivered by Volkswagen is expected to be an SUV. Also, its battery electric vehicles are estimated to constitute 70% of the company’s sales in Europe by 2030. [17]

The company has already experienced a remarkable increase in its electric vehicle (EV) sales worldwide, with an almost 80% year-over-year growth rate in 2021.

In 2023, Volkswagen delivered 394,000 fully electric vehicles worldwide, representing a growth of 21.1% compared to the previous year. [18]

Other Small Car Companies in Germany

9. Alpina

Founded in 1965Back from 2,700 ml, 12 day holiday down to Italy. Journey home from Florence went smoothly so we just did it in 1 blast of 1,091 mls! Being Sunday the pretty empty motorways helped. @ALPINA_GmbH B3 Touring was so fast, comfortable and quiet – just perfect for the task. pic.twitter.com/h4QsUiBZ5e

— RSDriver00 (@RSdriver00) September 25, 2023

Parent: BMW

Alpina works closely with BMW, with whom it shares a long-standing relationship. Unlike traditional tuning companies, it works in collaboration with BMW, receiving support from the manufacturer to develop its high-performance models.

Alpina vehicles are sold through BMW dealerships, offering buyers the assurance of factory-level quality and warranty coverage.

As of 2024, the company generates approximately $96 million in annual revenue with a workforce of 50 employees. This equates to a revenue-per-employee ratio of $1,920,000. [19]

By 2028, it is projected that the company’s revenue will increase to $111 million, with unit sales reaching 1,132 vehicles.

10. Brabus

Annual Revenue: $56 million

Brabus is a high-performance automotive tuning company that modifies vehicles manufactured by Mercedes-Benz, Smart, and Maybach.

Besides aftermarket modifications, it produces exclusive models based on Mercedes-Benz’s lineup, such as the Brabus G-Class, Brabus S-Class, and Brabus Rocket.

In 2023, Brabus made $56 million in annual revenue with a workforce of 750 employees. This results in a revenue-per-employee ratio of $74,667. [20]

11. Mansory

Ferrari 812 GTS – Mansory Stallone NR.836

Ferrari 812 GTS – Mansory Stallone NR.836

Known for aggressive exterior styling and unique paint finishes

Mansory has gained international recognition for its extravagant modifications of high-end cars. It customizes vehicles from various manufacturers, including Rolls-Royce, Mercedes-Benz, BMW, Ferrari, Lamborghini, Bugatti, Tesla, and Aston Martin.

Custom upholstery, carbon fiber body kits, exotic woods, exhaust systems, aerodynamic components, and suspension modifications are among the numerous options available to Mansory clients.

The company has plans to showcase three top-notch car modifications, highlighting different luxury brands and incorporating different drive technologies:

- Lamborghini Revuelto: Hybrid model

- Rolls-Royce Spectre: Fully electric version

- The Ferrari Purosangue [21]

Mansory currently employs 180+ people globally and has a vast distribution network in several countries, including the USA, UK, China, and Germany.

12. Wiesmann

Founded in 1988

View this post on Instagram

Known for customized convertibles and coupes

Wiesmann cars are characterized by their unique retro-inspired design language, featuring long hoods and muscular fenders reminiscent of classic sports cars from the 1960s.

Despite their vintage look, these cars incorporate modern engineering and aerodynamic enhancements for improved performance and handling. Each car is custom-built to order, allowing buyers to personalize every aspect of their vehicle.

In 2022, the company announced its entry into the electric sports car market with “Project Thunderball,” a roadster EV capable of accelerating to 60 mph in 2.6 seconds. Despite its $320,000 price tag, the entire first year’s production was already sold out. [22]

Read More

17 Different Car Engine Types | Explained

Sources Cited and Additional References- Industry Overview, The Automotive industry in Germany, Germany Trade & Invest

- Research and Development, Automotive industry at the forefront of investments, VDA

- Vehicle Manufacturing, Revenue in the automobile industry in Germany from 2013 to 2023, Statista

- Vehicles & Road Traffic, Number of employees in the automobile industry in Germany, Statista

- Passenger Cars, Mercedes-AMG (Passenger Cars) – Worldwide, Statista

- Company News, Mercedes-Benz finishes 2022 with strong Top-End and Battery Electric Vehicle deliveries, Mercedes-Benz Group

- Company News, Sales rise to 2,493,000 vehicles in 2023, Mercedes-Benz Group

- Lena Rachor, Porsche posts stable sales in 2023: strong growth for the 911 and Taycan, Prosche Newsroom

- Vehicles & Road Traffic, Porsche’s revenue from FY 2011 to FY 2023, Statista

- Corporate News, Opel Increases Global Sales by a Strong 15 Percent in 2023, Stellantis

- Key figures, Audi Group in fiscal year 2023, Audi

- Key figures, Full Year Results and Annual Report 2023, Mercedes-Benz Group

- BMW Group, Revenue for BMW (BMW.DE), CompaniesMarketCap

- Vehicles & Road Traffic, Global revenue of BMW Group from FY 2007 to FY 2023, Statista

- Press Release, A successful 2023: BMW Group posts record sales, meets ambitious e-mobility growth targets, BMW Group

- Company Highlights, Annual Report & Full Year Results 2023, Volkswagen Group

- Vehicles & Road Traffic, Volkswagen Group’s worldwide vehicle deliveries from 2012 to 2023, Statista

- Nina Krake-Thiemann, About 4.8 million vehicles worldwide: Volkswagen increases deliveries in 2023, Volkswagen Newsroom

- Mobility, Alpina (Passenger Cars) – Worldwide, Statista

- Company Overview, Brabus Germany, Zoominfo

- Press zone, Mansory Empower Future, Mansory

- Mike Duff, Wiesmann Project Thunderball EV Prototype Fuses Past and Future, Car and Driver